Is Palantir Stock A Buy Before The May 5th Earnings Announcement?

Table of Contents

Palantir's Recent Performance and Market Position

Revenue Growth and Profitability

Palantir's recent performance provides a crucial backdrop for evaluating the potential of Palantir stock. Examining quarterly reports reveals important trends in revenue growth and profitability.

- Q4 2022 Compared to Previous Quarters: Analyzing the Q4 2022 results against previous quarters helps determine the consistency of Palantir's growth trajectory. A comparison will reveal if the company is maintaining its growth momentum or experiencing any slowdown.

- Key Revenue Drivers: Palantir's revenue is largely driven by two key segments: government contracts and commercial sales. Understanding the contribution of each segment is essential. A strong performance in either area significantly impacts overall revenue.

- Operating Expenses: Monitoring changes in operating expenses is critical. A decrease in operating expenses, while maintaining or increasing revenue, points to improved profitability and efficiency. Conversely, increasing expenses could signal concerns.

- Path to Profitability: Investors should assess Palantir's progress towards profitability. While Palantir is not yet consistently profitable, examining its operating margin and projections for future profitability is vital for determining long-term investment potential.

Competitive Landscape and Market Share

Palantir operates in a competitive landscape dominated by major players in big data analytics and government contracting. Understanding its competitive positioning is key to assessing Palantir stock's prospects.

- Major Competitors: Key competitors include giants like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. These companies offer competing data analytics solutions and cloud infrastructure.

- Palantir's Unique Technology and Offerings: Palantir's differentiation lies in its proprietary platform's ability to integrate and analyze vast datasets, providing actionable insights. This specialized approach caters to specific government and commercial needs.

- Strategic Partnerships and Acquisitions: Palantir's strategic partnerships and any recent acquisitions significantly impact its market position and potential for future growth. These actions can expand its reach and offerings.

Analyzing Palantir's Upcoming Earnings Announcement

Key Metrics to Watch

The May 5th earnings announcement will provide crucial insights into Palantir's performance. Investors need to carefully track these key metrics:

- Revenue Growth (YoY and QoQ): Year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth rates are fundamental indicators of Palantir's financial health and momentum. Consistent growth is essential for positive market sentiment.

- Operating Income/Loss: A shift from operating losses to profits would signal significant progress towards sustainable profitability. Investors should carefully analyze the drivers behind any changes in operating income.

- Customer Acquisition and Retention Rates: High customer acquisition and low churn rates suggest a strong and sustainable customer base. This indicates the effectiveness of Palantir's sales and marketing efforts.

- Guidance for Future Quarters: Management's guidance on future performance is crucial. This offers insights into their expectations for revenue growth, profitability, and other key metrics.

- New Contract Wins: The announcement of significant new contracts, particularly large government contracts, could boost investor confidence and drive stock price increases.

Potential Catalysts and Risks

Several factors could influence Palantir's stock price following the earnings announcement.

- Positive Catalysts: Exceeding earnings expectations, launching new products or features, securing strategic partnerships, and expanding into new markets are all potential positive catalysts.

- Negative Catalysts: Missing earnings estimates, slower-than-expected revenue growth, increased competition, and challenges in securing new contracts can negatively impact Palantir stock.

Valuation and Investment Considerations

Palantir Stock Valuation

Determining whether Palantir stock is currently undervalued or overvalued requires analyzing its valuation using various metrics.

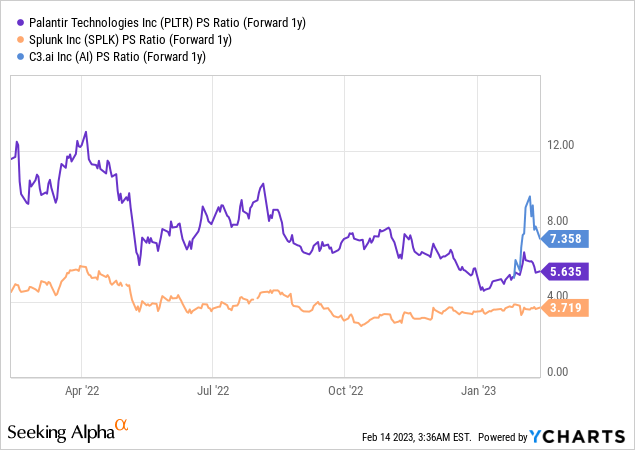

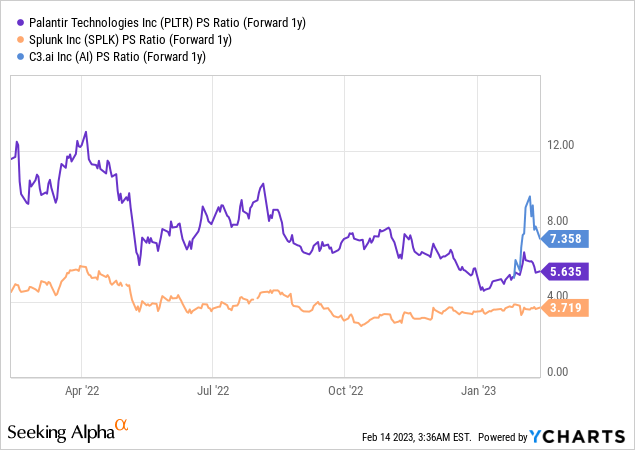

- Key Valuation Metrics: Investors should examine Palantir's P/E ratio (Price-to-Earnings), Price-to-Sales ratio, and other relevant multiples to understand its valuation compared to industry peers.

- Comparison to Competitors: Comparing Palantir's valuation to its competitors provides context and helps gauge whether it's trading at a premium or discount. This analysis helps determine if Palantir stock is a good value.

Risk Tolerance and Investment Strategy

Investing in Palantir stock involves inherent risks. Consider your risk tolerance and investment strategy.

- Long-Term vs. Short-Term Investors: Palantir stock may be better suited for long-term investors with a higher risk tolerance. Short-term investors might find the volatility challenging.

- Inherent Risks: Investing in Palantir carries risks, including potential volatility in its stock price and dependence on government contracts. Thorough due diligence is essential.

Conclusion

The decision of whether to buy Palantir stock before May 5th requires a careful evaluation of its recent performance, the upcoming earnings announcement, and its valuation. While Palantir shows potential for growth in the big data analytics market, significant risks exist. Thoroughly consider the information presented and conduct your own research before making any investment decisions. Remember, thorough due diligence is crucial when considering investing in Palantir stock. Analyze the earnings report carefully, consider your risk tolerance, and make an informed decision about whether Palantir stock aligns with your investment goals.

Featured Posts

-

Post Spaceflight Life Where Is Indias First Astronaut Rakesh Sharma Today

May 09, 2025

Post Spaceflight Life Where Is Indias First Astronaut Rakesh Sharma Today

May 09, 2025 -

Analysis Of Lais Ve Day Speech The Evolving Totalitarian Threat To Taiwan

May 09, 2025

Analysis Of Lais Ve Day Speech The Evolving Totalitarian Threat To Taiwan

May 09, 2025 -

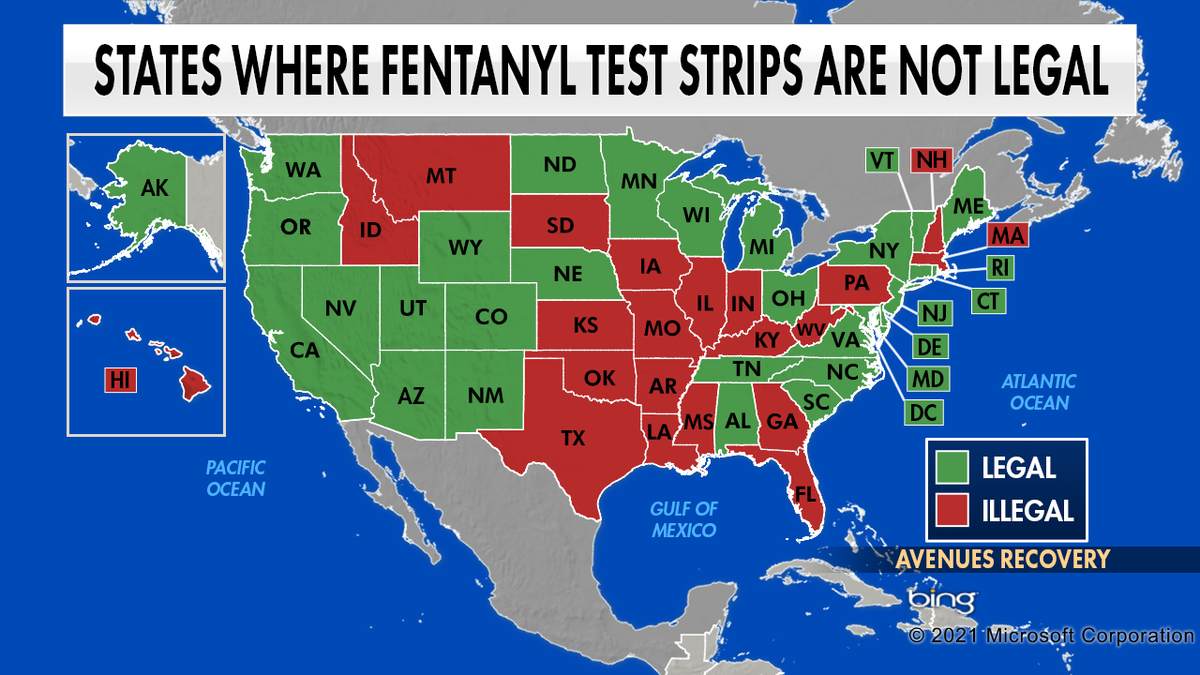

U S China Trade Talks The Unexpected Role Of The Fentanyl Crisis

May 09, 2025

U S China Trade Talks The Unexpected Role Of The Fentanyl Crisis

May 09, 2025 -

Are Bmw And Porsche Losing Ground In China A Detailed Examination

May 09, 2025

Are Bmw And Porsche Losing Ground In China A Detailed Examination

May 09, 2025 -

St Albert Dinner Theatre A Fast Flying Farce You Wont Want To Miss

May 09, 2025

St Albert Dinner Theatre A Fast Flying Farce You Wont Want To Miss

May 09, 2025