Is Palantir Stock A Good Buy Before May 5th? Pros And Cons

Table of Contents

Palantir Technologies (PLTR) stock has seen its share of ups and downs. With May 5th on the horizon, many investors are grappling with the question: is now the opportune moment to buy Palantir stock? This comprehensive analysis dives deep into the potential advantages and disadvantages of investing in PLTR before this date, equipping you with the knowledge needed to make a well-informed decision. We'll examine Palantir's financial health, market position, and future prospects to help you determine if Palantir fits your investment strategy.

Palantir's Strengths: Why Some Investors Are Bullish

Palantir's bullish sentiment stems from several key factors contributing to its potential for future growth. Let's explore the strengths that make some investors optimistic about PLTR stock.

Government Contracts and Revenue Growth

Palantir's significant revenue stream comes from substantial government contracts. This provides a stable foundation for the company's financial performance.

- Robust Government Contracts: Palantir enjoys a strong presence in the government sector, providing data analytics and intelligence solutions to various agencies worldwide. Examples include contracts with the US intelligence community and defense departments, contributing significantly to its revenue.

- Impressive Growth Projections: Analysts predict continued growth in Palantir's government contracts, fueled by increasing government spending on data analytics and national security initiatives. This projected growth fuels optimism about future profitability.

- Year-over-Year Revenue Growth: Palantir has consistently demonstrated year-over-year revenue growth, showcasing the effectiveness of its business model and market demand for its services. While specific numbers fluctuate, the overall trend indicates positive momentum.

- Increased Government Spending: The rising demand for advanced data analytics and artificial intelligence within government agencies worldwide presents a significant opportunity for Palantir to secure further lucrative contracts, driving future revenue growth and making it a potentially strong investment.

Expanding Commercial Market Share

While government contracts form a cornerstone of Palantir's business, its expansion into the commercial sector is equally vital for long-term growth.

- Strategic Commercial Partnerships: Palantir has successfully formed partnerships with major corporations across various industries, demonstrating its ability to adapt its technology to diverse business needs.

- Untapped Commercial Potential: The commercial market for advanced data analytics is vast and expanding rapidly, offering immense potential for Palantir to capture market share and fuel revenue growth. This diversification reduces reliance on government contracts.

- Successful Commercial Wins: Recent successful contract wins in the commercial sector highlight Palantir's increasing traction and ability to compete effectively against established players. These wins provide concrete evidence of its market penetration.

- Competitive Advantage: Palantir's unique technology and data integration capabilities provide a competitive edge, allowing it to attract and retain clients in a fiercely competitive market.

Technological Innovation and Future Potential

Palantir's commitment to innovation is another key driver of its potential.

- Significant R&D Investment: Palantir consistently invests heavily in research and development, focusing on artificial intelligence (AI), machine learning (ML), and other cutting-edge technologies. This commitment to innovation ensures its technological leadership in the data analytics space.

- Long-Term Technological Advantage: Palantir's technological advancements position it for future growth across diverse sectors, including healthcare, finance, and manufacturing, enhancing its potential for sustained success.

- New Product Launches: The introduction of new products and features showcases Palantir's ability to adapt to evolving market demands and maintain its competitive edge. These launches keep the company at the forefront of data analytics innovation.

- Strong Intellectual Property: Palantir's strong intellectual property portfolio protects its unique technologies and provides a significant competitive advantage in the market, ensuring a sustainable advantage in a constantly evolving landscape.

Palantir's Weaknesses: Reasons for Caution

Despite the considerable strengths, several factors warrant caution when considering a Palantir investment.

High Valuation and Stock Volatility

Palantir's current valuation is a key concern for some investors.

- High P/E Ratio: Compared to its earnings and revenue, Palantir's valuation is considered high by some analysts, making it susceptible to market corrections. Analyzing the Price-to-Earnings (P/E) ratio is crucial to assess this aspect.

- Stock Price Volatility: PLTR stock has historically exhibited significant volatility, posing a higher risk for investors compared to more stable stocks.

- Market Corrections: High-growth tech stocks, like Palantir, are often more sensitive to market downturns. A significant market correction could negatively impact PLTR's stock price.

- Financial Ratios: Scrutinizing relevant financial ratios, such as the P/E ratio and debt-to-equity ratio, is crucial before making an investment decision.

Dependence on Government Contracts

Reliance on government contracts presents inherent risks.

- Government Budget Cuts: Changes in government budgets or priorities could impact Palantir's revenue streams. Budget cuts or shifts in government focus could lead to reduced contract awards.

- Political Risk: Political changes and shifts in government policy can affect the awarding of future contracts and introduce uncertainty. Political instability can have a major impact on government spending.

- Revenue Stream Diversification: Palantir's continued push into the commercial sector is crucial to diversify its revenue streams and reduce dependence on government contracts, lessening this risk factor.

- Competitive Landscape: Understanding how Palantir's reliance on government contracts compares to its competitors provides valuable insight into its overall risk profile.

Competition in the Data Analytics Market

The data analytics market is highly competitive.

- Key Competitors: Companies like AWS, Microsoft, and Google offer competing data analytics services, creating a competitive landscape.

- Market Saturation: The increasing number of players in the data analytics market creates intense competition for market share.

- Competitive Advantages and Disadvantages: A thorough analysis of Palantir's competitive advantages and disadvantages against its rivals is crucial in assessing its future prospects.

- Future Competition: The potential for increased competition from both established players and new entrants in the future needs consideration.

Conclusion: Is Palantir Right for You?

Investing in Palantir before May 5th presents both significant opportunities and considerable risks. While the company displays impressive government contracts and a robust technological foundation, its high valuation and dependence on government funding remain significant concerns. The information provided above outlines the key pros and cons to help you make an informed decision.

Call to Action: Ultimately, whether Palantir stock is a good buy before May 5th hinges on your individual risk tolerance and investment strategy. Conduct exhaustive due diligence, consult with a financial advisor, and thoroughly analyze the Palantir stock outlook before committing your capital to PLTR or any other stock. Remember, investing in the stock market always carries risk.

Featured Posts

-

5 Factors Fueling Todays Stock Market Rally Sensex At 1400 Points Nifty Above 23800

May 10, 2025

5 Factors Fueling Todays Stock Market Rally Sensex At 1400 Points Nifty Above 23800

May 10, 2025 -

174 Billion Wipeout Trump Tariffs Impact On Global Billionaires

May 10, 2025

174 Billion Wipeout Trump Tariffs Impact On Global Billionaires

May 10, 2025 -

Infineon Ifx Stock Under Pressure Sales Guidance And Tariff Concerns

May 10, 2025

Infineon Ifx Stock Under Pressure Sales Guidance And Tariff Concerns

May 10, 2025 -

Wynne Evans And Go Compare An Update Following Strictly Incident

May 10, 2025

Wynne Evans And Go Compare An Update Following Strictly Incident

May 10, 2025 -

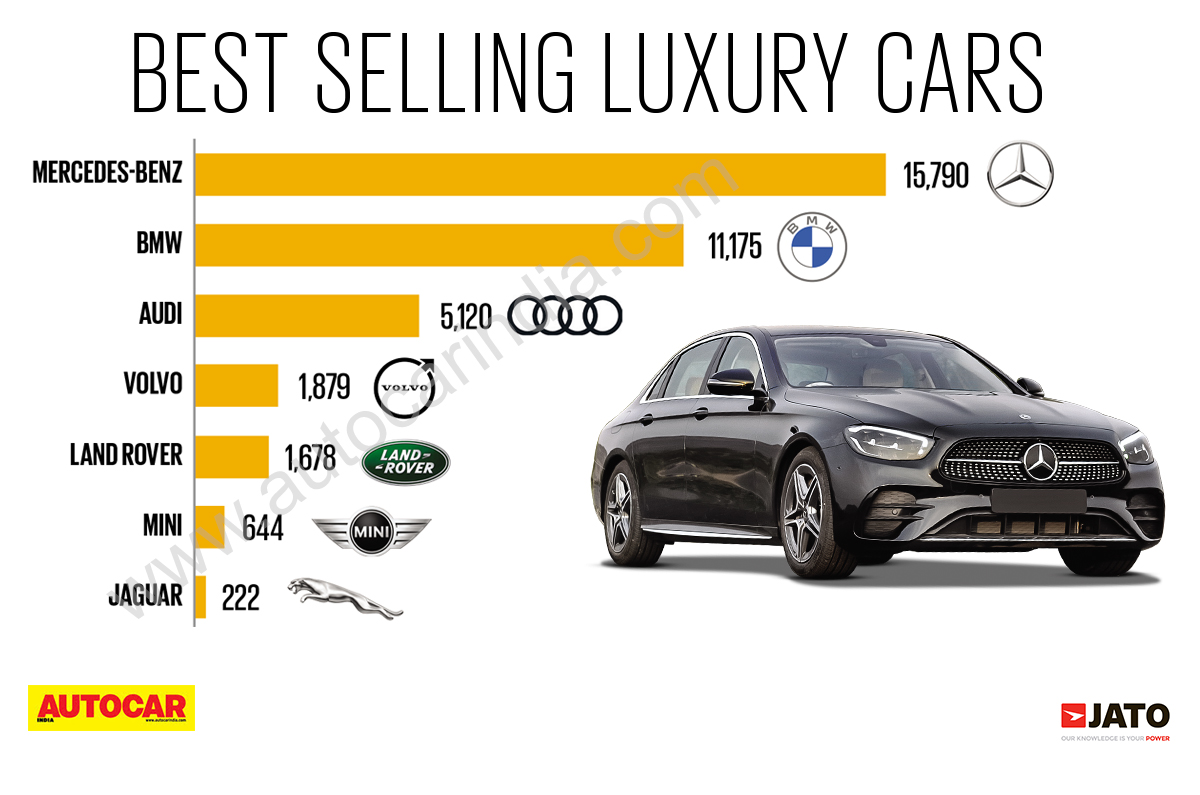

Luxury Car Sales In China The Headwinds Facing Bmw Porsche And Competitors

May 10, 2025

Luxury Car Sales In China The Headwinds Facing Bmw Porsche And Competitors

May 10, 2025