Japan Trading Houses See Share Price Increase After Berkshire Hathaway Investment

Table of Contents

Berkshire Hathaway's Investment in Japanese Trading Houses: A Deep Dive

Berkshire Hathaway's investment strategy is renowned for its long-term perspective and focus on undervalued companies with strong fundamentals. The decision to invest in prominent Japanese trading houses, including Mitsubishi Corporation, Mitsui & Co., Itochu Corporation, Marubeni Corporation, and Sumitomo Corporation, marks a significant expansion of its Asian holdings. While the exact percentage ownership for each company hasn't been publicly disclosed in full, Berkshire Hathaway acquired roughly 5% stakes in each, representing a significant commitment to these long-established businesses.

- Berkshire Hathaway's long-term investment philosophy: Buffett's strategy emphasizes identifying companies with durable competitive advantages, strong management teams, and consistent profitability. This aligns well with the reputation and performance of many Japanese trading houses.

- Reasons behind selecting Japanese trading houses: The diversification offered by these trading houses, their involvement in diverse sectors (energy, metals, food, etc.), and their historically stable performance likely influenced Berkshire Hathaway's decision. The undervalued nature of these stocks relative to their long-term potential may also have played a role.

- Comparison to previous Berkshire Hathaway investments in the Asian market: This investment represents a significant expansion of Berkshire's Asian portfolio, demonstrating increased confidence in the long-term prospects of the Japanese economy and specific sectors within it. It builds upon previous successful investments in other Asian markets, showcasing a strategic approach to global diversification.

Impact on Share Prices of Individual Trading Houses

The announcement of Berkshire Hathaway's investment triggered an immediate and significant increase in the share prices of the affected trading houses. While the exact percentage increase varied slightly across companies, each experienced a substantial jump in its stock value. The market reacted positively to the news, demonstrating strong investor confidence.

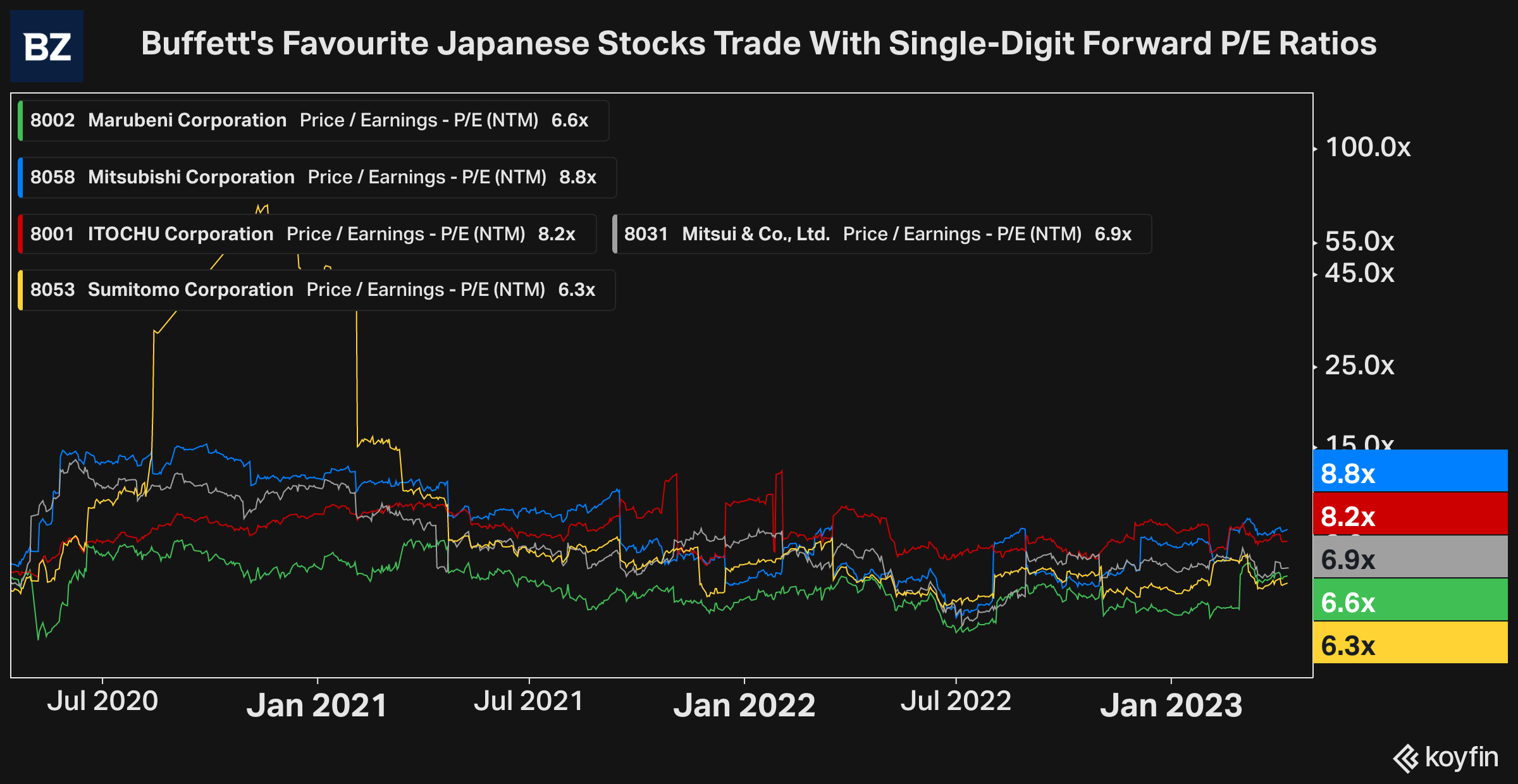

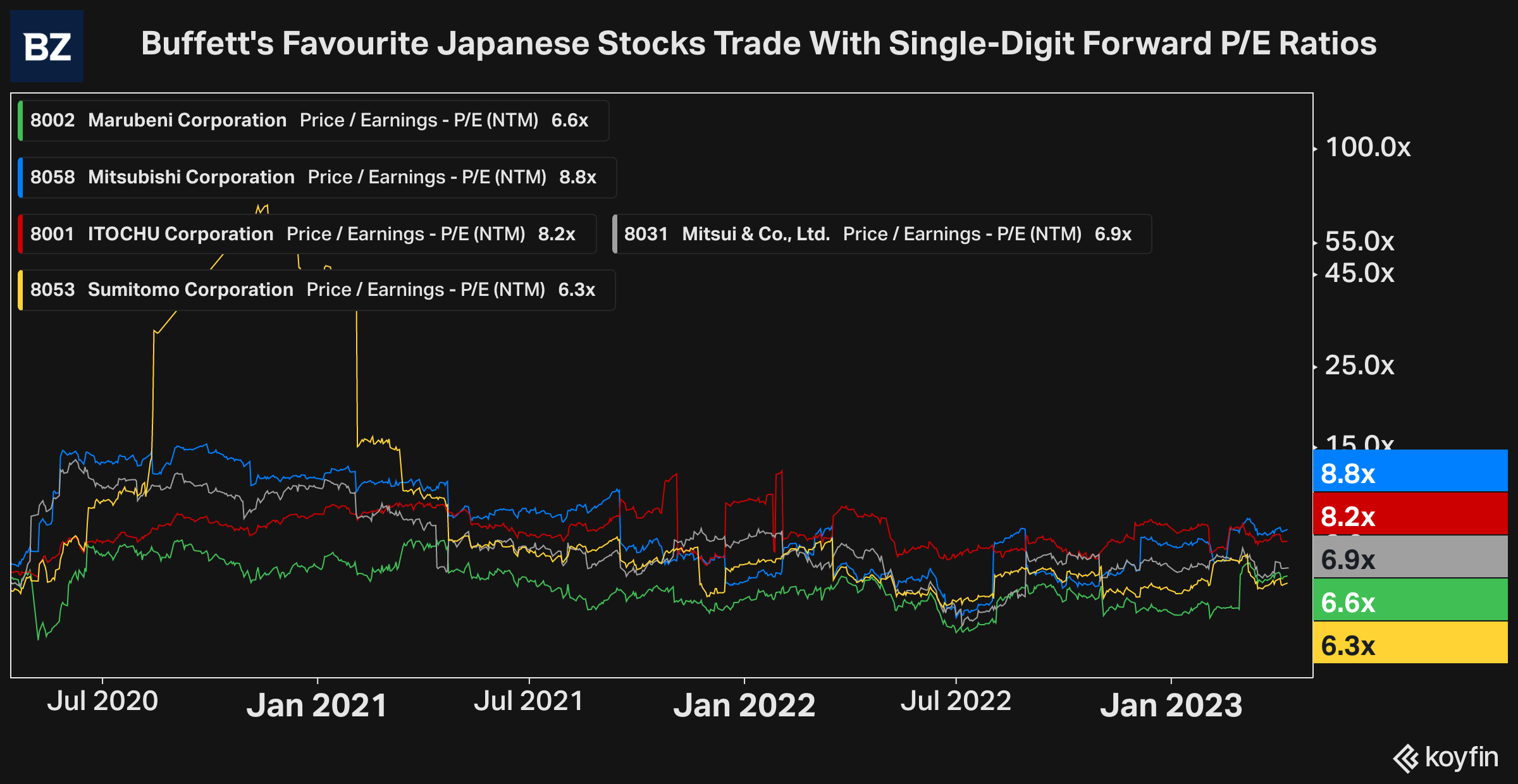

- Specific share price changes: [Insert a table or chart here showing the percentage increase in share prices for each company. Source the data appropriately.]

- Graphs or charts representing share price fluctuations: [Include a visual representation of share price movements before and after the announcement. Ensure clear labeling and sourcing.]

- Analysis of trading volume: Trading volume for these stocks increased dramatically following the news, indicating substantial market interest and investor activity.

Reasons Behind the Share Price Increase

Several factors contributed to the positive market response to Berkshire Hathaway's investment in Japan trading houses.

- The role of investor confidence and Warren Buffett's reputation: Buffett's legendary investing prowess and Berkshire Hathaway's track record instilled significant confidence in investors. His endorsement lent substantial credibility to these established, but perhaps previously overlooked, companies.

- The long-term stability and profitability of Japanese trading houses: These companies have a history of generating consistent revenue and profits, making them attractive investments for long-term investors. Their diversified portfolios and deep relationships in various industries enhance their resilience.

- Potential future growth opportunities: Investors are likely anticipating future growth opportunities for these trading houses, particularly in expanding Asian markets and through increased international partnerships.

Long-Term Implications for the Japanese Stock Market

Berkshire Hathaway's investment holds significant implications for the Japanese stock market.

- Attraction of further foreign investment: This move could attract further foreign investment into Japan, boosting the overall market sentiment and potentially leading to increased valuations for other Japanese companies.

- Potential ripple effect on other Japanese companies: The positive impact on these trading houses could influence investors to reconsider other large, established Japanese businesses.

- Long-term outlook for the Japanese economy: The investment highlights the renewed international interest in the Japanese economy and signals potential for future growth and development in various sectors.

Conclusion: The Future of Japan Trading Houses After the Berkshire Hathaway Investment

Berkshire Hathaway's investment in Japan trading houses represents a significant vote of confidence in these companies and the Japanese market as a whole. The substantial share price increases reflect the positive market reaction to this move, driven by investor confidence in both the long-term stability of these trading houses and the reputation of Berkshire Hathaway. The future prospects for these companies appear bright, given their diversification, established market positions, and now, the endorsement of a legendary investor. To stay updated on the evolving landscape of the Japanese stock market and further explore the ripple effects of this investment, follow reputable financial news sources such as the Financial Times, Nikkei, and Bloomberg, and keep an eye on the analysis provided by leading financial analysts specializing in the Japanese market. Continue to research the impact of Berkshire Hathaway’s investment on Japan trading houses to fully understand the ongoing implications.

Featured Posts

-

Wednesday Lotto Results April 16 2025

May 08, 2025

Wednesday Lotto Results April 16 2025

May 08, 2025 -

Uber Pet Service Now Available In Delhi And Mumbai

May 08, 2025

Uber Pet Service Now Available In Delhi And Mumbai

May 08, 2025 -

New Superman Footage Shows Kryptos Adorable Side

May 08, 2025

New Superman Footage Shows Kryptos Adorable Side

May 08, 2025 -

Bitcoin Piyasasi Guencel Durum Ve Gelecek Tahminleri

May 08, 2025

Bitcoin Piyasasi Guencel Durum Ve Gelecek Tahminleri

May 08, 2025 -

Gary Nevilles Psg Vs Arsenal Prediction Nervous Energy Ahead

May 08, 2025

Gary Nevilles Psg Vs Arsenal Prediction Nervous Energy Ahead

May 08, 2025