Is Uber Recession-Proof? Analyst Perspectives On Stock Performance

Table of Contents

Uber's Business Model and Recessionary Resilience

Uber's success hinges on its ability to adapt and thrive, even amidst economic uncertainty. Let's delve into key aspects of its business model and how they contribute to, or detract from, its recession-proof potential.

Demand Elasticity During Economic Slowdowns

The relationship between economic downturns and Uber's ridership is complex. Ride-sharing, while convenient, is often considered discretionary spending. This means that during economic slowdowns, demand can be significantly impacted.

- Essential vs. Discretionary Spending: While some Uber rides are for essential trips (e.g., commuting to work, airport transfers), many are for non-essential purposes (e.g., entertainment, social events). During a recession, the latter segment is likely to decline first.

- Shift Towards Cheaper Options: Consumers may switch to cheaper alternatives like public transportation or carpooling during economic hardship, directly impacting Uber's ridership numbers.

- Impact of Unemployment: High unemployment rates directly affect both riders (less disposable income) and drivers (loss of income). This creates a double whammy impacting Uber's overall performance.

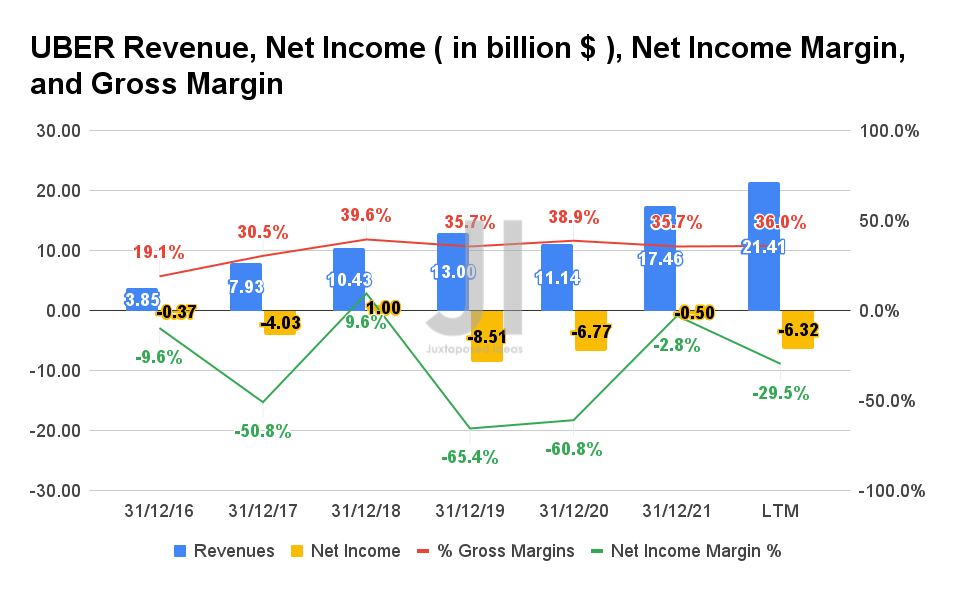

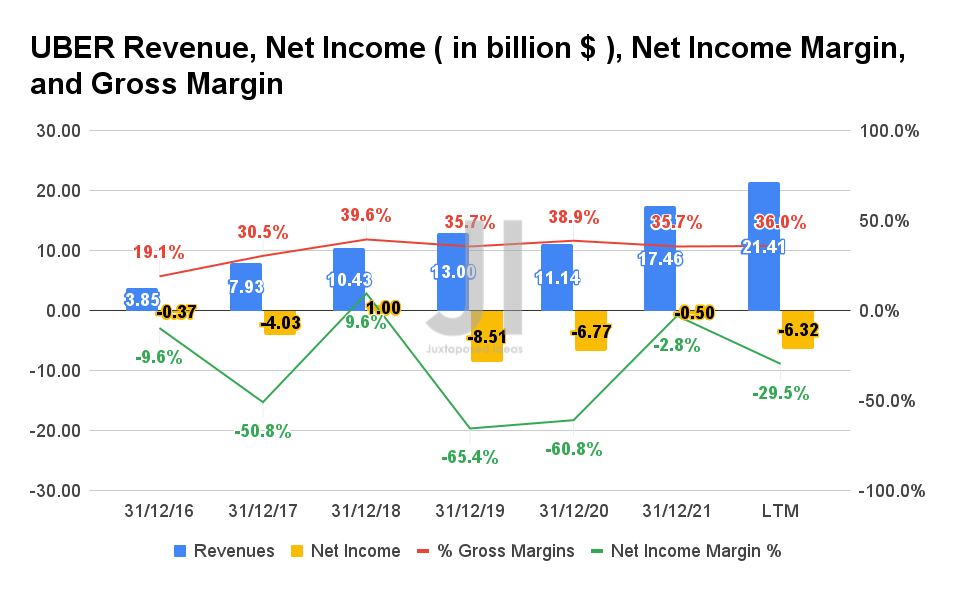

Analyzing historical data reveals mixed results. During previous recessions, Uber (and its predecessors in the ride-sharing market) experienced varied impacts. A deeper dive into these periods is required to accurately predict future performance. Further research into specific market reactions during previous economic downturns is needed to develop a more comprehensive analysis. (Charts and graphs would be inserted here illustrating this historical data, comparing Uber's performance against relevant economic indicators).

Diversification of Revenue Streams

Uber's diversification beyond its core ride-sharing business is a significant factor influencing its recession resilience. Its expansion into food delivery (Uber Eats), freight transportation (Uber Freight), and other services provides a buffer against downturns in any single sector.

- Relative Performance of Revenue Streams: Uber Eats, for instance, may experience less sensitivity to economic downturns compared to ride-sharing, as food delivery often remains a necessity, even during tough economic times.

- Offsetting Declines: The success of one sector can potentially offset declines in another, providing a more stable revenue stream overall.

- Subscription Services: The introduction of subscription services offers predictable recurring revenue, further mitigating the risks associated with fluctuating demand.

The ability of these diverse revenue streams to offset each other during economic uncertainty will ultimately play a critical role in determining Uber’s overall resilience.

Pricing Strategies and Cost-Cutting Measures

Uber utilizes dynamic pricing models to adjust fares based on demand. This strategy can help mitigate some risks during economic downturns. However, it also presents challenges.

- Dynamic Pricing Models: During periods of high demand (even during a recession, certain events or situations can create surges), Uber can increase prices to maximize revenue. However, this can alienate price-sensitive customers.

- Driver Retention and Cost Optimization: Maintaining a sufficient driver base is crucial; Uber must balance driver compensation with cost optimization strategies. Strategies during tough economic times might include incentives for drivers or adjustments to commission structures.

- Negative Consequences of Price Increases: While dynamic pricing can help during surges, consistently high prices can discourage ridership, especially during a recession. This delicate balance between pricing and maintaining rider numbers is key to Uber's resilience.

Analyst Opinions and Stock Performance

Understanding analyst perspectives and Uber's historical stock performance is vital in assessing its recession-proof characteristics.

Recent Analyst Ratings and Price Targets

Several rating agencies regularly assess Uber's stock, offering insights into their perceived recession resilience.

- Key Rating Agencies and Ratings: (Include a table summarizing ratings from reputable agencies like Morgan Stanley, Goldman Sachs, etc., including buy, hold, or sell recommendations).

- Price Target Ranges and Rationale: (Summarize the price targets and justifications given by each agency, highlighting their reasoning for their respective ratings.)

- Citations: (Provide links to original reports from the financial news sources.)

Historical Stock Performance and Correlation with Economic Indicators

Analyzing Uber's past stock performance against broader economic trends helps gauge its sensitivity to economic cycles.

- Correlation with Economic Indicators: (Illustrate using charts and graphs the correlation, or lack thereof, between Uber's stock price and indicators like GDP growth, unemployment rates, and consumer confidence. Discuss any notable exceptions.)

- Significant Deviations: (Highlight instances where Uber's performance deviated significantly from broader market trends, explaining potential causes.)

Potential Risks and Vulnerabilities

While Uber displays some resilience, potential risks and vulnerabilities must be considered.

Competition and Market Saturation

The ride-sharing and food delivery markets are fiercely competitive.

- Competitive Landscape: (Discuss Uber's major competitors and their market share.)

- Potential for Price Wars: Intense competition can lead to price wars, squeezing profit margins.

- New Entrants and Technological Disruptions: The emergence of new players and innovative technologies pose an ongoing threat.

Regulatory and Legal Challenges

Evolving regulations and legal battles pose significant challenges to Uber's operations.

- Labor Laws and Worker Classification: Ongoing disputes regarding driver classification and labor laws significantly impact Uber's operational costs and profitability.

- Changes in Regulations: Changes in regulations concerning ride-sharing and food delivery can impact Uber's ability to operate efficiently.

- Ongoing Legal Battles: (Mention any significant legal challenges Uber currently faces).

Fuel Prices and Inflationary Pressures

Fluctuating fuel prices and inflation impact Uber's profitability.

- Sensitivity to Fuel Price Changes: Uber's operations are significantly impacted by volatile fuel prices. Increased fuel costs can be passed on to consumers, potentially reducing demand.

- Impact of Rising Inflation: Inflation increases operational costs and may decrease consumer spending on non-essential services like ride-sharing.

Conclusion

Determining whether Uber is truly recession-proof is complex. While its diversified revenue streams and dynamic pricing models offer some resilience, the intense competition, regulatory challenges, and sensitivity to economic downturns present significant risks. The historical data presented here, along with expert opinions, provide some insight but don't offer definitive answers. It's crucial to remember that no investment is truly recession-proof.

Call to Action: Understanding whether Uber is truly recession-proof requires ongoing monitoring of its business model, stock performance, and the broader economic climate. Continue researching and staying informed about Uber's recession-proof characteristics to make well-informed investment decisions.

Featured Posts

-

Orlando Citys Home Opener Ends In Loss To Philadelphia Union

May 19, 2025

Orlando Citys Home Opener Ends In Loss To Philadelphia Union

May 19, 2025 -

Todays Nyt Connections Hints And Answers May 8 697

May 19, 2025

Todays Nyt Connections Hints And Answers May 8 697

May 19, 2025 -

Tampoy I Epistrofi Sto Mega

May 19, 2025

Tampoy I Epistrofi Sto Mega

May 19, 2025 -

Orlando Fringe Theatre Festival Celebrating Years Of Artistic Innovation In Loch Haven Park

May 19, 2025

Orlando Fringe Theatre Festival Celebrating Years Of Artistic Innovation In Loch Haven Park

May 19, 2025 -

Unraveling The Trial Teahs Involvement And Family Secrets

May 19, 2025

Unraveling The Trial Teahs Involvement And Family Secrets

May 19, 2025