Is Now The Right Time To Invest In Palantir Technologies Stock?

Table of Contents

Palantir's Current Financial Performance and Growth Prospects

Revenue Growth and Profitability

Analyzing Palantir's recent financial reports reveals a mixed bag. While the company has demonstrated consistent revenue growth year-over-year, profitability remains a key area of focus. Examining key financial metrics like gross margin, operating margin, and net income is crucial for understanding the company's financial health.

- Positive Trends: Palantir has successfully expanded its customer base, particularly within the commercial sector. This diversification reduces reliance on government contracts, historically a significant portion of their revenue.

- Challenges: Achieving sustained profitability remains a challenge. High research and development costs, coupled with intense competition, continue to impact profit margins. Investors should carefully review the company's quarterly earnings reports and financial statements for the most up-to-date information on Palantir revenue and Palantir profitability. Analyzing PLTR financial performance across multiple quarters provides a more comprehensive picture.

Government and Commercial Contracts

Palantir's revenue stream is derived from both government contracts and commercial clients. Understanding the balance between these two sectors is essential for assessing future growth potential.

- Government Contracts: While government contracts have been a cornerstone of Palantir's business, their long-term prospects depend on government spending and the renewal of existing contracts. Analyzing Palantir government contracts and the overall government spending landscape provides insights into the stability of this revenue source.

- Commercial Clients: Palantir's expansion into the commercial market offers significant growth potential. New partnerships and contract wins in this sector demonstrate the company's ability to compete effectively outside the traditional government space. Examining the specifics of Palantir commercial clients, such as industry verticals and contract values, is crucial in determining the success of this strategy. Tracking Palantir contract wins offers a glimpse into future revenue streams.

Market Analysis and Competitive Landscape

Industry Trends and Technological Advancements

Palantir operates within the rapidly evolving big data analytics and artificial intelligence (AI) industries. Understanding these industry trends and technological advancements is vital for assessing Palantir's competitive position.

- Competitive Landscape: Palantir faces stiff competition from established players and emerging startups in the data analytics and AI space. Identifying Palantir competitors and their respective strengths and weaknesses is crucial for determining Palantir's market share and future growth potential. Analyzing the competitive landscape also involves understanding the specific niche Palantir occupies and whether it has a sustainable competitive advantage.

- Technological Advancements: The big data analytics and AI markets are characterized by rapid technological advancements. Palantir's ability to innovate and adapt to these changes will determine its long-term success. Staying abreast of data analytics industry trends and AI technology advancements allows investors to understand the potential impact on Palantir's business.

Macroeconomic Factors and Market Sentiment

Macroeconomic conditions significantly influence Palantir's stock price and overall investor sentiment.

- Market Volatility: Interest rate hikes, inflation, and recessionary fears can all impact investor confidence and lead to increased market volatility. These factors can significantly influence investment decisions related to PLTR.

- Investor Sentiment: The overall market sentiment toward Palantir and the broader technology sector plays a crucial role in determining the stock price. News events, analyst ratings, and investor speculation can all contribute to swings in the stock price.

Risk Assessment and Investment Considerations

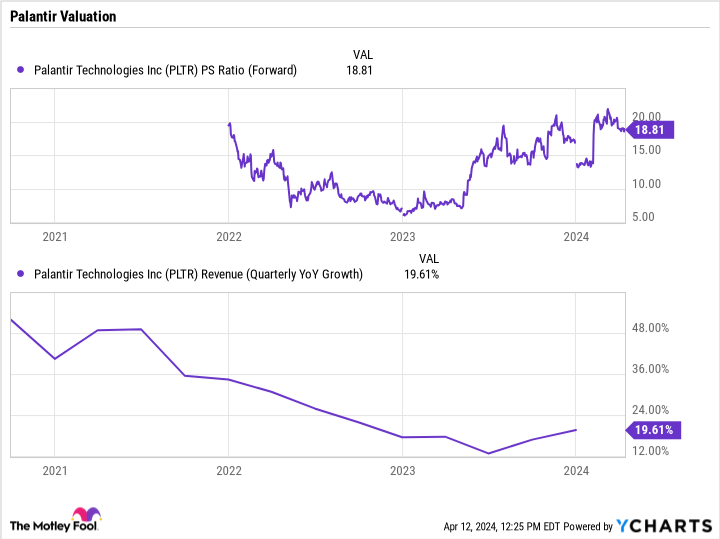

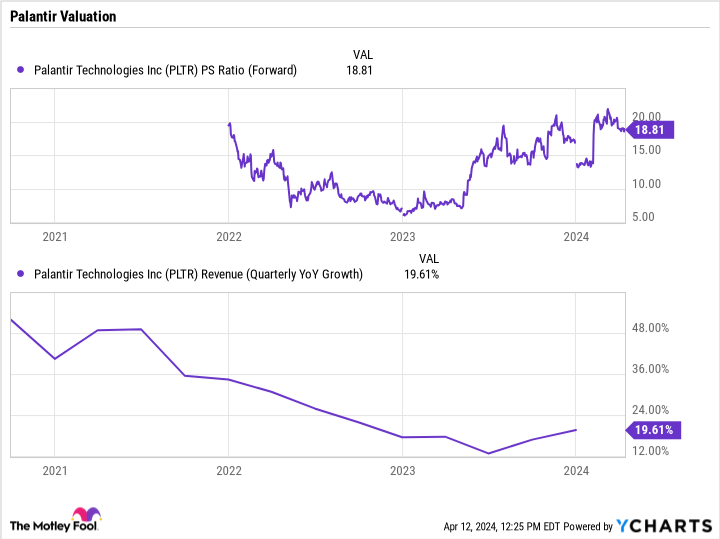

Valuation and Stock Price

Determining Palantir's fair value is crucial for assessing investment risk. Comparing Palantir stock price to its peers and historical performance can provide insights into whether the stock is currently overvalued or undervalued.

- Valuation Metrics: Employing valuation metrics like price-to-sales (P/S) ratio, price-to-earnings (P/E) ratio (if applicable), and other relevant metrics is essential for a thorough evaluation. Analyzing Palantir valuation in the context of its industry peers helps in determining if the stock is trading at a premium or discount.

- Investment Risks: Investing in Palantir carries inherent risks, including the possibility of significant short-term price volatility and the uncertainty of long-term profitability. Understanding and evaluating these risks is vital for any potential investor.

Long-Term Growth Potential vs. Short-Term Volatility

Palantir's long-term growth potential must be weighed against its inherent short-term volatility.

- Long-Term Investment Strategy: A long-term investment strategy in Palantir may be suitable for investors with a high risk tolerance and a longer investment horizon. This strategy allows investors to weather short-term fluctuations in price and potentially benefit from long-term growth.

- Short-Term Trading: Short-term trading in Palantir stock can be highly risky due to its volatility. This approach requires a high level of market knowledge and risk tolerance. Understanding your own risk tolerance is paramount when considering either a long-term investment or short-term trading strategy.

Conclusion

Analyzing Palantir Technologies' current financial performance, market position, and associated risks reveals a complex investment picture. While the company shows promise in terms of revenue growth and expansion into the commercial sector, achieving sustained profitability and navigating a competitive landscape remains a challenge. Macroeconomic factors and investor sentiment also play significant roles in influencing the stock price.

Therefore, the decision of whether now is the right time to invest in Palantir Technologies stock depends heavily on your individual risk tolerance, investment horizon, and due diligence. Consider adding Palantir Technologies to your portfolio only after conducting thorough research and consulting with a financial advisor. Begin your due diligence on Palantir Technologies stock today to make an informed investment decision.

Featured Posts

-

Barbashevs Ot Goal Ties Series Knights Defeat Wild 4 3

May 09, 2025

Barbashevs Ot Goal Ties Series Knights Defeat Wild 4 3

May 09, 2025 -

Navigating The Ai Landscape Apples Path Forward

May 09, 2025

Navigating The Ai Landscape Apples Path Forward

May 09, 2025 -

Manchester Castle Music Festival Olly Murs To Perform

May 09, 2025

Manchester Castle Music Festival Olly Murs To Perform

May 09, 2025 -

Indian Stock Market Today Sensex Nifty Updates And Analysis

May 09, 2025

Indian Stock Market Today Sensex Nifty Updates And Analysis

May 09, 2025 -

Franco Colapinto Sergio Perez Lead Tributes To F1 Figure

May 09, 2025

Franco Colapinto Sergio Perez Lead Tributes To F1 Figure

May 09, 2025