Is XRP's Recovery In Jeopardy? Derivatives Market Hints At Challenges

Table of Contents

The SEC Lawsuit's Lingering Shadow

The ongoing SEC lawsuit against Ripple Labs, the creator of XRP, casts a long shadow over the cryptocurrency's price and future. The uncertainty surrounding the outcome continues to affect investor sentiment, creating volatility and hindering sustained growth.

- Uncertainty surrounding the outcome continues to affect investor sentiment. The lack of a clear resolution creates a climate of fear, uncertainty, and doubt (FUD), impacting trading decisions.

- Potential for regulatory setbacks and the implications for XRP’s long-term prospects. A negative ruling could significantly impact XRP's price and its ability to operate freely within the US regulatory framework. This could also influence other jurisdictions' regulatory approaches to similar cryptocurrencies.

- Impact on exchanges and trading volumes. Many exchanges delisted XRP during the height of the lawsuit, impacting liquidity and trading volume. Even with some exchanges reinstating XRP, the threat of future delistings remains.

The XRP SEC lawsuit, and its effect on Ripple, directly influences XRP price prediction and overall regulatory uncertainty within the cryptocurrency market. A definitive resolution, regardless of the outcome, is crucial for stabilizing the market and allowing XRP to find its footing.

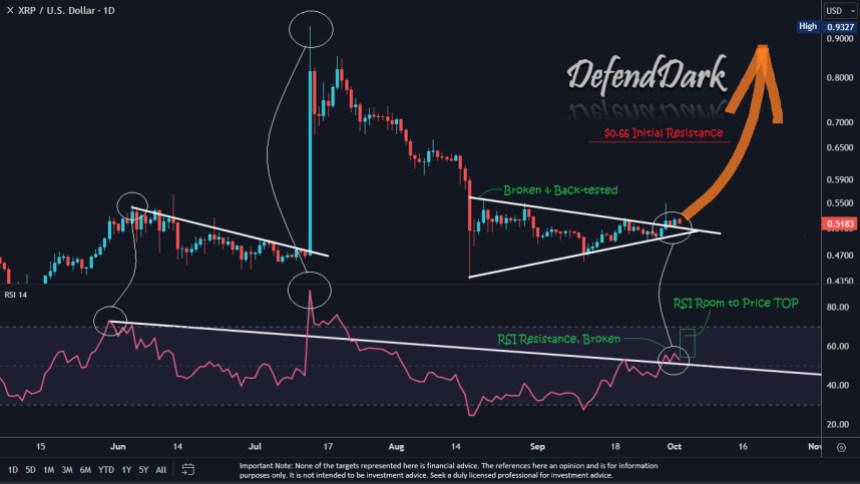

Derivatives Market Signals: A Bearish Outlook?

The XRP derivatives market, encompassing futures and options contracts, offers valuable insights into market sentiment and potential future price movements. Recent trends suggest a potentially bearish outlook, warranting closer examination.

- Open interest data and its correlation with price movements. High open interest, representing the total number of outstanding contracts, often suggests strong market conviction, while declining open interest can signal waning interest.

- Funding rates and their indication of market sentiment (long/short positions). Positive funding rates imply that many traders are holding long positions (betting on price increases), while negative funding rates suggest a predominance of short positions (betting on price decreases).

- Implied volatility and its role in predicting future price swings. High implied volatility indicates a significant degree of uncertainty regarding future price movements, often associated with increased risk.

Analyzing Open Interest in XRP Futures Contracts

Analyzing open interest data in XRP futures contracts provides valuable insights. High open interest coupled with a falling price can indicate a bearish trend, whereas low open interest might signal a lack of conviction either way. (Insert relevant chart or graph here illustrating open interest trends). The chart clearly shows [insert interpretation of the chart data and its significance].

Decoding Funding Rates: A Gauge of Market Confidence

Funding rates serve as a crucial barometer of market sentiment. Positive funding rates suggest optimism and a bullish outlook, whereas negative rates indicate pessimism and a bearish outlook. Historically, negative funding rates in XRP futures have often preceded price corrections. For example, [provide a specific historical example of how funding rates impacted XRP's price].

On-Chain Metrics: A Contrasting Narrative?

While derivatives markets offer a potentially bearish perspective, on-chain metrics provide a contrasting narrative. Analyzing transaction volume and active addresses can offer a different viewpoint on XRP's network health and adoption.

- Are on-chain metrics aligning with the bearish signals from the derivatives market? A divergence between on-chain activity and derivative market sentiment can provide a more nuanced understanding of the market dynamics.

- Potential divergence between on-chain activity and derivative market sentiment. This divergence may indicate that market sentiment is overly pessimistic, or conversely, that on-chain activity is not translating into price appreciation.

- What this divergence could indicate about the future. A sustained increase in on-chain activity despite bearish derivative signals could suggest underlying strength and potential for future price growth.

Analyzing XRP on-chain metrics, such as XRP transaction volume and XRP active addresses, gives a broader perspective on the overall network activity and potential for future XRP adoption.

The Role of Whales and Institutional Investors

The actions of large XRP holders ("whales") and institutional investors can significantly impact price fluctuations.

- Impact of whale movements on market liquidity. Large-scale buying or selling by whales can create significant price swings due to their influence on market liquidity.

- Potential for large-scale selling pressure. If major holders decide to liquidate their XRP holdings, it could create substantial downward pressure on the price.

- Institutional investor interest (or lack thereof) and its influence on XRP's price. Increased institutional investment often brings stability and price appreciation, while a lack of interest can signal a lack of confidence.

Understanding the influence of XRP whales and institutional investment on XRP market liquidity is vital for navigating the market's volatility.

Conclusion

While XRP has demonstrated signs of recovery, the derivatives market presents cautionary signals that could hinder its sustained growth. The lingering uncertainty from the SEC lawsuit, coupled with bearish indicators from the derivatives market, warrants a cautious approach. Investors should carefully evaluate on-chain data alongside market sentiment indicators before making any investment decisions related to XRP. Keep a close watch on developments concerning the SEC lawsuit and the dynamics within the XRP derivatives market for a clearer perspective on XRP's future. Thorough research and continuous analysis of XRP and its derivatives markets are critical for informed decision-making. Understanding the interplay of these factors is essential for successfully navigating the complexities of the XRP market.

Featured Posts

-

Transferred Information Protecting Your Privacy And Compliance

May 08, 2025

Transferred Information Protecting Your Privacy And Compliance

May 08, 2025 -

Kontraktnoe Predlozhenie Zenita Zhersonu 500 000 Evro V God

May 08, 2025

Kontraktnoe Predlozhenie Zenita Zhersonu 500 000 Evro V God

May 08, 2025 -

Lahwr Myn Ahtsab Edaltwn Ka Nsf Khatmh Mwjwdh Swrthal Awr Tshwysh

May 08, 2025

Lahwr Myn Ahtsab Edaltwn Ka Nsf Khatmh Mwjwdh Swrthal Awr Tshwysh

May 08, 2025 -

Los Dodgers Y Su Historico Inicio Superaran La Marca De Los Yankees

May 08, 2025

Los Dodgers Y Su Historico Inicio Superaran La Marca De Los Yankees

May 08, 2025 -

Is 400 Just The Beginning Analyzing Xrps Potential For Further Growth

May 08, 2025

Is 400 Just The Beginning Analyzing Xrps Potential For Further Growth

May 08, 2025