Is Uber Recession-Proof? Analyst Insights On Stock Performance

Table of Contents

Uber's Revenue Streams: Diversification and Recession Resilience

Uber's business model, once heavily reliant on ride-sharing, has diversified significantly, impacting its potential to withstand economic downturns. This diversification is key to assessing whether the phrase "Uber recession-proof" holds any merit.

Ride-Sharing's Sensitivity to Economic Fluctuations:

- Decreased Disposable Income: During recessions, consumers often cut back on discretionary spending, including ride-sharing services. This directly impacts Uber's core revenue stream.

- Increased Unemployment: Higher unemployment rates lead to less consumer spending across the board, including on transportation services like Uber.

- Fuel Price Volatility: Fluctuations in fuel prices directly impact both Uber drivers' profitability and consumer willingness to use ride-sharing services. High fuel costs can translate to higher fares, impacting demand.

- Alternative Transportation: The availability and affordability of public transportation and personal vehicles can influence the demand for ride-sharing services, particularly during economic hardship.

Analyzing historical data from previous recessions reveals a correlation between economic slowdowns and reduced demand for ride-sharing services. While Uber doesn't release granular recession-specific data, publicly available financial reports show a slowdown in growth during periods of economic contraction.

The Growing Importance of Uber Eats and Freight:

- Uber Eats' Resilience: Food delivery services, like Uber Eats, often see increased demand even during economic downturns. People may cut back on restaurant dining but still utilize delivery for convenience.

- Uber Freight's Growth Potential: The freight sector is less directly sensitive to consumer spending fluctuations. The demand for logistics and transportation remains relatively consistent even during economic slowdowns.

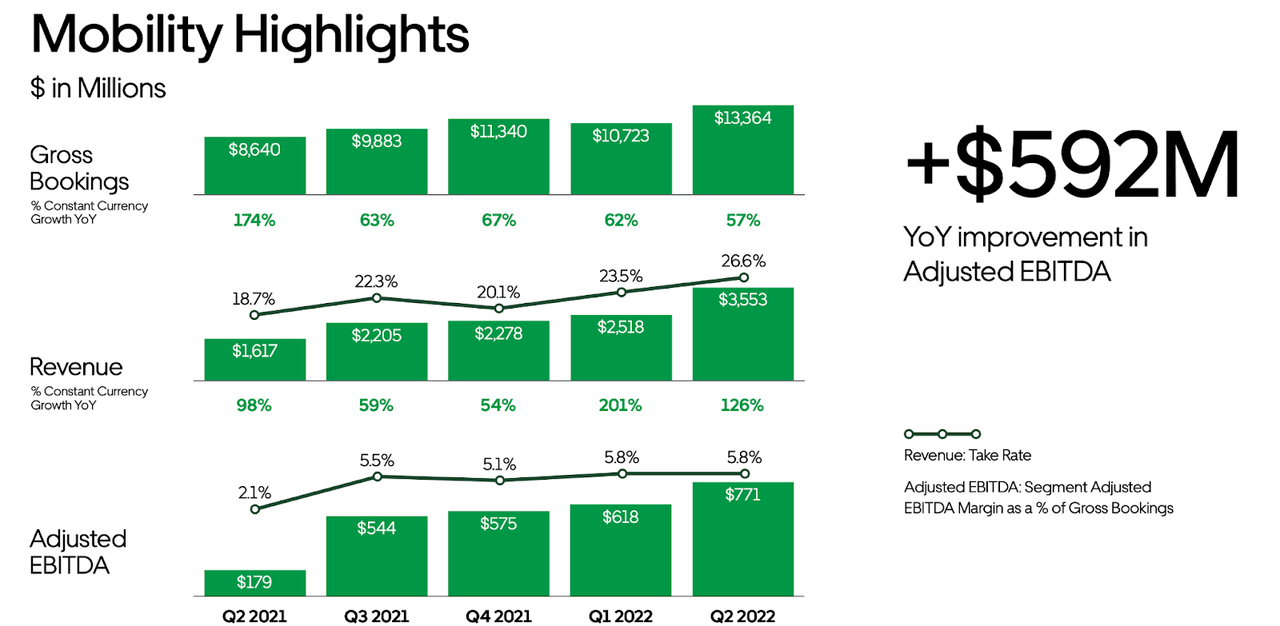

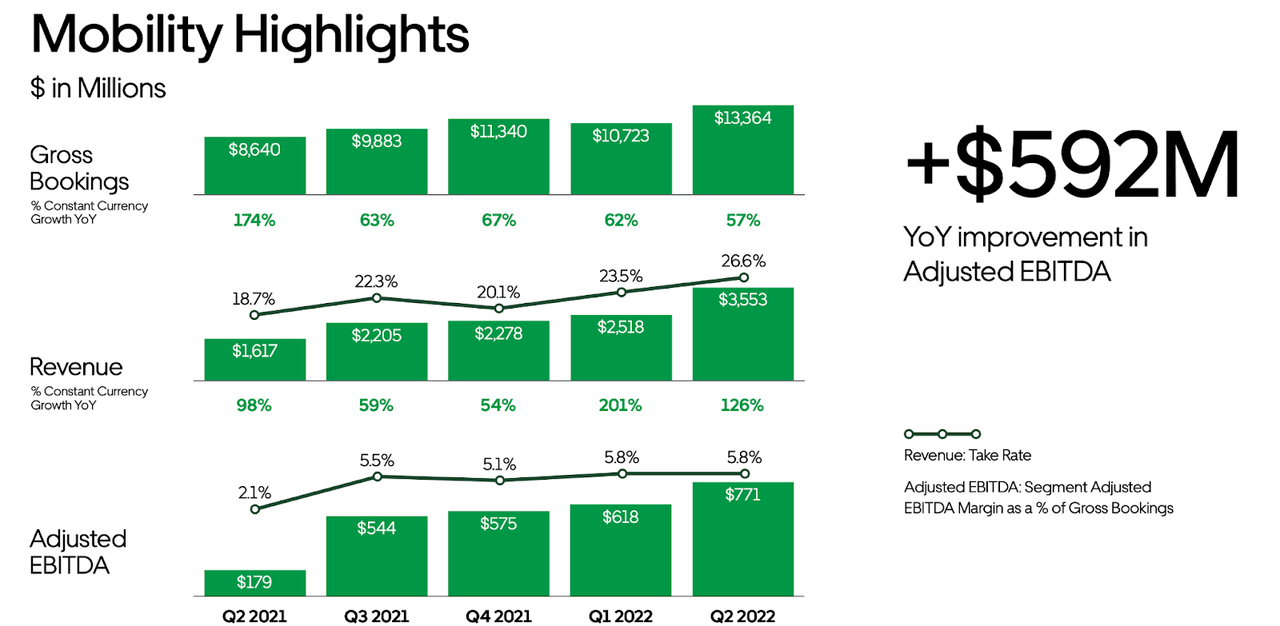

The diversification into Uber Eats and Uber Freight significantly contributes to Uber's financial stability. Data comparing the growth rates of these segments against the ride-sharing segment showcases a shift towards greater resilience. While ride-sharing revenue may dip during economic downturns, the growth in Eats and Freight can help offset these losses, making the "Uber recession-proof" debate more complex.

Analyst Sentiment and Stock Performance

Understanding Wall Street's perception of Uber's recession resistance is crucial for evaluating its investment potential.

Wall Street's View on Uber's Recession Resistance:

- Mixed Analyst Ratings: While some analysts maintain a positive outlook on Uber's long-term growth potential, citing its diversification strategy, others express concerns regarding its sensitivity to macroeconomic factors. (Sources: Bloomberg, Yahoo Finance, etc. - Insert specific examples and data here)

- Price Target Variations: Analyst price targets for Uber stock vary considerably, reflecting the differing opinions on its resilience to economic downturns. (Include specific examples of price targets and their justifications).

The divergence in analyst opinions highlights the uncertainty surrounding Uber's ability to completely weather economic storms. Some analysts believe the diversified revenue streams will be enough to protect the company. Others remain skeptical, highlighting the sensitivity of the ride-sharing sector.

Impact of Macroeconomic Factors on Uber's Stock:

- Inflation and Interest Rates: Rising inflation and interest rates can negatively impact consumer spending and increase borrowing costs for Uber, potentially affecting its stock price.

- Economic Growth Rates: Stronger economic growth generally correlates with higher demand for ride-sharing services, positively impacting Uber's stock.

Charts and graphs illustrating the correlation between macroeconomic indicators and Uber's stock price would provide valuable visual data to support this section. (Include relevant charts and graphs here).

Operational Efficiency and Cost-Cutting Measures

Uber's ability to adapt to economic changes through efficient operations and cost-cutting measures is a key factor determining its recession resilience.

Uber's Ability to Adapt to Economic Changes:

- Driver Incentive Adjustments: Uber has historically adjusted driver incentives to manage costs and maintain profitability during economic fluctuations.

- Dynamic Pricing Strategies: Uber's dynamic pricing models help optimize pricing based on demand, ensuring profitability even during periods of reduced ridership.

- Marketing Spend Optimization: Strategic adjustments to marketing campaigns can help reduce costs during economic downturns while still maintaining brand visibility.

Analyzing how these measures have impacted profitability during past economic downturns would demonstrate Uber's capacity for adaptation. Quantifiable data on cost savings and profitability improvements would strengthen the argument.

Technological Innovation and Future Growth Potential:

- Autonomous Vehicle Technology: Investments in autonomous vehicle technology could significantly reduce operational costs in the long term, improving profitability and resilience.

- Other Technological Advancements: Continued investment in technological innovation and efficiency improvements will be crucial to enhancing Uber's competitiveness and profitability, particularly during periods of economic uncertainty.

The potential long-term impact of these technological advancements on Uber's operational efficiency and revenue generation needs further exploration. Analyzing the timelines for implementation and the potential cost reductions would be beneficial.

Conclusion

While Uber's diversification into Uber Eats and Uber Freight offers increased resilience against economic downturns compared to its earlier, ride-sharing-only model, it's not entirely recession-proof. Analyst sentiment remains mixed, reflecting the continued sensitivity of its ride-sharing segment to macroeconomic factors. Uber's history of adapting to economic changes through operational efficiency and cost-cutting measures, coupled with its investments in technological innovation, suggests a capacity for navigating economic uncertainty. However, the impact of future macroeconomic conditions remains uncertain.

While Uber demonstrates resilience through diversification, its sensitivity to economic shifts remains. Further research into individual investor risk tolerance and ongoing market analysis is crucial before making investment decisions related to whether Uber is truly Uber Recession-Proof. Stay informed about the latest developments concerning Uber's recession resilience and consult a financial advisor for personalized guidance.

Featured Posts

-

Nba Playoffs Knicks Vs Pistons Bet365 Bonus Code Nypbet And Betting Preview

May 17, 2025

Nba Playoffs Knicks Vs Pistons Bet365 Bonus Code Nypbet And Betting Preview

May 17, 2025 -

May 15 2025 Examining Trumps Middle East Trip And Its Presidential Significance

May 17, 2025

May 15 2025 Examining Trumps Middle East Trip And Its Presidential Significance

May 17, 2025 -

Knicks Vs Trail Blazers Live Score 77 77 March 13 2025

May 17, 2025

Knicks Vs Trail Blazers Live Score 77 77 March 13 2025

May 17, 2025 -

Knicks Coach Thibodeau Seeks Improved Fight Following 37 Point Loss

May 17, 2025

Knicks Coach Thibodeau Seeks Improved Fight Following 37 Point Loss

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025