Is Palantir A Good Investment Right Now?

Table of Contents

Palantir's Business Model and Growth Potential

Palantir operates through two primary platforms: Gotham, catering to government agencies and defense contractors, and Foundry, serving commercial clients across various sectors. Gotham focuses on national security and intelligence, leveraging Palantir's advanced data integration and analysis capabilities for complex investigations and operational efficiency. Foundry, on the other hand, empowers commercial organizations to integrate and analyze vast amounts of data, driving better decision-making across departments.

Palantir's target markets offer substantial growth opportunities. The government sector, particularly in defense and intelligence, represents a large and relatively stable source of revenue through long-term contracts. The commercial market presents even greater potential for expansion, with numerous industries seeking to leverage data analytics for improved efficiency and competitive advantage. This dual-platform approach mitigates risk and provides avenues for growth in diverse sectors.

Palantir's revenue streams largely consist of subscription fees and professional services related to the implementation and support of its platforms. While profitability has been a focus, the company's significant investment in research and development suggests a long-term strategy prioritizing growth over immediate profits.

- Market share in government and commercial data analytics: While precise figures are difficult to obtain, Palantir holds a significant position in certain niche government markets and is aggressively expanding its commercial footprint.

- Competitive advantages and technological innovation: Palantir’s platforms are known for their intuitive interface and ability to handle exceptionally complex datasets. Continuous innovation in artificial intelligence (AI) and machine learning (ML) further strengthens its competitive edge.

- Long-term contracts and recurring revenue streams: Government contracts, in particular, provide a predictable revenue stream, reducing reliance on short-term sales cycles.

- Potential for expansion into new markets: Palantir continues to explore new application areas for its platforms, creating opportunities for future growth.

Financial Performance and Valuation

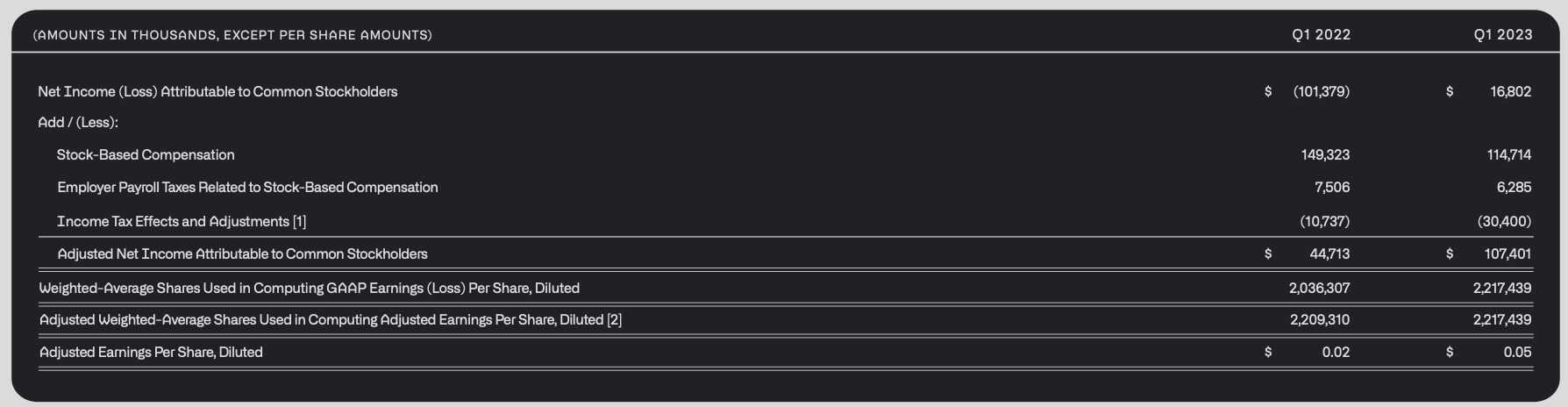

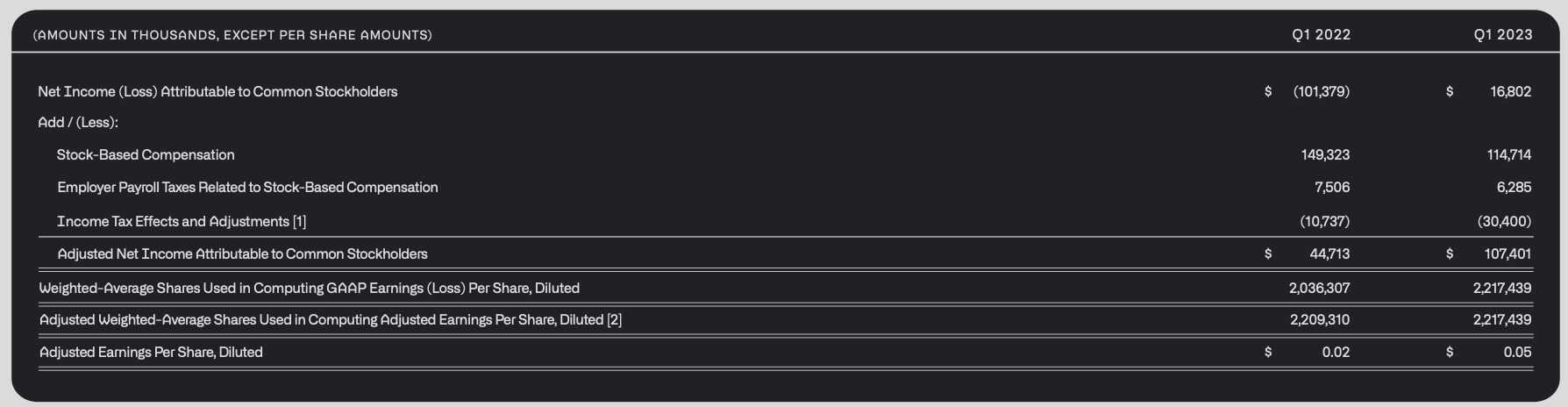

Analyzing Palantir's financial performance requires a nuanced approach. While revenue has shown consistent growth, profitability remains a key area of focus for investors. Examining key financial metrics like revenue growth, operating margins, and cash flow provides insight into the company’s financial health. The Palantir stock price reflects investor sentiment and market conditions, exhibiting significant volatility. Its valuation, often compared to other data analytics companies like Snowflake and Datadog, requires careful assessment relative to its growth trajectory and future prospects.

- Key financial metrics (revenue growth, profitability margins, debt-to-equity ratio): Investors should closely monitor these metrics to assess Palantir's financial strength and sustainability.

- Comparison to competitors' valuations (e.g., Snowflake, Datadog): A comparative analysis with similar companies offers valuable context for evaluating Palantir’s valuation.

- Analyst ratings and price targets: While not definitive, analyst opinions provide a snapshot of market sentiment towards Palantir stock.

- Potential risks related to financial performance: Fluctuations in revenue growth, particularly from government contracts, can significantly impact the stock price.

Risks and Challenges Facing Palantir

Despite its potential, Palantir faces several challenges. Competition in the data analytics market is fierce, with established players and emerging startups vying for market share. An economic slowdown could negatively impact demand for Palantir's services, especially in the commercial sector. Regulatory changes related to data privacy and security could also pose challenges. Furthermore, its substantial reliance on large government contracts presents a risk, as these contracts can be subject to budgetary constraints and political shifts.

- Competitive landscape and major competitors: Companies like Snowflake, Datadog, and Amazon Web Services (AWS) represent significant competition in the data analytics space.

- Dependence on government contracts and its impact: A reduction in government spending or changes in procurement processes could negatively impact Palantir's revenue.

- Potential for regulatory hurdles or investigations: Data privacy regulations require careful adherence, and any breaches or violations can have serious consequences.

- Risks associated with data security and privacy: Protecting sensitive data is paramount, and any security breaches can damage Palantir’s reputation and financial performance.

Alternative Investments in the Data Analytics Sector

The data analytics sector offers several alternative investment options. Companies like Snowflake, Datadog, and Tableau provide different approaches to data management and analysis. Each company possesses unique strengths and weaknesses, and a comparative analysis is crucial before making an investment decision. Investors should consider their specific investment objectives and risk tolerance before selecting a company within this dynamic market.

| Company | Strengths | Weaknesses |

|---|---|---|

| Snowflake | Cloud-based data warehousing, scalability | High valuation, dependence on cloud providers |

| Datadog | Monitoring and analytics for cloud apps | Competition from established players |

| Tableau | Data visualization and business intelligence | Less focus on data integration |

Conclusion: Is Palantir the Right Investment for You? A Final Verdict

Investing in Palantir involves weighing significant growth potential against substantial risks. The company’s innovative platforms and substantial market opportunity are compelling, particularly within the government and expanding commercial sectors. However, its valuation, dependence on large government contracts, and intense competition necessitate careful consideration. Before investing in Palantir stock or exploring other data analytics investment opportunities, conduct thorough due diligence, analyze financial statements, and assess your own risk tolerance. The long-term outlook for Palantir is promising, but the inherent volatility demands a cautious and informed approach. Ultimately, the decision of whether Palantir is the right investment for you rests on your individual circumstances and investment strategy. Research further and make informed decisions about a Palantir investment based on your risk tolerance and financial goals.

Featured Posts

-

First Hand Accounts Nottingham Attack Survivors Recount Ordeals

May 09, 2025

First Hand Accounts Nottingham Attack Survivors Recount Ordeals

May 09, 2025 -

Nyt Strands Friday March 14 Game 376 Answers And Help

May 09, 2025

Nyt Strands Friday March 14 Game 376 Answers And Help

May 09, 2025 -

Palantir Stock Investment Should You Buy Before May 5th

May 09, 2025

Palantir Stock Investment Should You Buy Before May 5th

May 09, 2025 -

Adani Ports Rises Eternal Falls Key Stock Market Movers Today

May 09, 2025

Adani Ports Rises Eternal Falls Key Stock Market Movers Today

May 09, 2025 -

Analyzing Luis Enriques Success The Psg Winning Strategy

May 09, 2025

Analyzing Luis Enriques Success The Psg Winning Strategy

May 09, 2025