Is Uber Technologies (UBER) A Smart Investment?

Table of Contents

Uber's Business Model and Market Position

Uber's core business model revolves around connecting riders with drivers through its app, but its reach extends far beyond ride-sharing. Uber Eats dominates the food delivery sector, competing with giants like DoorDash and Grubhub. The company also operates Uber Freight, a logistics platform connecting shippers with truckers. This diversification provides a buffer against reliance on any single service.

Uber holds a significant market share in the ride-hailing industry globally, particularly in urban areas. However, it faces stiff competition from Lyft in the US and various other ride-hailing apps internationally. The competitive landscape is dynamic, requiring Uber to constantly innovate and adapt.

- Market dominance in ride-sharing: Uber maintains a leading position in many major cities worldwide.

- Growth potential in food delivery and other segments: Uber Eats and Uber Freight offer significant avenues for future growth.

- Competitive threats and strategies to mitigate them: Aggressive pricing strategies, technological advancements, and strategic partnerships are crucial for maintaining competitiveness.

- Geographic expansion and international opportunities: Expanding into new markets remains a key growth strategy for Uber.

Financial Performance and Growth Prospects

Analyzing Uber's financial statements reveals a complex picture. While revenue has shown consistent growth, profitability remains a challenge. Investors need to carefully examine key financial metrics like revenue growth rate, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and net income. The path to consistent profitability is a major factor in evaluating UBER as a long-term investment.

- Revenue streams and their growth potential: Diversification across ride-sharing, food delivery, and freight provides multiple avenues for revenue generation.

- Profitability margins and path to profitability: Achieving sustainable profitability is a critical factor for long-term investor confidence.

- Debt levels and financial stability: Analyzing Uber's debt-to-equity ratio and cash flow is essential for assessing its financial health.

- Analyst ratings and price targets: Monitoring analyst ratings and price targets offers valuable insight into market sentiment and future expectations.

Risks and Challenges Facing Uber

Investing in Uber Technologies involves inherent risks. Regulatory hurdles vary significantly across different regions, potentially impacting operations and profitability. Driver relations are another critical concern, with ongoing debates about compensation and working conditions. Intense competition and potential economic downturns further add to the uncertainty.

- Regulatory changes affecting the ride-sharing industry: New laws and regulations can significantly impact Uber's operations and profitability.

- Driver compensation and labor relations issues: Maintaining positive relationships with drivers is vital for operational efficiency and public image.

- Intense competition and market saturation: The highly competitive nature of the ride-sharing and food delivery markets poses a constant threat.

- Economic sensitivity of the business model: Economic downturns can significantly reduce demand for ride-sharing and food delivery services.

- Cybersecurity risks and data privacy concerns: Protecting user data is paramount, and any data breaches can have significant repercussions.

Valuation and Investment Considerations

Uber's stock valuation needs careful analysis. Comparing its Price-to-Earnings ratio (P/E) to competitors and industry benchmarks helps determine whether it's overvalued or undervalued. Considering your investment timeline (long-term vs. short-term), risk tolerance, and overall portfolio diversification is crucial.

- Price-to-earnings ratio (P/E): Comparing Uber's P/E ratio to industry peers provides a relative valuation benchmark.

- Market capitalization and share price: Understanding the market capitalization and current share price is essential for assessing investment potential.

- Comparison to competitor valuations: Comparing Uber's valuation to its main competitors provides valuable context.

- Potential for long-term growth and returns: Uber's long-term growth potential in various segments needs thorough evaluation.

- Risk assessment and diversification strategies: A diversified investment portfolio can mitigate the risks associated with investing in a single stock like UBER.

Conclusion: Is Uber Technologies (UBER) Right for Your Investment Portfolio?

Investing in Uber Technologies (UBER) presents a complex scenario. While the company's diverse business model and global reach offer significant growth potential, considerable risks remain, particularly concerning regulation, competition, and profitability. Before investing in UBER stock, thorough due diligence is paramount. Carefully weigh the pros and cons, analyze Uber's financial reports, and consider industry analysis to determine if investing in UBER aligns with your individual investment goals and risk tolerance. Remember, this article is not financial advice; conducting your own research is crucial before making any investment decisions regarding UBER stock or other investment opportunities.

Featured Posts

-

Arrascaeta Marca Dois Flamengo Derrota Gremio No Brasileirao

May 08, 2025

Arrascaeta Marca Dois Flamengo Derrota Gremio No Brasileirao

May 08, 2025 -

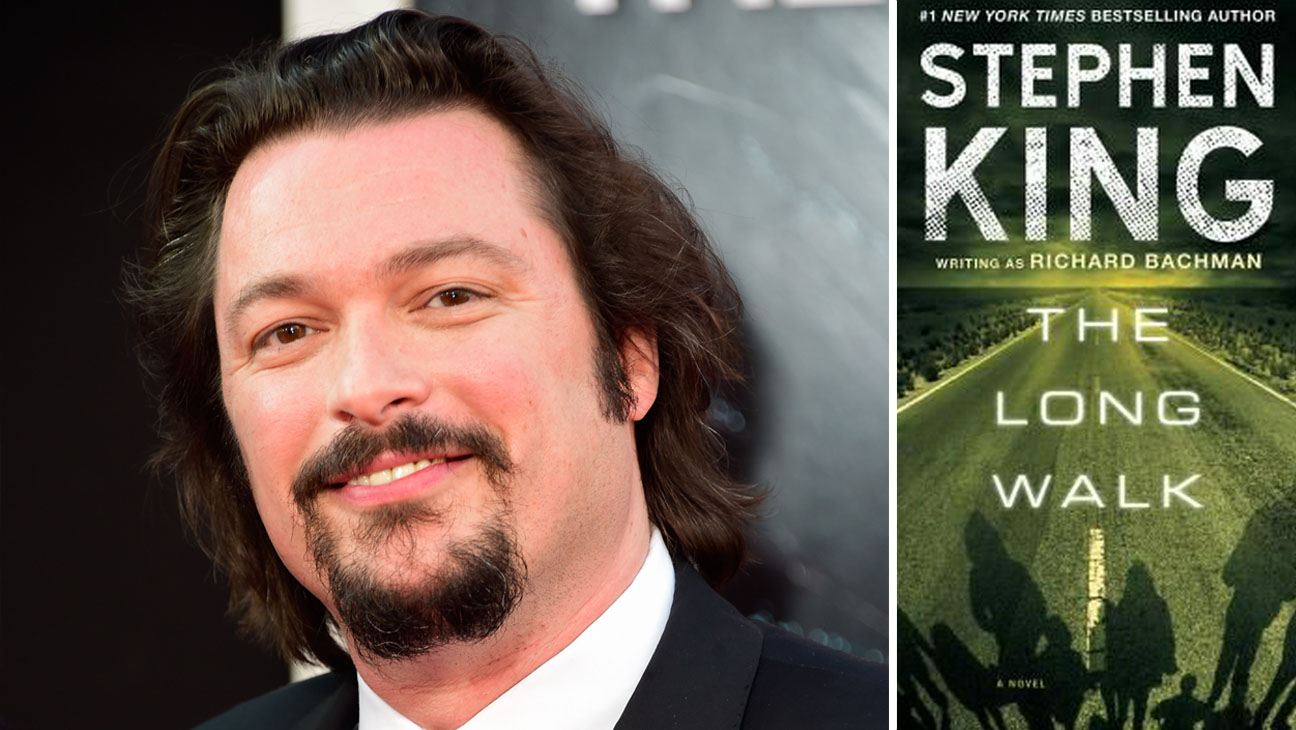

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025 -

Thailand Theater Reveals Superman Minecraft Preview 5 Minute Sneak Peek

May 08, 2025

Thailand Theater Reveals Superman Minecraft Preview 5 Minute Sneak Peek

May 08, 2025 -

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025 -

Pakistan Super League 10 Tickets Go On Sale

May 08, 2025

Pakistan Super League 10 Tickets Go On Sale

May 08, 2025