Is Palantir Stock A Good Buy Before May 5th? Risk And Reward Assessment

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Analyzing Palantir's financial health is crucial for assessing its investment viability. This involves examining revenue growth, profitability, and the balance between government and commercial contracts.

Revenue Growth and Profitability

Palantir's revenue growth has shown a mixed pattern in recent quarters. While the company has demonstrated consistent growth, profitability remains a key area of focus for investors.

- Q4 2023 Revenue: [Insert Actual Q4 2023 Revenue Figure Here] – representing a [percentage]% increase/decrease compared to Q4 2022.

- Annual Revenue Growth (2022-2023): [Insert Actual Annual Revenue Growth Figure Here]

- Operating Margin: [Insert Actual Operating Margin Figure Here] – indicating [positive/negative] profitability.

- Net Income: [Insert Actual Net Income Figure Here] – showing [positive/negative] net income. This should be compared to previous years to establish trends.

These figures need to be analyzed in the context of broader market trends and compared to industry competitors to gain a complete picture of Palantir's financial performance.

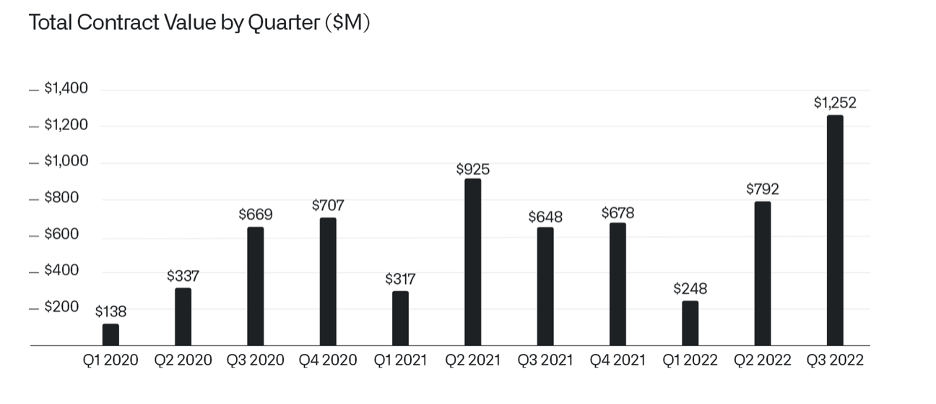

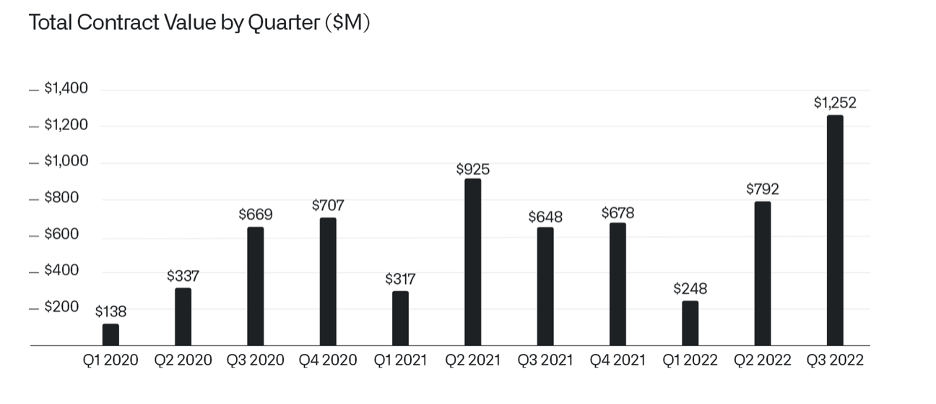

Government Contracts vs. Commercial Growth

Palantir's revenue stream is significantly influenced by the balance between government and commercial contracts.

- Government Contracts: [Insert approximate percentage of revenue from government contracts]. This sector provides stable, albeit potentially less rapidly growing revenue. The renewal of existing contracts is a critical factor to monitor.

- Commercial Growth: [Insert approximate percentage of revenue from commercial contracts]. This area presents higher growth potential but also carries higher risk due to market competition and the need to secure new clients consistently.

Understanding the dynamics between these two revenue streams is crucial for forecasting Palantir's future financial performance.

Key Partnerships and Strategic Initiatives

Strategic partnerships and new product launches significantly impact Palantir's growth trajectory.

- Partnership with [Partner Name]: This collaboration allows Palantir to [explain the benefit of the partnership, e.g., expand into new markets, access new technologies].

- Launch of [New Product/Service]: The introduction of [new product/service] positions Palantir to capitalize on the growing demand for [market segment]. This should be further elaborated on, detailing its potential impact.

Assessing the Risks of Investing in Palantir Stock

Investing in Palantir stock involves inherent risks that require careful consideration. These risks include valuation concerns, intense competition, and potential geopolitical and regulatory challenges.

Valuation and Stock Price Volatility

PLTR stock has historically exhibited significant volatility.

- Current P/E Ratio: [Insert Current P/E Ratio Here] – compare this to industry averages and competitor ratios to assess whether the stock is overvalued or undervalued.

- Historical Volatility: Analysis of past price fluctuations can highlight the inherent risk associated with investing in PLTR stock. Consider using a standard deviation measure.

Competition and Market Saturation

The big data and AI market is highly competitive.

- Key Competitors: [List key competitors, e.g., AWS, Microsoft Azure, Google Cloud]. Analyze each competitor's strengths and weaknesses relative to Palantir.

- Market Saturation Risk: Assess the potential for market saturation and the impact it could have on Palantir's future growth.

Geopolitical Risks and Regulatory Concerns

Geopolitical events and regulatory changes can significantly affect Palantir's business.

- Impact of [Geopolitical Event]: Discuss how specific geopolitical events, such as international conflicts or trade wars, might affect Palantir's operations.

- Regulatory Scrutiny: Analyze the potential impact of data privacy regulations and other relevant laws on Palantir's operations and future growth.

Evaluating the Potential Rewards of Investing in Palantir Stock

Despite the risks, investing in Palantir offers several potential rewards, including long-term growth prospects, potential for increased profitability, and a strong client base.

Long-Term Growth Potential in Big Data and AI

Palantir operates within a rapidly expanding market.

- Market Size Projections: Cite market research data predicting the future size of the big data and AI markets.

- Palantir's Competitive Advantages: Highlight Palantir's unique technologies and capabilities that give it a competitive edge.

- Future Market Share Gains: Analyze Palantir's potential to increase its market share in the coming years.

Potential for Increased Profitability

Palantir is actively working to improve its profitability.

- Cost-Cutting Measures: Discuss Palantir's strategies to reduce costs and improve efficiency.

- Improved Operating Margins: Analyze the potential for improved operating margins in the future.

Strong Client Base and Brand Recognition

Palantir enjoys a strong reputation and a diverse client base.

- Key Clients: Mention some of Palantir's prominent clients, showcasing the breadth and depth of its clientele.

- Client Relationships: Assess the strength and stability of Palantir's relationships with its clients.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Ultimately, the decision of whether to buy Palantir stock before May 5th is complex. While Palantir operates in a high-growth market and has a strong client base, the stock's volatility and the competitive landscape present significant risks. The analysis of its financial performance, competitive advantages, and potential challenges, including those related to geopolitical factors and regulatory changes, should inform your investment strategy. Conduct your own thorough due diligence before making any investment decisions related to Palantir stock or PLTR stock. Remember to consider your individual risk tolerance and investment goals before investing in Palantir or any other stock.

Featured Posts

-

Officers Face Misconduct Meeting Nottingham Attacks Probe

May 09, 2025

Officers Face Misconduct Meeting Nottingham Attacks Probe

May 09, 2025 -

Korol Charlz Iii Nagradil Stivena Fraya Rytsarskim Ordenom

May 09, 2025

Korol Charlz Iii Nagradil Stivena Fraya Rytsarskim Ordenom

May 09, 2025 -

Inquiry Into Nottingham Attacks Judge Taylors Appointment

May 09, 2025

Inquiry Into Nottingham Attacks Judge Taylors Appointment

May 09, 2025 -

Space X Valuation Soars Musks Stake Exceeds Tesla Investment By 43 Billion

May 09, 2025

Space X Valuation Soars Musks Stake Exceeds Tesla Investment By 43 Billion

May 09, 2025 -

Indian Insurers Seek Simpler Rules For Bond Forward Trading

May 09, 2025

Indian Insurers Seek Simpler Rules For Bond Forward Trading

May 09, 2025