Is XRP's 400% 3-Month Rally Sustainable? A Buyer's Guide

Table of Contents

XRP, the cryptocurrency associated with Ripple Labs, has experienced a remarkable 400% surge in the past three months. This meteoric rise has captivated investors, sparking the crucial question: is this rally sustainable? This buyer's guide delves into the factors influencing XRP's price, helping you assess the risks and potential rewards before investing in XRP. We'll explore the legal battles, adoption rates, market sentiment, and fundamental and technical analyses to help you make an informed decision.

Analyzing the Factors Behind XRP's Recent Surge

The Ripple Lawsuit and its Impact

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has significantly impacted XRP's price. The lawsuit's uncertainty created volatility, but recent developments suggest potential positive outcomes.

-

Potential Positive Outcomes: A favorable ruling could lead to increased regulatory clarity, boosting investor confidence and driving XRP's price higher. This could unlock institutional investment currently hesitant due to the legal uncertainty. Several legal experts believe Ripple has a strong case.

-

Potential Negative Outcomes: An unfavorable ruling could negatively impact XRP's price, potentially leading to a significant correction. This would further solidify regulatory uncertainty around XRP and hinder its adoption.

-

Expert Opinions: Many legal analysts are closely following the case, with opinions varying widely. It's crucial to consult multiple sources and not rely solely on biased opinions. Keeping abreast of court filings and expert commentary is vital for informed decision-making. Keywords: Ripple lawsuit, SEC lawsuit, legal uncertainty, XRP price prediction, regulatory clarity.

Growing Institutional Adoption of XRP

The increasing use of XRP in cross-border payments via RippleNet and On-Demand Liquidity (ODL) is a key driver of its price increase. This demonstrates XRP's real-world utility, attracting institutional investors seeking efficient and cost-effective solutions.

-

Examples of Adoption: Several financial institutions are already leveraging RippleNet and ODL to facilitate faster and cheaper international money transfers. This practical application distinguishes XRP from many other cryptocurrencies focused primarily on speculation.

-

Statistics and Data: While precise figures on XRP's transaction volume through RippleNet are not publicly released, anecdotal evidence and news reports strongly suggest a significant and growing usage. Tracking news from Ripple and its partners provides valuable insights. Keywords: institutional adoption, cross-border payments, RippleNet, On-Demand Liquidity (ODL), XRP utility.

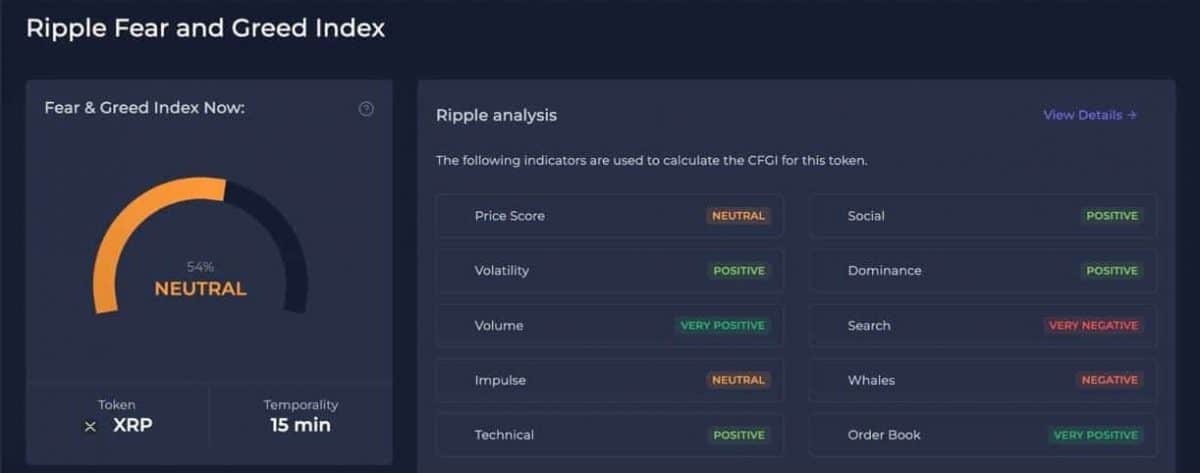

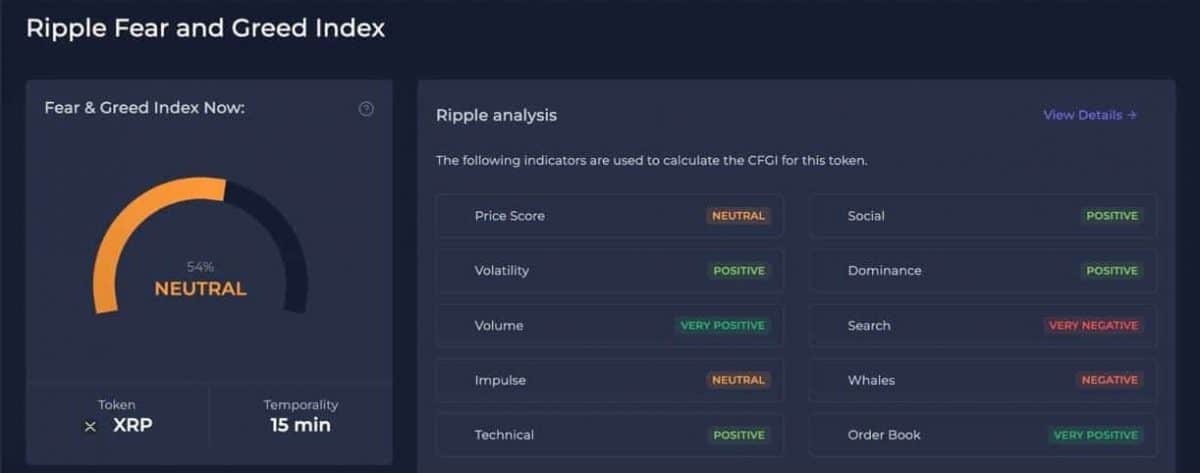

Market Sentiment and Speculative Trading

Fear Of Missing Out (FOMO) and speculative trading have undoubtedly played a significant role in XRP's recent price surge. This speculative element, however, introduces significant risk.

-

Risks Associated with Speculative Bubbles: Rapid price increases fueled by speculation are often unsustainable. A sudden shift in market sentiment could trigger a sharp price correction, leading to significant losses for investors.

-

Price Volatility: Charts clearly illustrate the high volatility of XRP's price, highlighting the inherent risk associated with this cryptocurrency. Analyzing historical price data is crucial for understanding its volatility and potential future fluctuations. Keywords: market sentiment, FOMO, speculation, price volatility, cryptocurrency market.

Assessing the Sustainability of the Rally

Fundamental Analysis of XRP

A fundamental analysis of XRP focuses on its underlying technology, utility, and long-term potential. While XRP's value proposition centers around its use in cross-border payments, several factors influence its fundamental value.

-

XRP Technology and Utility: XRP's speed, low transaction fees, and integration with RippleNet contribute to its utility. However, its centralized nature, unlike many decentralized cryptocurrencies, is a point of contention for some.

-

Market Capitalization and Comparison: Comparing XRP's market capitalization to other cryptocurrencies provides context for its potential growth. However, market capitalization alone doesn't dictate future price movements. Keywords: XRP technology, RippleNet, blockchain technology, market capitalization, cryptocurrency comparison.

Technical Analysis of XRP Price Charts

Technical analysis uses price charts and indicators to predict future price movements. Analyzing XRP's charts helps identify potential support and resistance levels and predict future price targets.

-

Support and Resistance Levels: Identifying key support and resistance levels helps determine potential price ranges and predict potential price reversals.

-

Technical Indicators: Moving averages and Relative Strength Index (RSI) provide insights into price trends and momentum, assisting in predicting short-term price movements. Keywords: technical analysis, price charts, support and resistance, moving averages, RSI, price prediction.

Regulatory Landscape and its Influence

The regulatory environment significantly impacts XRP's future. Uncertainty surrounding cryptocurrency regulations globally presents both challenges and opportunities.

-

Regulatory Uncertainty: Different jurisdictions have varying regulatory frameworks for cryptocurrencies, creating uncertainty for investors and potentially hindering wider adoption.

-

Global Regulatory Landscape: Monitoring regulatory developments globally is crucial for assessing the long-term prospects of XRP. Keywords: cryptocurrency regulation, regulatory uncertainty, global regulatory landscape, legal compliance.

A Prudent Investor's Approach to XRP

Risk Management Strategies

Investing in XRP, like any cryptocurrency, carries substantial risk. A prudent investor employs risk management strategies to mitigate potential losses.

-

Diversification: Diversifying your investment portfolio across different asset classes, including other cryptocurrencies and traditional investments, is crucial.

-

Risk Tolerance and Investment Goals: Setting realistic investment goals and aligning them with your risk tolerance is paramount. Keywords: risk management, diversification, investment strategy, risk tolerance, stop-loss orders.

Due Diligence Before Investing in XRP

Thorough research is essential before investing in XRP or any cryptocurrency. This involves assessing the risks and potential rewards based on your own research and analysis.

- Reliable Sources of Information: Consult reputable sources like financial news outlets, independent research firms, and official statements from Ripple Labs. Keywords: due diligence, research, investment advice, cryptocurrency research, reputable sources.

Conclusion

XRP's recent 400% rally is impressive, but its sustainability hinges on several factors, including the Ripple lawsuit's outcome, continued institutional adoption, and broader market sentiment. While significant upside potential exists, investors must proceed cautiously, performing thorough due diligence and implementing robust risk management strategies. Before investing in XRP, carefully assess the potential rewards against the inherent risks. Remember, this buyer's guide is for informational purposes only and does not constitute financial advice. Do your own research and make informed decisions before investing in XRP.

Featured Posts

-

Psl Matches In Lahore Impact On School Schedules

May 08, 2025

Psl Matches In Lahore Impact On School Schedules

May 08, 2025 -

Arsenals Path To The Final Psg Presents A Stiffer Challenge Than Real Madrid

May 08, 2025

Arsenals Path To The Final Psg Presents A Stiffer Challenge Than Real Madrid

May 08, 2025 -

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan

May 08, 2025

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan

May 08, 2025 -

Champions League Inters Shock Win Against Bayern Munich

May 08, 2025

Champions League Inters Shock Win Against Bayern Munich

May 08, 2025 -

Angels Offense Falters 13 More Strikeouts In Series Loss To Twins

May 08, 2025

Angels Offense Falters 13 More Strikeouts In Series Loss To Twins

May 08, 2025