Is XRP's 400% Rise Sustainable? Future Price Analysis

Table of Contents

XRP, Ripple's native cryptocurrency, has recently experienced a remarkable 400% surge. This explosive growth has captivated investors, sparking crucial questions: Is this rally sustainable? What factors will drive XRP's future price? This in-depth analysis delves into the current market conditions, technological advancements, and regulatory landscape to offer a comprehensive assessment of XRP's potential for continued growth. We will explore the factors contributing to this recent surge, analyze the challenges and risks, and offer a realistic outlook on XRP's future price.

Factors Contributing to XRP's Recent Surge

Several interconnected factors have contributed to XRP's recent impressive price increase. Let's examine the key drivers:

Increased Institutional Adoption

Growing interest from institutional investors is a significant catalyst for XRP's price surge. This increased participation brings larger trading volumes and greater market stability. While specific partnerships are often kept confidential for business reasons, the overall increase in trading volume on major exchanges strongly suggests heightened institutional activity.

- Increased trading volume on major exchanges: Data from leading exchanges shows a significant uptick in XRP trading volume, indicating substantial institutional involvement.

- Partnerships with financial institutions: Although often undisclosed, anecdotal evidence and press releases point to Ripple forging partnerships with several financial institutions, leading to increased XRP utility.

- Growing use of RippleNet: RippleNet, Ripple's blockchain-based global payment network, continues to expand its reach, further driving demand for XRP as a liquidity solution.

Positive Regulatory Developments (or lack thereof)

The ongoing legal battle between Ripple and the SEC casts a long shadow over XRP's price. While uncertainty remains, recent developments, even if not explicitly positive rulings, have seemingly impacted investor sentiment. The lack of outright negative rulings has, for some, been interpreted as a positive sign.

- Outcomes of court cases: Positive developments, even small ones, in the ongoing SEC lawsuit can significantly impact investor sentiment and drive price increases. Conversely, negative developments can lead to sharp declines.

- Potential settlements: Speculation surrounding potential settlements between Ripple and the SEC creates uncertainty but also fuels price volatility.

- Changing regulatory attitudes towards crypto: A more favorable regulatory environment globally could dramatically impact XRP's price.

Growing Utility and Ecosystem

XRP's expanding use cases within and beyond the RippleNet ecosystem are further bolstering its value. Technological advancements are constantly refining the XRP Ledger, making it a more efficient and attractive platform.

- Cross-border payments: XRP's speed and low transaction costs make it an attractive solution for cross-border payments, driving its adoption by financial institutions.

- Liquidity solutions: RippleNet uses XRP to facilitate liquidity between financial institutions, creating a constant demand for the token.

- Decentralized finance (DeFi) applications built on XRP: The growing DeFi ecosystem is exploring XRP integration, opening new avenues for growth and utility.

Challenges and Risks Facing XRP's Future Growth

Despite the recent surge, several significant challenges and risks could hinder XRP's future growth:

Regulatory Uncertainty

The ongoing legal uncertainty surrounding XRP's classification as a security remains a major headwind. The SEC's stance continues to impact investor confidence and could lead to further regulatory hurdles.

- Potential for further regulatory crackdowns: Increased regulatory scrutiny of cryptocurrencies globally poses a significant risk to XRP's price.

- Impact of varying regulatory approaches across different jurisdictions: Inconsistencies in regulatory frameworks across different countries create complexities and uncertainties for XRP's global adoption.

Market Volatility and Crypto Winter

The cryptocurrency market is inherently volatile, and XRP is no exception. A potential crypto winter, characterized by prolonged bear markets, could significantly impact investor confidence and XRP's price.

- Correlation with Bitcoin price: XRP's price often correlates with Bitcoin's price, meaning a Bitcoin downturn often negatively impacts XRP.

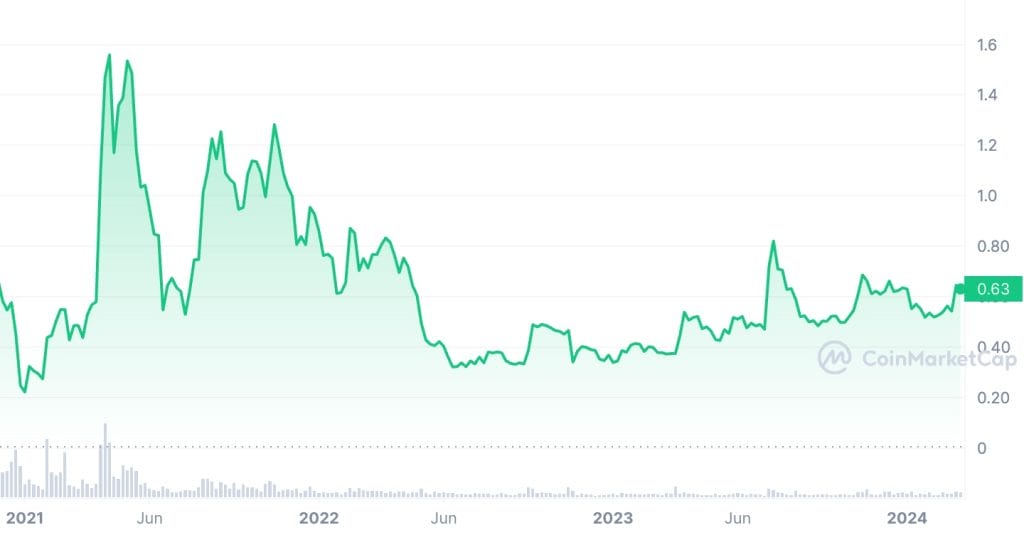

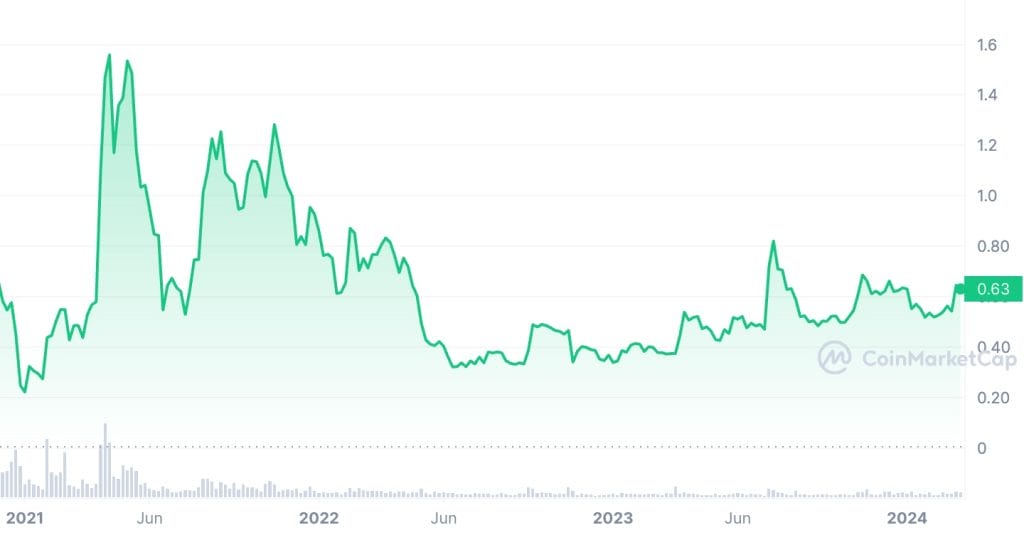

- Historical price fluctuations: XRP's past price performance demonstrates its significant volatility, highlighting the inherent risks of investment.

- Impact of macroeconomic factors: Global economic conditions, inflation, and interest rate changes can significantly influence cryptocurrency prices.

Competition from other Cryptocurrencies

XRP faces stiff competition from other cryptocurrencies offering similar functionalities, such as cross-border payments and decentralized finance applications.

- Comparison with other cryptocurrencies with similar functionalities: Several other cryptocurrencies are vying for a share of the market, increasing competition for XRP.

- Market capitalization comparisons: XRP's market capitalization relative to its competitors is a key factor influencing its future price potential.

Predicting XRP's Future Price: A Realistic Outlook

Predicting XRP's future price with certainty is impossible. However, combining technical and fundamental analysis can provide a more informed outlook.

Technical Analysis

Technical analysis uses charts and indicators to identify potential price trends. While not foolproof, studying indicators like moving averages and RSI can offer insights into potential support and resistance levels.

- Support and resistance levels: Identifying key price levels where buying or selling pressure is anticipated can help predict potential price movements.

- Trend analysis: Analyzing price trends over different timeframes can help identify the overall direction of XRP's price.

- Trading volume patterns: High trading volume often accompanies significant price movements, providing clues about market sentiment.

Fundamental Analysis

Reassessing the factors discussed previously allows for a more balanced prediction. While the 400% rise is impressive, it's crucial to consider the underlying fundamentals.

- Predicted adoption rates: The future rate of adoption by financial institutions and individuals will significantly influence XRP's price.

- Potential regulatory outcomes: The resolution of the SEC lawsuit and broader regulatory changes will have a profound impact.

- Technological advancements: Continued innovation and improvements to the XRP Ledger will increase its competitiveness.

Conclusion

XRP's recent 400% price increase is noteworthy, but it doesn't guarantee sustained growth. While increased institutional adoption, potential regulatory clarity, and expanding utility all present potential upside, significant challenges remain, including regulatory uncertainty, market volatility, and competition. This analysis provides a framework for informed decision-making, but remember, conducting thorough research and understanding the inherent risks are crucial before investing in XRP or any cryptocurrency. Stay updated on the latest XRP price prediction analyses and developments within the XRP ecosystem to make informed investment choices for your portfolio. Continue your research on XRP price prediction to navigate the dynamic world of cryptocurrency investment.

Featured Posts

-

Get Ready For Andor Season 2 A Complete Guide For New And Returning Viewers

May 08, 2025

Get Ready For Andor Season 2 A Complete Guide For New And Returning Viewers

May 08, 2025 -

Daily Lotto Winning Numbers For Friday 18th April 2025

May 08, 2025

Daily Lotto Winning Numbers For Friday 18th April 2025

May 08, 2025 -

Lahore School Timetable Changes Psl 2024 Considerations

May 08, 2025

Lahore School Timetable Changes Psl 2024 Considerations

May 08, 2025 -

Increased Fia Action Against Human Smugglers Four More Arrested

May 08, 2025

Increased Fia Action Against Human Smugglers Four More Arrested

May 08, 2025 -

Saturday Lotto Draw Results April 12 2025

May 08, 2025

Saturday Lotto Draw Results April 12 2025

May 08, 2025