Is Palantir Stock A Buy In 2024 Before A Potential 40% Rise In 2025?

Table of Contents

Palantir's Financial Performance and Growth Trajectory

Palantir, renowned for its sophisticated big data analytics platforms and substantial government contracts, has shown a mixed bag in recent financial reports. While revenue growth has been consistent, profitability remains a key focus for the company. Examining key performance indicators (KPIs) is crucial for investors considering a Palantir investment.

- Revenue Growth Year-over-Year: Analyzing the year-over-year revenue growth reveals the company's ability to expand its customer base and secure new contracts. Consistent and accelerating growth is a positive indicator.

- Profitability Trends: Tracking Palantir's profit margins (gross, operating, and net) provides insight into the efficiency of its operations and its ability to translate revenue into profit. Investors should look for signs of improving profitability.

- Customer Acquisition and Retention: The rate at which Palantir acquires new customers and retains existing ones demonstrates the stickiness of its products and services. High customer retention suggests strong customer satisfaction and long-term revenue streams.

- Government vs. Commercial Contracts Revenue Breakdown: Understanding the proportion of revenue generated from government versus commercial contracts is crucial, as each sector presents different risk profiles and growth opportunities. Diversification across both sectors is generally considered positive.

Competitive Landscape and Market Position

Palantir operates in a competitive big data analytics market, facing established players and emerging disruptors. Analyzing its competitive advantages is crucial for assessing its long-term viability.

- Key Competitors and Their Market Share: Major competitors include companies like AWS, Microsoft, Google Cloud, and other specialized analytics firms. Evaluating their market share helps determine Palantir's relative position.

- Palantir's Unique Selling Propositions (USPs): Palantir's strengths lie in its advanced data integration capabilities, its expertise in handling sensitive government data, and its strong relationships with governmental agencies.

- Potential Threats to Palantir's Market Position: The emergence of open-source alternatives and new entrants with innovative technologies poses a constant threat. Keeping track of technological advancements is crucial.

- Analysis of Market Saturation and Future Growth Potential: The market for big data analytics is vast and growing, but understanding market saturation and future growth potential is crucial for determining Palantir's long-term growth trajectory.

Future Growth Drivers and Potential Risks

The projected 40% rise in Palantir's stock price by 2025 hinges on several factors, but also faces considerable risks.

- New Product Development and Market Penetration Strategies: Palantir's ability to launch innovative products and expand into new markets will significantly impact its future growth.

- Government Policy Changes Impacting the Company: Shifts in government spending and regulatory changes could significantly affect Palantir's revenue from government contracts.

- Economic Forecasts and Their Impact on Palantir: A global economic downturn could negatively impact both government and commercial spending on big data analytics.

- Geopolitical Risks and Their Influence on the Company's Performance: Geopolitical instability can disrupt operations and affect contracts, particularly in international markets.

Valuation and Investment Considerations

Before investing in Palantir, a thorough valuation analysis is essential.

- Key Valuation Metrics and Their Interpretation: Analyzing key metrics like the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and other relevant financial ratios is vital for determining Palantir's valuation relative to its peers and its intrinsic value.

- Comparison with Industry Peers’ Valuations: Comparing Palantir's valuation to its competitors provides a benchmark to assess whether it's overvalued or undervalued.

- Assessing the Risk-Reward Profile of Investing in Palantir: Weighing the potential for a 40% increase against the risks identified above is crucial for determining the risk-reward profile.

- Diversification Strategies for Managing Investment Risk: Diversifying your investment portfolio reduces the overall risk associated with any single investment, including Palantir stock.

Conclusion: Should You Buy Palantir Stock in 2024?

Palantir's future performance rests on a delicate balance between its potential for growth and inherent risks. While the prospect of a 40% stock price increase by 2025 is tempting, investors must carefully consider the competitive landscape, economic factors, and geopolitical uncertainties. Its financial performance shows promise, but profitability and consistent growth need to be maintained. After carefully considering Palantir's growth potential and the associated risks, decide if Palantir stock aligns with your investment strategy. Conduct thorough due diligence before making any investment decisions regarding Palantir stock. Remember, this is not financial advice; consult with a financial advisor before making any investment decisions.

Featured Posts

-

Betting On The Oilers Kings Series Odds And Expert Analysis

May 10, 2025

Betting On The Oilers Kings Series Odds And Expert Analysis

May 10, 2025 -

Elizabeth Stewart And Lilysilk Spring Collection Sustainable Style Meets Hollywood Glamour

May 10, 2025

Elizabeth Stewart And Lilysilk Spring Collection Sustainable Style Meets Hollywood Glamour

May 10, 2025 -

The Future Of Design Figmas Ai And Its Competitors

May 10, 2025

The Future Of Design Figmas Ai And Its Competitors

May 10, 2025 -

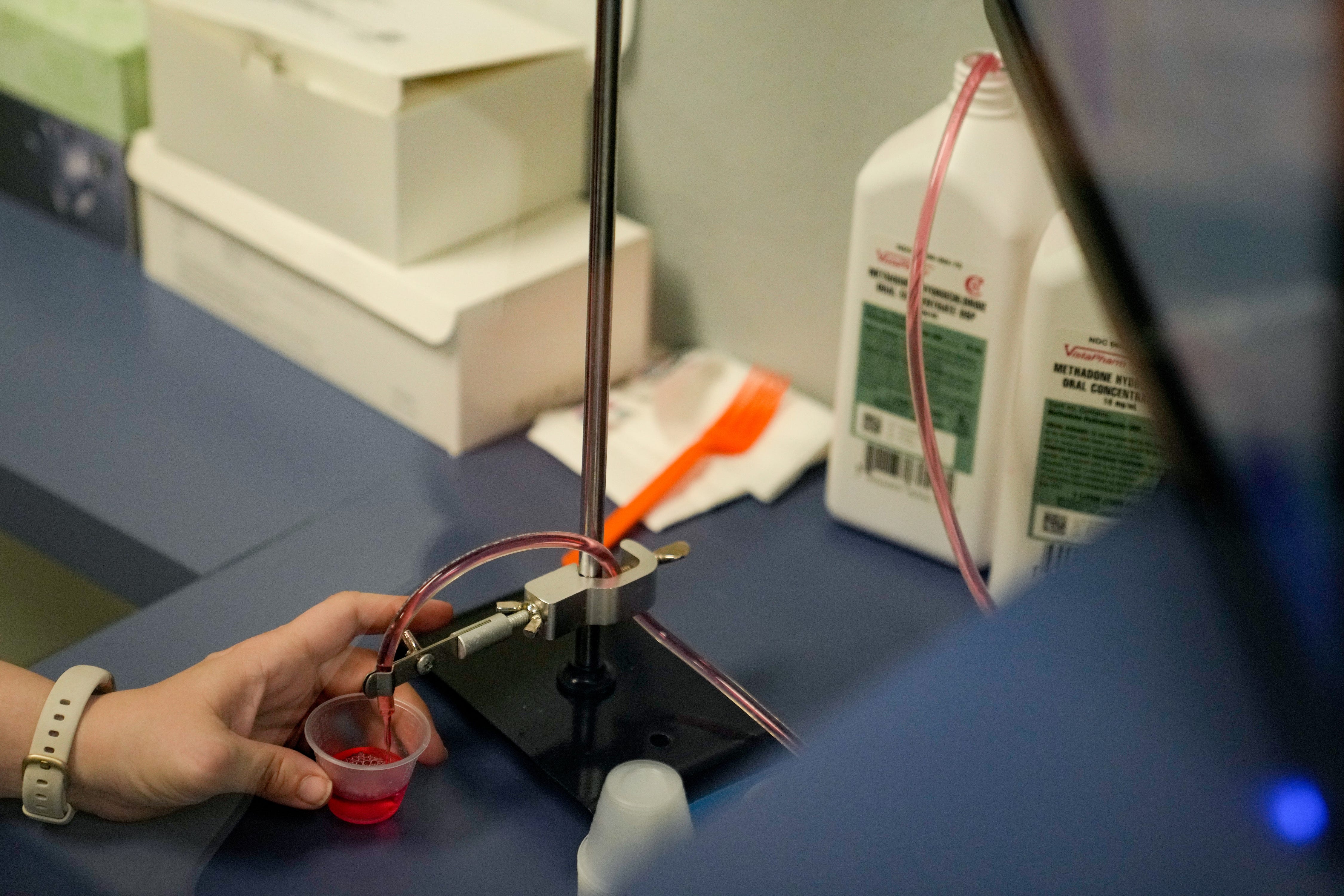

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025 -

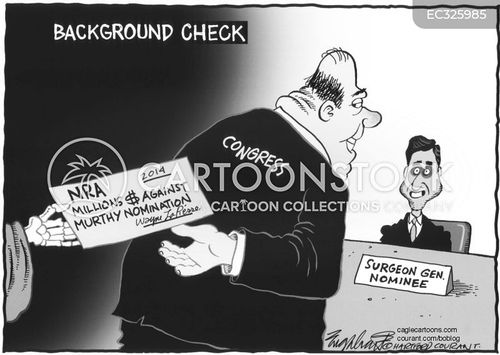

White Houses Last Minute Decision Maha Influencer Replaces Surgeon General Nominee

May 10, 2025

White Houses Last Minute Decision Maha Influencer Replaces Surgeon General Nominee

May 10, 2025