Is The Public Sector Pension System Sustainable? A Taxpayer Perspective

Table of Contents

The Growing Burden of Public Sector Pension Liabilities

The increasing costs associated with public sector pensions represent a significant and growing financial burden for taxpayers. This burden stems from a confluence of factors, demanding a careful examination of current practices and the implementation of sustainable reform strategies.

Unfunded Liabilities: A Looming Crisis

Unfunded liabilities – the difference between a pension plan's promised benefits and its current assets – pose a substantial risk to the financial health of many public sector pension systems. These liabilities translate directly into increased tax burdens for current and future generations, or necessitate cuts to vital public services.

- Examples of countries/regions with significant unfunded liabilities: Many developed nations, including the United States, several European Union member states, and parts of Canada, grapple with substantial unfunded public pension liabilities. The exact figures vary widely depending on actuarial assumptions and accounting methodologies.

- Impact of unfunded liabilities on taxpayers: To cover unfunded liabilities, governments may be forced to:

- Increase taxes significantly, impacting disposable income and economic growth.

- Reduce spending on essential public services like education, healthcare, and infrastructure.

- Borrow heavily, increasing national debt and potentially triggering financial instability.

Demographic Shifts and Longevity: A Perfect Storm

Increasing life expectancy and a shrinking workforce are creating a perfect storm that threatens the sustainability of many public sector pension systems. People are living longer, requiring pension payouts for extended periods, while the shrinking workforce means fewer active contributors to support a growing number of retirees.

- Statistics on increasing life expectancy and its effect on pension obligations: Global life expectancy continues to rise, placing an increasing strain on pension systems designed for shorter lifespans. This necessitates significantly larger contributions or benefit reductions to maintain solvency.

- Impact of a shrinking workforce: A declining birth rate and an aging population lead to fewer working-age individuals contributing to pension funds, further exacerbating the financial burden on taxpayers. The shrinking contributor base makes it more difficult to maintain adequate funding levels.

Funding Models and Their Challenges

The choice of funding model plays a crucial role in the long-term sustainability of public sector pension systems. Two primary models exist: defined benefit and defined contribution plans.

Defined Benefit vs. Defined Contribution Plans: A Comparative Analysis

-

Defined Benefit (DB) plans: These plans guarantee a specified monthly payment to retirees upon retirement, based on factors like salary and years of service. They offer predictable income for retirees but can be financially risky for governments if investment returns are lower than expected or life expectancy increases significantly.

-

Defined Contribution (DC) plans: These plans require both the employer and employee to contribute to an individual account, with the final payout dependent on the investment performance of the account. They shift investment risk to the employee but can provide greater flexibility and portability.

-

Advantages and disadvantages: DB plans offer predictable income but require significant government funding; DC plans offer flexibility but leave the risk of insufficient funds to the employee.

-

Examples of countries and their experiences: Many countries utilize a hybrid approach, combining elements of both DB and DC plans, seeking to balance the benefits and risks of each model.

Investment Strategies and Returns: Navigating Market Volatility

The performance of pension fund investments significantly influences the sustainability of the system. However, achieving consistently high returns while mitigating risk is challenging.

- Risks associated with different investment strategies: Investment strategies must balance the need for high returns with the desire for security. Aggressive strategies can yield higher returns but also expose pension funds to greater risk of loss.

- Impact of low interest rates and market volatility: Periods of low interest rates and market volatility can dramatically reduce the value of pension fund assets, threatening the ability to meet future obligations.

Potential Solutions and Reforms

Addressing the challenges to public sector pension system sustainability requires a multifaceted approach involving several key reforms.

Increasing Retirement Age: A Gradual Approach

Raising the retirement age is a common strategy to extend the working life of individuals and reduce the financial burden on pension systems.

- Pros and cons: While increasing the retirement age can improve the sustainability of public sector pension systems, it may also face resistance from employees concerned about their health and work-life balance.

- Comparison of retirement ages across different countries: Countries have adopted different approaches, with some implementing gradual increases over time while others maintain relatively lower retirement ages.

Contribution Rate Adjustments: Balancing Act

Adjusting employee and/or employer contribution rates can significantly impact the financial health of pension systems.

- Implications of increasing contribution rates: Higher contribution rates can improve funding but may reduce disposable income and potentially discourage workforce participation.

- Potential for reducing contribution rates: Reducing contribution rates is feasible only if the investment performance of pension funds improves significantly.

Pension Benefit Reforms: A Necessary Adjustment

Modifying benefit structures, such as implementing benefit caps or adjusting inflation adjustments, can improve sustainability.

- Examples of pension benefit reforms: Many countries have successfully implemented various benefit reforms, often in combination with other measures.

- Potential political and social implications: Pension reforms often face significant political and social opposition, necessitating careful planning and public consultation.

Conclusion

The sustainability of public sector pension systems poses a significant financial challenge for taxpayers worldwide. The growing burden of unfunded liabilities, demographic shifts, and investment risks necessitate a proactive and comprehensive approach to reform. Addressing this issue requires a combination of strategies, including carefully considered increases in the retirement age, adjustments to contribution rates, and thoughtful pension benefit reforms. Proactive management of investment strategies is crucial to mitigate risks associated with market volatility.

Understanding the challenges to public sector pension system sustainability is crucial for informed civic engagement. Stay informed about the ongoing debate regarding public sector pension system sustainability and advocate for responsible and sustainable solutions. Learn more about [link to relevant resource] to become a more informed taxpayer.

Featured Posts

-

Land Your Dream Private Credit Job 5 Essential Tips

Apr 29, 2025

Land Your Dream Private Credit Job 5 Essential Tips

Apr 29, 2025 -

The Reality Of Ai Thinking Less Intelligent Than You Might Think

Apr 29, 2025

The Reality Of Ai Thinking Less Intelligent Than You Might Think

Apr 29, 2025 -

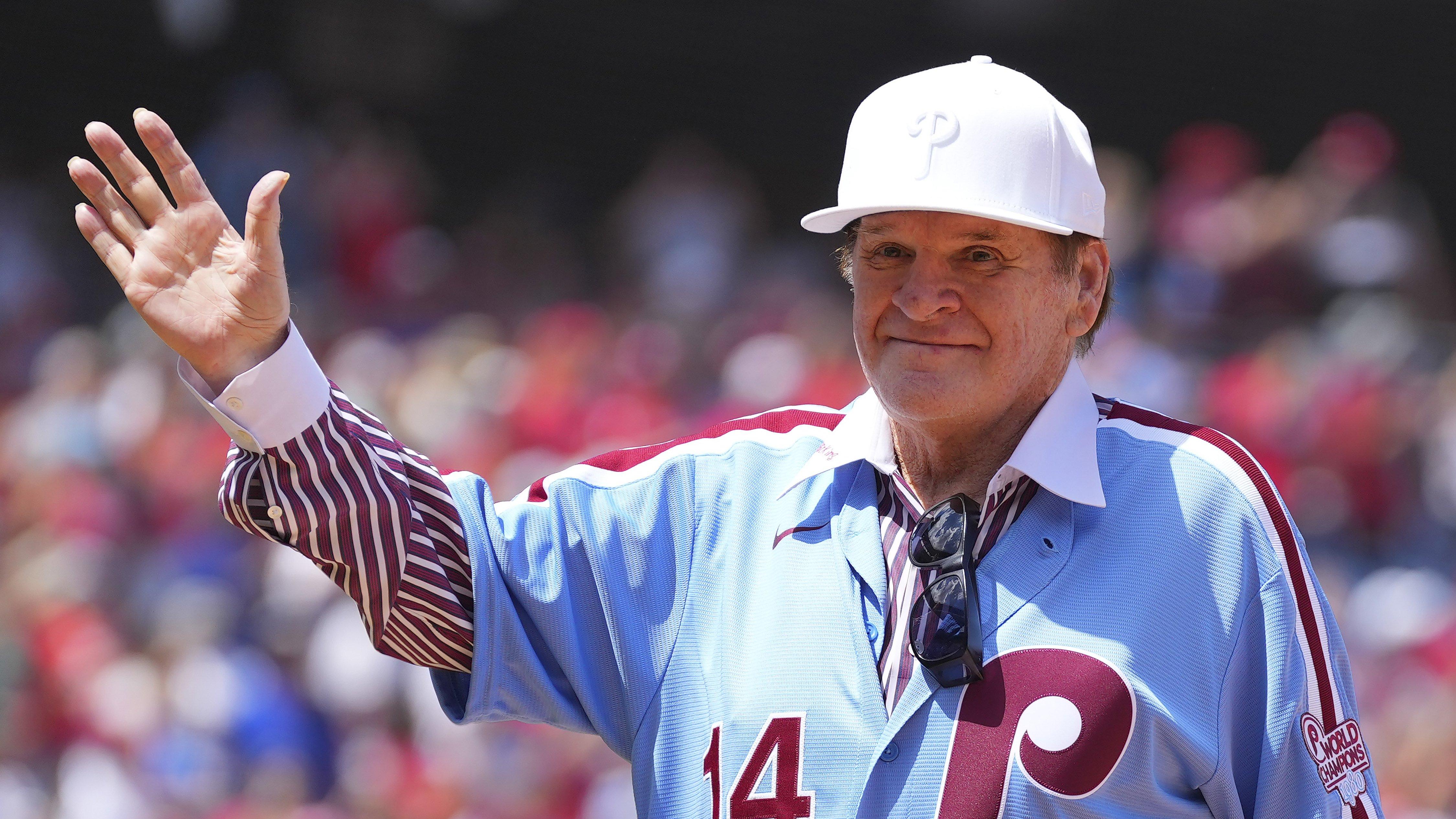

Donald Trumps Pardon Push Pete Roses Hall Of Fame Hope

Apr 29, 2025

Donald Trumps Pardon Push Pete Roses Hall Of Fame Hope

Apr 29, 2025 -

Jeff Goldblum Explains His Wish To Rewrite The Flys Conclusion

Apr 29, 2025

Jeff Goldblum Explains His Wish To Rewrite The Flys Conclusion

Apr 29, 2025 -

2025 Porsche Cayenne A Comprehensive Look At Its Interior And Exterior

Apr 29, 2025

2025 Porsche Cayenne A Comprehensive Look At Its Interior And Exterior

Apr 29, 2025