Is The $2 Support Level A True Reversal Signal For XRP? Price Prediction Analysis

Table of Contents

Technical Analysis of the $2 Support Level

Analyzing the technical aspects of XRP's price action around the crucial $2 support level is vital for predicting its future movement. We'll examine chart patterns, volume, and other key support and resistance levels to get a clearer picture.

Chart Patterns and Indicators

Examining candlestick patterns provides valuable insights into the market's sentiment. Around the $2 level, the presence of bullish reversal patterns like hammers or engulfing patterns would suggest a potential bottom. Conversely, bearish continuation patterns could indicate further downward pressure. Simultaneously, analyzing technical indicators adds another layer of confirmation.

- RSI (Relative Strength Index): Readings near oversold territory (typically below 30) around the $2 support suggest that the selling pressure might be exhausted, potentially hinting at a price reversal.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover, where the MACD line crosses above the signal line, could indicate a shift in momentum towards a bullish trend.

- Moving Averages (20-day, 50-day, 200-day): A bounce off the 20-day moving average, coupled with prices holding above the 50-day and 200-day moving averages, would strengthen the case for a sustained uptrend. Conversely, a break below all three moving averages would signal a bearish outlook.

Volume Analysis

Trading volume provides crucial context to price movements. High volume during the bounce at the $2 support level signifies strong buying pressure, increasing the probability of a genuine reversal. Conversely, low volume suggests weak support and a higher likelihood of a breakdown below $2.

- High Volume Bounce: Did the price bounce at $2 coincide with significantly higher trading volume than in previous price drops? This indicates strong buying interest and supports the notion of a potential reversal.

- Decreasing Volume: Conversely, consistently decreasing volume during the price action around $2 could indicate waning interest and a weakening of the support level. This suggests that the $2 support may not hold for long.

Support and Resistance Levels

Identifying other crucial support and resistance levels is essential for setting realistic price targets. These levels often act as magnets, attracting buying or selling pressure.

- Support Levels Below $2: Identifying potential support levels below $2 is crucial for assessing the downside risk if the $2 support fails. These could be based on previous lows or Fibonacci retracement levels.

- Resistance Levels Above $2: Determining resistance levels above $2 is crucial for setting targets in a bullish scenario. These could be based on previous highs, psychological levels (e.g., $2.50, $3.00), or Fibonacci extension levels.

Market Sentiment and News Affecting XRP Price

Beyond technical analysis, market sentiment and external factors significantly influence XRP's price. The ongoing Ripple lawsuit, regulatory landscape, and adoption rate all play crucial roles.

Ripple Lawsuit Impact

The ongoing legal battle between Ripple and the SEC continues to cast a shadow over XRP's price. Positive developments in the case, such as favorable court rulings or settlements, tend to boost investor confidence and push the price upward. Conversely, negative news can trigger significant sell-offs.

- Positive News Impact: Favorable rulings or positive statements from the court can lead to a sharp increase in XRP's price, potentially breaking through resistance levels.

- Negative News Impact: Negative news, such as unfavorable court rulings, can severely impact investor sentiment, potentially pushing the price below the $2 support.

Regulatory Landscape

Global regulatory clarity regarding cryptocurrencies is paramount for investor confidence. Positive regulatory developments in key jurisdictions can increase adoption and drive demand, while stricter regulations can stifle growth and decrease investor participation.

- Regional Regulatory Changes: Regulatory changes in specific regions like the US, EU, or Japan can significantly influence XRP’s price, both positively and negatively.

- Upcoming Regulatory Developments: Anticipating and assessing potential regulatory changes is crucial for formulating investment strategies. Keeping abreast of regulatory news is vital.

Adoption and Use Cases

The increasing adoption of XRP in payment systems and cross-border transactions fuels demand and can push the price higher. New partnerships, integrations, and increased usage contribute to a positive outlook.

- New Partnerships & Integrations: Collaborations with financial institutions or payment processors can increase XRP’s visibility and adoption, driving price appreciation.

- Increased Usage in Cross-Border Payments: Growing utilization of XRP in cross-border transactions demonstrates its real-world utility, boosting its value proposition and attracting more investors.

Predicting Future XRP Price Movement

Based on our technical and fundamental analysis, let's outline potential scenarios for XRP's price movement.

Bullish Scenario

A bullish scenario would involve the $2 support holding, followed by a breakout above key resistance levels.

- Price Targets: Based on technical analysis, price targets could range from $2.50 to $3.00 or even higher, depending on the strength of the breakout and overall market conditions.

- Contributing Factors: Positive developments in the Ripple lawsuit, increased adoption, and sustained positive market sentiment would all contribute to a bullish outlook.

Bearish Scenario

A bearish scenario would see the $2 support break, leading to further price declines.

- Price Targets: If the $2 support fails, price targets could range from $1.50 to $1.00 or even lower, depending on the extent of the sell-off and broader market trends.

- Contributing Factors: Negative news related to the Ripple lawsuit, stricter regulations, and a bearish market sentiment could all contribute to a bearish outlook.

Neutral Scenario

A neutral scenario involves XRP consolidating around the $2 level before making a significant move in either direction.

- Factors Contributing to Sideways Movement: Lack of clear catalysts, either positive or negative, coupled with sideways market trends, could lead to extended consolidation.

Conclusion

The $2 support level for XRP represents a critical juncture. While our analysis offers insights, predicting XRP's future price remains challenging due to inherent market volatility. A decisive break above key resistance levels, combined with positive news regarding the Ripple lawsuit and increased adoption, would suggest a bullish trend. Conversely, a breakdown below $2, coupled with negative news, could signal further price declines. Therefore, continuous monitoring of technical indicators, market sentiment, and regulatory developments is crucial for informed decision-making. Continuously analyze the XRP price prediction and adjust your strategy accordingly. Remember, this is not financial advice. Conduct thorough due diligence before investing in XRP or any other cryptocurrency. Further research into XRP’s potential and a detailed understanding of the involved risks are essential before making any investment decisions.

Featured Posts

-

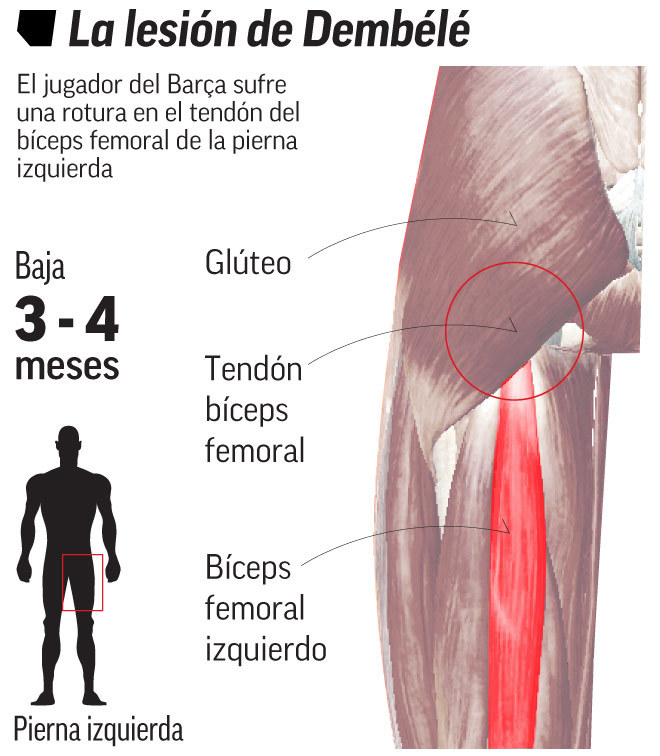

Arsenal News Dembele Injury Blow Throws Artetas Plans Into Disarray

May 08, 2025

Arsenal News Dembele Injury Blow Throws Artetas Plans Into Disarray

May 08, 2025 -

Zielinskis Calf Injury Weeks Out For Inter Milan

May 08, 2025

Zielinskis Calf Injury Weeks Out For Inter Milan

May 08, 2025 -

Ai Fears Halt Publication Of Star Wars Andor Novel

May 08, 2025

Ai Fears Halt Publication Of Star Wars Andor Novel

May 08, 2025 -

Jayson Tatum And Ella Mai New Commercial Hints At Sons Birth

May 08, 2025

Jayson Tatum And Ella Mai New Commercial Hints At Sons Birth

May 08, 2025 -

Missed Dwp Mail Understanding The 6 828 Risk To Your Benefits

May 08, 2025

Missed Dwp Mail Understanding The 6 828 Risk To Your Benefits

May 08, 2025