Is Palantir Stock A Good Investment Before May 5th? Analyst Opinions

Table of Contents

Recent Palantir Stock Performance and Price Predictions Before May 5th

Palantir's stock price has experienced considerable volatility in recent months. Understanding these fluctuations is crucial for any potential Palantir stock investment. Let's examine the recent trends:

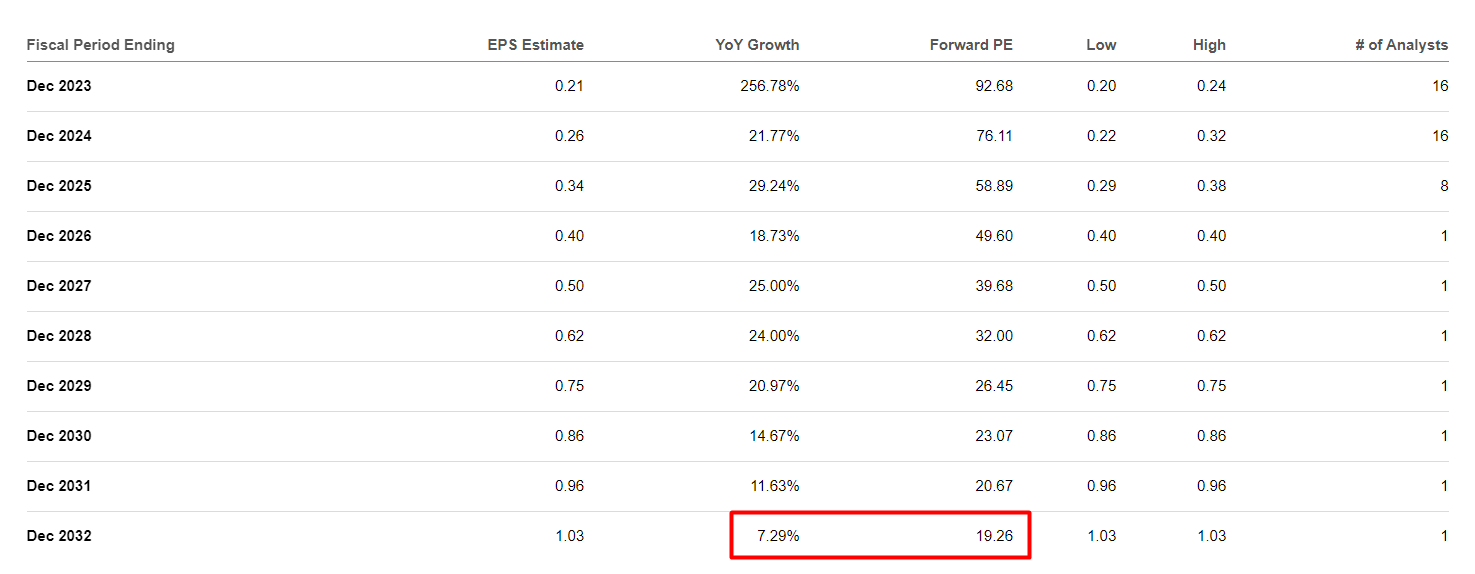

[Insert Chart/Graph showing Palantir stock price performance over the past 3-6 months]

Key Performance Indicators (KPIs):

- Average daily trading volume in April: [Insert Data] This indicates the level of investor activity surrounding the stock.

- Highest and lowest stock price in the past month: [Insert Data] This highlights the recent price range and volatility.

- Comparison to industry peers' performance: [Insert Data, compare to similar companies in the data analytics sector]. This helps to contextualize Palantir's performance within its market.

Several factors influence Palantir's stock price. Recent earnings reports, news regarding new contracts (particularly government contracts), and overall market sentiment all play significant roles. Positive news regarding AI integration or expansion into new markets can boost the stock price, while negative news or disappointing earnings can lead to declines. Keeping abreast of these factors is vital for informed Palantir stock investment decisions.

Analyst Ratings and Price Targets for Palantir Stock

Analyst opinions on Palantir stock vary, making it essential to review multiple perspectives before investing. The consensus rating among major financial analysts often provides a valuable overview.

[Insert Table summarizing analyst ratings (Buy, Hold, Sell) and price targets from various firms like Goldman Sachs, Morgan Stanley, JPMorgan Chase, etc.]

Individual Analyst Viewpoints:

- Goldman Sachs: [Summarize Goldman Sachs' outlook, including their reasoning and projected growth for Palantir].

- Morgan Stanley: [Summarize Morgan Stanley's assessment, focusing on identified risks and potential downsides].

- JPMorgan Chase: [Summarize JPMorgan Chase's prediction, including their forecast for Palantir's earnings and revenue].

It's crucial to note that analyst opinions are not guarantees of future performance. Their price targets and ratings represent their current assessments based on available data and should be considered alongside your own research. Changes in analyst sentiment, as reflected in updated ratings and price targets, should be carefully monitored.

Key Factors to Consider Before Investing in Palantir Stock

Before making any Palantir stock investment, you must carefully assess several key factors:

Company Fundamentals: Examine Palantir's revenue growth, profitability (or lack thereof), and debt levels. A strong track record of revenue growth and improving profitability is generally a positive sign.

Competitive Landscape: Palantir operates in a competitive data analytics market. Analyze its competitive advantages, market share, and ability to innovate and adapt to technological advancements.

Potential Risks: Investing in Palantir carries several risks:

- Competition: The data analytics sector is fiercely competitive. New entrants and existing players could erode Palantir's market share.

- Regulatory Hurdles: Government regulations, particularly concerning data privacy and security, could impact Palantir's operations.

- Technological Disruption: Rapid technological advancements could render some of Palantir's technologies obsolete.

Strengths and Weaknesses:

- Strengths: Strong government contracts, potential for growth in the AI sector, and a strong brand reputation.

- Weaknesses: Dependence on a few key clients, profitability concerns, and high competition.

Conclusion

Analyzing Palantir stock investment requires a thorough understanding of recent performance, analyst opinions, and the inherent risks and rewards. While some analysts are bullish on Palantir's long-term potential, particularly in the burgeoning AI market, others express concerns about profitability and competition. The date of May 5th, while seemingly arbitrary for this analysis, serves as a convenient marker for current investor sentiment. Remember, stock market predictions are inherently uncertain. This analysis provides insights, but conducting your own thorough due diligence is paramount.

Call to Action: Based on this analysis, consider carefully weighing the potential rewards against the considerable risks before making any Palantir stock investment. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions related to Palantir stock investment. This analysis should not be considered financial advice.

Featured Posts

-

Elizabeth Line Ensuring Smooth Journeys For Wheelchair Users

May 10, 2025

Elizabeth Line Ensuring Smooth Journeys For Wheelchair Users

May 10, 2025 -

The Tragic Fate Of Americas First Non Binary Person

May 10, 2025

The Tragic Fate Of Americas First Non Binary Person

May 10, 2025 -

Shifting Sands China Diversifies Canola Imports Post Canada Fallout

May 10, 2025

Shifting Sands China Diversifies Canola Imports Post Canada Fallout

May 10, 2025 -

Solving The April 12 2025 Nyt Crossword Strands Theme Explained

May 10, 2025

Solving The April 12 2025 Nyt Crossword Strands Theme Explained

May 10, 2025 -

Real Id Act Impacts On Summer Travel Plans

May 10, 2025

Real Id Act Impacts On Summer Travel Plans

May 10, 2025