Is Palantir Stock A Buy Before May 5th? A Comprehensive Guide

Table of Contents

Palantir's Recent Performance and Financial Health

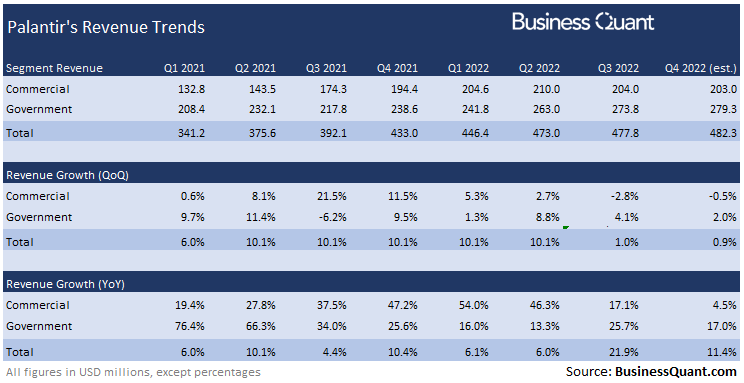

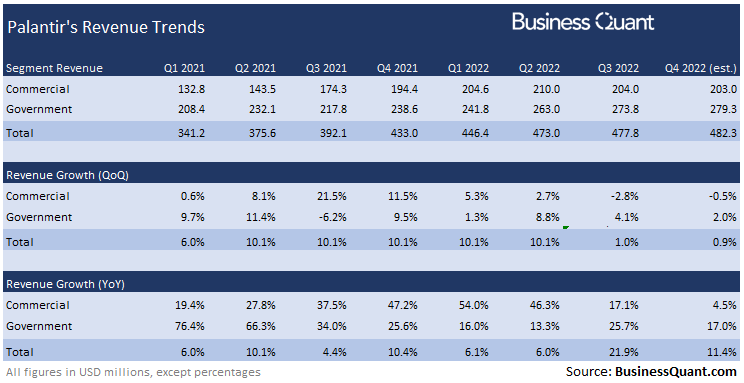

Analyzing Palantir's recent performance requires a deep dive into its financial reports. Understanding its revenue growth, profitability, and overall financial health is crucial for assessing its investment potential. Let's examine the key metrics:

-

Revenue Growth: Examining the latest quarterly earnings reports reveals Palantir's revenue growth compared to previous quarters and year-over-year performance. Consistent, strong revenue growth is a positive sign, indicating market demand for its products and services. Any significant deviations from expected growth should be carefully scrutinized.

-

Profitability Margins: Palantir's profitability margins, including gross and operating margins, provide insight into its operational efficiency and pricing strategies. Improving margins indicate a positive trend in cost management and pricing power. Declining margins may warrant further investigation.

-

Cash Flow and Debt: A healthy cash flow situation and manageable debt levels are vital for long-term sustainability. Analyzing Palantir's cash flow from operations and its debt-to-equity ratio helps determine its financial stability and its ability to invest in future growth initiatives.

-

Key Performance Indicators (KPIs): Understanding Palantir's KPIs, such as customer acquisition cost (CAC) and average contract value (ACV), sheds light on the efficiency of its sales and marketing efforts and the value it delivers to its clients. Tracking these KPIs over time provides valuable insights into the company's performance.

Recent news and events, such as new contract wins or strategic partnerships, also have a significant impact on Palantir's stock price. Staying informed about these developments is essential for making well-informed investment choices.

Future Growth Prospects and Market Opportunities

Palantir's future growth depends heavily on its ability to capitalize on market opportunities in both the government and commercial sectors. Its growth strategy involves several key areas:

-

Government Contracts: Government contracts constitute a significant portion of Palantir's revenue. The securing of new government contracts, particularly large-scale ones, significantly impacts future revenue streams and overall growth trajectory. Understanding the pipeline of potential future contracts is crucial.

-

Commercial Sector Expansion: Palantir's expansion into the commercial sector is a key driver of future growth. Competition in this sector is intense, requiring Palantir to demonstrate a clear competitive advantage and effectively reach new customers. Analyzing its market penetration and competitive landscape is crucial.

-

AI Innovation: Palantir's investments in artificial intelligence (AI) and machine learning (ML) are pivotal for its future innovation and product development. The successful integration of AI into its offerings could drive significant growth and market differentiation.

-

Long-Term Market Trends: Factors like increasing data volumes, growing demand for data analytics, and the expanding adoption of AI in various industries will influence Palantir's long-term prospects. Staying aware of these broader industry trends is essential.

Risk Assessment and Potential Downsides

Investing in Palantir stock, like any investment, carries inherent risks. It’s crucial to acknowledge potential downsides:

-

Competition: Palantir faces competition from established tech giants like Microsoft and Google, which could impact its market share and growth potential. Analyzing the competitive landscape and Palantir's competitive advantages is essential.

-

Government Contract Dependence: Palantir's significant reliance on government contracts exposes it to potential risks associated with government budgeting, policy changes, and geopolitical factors.

-

Regulatory Risks: Compliance with data privacy regulations and other regulatory requirements is critical for Palantir's operations. Failure to comply could result in significant penalties and reputational damage.

-

Valuation Concerns: Palantir's current market capitalization relative to its revenue and earnings should be carefully considered. Overvaluation could lead to a decline in stock price if the company fails to meet investor expectations.

Technical Analysis and Chart Patterns (Optional)

(Note: This section should only be included if the author possesses sufficient expertise in technical analysis. Otherwise, it should be omitted to avoid providing misleading or inaccurate information.)

A brief technical analysis of Palantir's stock chart can provide additional insights. Identifying key support and resistance levels, along with relevant technical indicators like moving averages and RSI, could offer clues about potential price movements. However, it's crucial to remember that technical analysis is not a foolproof method for predicting future stock prices.

Conclusion

Deciding whether Palantir stock is a buy before May 5th requires a careful consideration of its recent performance, future prospects, and associated risks. While Palantir demonstrates strong growth potential in government and commercial sectors, fuelled by AI innovation, it also faces significant competition and relies heavily on government contracts. Thorough due diligence is vital. Based on the analysis above, further research is needed before a definitive buy/sell/hold recommendation can be made.

Is Palantir stock a buy for you before May 5th? Conduct your own thorough research and make an informed decision based on your individual risk tolerance and investment goals. Learn more about Palantir's stock performance and future projections before making any investment.

Featured Posts

-

Accelerated Nuclear Power Plant Construction A Trump Administration Priority

May 10, 2025

Accelerated Nuclear Power Plant Construction A Trump Administration Priority

May 10, 2025 -

Nottingham Attack Investigation Appointment Of Retired Judge Announced

May 10, 2025

Nottingham Attack Investigation Appointment Of Retired Judge Announced

May 10, 2025 -

Indiana High School Sports Examining The Ihsaas Transgender Athlete Ban Following Trump Order

May 10, 2025

Indiana High School Sports Examining The Ihsaas Transgender Athlete Ban Following Trump Order

May 10, 2025 -

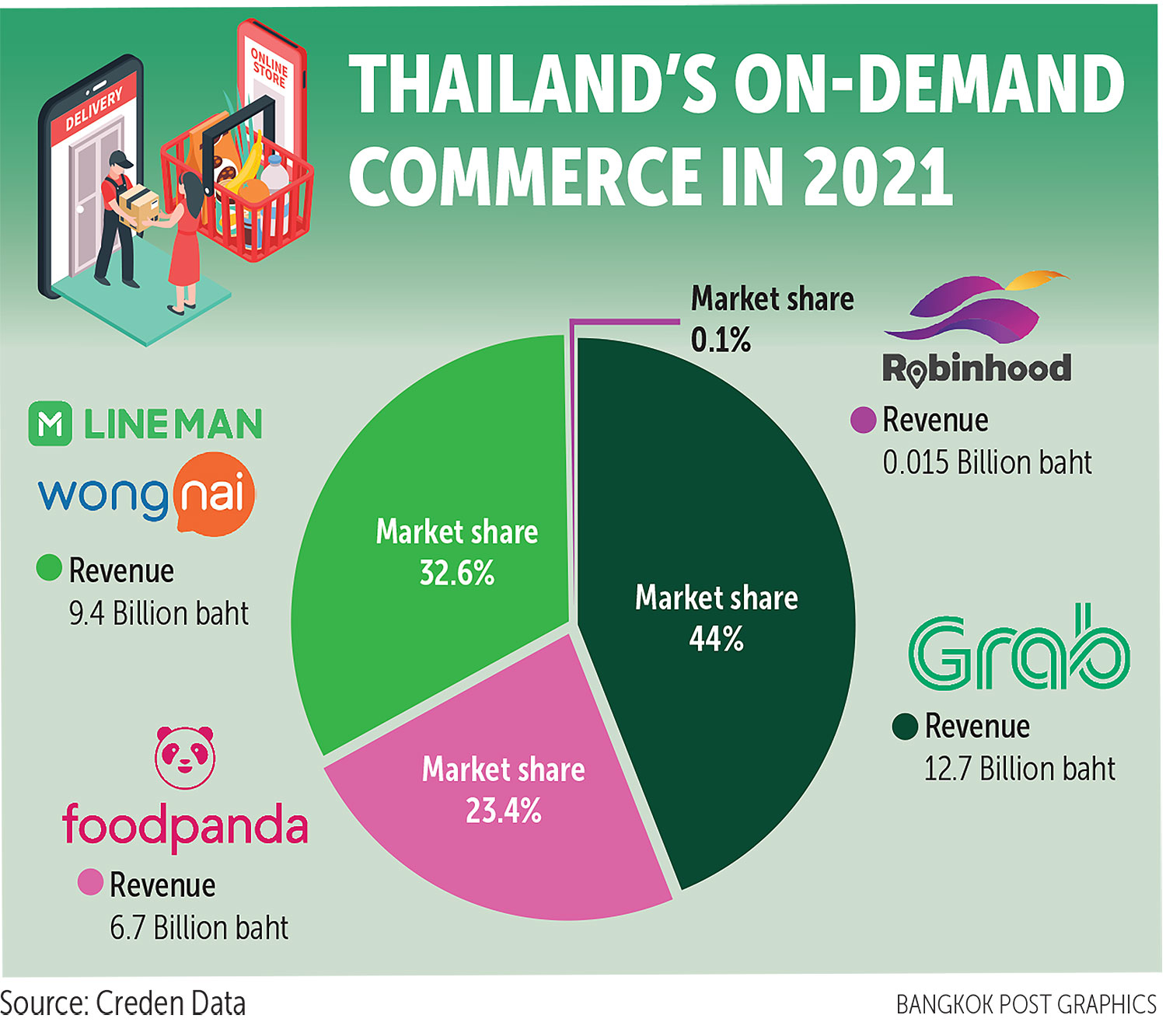

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

The Epstein Client List Pam Bondis Involvement And Potential Fallout

May 10, 2025

The Epstein Client List Pam Bondis Involvement And Potential Fallout

May 10, 2025