Is Palantir Technologies Stock A Buy Now? A Comprehensive Investment Analysis

Table of Contents

1. Palantir's Business Model and Growth Prospects

Palantir Technologies is a prominent player in the big data analytics market, providing cutting-edge software platforms to government and commercial clients. Its success hinges on its ability to process and analyze vast amounts of data, delivering actionable insights to its clientele. Understanding its growth prospects is vital for assessing whether Palantir Technologies stock is a wise investment.

1.1 Government Contracts and Revenue Streams

Palantir's revenue streams are significantly influenced by its substantial government contracts, both domestically in the US and internationally. This reliance, while currently providing a stable revenue base, also presents inherent risks.

- Recent Contract Wins: Palantir has secured several significant contracts with government agencies, bolstering its revenue streams and contributing to its growth trajectory. However, specific details of these contracts are often confidential due to security and competitive reasons.

- Revenue Growth Trends: Palantir has demonstrated consistent revenue growth, though the rate of growth has fluctuated. Analyzing historical trends and comparing them to industry averages can help determine the sustainability of this growth.

- Risks Associated with Government Contracts: Government contracts are subject to budgetary constraints and political shifts. Changes in government priorities or funding cuts can directly impact Palantir's revenue and overall financial health. This risk should be considered when assessing Palantir Technologies stock.

1.2 Technological Innovation and Competitive Advantage

Palantir's core technologies, Gotham and Foundry, are the engines driving its success. Gotham focuses on government clients, while Foundry caters to commercial clients. Their ability to maintain a competitive edge in the rapidly evolving big data analytics market is crucial for long-term growth.

- Key Technologies and Applications: Gotham and Foundry provide powerful data integration, analysis, and visualization capabilities, setting them apart from competitors. Their applications span various sectors, from intelligence and defense to finance and healthcare.

- Comparison with Competitors: The big data analytics market is competitive. Key competitors include Databricks, Snowflake, and others. Palantir’s competitive advantage lies in its specialized platforms and strong relationships with key government clients.

- R&D Spending and Future Growth: Palantir's consistent investment in research and development is crucial for maintaining its technological edge and developing new products and services. This investment directly impacts future growth projections for Palantir Technologies stock.

2. Financial Performance and Valuation

A thorough examination of Palantir's financial performance and valuation is vital for determining whether Palantir Technologies stock is currently undervalued or overvalued.

2.1 Key Financial Metrics

Analyzing Palantir's key financial metrics provides insights into its financial health and growth potential.

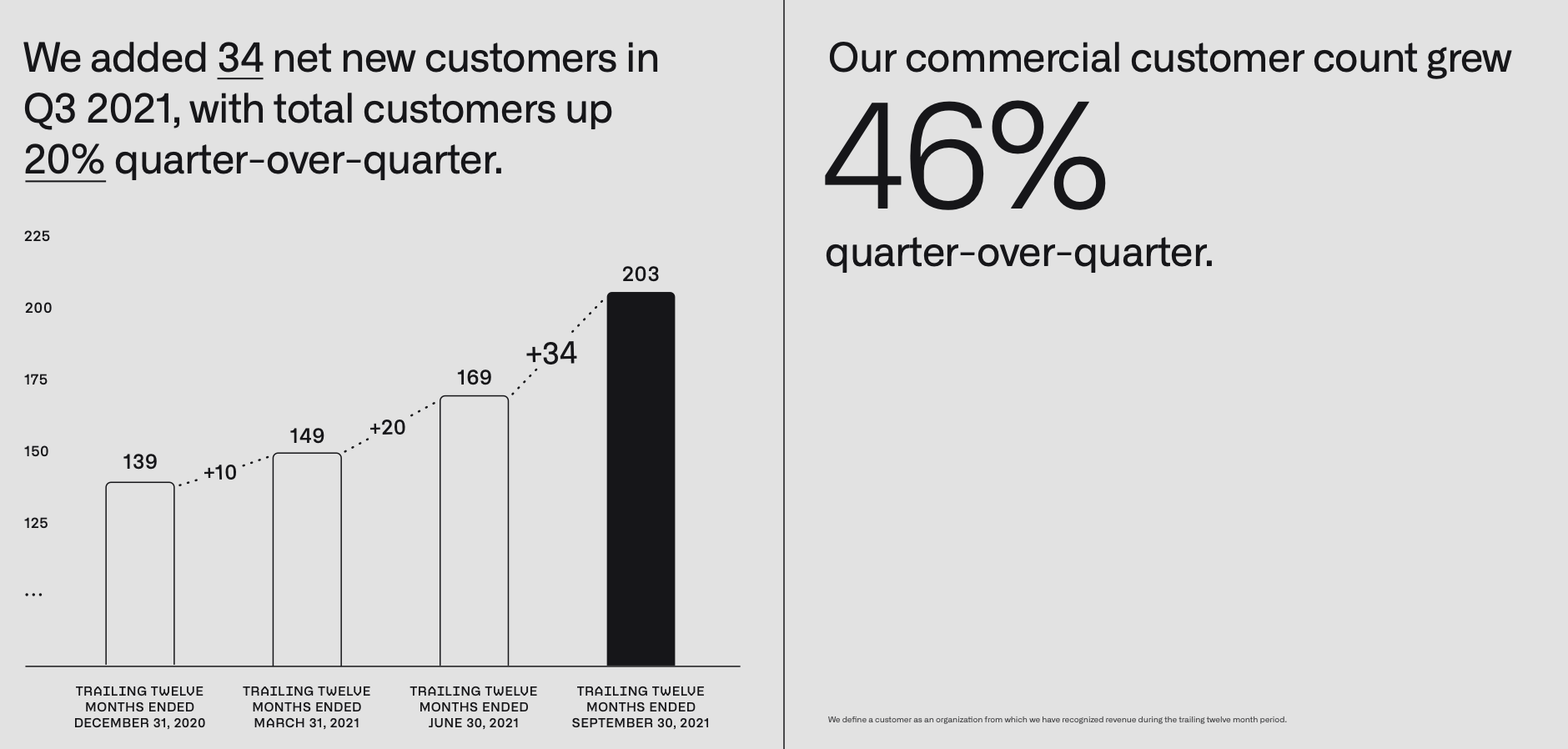

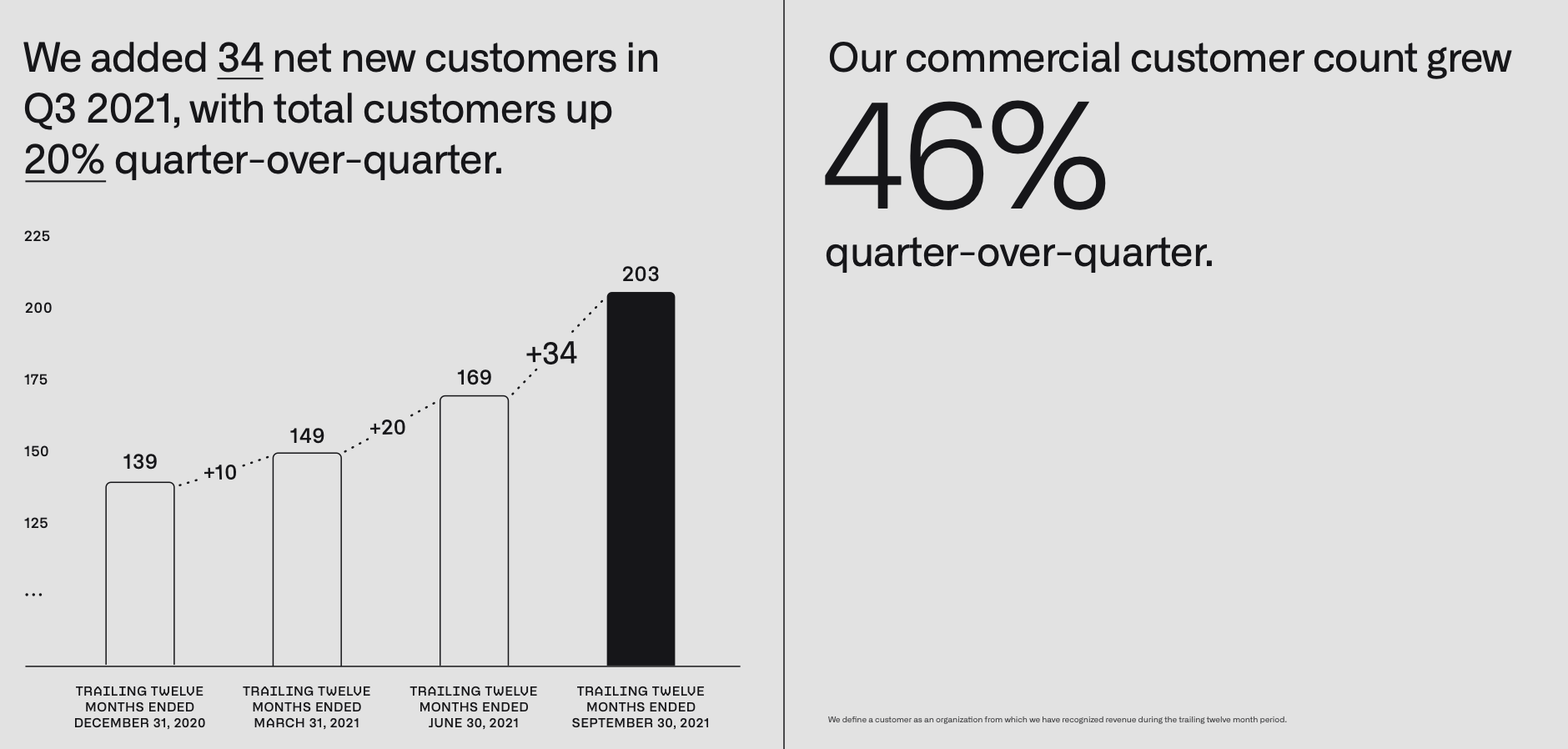

- Revenue, Profit Margins, Cash Flow, Debt Levels: Examining trends in these metrics over time – visualizing them with charts and graphs – offers a clearer picture of the company's financial performance. Comparing these to industry benchmarks is essential for context.

- Profitability and Future Profitability: Palantir's path to profitability is a key factor for investors. Analyzing its operating margins and projections for future profitability provides crucial information for assessing Palantir Technologies stock.

2.2 Stock Valuation and Price Targets

Various valuation methods can be used to assess Palantir's current stock price.

- Price-to-Sales Ratio, Discounted Cash Flow Analysis: Applying these methods helps determine whether Palantir Technologies stock is trading at a fair price relative to its revenues and future cash flows.

- Analyst Price Targets: Comparing different analyst price targets provides a range of potential future price points. Understanding the reasoning behind these targets is important for informed investment decisions.

- Uncertainties and Assumptions in Valuation: It's crucial to acknowledge the inherent uncertainties and assumptions involved in any valuation model. These uncertainties should be factored into investment decisions concerning Palantir Technologies stock.

3. Risks and Challenges

Investing in Palantir Technologies stock involves understanding and assessing the inherent risks.

3.1 Geopolitical Risks

Palantir's government contracts expose it to geopolitical risks and international relations. Changes in political landscapes can significantly impact its business.

3.2 Competition and Market Saturation

The big data analytics market is highly competitive, and the potential for market saturation poses a risk to Palantir's future growth.

3.3 Regulatory Risks and Compliance

Navigating regulatory hurdles and ensuring compliance with data privacy regulations are crucial challenges for Palantir.

3.4 Dependence on Key Clients

Losing significant clients could have a substantial negative impact on Palantir's revenue and profitability. This dependence highlights a key risk for investors considering Palantir Technologies stock.

4. Conclusion

Analyzing Palantir Technologies stock requires a comprehensive understanding of its business model, financial performance, and the risks it faces. While Palantir boasts strong technology and a significant presence in the government sector, its reliance on government contracts and the competitive landscape present considerable challenges. The valuation of Palantir Technologies stock is subject to considerable uncertainty. Based on the current market conditions and the analysis presented, a detailed assessment of the company's future growth trajectory and its ability to navigate the various risks is essential before making an investment decision. Therefore, whether Palantir Technologies stock is a buy, sell, or hold remains a nuanced decision dependent on individual investor risk tolerance and investment goals.

Before making any investment decisions regarding Palantir Technologies stock, always conduct your own thorough due diligence. Consider consulting with a financial advisor to determine if Palantir Technologies stock aligns with your investment goals. Remember, investing in the stock market involves risk, and past performance is not indicative of future results.

Featured Posts

-

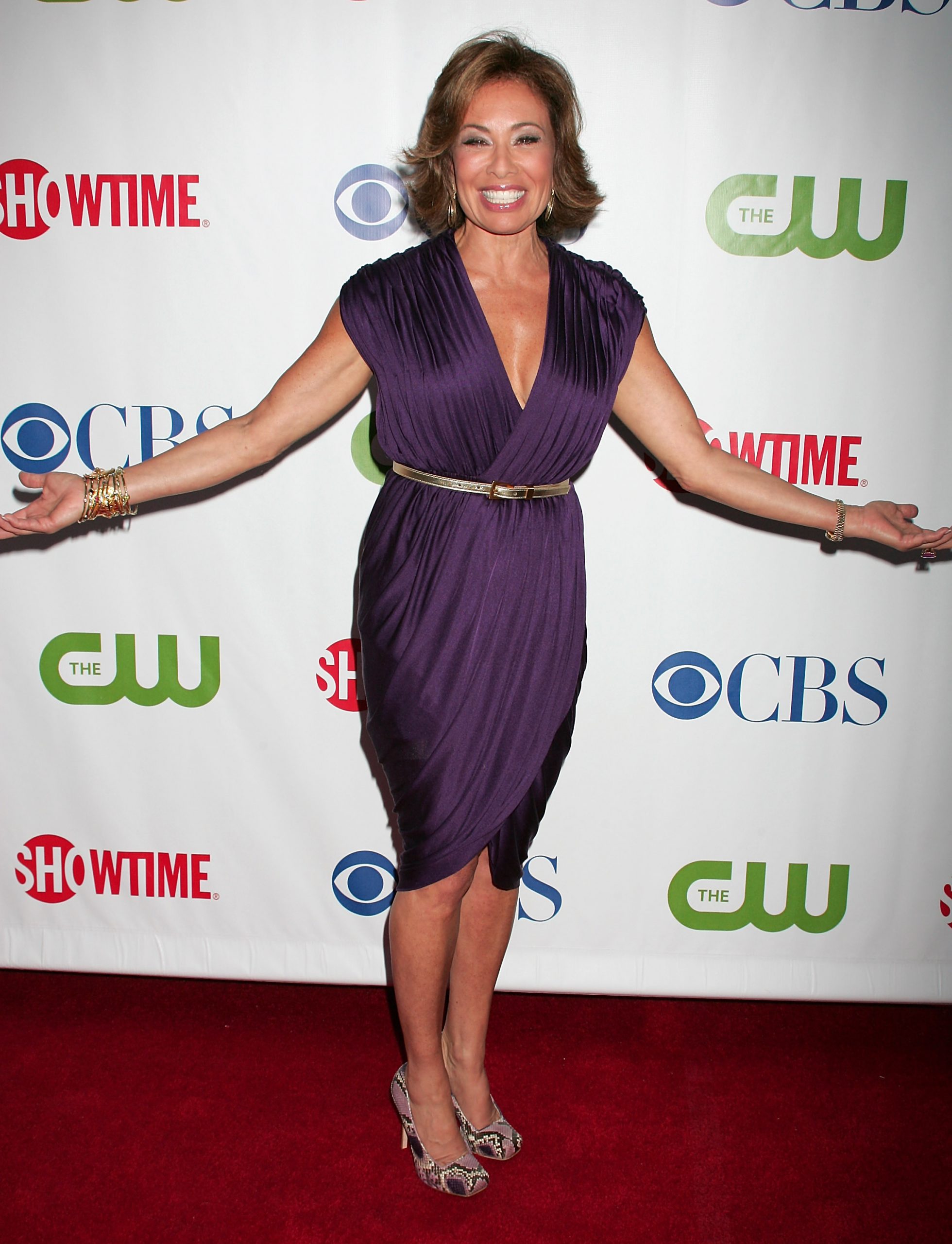

Upcoming Appearance Jeanine Pirro Visits North Idaho

May 09, 2025

Upcoming Appearance Jeanine Pirro Visits North Idaho

May 09, 2025 -

Musks Space X Holdings Outpace Tesla A 43 Billion Difference

May 09, 2025

Musks Space X Holdings Outpace Tesla A 43 Billion Difference

May 09, 2025 -

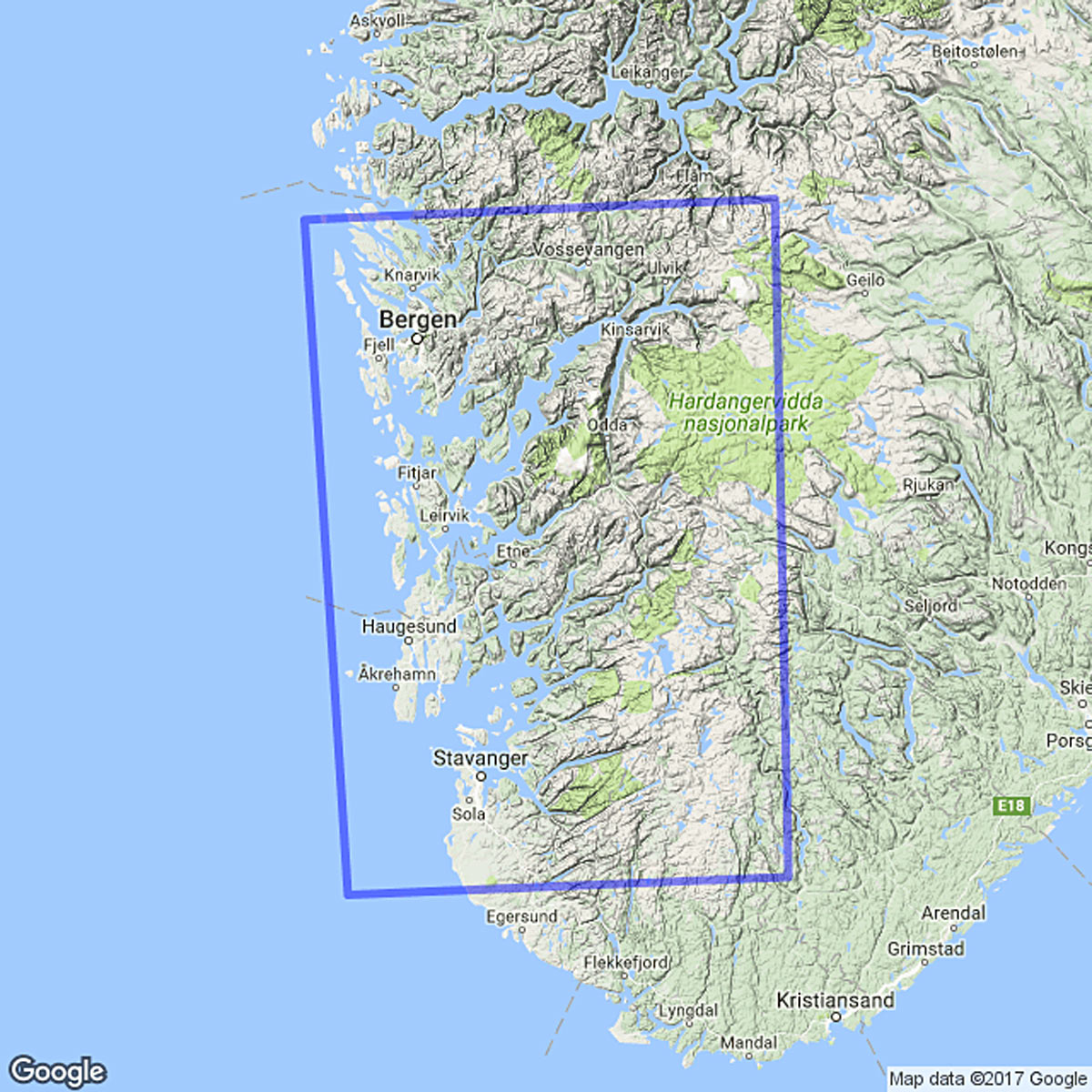

Vinterfore I Sor Norge Sjekk Veimeldinger For Fjelltur

May 09, 2025

Vinterfore I Sor Norge Sjekk Veimeldinger For Fjelltur

May 09, 2025 -

Dijon Enquete Apres La Chute Mortelle D Un Jeune Ouvrier

May 09, 2025

Dijon Enquete Apres La Chute Mortelle D Un Jeune Ouvrier

May 09, 2025 -

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025