Is Palantir Stock A Bargain After Its 30% Fall?

Table of Contents

Analyzing Palantir's Recent Performance and the Reasons Behind the Fall

Several factors contribute to Palantir's recent stock price decline. Let's break down the key elements:

Macroeconomic Factors

The current macroeconomic conditions have significantly impacted the stock market, particularly affecting growth stocks like Palantir. Rising interest rates, increased inflation, and a potential recession are all contributing to market volatility. Investors are becoming more risk-averse, leading to a sell-off in many tech stocks, including PLTR. This broader tech stock downturn is a key factor influencing Palantir's price.

- Increased Risk Aversion: Investors are shifting away from riskier growth stocks in favor of safer investments during times of economic uncertainty.

- Interest Rate Hikes: Higher interest rates increase borrowing costs for companies and reduce the present value of future earnings, impacting the valuation of growth stocks.

- Market Volatility: The unpredictable nature of the current market makes investors hesitant to invest in companies with uncertain growth trajectories.

Palantir's Financial Performance

While Palantir has shown revenue growth, scrutiny of its financial performance is necessary. Analyzing Palantir earnings reports reveals a mixed bag. While revenue is increasing, profit margins and cash flow may not be growing at the same rate, potentially causing concern for some investors. Competition in the data analytics sector is intense, and Palantir faces challenges in maintaining its growth trajectory in certain market segments.

- Revenue Growth: Examine the year-over-year revenue growth figures reported in Palantir's quarterly earnings releases. Look for consistent growth or any signs of slowing.

- Profit Margins: Analyze the company's gross and operating profit margins to assess its profitability and efficiency.

- Cash Flow: A strong positive cash flow indicates financial health and stability; monitor Palantir's cash flow from operations.

Government Contracts and Future Growth

Palantir's revenue significantly relies on government contracts, particularly in the US. This dependence creates both opportunities and risks. While government contracts provide a stable revenue stream, they also limit the company's exposure to the broader commercial market. Future growth hinges on securing new contracts and expanding into the commercial sector.

- Government Contract Renewals: The success of future revenue depends heavily on the renewal of existing government contracts.

- Commercial Market Penetration: Palantir's expansion into the commercial market is crucial for long-term sustainable growth.

- Geopolitical Risks: International political instability and changes in government priorities can impact the revenue stream from government contracts.

Valuation and Potential Upside: Is Palantir Stock Undervalued?

Determining whether Palantir stock is undervalued requires a careful valuation analysis.

Comparing Palantir's Valuation to Peers

Comparing Palantir's Price-to-Sales (P/S) ratio and other key valuation metrics to competitors in the data analytics and government tech space is crucial. This comparative analysis helps to determine if the current Palantir valuation reflects the company's long-term potential or if it's currently trading at a discount compared to similar companies.

- P/S Ratio: Compare Palantir's P/S ratio to that of its competitors. A lower P/S ratio may indicate undervaluation.

- Comparable Companies Analysis: Identify companies with similar business models and market positions to benchmark Palantir's valuation.

Assessing the Risk-Reward Profile

Investing in Palantir carries inherent risks. The volatile stock price and reliance on specific contracts present challenges. However, if the company meets its growth targets, the potential upside could be substantial. Investors need to carefully weigh these risks against the potential rewards.

- Volatility Risk: Palantir's stock price is known for its volatility, potentially leading to significant losses in the short term.

- Contract Risk: Dependence on a limited number of large contracts makes Palantir vulnerable to contract losses or delays.

- Competition Risk: Intense competition in the data analytics market poses a threat to Palantir's market share and profitability.

Alternative Investment Strategies: Options Beyond Buying the Dip

Investing in Palantir doesn't necessitate a "buy the dip" approach. Several alternative investment strategies can help mitigate risk.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps mitigate the risk of investing a lump sum at a market peak.

Diversification

Diversifying your investment portfolio across different asset classes and sectors reduces the overall risk. Don't put all your eggs in one basket.

Options Trading (Optional)

For sophisticated investors, options trading can be a tool to manage risk and potentially profit from price fluctuations. However, options trading carries substantial risk and should only be undertaken with a thorough understanding of the market.

Conclusion: Is Palantir Stock a Bargain? The Verdict and Next Steps

Determining whether Palantir stock is currently a bargain requires careful consideration of its recent performance, valuation, and inherent risks. While the 30% drop presents a potentially attractive entry point for some investors, the macroeconomic environment and Palantir's reliance on government contracts remain significant concerns. Before making any investment decision, conduct thorough due diligence, consider your risk tolerance, and explore alternative investment strategies like dollar-cost averaging and portfolio diversification. Is Palantir stock investment right for you? Only your own research can answer that question. Analyze Palantir stock outlook and determine if PLTR aligns with your investment goals. Consider whether this bargain stock fits your portfolio strategy.

Featured Posts

-

Bbc Strictly Come Dancing Wynne Evanss Response To Return Rumors

May 10, 2025

Bbc Strictly Come Dancing Wynne Evanss Response To Return Rumors

May 10, 2025 -

Pam Bondi Laughs Reaction To James Comers Epstein Files Accusations

May 10, 2025

Pam Bondi Laughs Reaction To James Comers Epstein Files Accusations

May 10, 2025 -

Informations Utiles Sur Le Don De Cheveux A Dijon

May 10, 2025

Informations Utiles Sur Le Don De Cheveux A Dijon

May 10, 2025 -

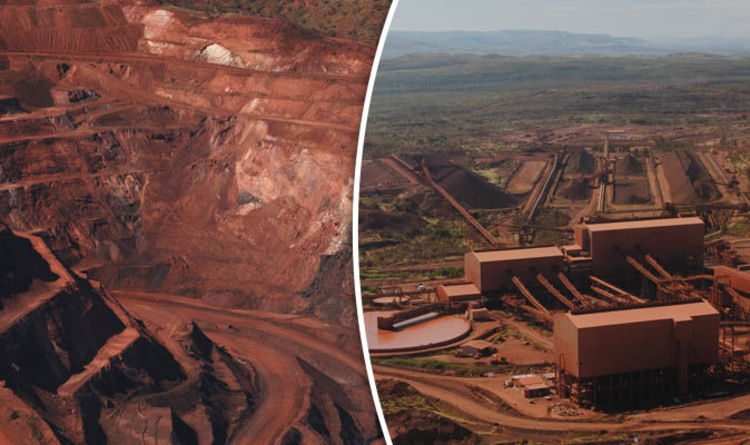

Iron Ore Price Drop Chinas Steel Output Restrictions And Market Response

May 10, 2025

Iron Ore Price Drop Chinas Steel Output Restrictions And Market Response

May 10, 2025 -

Krt Alqdm Waltdkhyn Tathyrh Ela Allaebyn Walryadt

May 10, 2025

Krt Alqdm Waltdkhyn Tathyrh Ela Allaebyn Walryadt

May 10, 2025