Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir's Financial Performance and Valuation

Revenue Growth and Profitability

Palantir's recent financial reports paint a mixed picture. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus for investors considering whether to buy Palantir stock.

- Year-over-Year Revenue Growth: Analyzing the year-over-year revenue growth reveals the trajectory of Palantir's top-line performance. Consistent high growth indicates strong market demand and successful execution of its business strategy. Conversely, slowing growth can signal challenges in the market or internal operational issues.

- Quarterly Earnings: Examining quarterly earnings reports provides a more granular view of Palantir's financial performance, highlighting short-term trends and fluctuations. Positive and consistently improving quarterly earnings are a positive sign for potential investors considering buying Palantir stock.

- Free Cash Flow: Free cash flow (FCF) is a crucial metric, indicating the cash generated by Palantir's operations after accounting for capital expenditures. Strong FCF suggests financial health and the ability to reinvest in growth or return capital to shareholders.

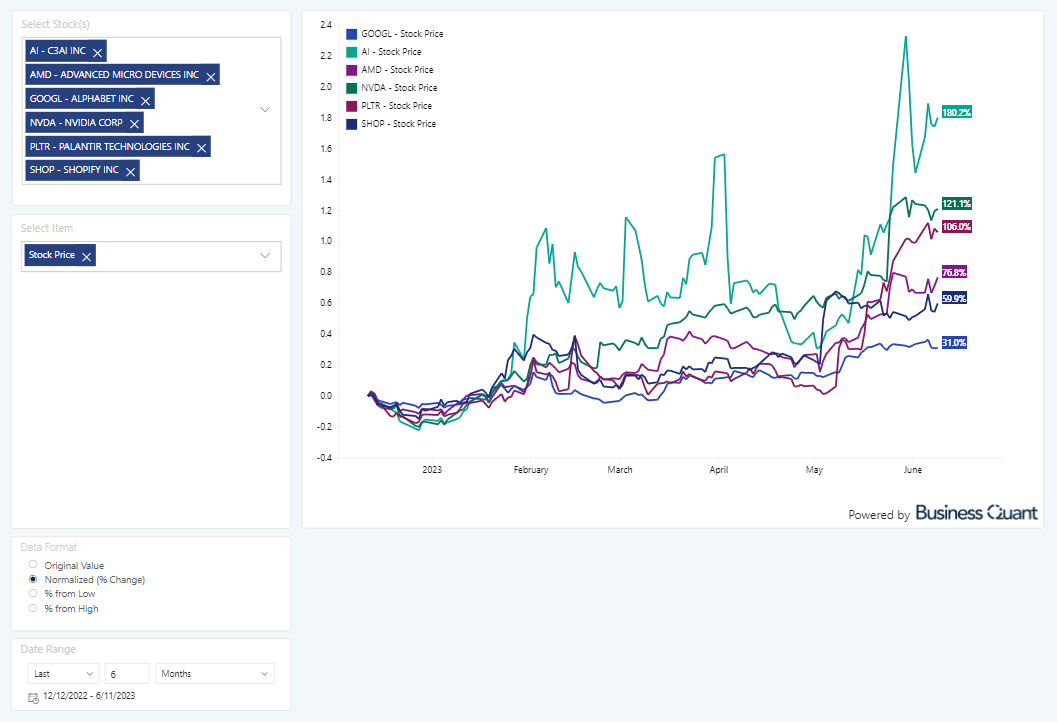

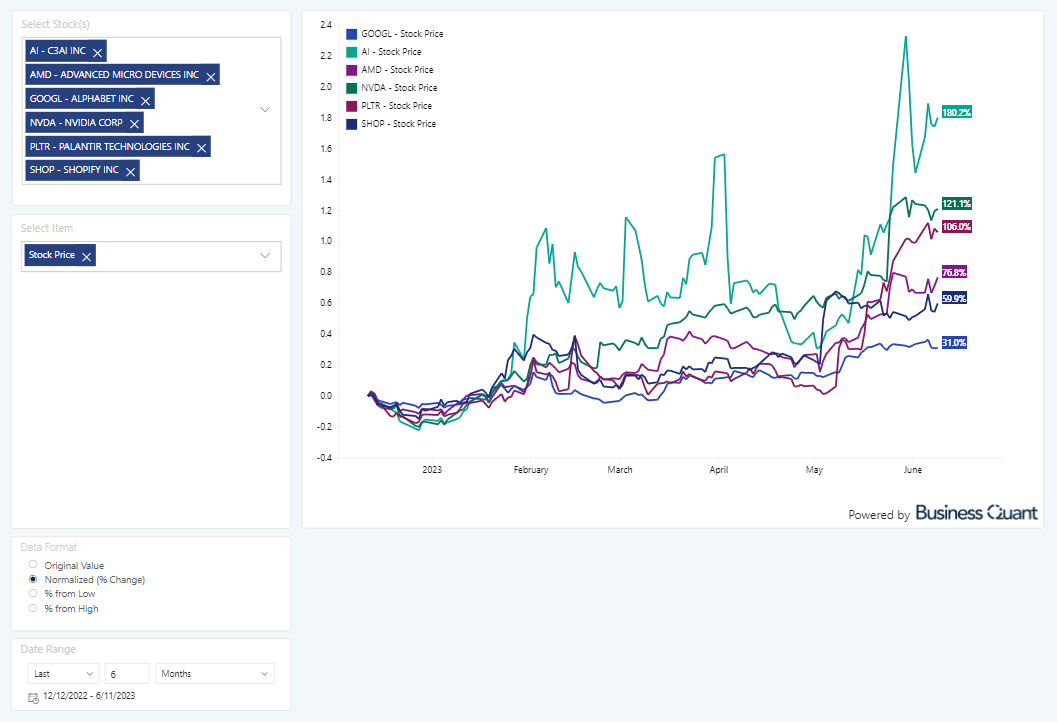

- Comparison to Competitors: Benchmarking Palantir's financial performance against competitors like Snowflake, Databricks, and other big data analytics firms provides valuable context. This comparison helps determine whether Palantir's growth and profitability are in line with, or exceeding, industry standards.

Valuation Metrics

Determining whether Palantir stock is a buy also requires a thorough evaluation of its valuation. Several key metrics offer insights into whether the current stock price accurately reflects the company's intrinsic value.

- Price-to-Sales (P/S) Ratio: The P/S ratio compares Palantir's market capitalization to its revenue. A high P/S ratio might suggest that the market is anticipating significant future growth, while a low P/S ratio could indicate undervaluation.

- Price-to-Earnings (P/E) Ratio: The P/E ratio compares Palantir's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay a premium for future growth, while a low P/E ratio might suggest the stock is undervalued.

- PEG Ratio: The PEG ratio combines the P/E ratio with the company's growth rate. This metric helps adjust for differences in growth rates when comparing companies with different P/E ratios. A lower PEG ratio generally indicates a more attractive valuation.

- Interest Rate Impact: Rising interest rates can impact Palantir's valuation, potentially making the stock less attractive to investors as they seek higher returns from less risky investments.

Growth Prospects and Market Opportunity

Government Contracts and Commercial Growth

Palantir's revenue is derived from both government and commercial contracts. Understanding the balance and future potential of each is crucial for assessing the prospects of buying Palantir stock.

- Government Contracts: Palantir has a strong presence in government contracts, providing data analytics solutions to various agencies. The stability and long-term nature of these contracts offer revenue predictability, but excessive reliance on government contracts can pose risks.

- Commercial Growth Strategy: Palantir's ability to expand its commercial client base is critical for long-term growth. The size and growth potential of its addressable market in the commercial sector will be a major determinant of its future success and whether buying Palantir stock is a sound investment.

- Long-Term Contract Impact: The predictability and duration of long-term contracts significantly influence Palantir's revenue stream and provide a strong foundation for future growth. These contracts are a significant factor in evaluating the risks and rewards of buying Palantir stock.

Technological Innovation and Competitive Landscape

Palantir's continued success hinges on its ability to innovate and maintain a competitive edge in the rapidly evolving big data analytics market.

- Key Innovations: Palantir's technological advancements and the potential impact of these innovations on its market share and revenue growth are crucial for assessing its investment potential. Innovative products and services are essential for attracting and retaining clients.

- Competitive Landscape Analysis: A thorough analysis of Palantir's competitors, including their strengths and weaknesses, is necessary to gauge Palantir's competitive position and long-term sustainability. A strong competitive position is a crucial factor when considering whether to buy Palantir stock.

Risks and Challenges

Dependence on a Few Key Clients

Palantir's reliance on a relatively small number of large clients presents a significant risk.

- Impact of Client Loss: The potential impact of losing a major client on Palantir's revenue and profitability must be carefully considered. This risk can significantly affect the viability of buying Palantir stock.

- Client Concentration Mitigation: Palantir's strategies to mitigate the risk of client concentration, such as diversifying its client base and developing new products and services, should be evaluated.

Geopolitical Risks and Regulatory Scrutiny

Geopolitical factors and regulatory changes pose additional challenges for Palantir.

- International Relations and Trade Policies: The impact of international relations and trade policies on Palantir's operations, particularly its government contracts, must be considered. Geopolitical instability can introduce significant uncertainty.

- Regulatory Scrutiny and Changes: The potential for regulatory changes and their impact on Palantir's growth and profitability need to be carefully analyzed. Increased regulatory scrutiny can hinder operations and limit growth.

Conclusion

Is Palantir stock a buy? Our analysis reveals a company with significant growth potential in a rapidly expanding market. However, its reliance on a few key clients, along with geopolitical and regulatory uncertainties, presents considerable risk. While Palantir's revenue growth is promising, profitability and valuation remain areas of concern. Based on our analysis, while Palantir stock presents both opportunities and risks, it's a hold recommendation for investors with a high-risk tolerance. Further research and consideration of your individual investment goals are crucial before deciding whether to buy Palantir stock. Remember that investing in Palantir stock involves inherent risks, and past performance is not indicative of future results. Thoroughly assess your own risk tolerance before making any investment decisions related to Palantir stock.

Featured Posts

-

Family Support For Dakota Johnsons Materialist Film Debut

May 10, 2025

Family Support For Dakota Johnsons Materialist Film Debut

May 10, 2025 -

Incredibly Dangerous Months Of Warnings Before Newark Atc System Failure

May 10, 2025

Incredibly Dangerous Months Of Warnings Before Newark Atc System Failure

May 10, 2025 -

Dijon Bilel Latreche Boxeur Convoque Pour Violences Conjugales

May 10, 2025

Dijon Bilel Latreche Boxeur Convoque Pour Violences Conjugales

May 10, 2025 -

Dijon Concertation Achevee Pour La 3e Ligne De Tram

May 10, 2025

Dijon Concertation Achevee Pour La 3e Ligne De Tram

May 10, 2025 -

La Fire Victims Face Exploitative Rent Hikes A Selling Sunset Star Speaks Out

May 10, 2025

La Fire Victims Face Exploitative Rent Hikes A Selling Sunset Star Speaks Out

May 10, 2025