Is This Cryptocurrency Immune To Trade War Effects?

Table of Contents

Trade wars create global economic uncertainty, sending shockwaves through traditional financial markets. But what about cryptocurrencies? Are they immune to the fallout of escalating trade tensions, or are they just as susceptible to market volatility? This article delves into the complex relationship between cryptocurrencies and trade wars, examining potential vulnerabilities and highlighting those that might offer a degree of protection. We will explore specific examples and factors that determine a cryptocurrency's resilience in such turbulent times.

Decentralization: A Key Factor in Trade War Resilience

Reduced Dependence on Geopolitical Factors

- Decentralized cryptocurrencies are less reliant on specific countries or economies, unlike fiat currencies.

- They are less susceptible to sanctions and trade restrictions imposed on particular nations.

- Examples include Bitcoin, Ethereum, and other cryptocurrencies operating on permissionless blockchains.

The distributed nature of blockchain technology mitigates risks associated with trade wars. The absence of central control points and the global nature of the cryptocurrency network mean that the impact of trade restrictions on a single nation is significantly lessened. A decentralized cryptocurrency's value isn't tied to the fortunes of a single government or economy, making it potentially more resilient during periods of geopolitical instability.

Market Volatility vs. Trade War Impacts

- Inherent cryptocurrency volatility exists independently of trade wars. Market sentiment plays a major role.

- Trade wars can exacerbate existing volatility but may not be the sole driver of price fluctuations.

Analyzing historical data shows a correlation between periods of trade war escalation and increased cryptocurrency market volatility. However, it's crucial to distinguish between volatility directly caused by trade war anxieties and that stemming from other market influences, such as technological developments, regulatory changes, or investor sentiment. While trade wars can create uncertainty and impact investor confidence, impacting the price, it's not always a direct causal relationship.

Cryptocurrencies Vulnerable to Trade War Effects

Regulatory Uncertainty and Cross-Border Transactions

- Differing regulatory frameworks across nations can hinder cryptocurrency adoption and transactions, amplifying trade war effects.

- Regulatory uncertainty creates risk for investors and businesses dealing in cryptocurrencies.

Several countries have imposed restrictions on cryptocurrency use or exchanges, adding complexity to cross-border transactions. These regulatory actions create uncertainty and can significantly affect the cryptocurrency market, especially during times of heightened economic stress caused by trade conflicts. The lack of a unified global regulatory framework for cryptocurrencies increases vulnerability during trade wars.

Impact on Stablecoins and their Peg

- Trade wars can impact the value of fiat currencies pegged to stablecoins, affecting their stability.

- De-pegging events can occur due to economic shocks, including those related to trade wars.

Stablecoins, designed to maintain a stable value relative to a fiat currency like the US dollar, are indirectly susceptible to trade war impacts. If the fiat currency to which a stablecoin is pegged experiences devaluation or instability due to trade war effects, the stablecoin's peg may be compromised, impacting its price stability and potentially leading to investor losses.

Specific Cryptocurrencies and Their Resilience

Case Studies

- Bitcoin (BTC): Bitcoin, often viewed as a safe haven asset, has shown mixed reactions to trade wars. While its decentralized nature offers some protection, its price can still be impacted by broader market sentiment.

- Ethereum (ETH): Similar to Bitcoin, Ethereum's price can fluctuate during trade wars due to its exposure to overall market sentiment. However, its use in decentralized finance (DeFi) might offer some insulation against purely geopolitical factors.

- Stablecoins (e.g., USDT, USDC): Stablecoins are generally considered less volatile than other cryptocurrencies, but their reliance on fiat currencies exposes them to indirect risks from trade wars impacting the pegged currency.

Analyzing the performance of different cryptocurrencies during past trade war escalations reveals varied responses. Some decentralized cryptocurrencies show relative resilience, while others, particularly those tied to specific fiat currencies or jurisdictions, demonstrate greater sensitivity.

Investing in Crypto During Trade Wars: A Risk Assessment

Diversification and Due Diligence

- Diversifying cryptocurrency holdings across different assets and projects is crucial for risk mitigation.

- Thorough research and understanding of each cryptocurrency's characteristics is essential before investing.

During times of economic uncertainty, a diversified cryptocurrency portfolio can help reduce the impact of any single asset's price fluctuations. This is especially important when navigating the complexities of trade wars. Conducting thorough due diligence on each cryptocurrency investment, considering factors like its technology, team, market adoption, and regulatory landscape, is vital to making informed investment decisions. Remember to assess your own risk tolerance before investing.

Conclusion

This article examined the complex relationship between cryptocurrencies and the impact of trade wars. While decentralization offers a degree of protection against some trade war effects, regulatory uncertainty and the inherent volatility of the cryptocurrency market remain significant factors. The resilience of specific cryptocurrencies varies depending on their design and underlying technology.

Understanding the potential impact of trade wars on your cryptocurrency investments is crucial. Continue your research on various cryptocurrencies and their susceptibility to trade war effects to make informed investment decisions. Learn more about the factors influencing cryptocurrency resilience and make strategic choices for navigating the complexities of the crypto market during periods of global economic uncertainty. Make sure to diversify your cryptocurrency portfolio and perform thorough due diligence before any investment.

Featured Posts

-

Benson Boone Addresses Harry Styles Copying Claims

May 09, 2025

Benson Boone Addresses Harry Styles Copying Claims

May 09, 2025 -

Another Large Scale Anti Trump Protest Rocks Anchorage

May 09, 2025

Another Large Scale Anti Trump Protest Rocks Anchorage

May 09, 2025 -

Elon Musks Business Ventures A Path To Unprecedented Financial Success

May 09, 2025

Elon Musks Business Ventures A Path To Unprecedented Financial Success

May 09, 2025 -

Woman Claiming To Be Madeleine Mc Cann Arrested For Stalking

May 09, 2025

Woman Claiming To Be Madeleine Mc Cann Arrested For Stalking

May 09, 2025 -

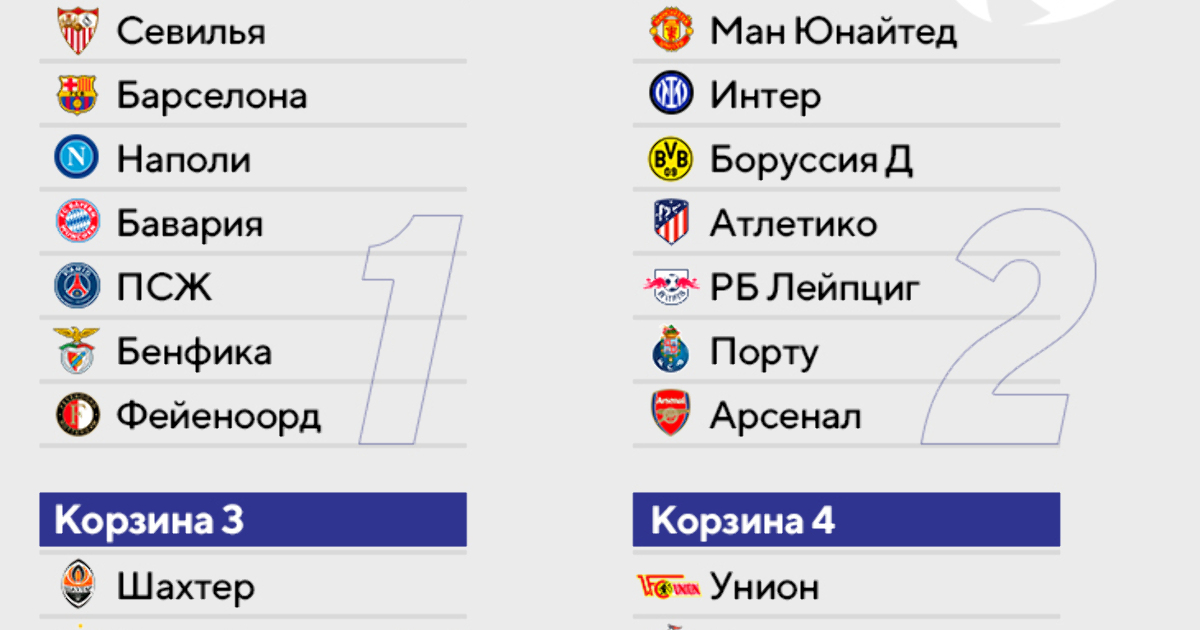

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025