Is Palantir Stock A Buy In 2024?

Table of Contents

Palantir's Financial Performance and Growth Prospects

Analyzing Palantir's financial performance is crucial to understanding its investment potential. Recent financial reports reveal a company experiencing growth, but with certain complexities. Key aspects of Palantir Financials include revenue growth, operating margins, and earnings per share (EPS). Understanding these metrics in the context of future projections is vital for any investment decision.

- Revenue Growth: Palantir has shown consistent revenue growth, indicating increasing demand for its data analytics platforms. However, the rate of growth should be assessed against industry averages and future projections to gauge sustainability.

- Operating Margin: Analyzing Palantir's operating margin helps determine the profitability of its operations. Improvements in this metric demonstrate operational efficiency and contribute to long-term value.

- Earnings Per Share (EPS): Tracking EPS is crucial for assessing profitability on a per-share basis. Positive and growing EPS typically indicates a healthy financial position, attractive to investors.

While Palantir showcases positive growth in many areas, potential challenges exist. Increased competition in the big data analytics market and the potential for fluctuations in government contracts pose risks to future growth. Careful consideration of these factors is critical when evaluating Palantir's long-term financial performance. Analyzing Palantir Earnings and PLTR Revenue trends alongside these risks offers a comprehensive perspective.

Government Contracts vs. Commercial Partnerships

Palantir's revenue stream is split between substantial government contracts and its expanding commercial partnerships. Understanding the strengths and weaknesses of each is crucial for assessing the overall risk and reward profile of Palantir stock.

- Government Contracts: These contracts provide a degree of stability and predictable revenue, contributing significantly to Palantir's overall financial health. However, they can be subject to political and budgetary fluctuations. Government Spending on Data Analytics is a key factor influencing this sector.

- Commercial Partnerships: The commercial sector offers greater scalability potential. Palantir's success in securing and maintaining commercial clients speaks to the applicability of its technology beyond government applications. However, competition is significantly fiercer in the commercial arena.

The comparison between Palantir Government Contracts and Palantir Commercial Clients highlights differing risk profiles. Government contracts offer stability but potentially limited scalability, while commercial partnerships have greater growth potential but also increased competition and risk. Assessing the balance of these two revenue streams is key to a complete understanding of Palantir's business model. Analyzing Palantir Partnerships and their contribution to the overall financial picture provides a clearer understanding of their potential impact.

Competition and Market Position

Palantir operates in a fiercely competitive big data analytics market. Key competitors include industry giants like AWS, Microsoft Azure, and Google Cloud. While these companies offer comprehensive cloud services, Palantir differentiates itself through specialized software and strong client relationships, particularly in the government sector.

- Competitive Advantages: Palantir's specialized expertise in complex data analysis and its proven track record with high-profile clients, particularly in the national security space, provide significant competitive advantages.

- Market Share and Expansion: Determining Palantir's market share and its potential for expansion in both the government and commercial sectors is critical. Careful comparison to its competitors reveals the opportunities and challenges Palantir faces in this rapidly evolving landscape.

Understanding the Competitive Landscape Palantir operates in and assessing its Market Share Palantir holds is crucial. A comparison of Palantir Competitors and their relative strengths and weaknesses helps contextualize Palantir's position within the market and provides valuable insight into its future prospects.

Valuation and Stock Price Analysis

Analyzing Palantir's stock price and valuation metrics is essential for determining whether the stock is currently undervalued or overvalued. Key metrics include the Price-to-Earnings (P/E) ratio, which helps to compare Palantir's valuation to other companies in the same industry.

- Stock Price and Valuation Metrics: Tracking Palantir Stock Price fluctuations alongside key valuation metrics is crucial. The Palantir PE Ratio and other similar metrics offer a benchmark against industry peers and help assess whether the current price reflects the company's intrinsic value.

- Market Conditions: External factors like overall market sentiment and economic conditions can significantly influence Palantir's stock price and should be considered. A thorough understanding of these market conditions is necessary to form a well-informed investment decision.

Analyzing PLTR Valuation relative to its growth prospects and comparing it to the performance of industry peers allows for a more informed judgment of whether the Palantir Stock Price reflects its true value. Predictions regarding Stock Price Prediction Palantir should be treated cautiously, relying more on a fundamental analysis.

Conclusion: Should You Buy Palantir Stock in 2024?

Our analysis of Palantir’s financial performance, competitive landscape, and valuation reveals a company with significant growth potential but also inherent risks. While Palantir showcases promising revenue growth and a unique position in the big data analytics market, the competitiveness of the sector and potential fluctuations in government contracts should be carefully considered. Based on this analysis, whether Palantir stock is a buy, hold, or sell in 2024 depends significantly on your personal risk tolerance and investment horizon.

While this analysis suggests a cautious optimism regarding Palantir's future, this is not a financial recommendation. Before making any investment decision regarding Palantir stock, conducting thorough independent research is essential. Remember to consider your individual financial circumstances and consult with a financial advisor if necessary. Ultimately, the decision of whether to Buy Palantir Stock rests with you, armed with the information and perspective this analysis has provided. Remember to carefully consider the implications of investing in Palantir Stock and whether it aligns with your overall investment strategy and risk tolerance. Should I Buy Palantir Stock? The answer depends on your personal assessment after your own diligent research.

Featured Posts

-

Inter Milans Shock Pursuit Of Matthijs De Ligt Loan With Option To Buy

May 09, 2025

Inter Milans Shock Pursuit Of Matthijs De Ligt Loan With Option To Buy

May 09, 2025 -

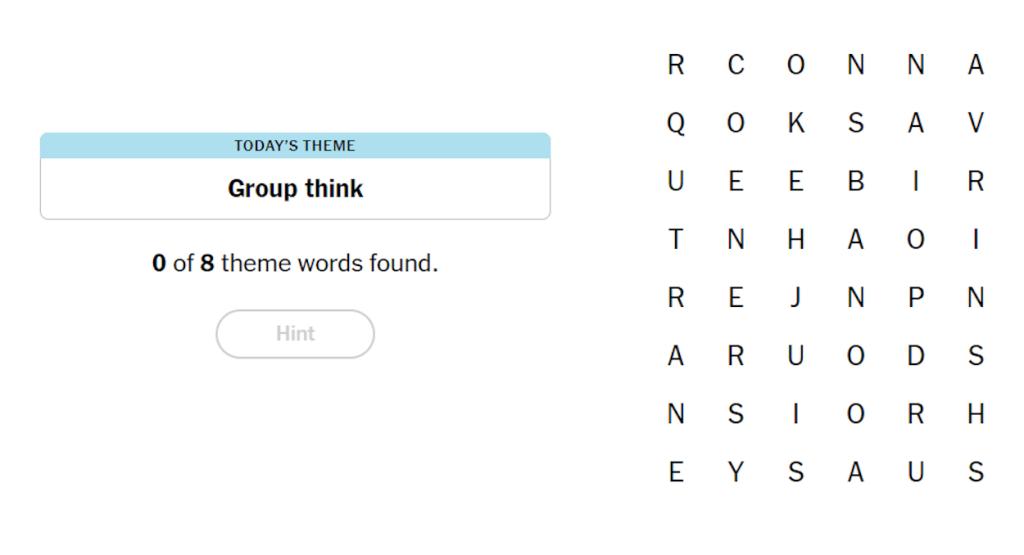

Nyt Strands April 10th Game 403 Complete Solution Guide

May 09, 2025

Nyt Strands April 10th Game 403 Complete Solution Guide

May 09, 2025 -

Bundesliga 2 Matchday 27 Overview Cologne Now Leads Hamburg

May 09, 2025

Bundesliga 2 Matchday 27 Overview Cologne Now Leads Hamburg

May 09, 2025 -

Reaching Nome The Journeys Of 7 First Time Iditarod Competitors

May 09, 2025

Reaching Nome The Journeys Of 7 First Time Iditarod Competitors

May 09, 2025 -

Elon Musks Net Worth How He Built His Business And Financial Powerhouse

May 09, 2025

Elon Musks Net Worth How He Built His Business And Financial Powerhouse

May 09, 2025