Is The World's Largest Bond Market In Trouble? A Posthaste Perspective

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The relationship between interest rates and bond prices is inversely proportional. When interest rates rise, the value of existing bonds with lower coupon rates falls, as newer bonds offer higher yields. The Federal Reserve's monetary policy plays a significant role in this dynamic. By raising the federal funds rate, the Fed influences the overall interest rate environment, directly impacting bond yields and valuations.

- Impact on existing bond holders: Existing bondholders face the risk of capital losses if they need to sell their bonds before maturity. The higher the interest rate rise, the greater the potential loss.

- Attractiveness of new bond issues: Higher interest rates make newly issued bonds more attractive to investors, leading to increased demand and potentially higher prices for these new issues.

- Potential for capital losses: Investors holding bonds with long maturities are particularly vulnerable to interest rate risk, as their bonds are more sensitive to changes in interest rates. Understanding bond valuation and managing interest rate risk is critical for investors.

Inflationary Pressures and the Bond Market

High inflation erodes the purchasing power of fixed-income investments like bonds. When inflation rises, the real return (the return after adjusting for inflation) on a bond decreases, making it less attractive to investors. Inflation expectations also influence bond yields; higher expected inflation usually leads to higher bond yields to compensate investors for the anticipated erosion of purchasing power.

- Real vs. nominal yields: Investors should focus on real yields rather than nominal yields when assessing the true return on their bond investments. Real yield accounts for the impact of inflation.

- Inflation-protected securities (TIPS): Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation risk. Their principal adjusts with inflation, ensuring a real return.

- Central bank response to inflation: Central banks often respond to high inflation by raising interest rates, which can have a significant impact on the bond market.

Geopolitical Uncertainty and its Influence

Global events such as war, political instability, and trade disputes significantly influence investor sentiment and bond prices. During times of uncertainty, investors often flock to safe-haven assets, such as US Treasury bonds, driving up their prices and lowering their yields. This "flight-to-safety" phenomenon can lead to increased market volatility.

- Examples of recent geopolitical events and their market impact: The war in Ukraine, for instance, led to a significant flight-to-safety, boosting demand for US Treasury bonds.

- Safe-haven assets vs. risky assets: US Treasury bonds are often considered safe-haven assets due to their perceived low risk and the backing of the US government. Risky assets, such as stocks, tend to suffer during periods of geopolitical uncertainty.

- Diversification strategies for mitigating geopolitical risk: Diversification across different asset classes and geographies is a key strategy to mitigate geopolitical risk.

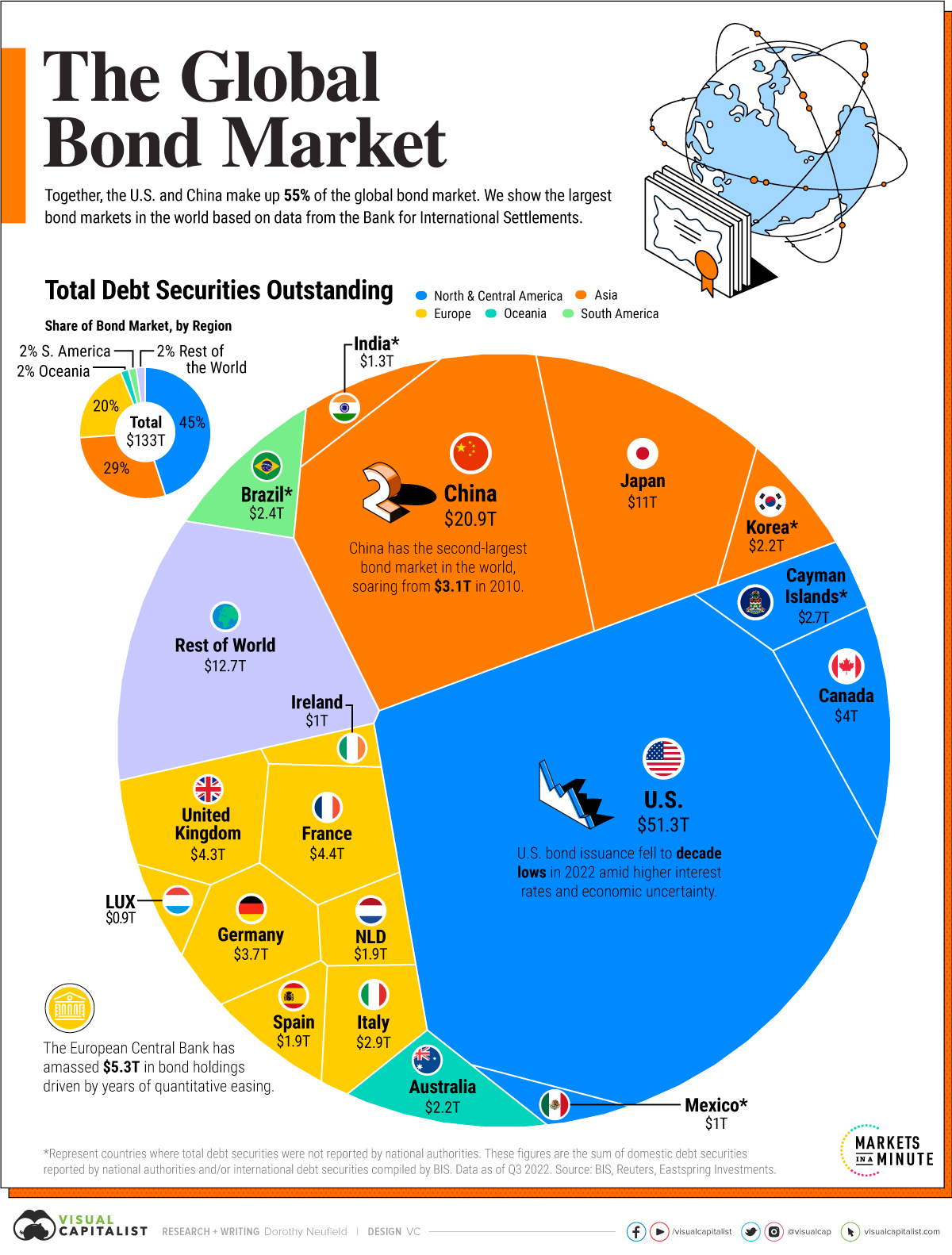

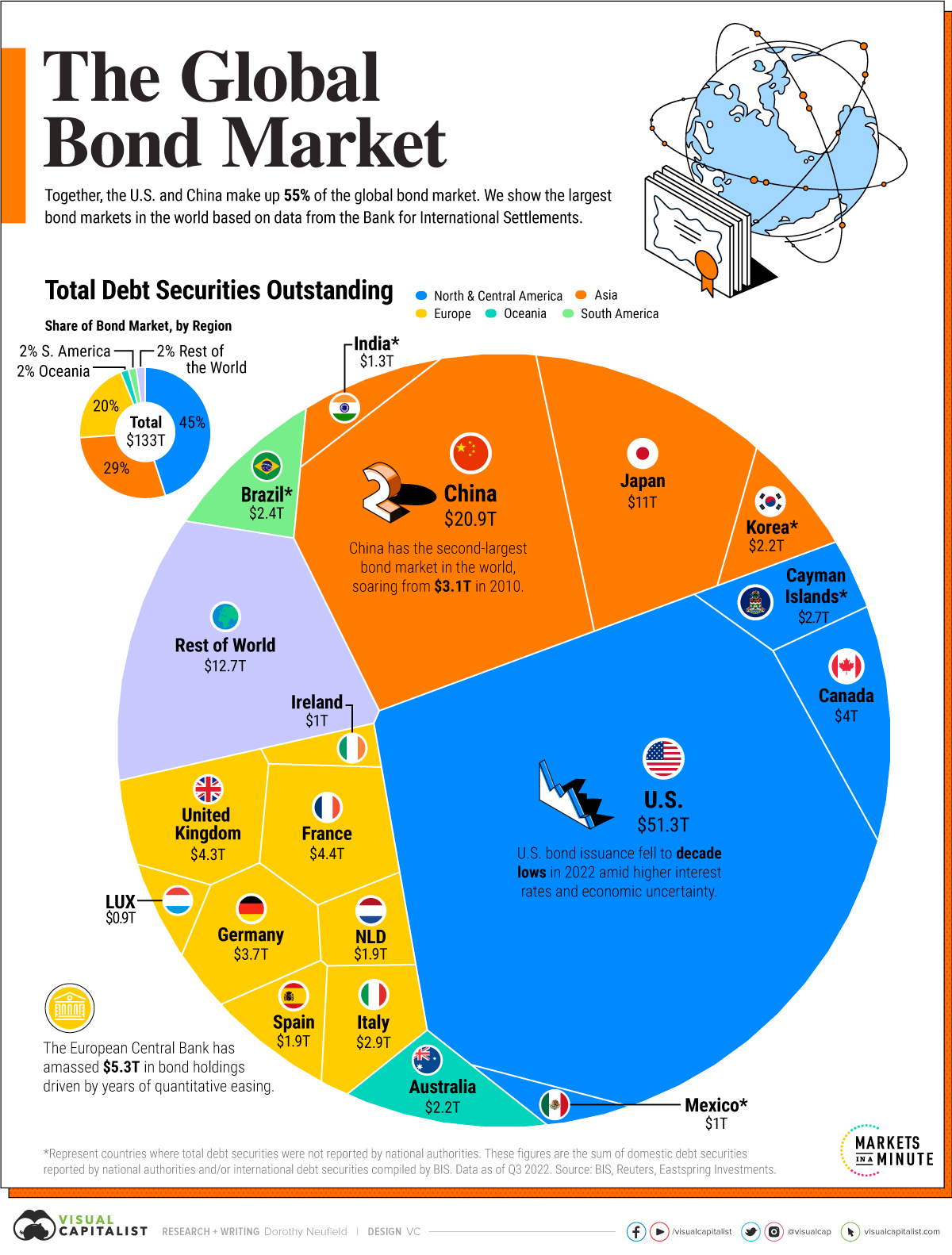

Assessing the Overall Health of the US Treasury Market

The US Treasury market remains the world's deepest and most liquid bond market. Its strength lies in the large number of market participants (central banks, institutional investors, and individuals) and the high trading volume. However, potential vulnerabilities exist, including the impact of rising interest rates and the potential for increased inflation.

- Strengths of the US Treasury market: High liquidity, large trading volumes, and the backing of the US government are key strengths.

- Potential vulnerabilities: Rising interest rates, high inflation, and potential for future debt crises represent potential vulnerabilities.

- Long-term outlook: The long-term outlook for the US Treasury market depends on several factors, including economic growth, inflation, and government policy. Managing systemic risk remains a key challenge.

Conclusion: Is the World's Largest Bond Market Truly in Trouble?

While the current challenges facing the global bond market, particularly the US Treasury market, are significant – rising interest rates, inflation, and geopolitical risks – they don't necessarily signal a systemic collapse. The market's depth and liquidity offer resilience. However, investors need to be aware of the risks and adjust their strategies accordingly. This includes understanding interest rate risk, inflation risk, and geopolitical risk, and diversifying their portfolios.

Stay informed about the evolving dynamics of the global bond market and consult with a financial advisor to develop a robust investment strategy that considers the current challenges and potential opportunities within the world's largest bond market. Careful monitoring of interest rates, inflation expectations, and geopolitical events is crucial for navigating this complex environment successfully. Understanding US Treasury bonds and their role in your investment portfolio is paramount for mitigating risk and capitalizing on potential rewards in the ever-changing landscape of the global bond market.

Featured Posts

-

80 Millio Forintos Extrak Ezen A Porsche 911 Esen

May 24, 2025

80 Millio Forintos Extrak Ezen A Porsche 911 Esen

May 24, 2025 -

Kering Q1 Results Send Shares Down 6

May 24, 2025

Kering Q1 Results Send Shares Down 6

May 24, 2025 -

Philips 2025 Annual General Meeting Key Updates And Agenda

May 24, 2025

Philips 2025 Annual General Meeting Key Updates And Agenda

May 24, 2025 -

Dr Beachs 2025 Best Beaches In The Us Top 10 List

May 24, 2025

Dr Beachs 2025 Best Beaches In The Us Top 10 List

May 24, 2025 -

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Latest Posts

-

The Last Rodeo A Familiar Yet Powerful Story

May 24, 2025

The Last Rodeo A Familiar Yet Powerful Story

May 24, 2025 -

The Last Rodeo Review A Touching Bull Riding Drama

May 24, 2025

The Last Rodeo Review A Touching Bull Riding Drama

May 24, 2025 -

Neal Mc Donoughs New Bull Riding Video A Look At The Dedication

May 24, 2025

Neal Mc Donoughs New Bull Riding Video A Look At The Dedication

May 24, 2025 -

Is Publix Open On Memorial Day 2025 Florida Store Holiday Hours

May 24, 2025

Is Publix Open On Memorial Day 2025 Florida Store Holiday Hours

May 24, 2025 -

Actor Neal Mc Donough Tackles Pro Bull Riding For The Last Rodeo

May 24, 2025

Actor Neal Mc Donough Tackles Pro Bull Riding For The Last Rodeo

May 24, 2025