Is News Corp's True Value Hidden? An Investigation Into Its Underappreciated Assets

Table of Contents

News Corp's Diversified Portfolio: Beyond the Headlines

News Corp operates across a range of media and information services, creating a diversified portfolio that offers resilience against market fluctuations. This isn't just about headlines; it's about a strategic mix of assets with varying growth trajectories. Let's break down the key segments:

-

Newspapers: News Corp's newspapers, while facing challenges in the digital age, still retain significant value. The enduring power of print media, coupled with the growing potential of digital subscriptions and targeted online content, represents a substantial opportunity. News Corp newspapers continue to hold a strong position in their respective markets, providing a stable base of revenue and influence. Many are successfully transitioning to digital-first models, expanding their reach and engagement.

-

Book Publishing: The book publishing sector shows remarkable resilience. News Corp's strong author relationships, combined with its expertise in identifying and developing successful titles, position it for continued growth. News Corp publishing benefits from a loyal readership and the ongoing popularity of physical and e-books, making it a consistently performing segment.

-

Digital Real Estate: This is where significant untapped potential lies. News Corp digital assets, encompassing various websites and online platforms, represent a rapidly growing revenue stream. The strategic acquisition and development of digital properties position News Corp for significant long-term growth in this increasingly valuable sector. This includes opportunities in both advertising revenue and subscription models.

-

Other Assets: News Corp also holds other significant assets, including television production and streaming services, further diversifying its revenue streams and mitigating risk. These assets offer additional growth opportunities and contribute to the overall valuation of the company.

Analyzing News Corp's Financial Performance and Market Valuation

To understand News Corp's true value, we must analyze its financial health and compare it to industry benchmarks. While detailed financial data requires in-depth research (accessing SEC filings and financial reports), several key aspects warrant consideration:

- Revenue Diversification: News Corp's diversified revenue streams reduce reliance on any single segment, creating greater resilience during economic downturns.

- Profit Margins: Analyzing profit margins across different segments helps to identify areas of strength and areas needing improvement.

- Debt Levels: A reasonable debt-to-equity ratio suggests financial stability and capacity for future growth initiatives.

Comparing News Corp's valuation ratios (Price-to-Earnings, Price-to-Book, etc.) to its competitors reveals a potential undervaluation. Market sentiment, often driven by short-term concerns, may not fully reflect the long-term value of News Corp's assets. Factors such as cyclical industry trends and overall market volatility can also contribute to this undervaluation.

Identifying Underappreciated Assets within News Corp's Holdings

Several assets within News Corp's portfolio appear significantly undervalued by the market. For example, the digital real estate division's growth potential may be underappreciated given its rapid expansion and potential for increased revenue generation through strategic partnerships and technological advancements. The book publishing division, with its strong author relationships and established brand recognition, also presents a compelling case for undervaluation.

- Growth Catalysts: Strategic acquisitions, divestitures of non-core assets, and technological innovations could unlock significant value. Focusing on digital transformation and developing innovative content delivery models are key.

- Future Projections: Conservative growth projections for the digital assets, coupled with the ongoing strength of the book publishing and newspaper divisions, suggest a higher intrinsic value for News Corp than currently reflected in the market price.

Risks and Challenges Facing News Corp and its Future Outlook

News Corp, like any company, faces risks and challenges:

- Competition: The media landscape is intensely competitive, necessitating continuous innovation and adaptation.

- Regulatory Changes: Changes in media regulations can impact profitability and operational efficiency.

- Economic Downturn: Economic downturns can reduce advertising revenue and consumer spending.

However, News Corp's diversified portfolio and proven ability to adapt to changing market conditions offer mitigating factors. Strategic investments in technology, content creation, and talent acquisition will be crucial in navigating these challenges and capitalizing on new opportunities.

Conclusion: Is News Corp's True Value Finally Emerging? A Call to Action

This analysis suggests that News Corp's true value is significantly higher than what's currently reflected in the market. The company's diversified portfolio, strong financial foundation, and potential for growth in key sectors, particularly digital real estate, present a compelling investment opportunity. We've examined News Corp's assets, financial performance, and future prospects, uncovering the hidden potential within this media conglomerate.

It's time to reassess your investment strategy regarding News Corp. Discover News Corp's true value by conducting your own thorough research, including reviewing its financial statements and industry analysis. Uncover the hidden potential of News Corp and consider its position in a diversified portfolio. Don't miss the opportunity to capitalize on this potentially undervalued gem in the media landscape.

Featured Posts

-

Kazuo Ishiguro An Exploration Of Memory And Forgetting

May 25, 2025

Kazuo Ishiguro An Exploration Of Memory And Forgetting

May 25, 2025 -

Negotiating With Trump Republican Strategies And Challenges

May 25, 2025

Negotiating With Trump Republican Strategies And Challenges

May 25, 2025 -

The Troubles Of Tim Cook Analyzing Apples Recent Struggles

May 25, 2025

The Troubles Of Tim Cook Analyzing Apples Recent Struggles

May 25, 2025 -

Naomi Kempbell Nayvidvertisha Fotosesiya Za Vsyu Kar Yeru

May 25, 2025

Naomi Kempbell Nayvidvertisha Fotosesiya Za Vsyu Kar Yeru

May 25, 2025 -

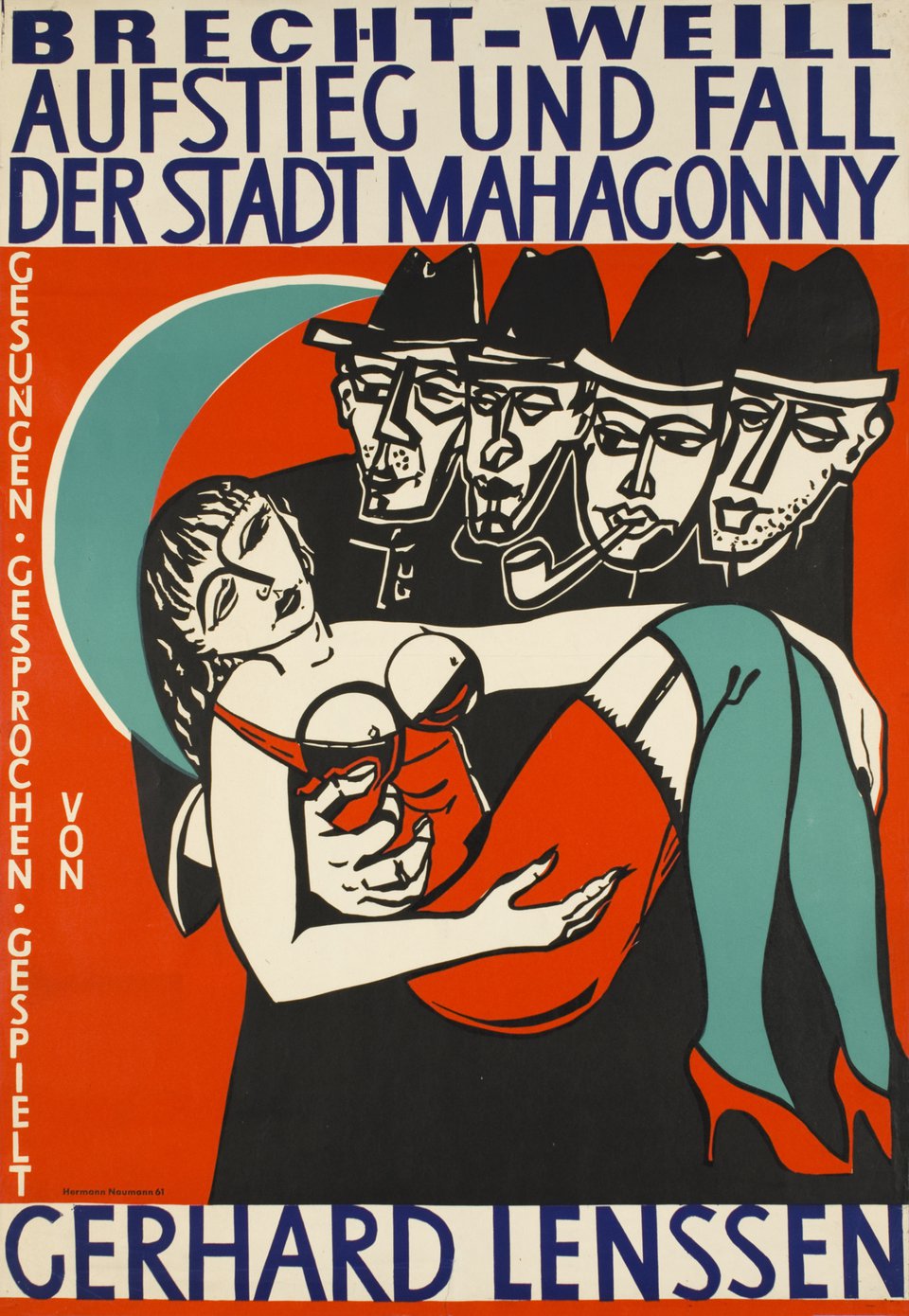

Der Hsv Und Der Aufstieg 2 Bundesliga Saisonhoehepunkt Zwischen Konzerten Und Tradition

May 25, 2025

Der Hsv Und Der Aufstieg 2 Bundesliga Saisonhoehepunkt Zwischen Konzerten Und Tradition

May 25, 2025