Japanese Bond Market: Foreign Investor Bets On Sustained Yield Rise

Table of Contents

Factors Driving Foreign Investment in Japanese Bonds

The increased foreign interest in Japanese Government Bonds (JGBs) is a confluence of several compelling factors, significantly altering the dynamics of the Japanese bond market and impacting global investment strategies.

-

The Bank of Japan's (BOJ) Policy Shift: The BOJ's gradual departure from its years-long policy of yield curve control (YCC) has been a primary catalyst. The shift towards a more normalized monetary policy, allowing longer-term interest rates to rise, has made JGBs more attractive to yield-hungry investors globally. This represents a significant change in the landscape of Japanese interest rates and the overall investment climate.

-

Rising Inflation: Japan, like many other developed nations, is experiencing a rise in inflation, albeit at a slower pace than some other countries. This inflation, coupled with the BOJ's policy adjustments, justifies higher yields on JGBs, making them a more compelling investment compared to bonds in other developed economies with similar inflationary pressures. The expectation of further inflation also fuels the demand for JGBs.

-

Attractive Yields Compared to Other Markets: JGB yields, while still relatively low compared to historical levels, are now significantly higher than those offered by many other developed nations' government bonds. This relative yield advantage attracts investors seeking higher returns in a low-yield global environment. This comparative yield analysis is crucial for foreign investors' decision-making.

-

Diversification Strategies: Global investors are increasingly incorporating JGBs into their portfolios as a means of diversification. The relatively low correlation between JGBs and other asset classes makes them a valuable tool for reducing overall portfolio risk and improving risk-adjusted returns. This diversification strategy further enhances the appeal of JGBs.

-

Expectations of Further Yield Increases: Market participants anticipate further yield increases as the BOJ continues to adjust its monetary policy. This expectation of future yield gains further strengthens the allure of JGBs for investors looking for long-term growth potential. The prediction of further yield curve adjustments fuels speculative investment.

Analyzing the Risks and Opportunities in the Japanese Bond Market

While the rising yields in the Japanese bond market present attractive opportunities, investors must carefully consider the inherent risks.

-

Increased Volatility: The BOJ's policy adjustments have introduced increased volatility into the JGB market. Fluctuations in bond prices can impact returns, making careful risk management crucial for investors. This volatility risk requires sophisticated investment strategies.

-

Currency Risk (Yen Exchange Rate): Foreign investors are exposed to currency risk due to fluctuations in the Yen's exchange rate against their home currencies. Unfavorable exchange rate movements can significantly impact the returns realized from JGB investments. Hedging strategies are essential to manage this risk.

-

Credit Risk: While Japan maintains a high credit rating, credit risk, although minimal, still exists. Investors should assess the creditworthiness of Japanese government debt, although the risk is generally considered very low. This credit risk assessment is crucial before making any investment decisions.

-

Geopolitical Risks: Global geopolitical events, such as economic slowdowns or international conflicts, can impact JGB yields. Investors need to consider the influence of global events on the Japanese bond market. Global economic outlook has significant implications for JGBs.

-

Long-Term Outlook: Japan's demographic trends and economic growth prospects play a significant role in the long-term outlook for the Japanese bond market. Careful consideration of these factors is vital for long-term investment strategies. Analyzing Japan’s long-term economic growth is vital to successful JGB investment.

Investment Strategies for Foreign Investors in the Japanese Bond Market

Foreign investors have several avenues for accessing the Japanese bond market, each carrying its own set of risks and rewards.

-

Investment Vehicles: Investors can gain exposure to JGBs through various vehicles, including actively managed bond funds, passively managed exchange-traded funds (ETFs), and direct investment in individual bonds. The choice depends on the investor's risk tolerance and investment goals. Each investment vehicle offers a different level of control and risk exposure.

-

Mitigating Risks: Strategies for mitigating currency risk include hedging techniques, such as forward contracts or options. Diversification across different maturities and credit qualities of JGBs can help reduce overall portfolio risk. Risk mitigation strategies are pivotal for successful JGB investing.

-

Return and Risk Analysis: A thorough analysis of potential returns and risk levels associated with various JGB investment strategies is crucial. Investors should carefully evaluate their risk tolerance before making investment decisions. This detailed analysis will improve the odds of investment success.

-

Portfolio Diversification: Including JGBs in a well-diversified portfolio can effectively reduce overall portfolio volatility. Diversification should be a key element of any JGB investment strategy. Diversification is crucial to manage risk and achieve optimal returns.

-

Risk Tolerance and Investment Goals: Careful consideration of an investor's risk tolerance and investment goals is paramount in formulating a suitable investment strategy. The risk profile should guide the investment approach. Alignment of risk tolerance with investment strategy is critical for investment success.

Conclusion: Navigating the Future of the Japanese Bond Market

The sustained rise in yields in the Japanese bond market has sparked significant interest from foreign investors, driven by the BOJ's policy shift, rising inflation, and attractive yields compared to other developed markets. While the opportunities are compelling, investors must carefully weigh the potential risks, including volatility, currency risk, and geopolitical factors. Successful navigation of this market requires a well-defined investment strategy that incorporates effective risk management techniques and a comprehensive understanding of Japan's economic outlook. Stay informed about the future trajectory of the Japanese bond market and consider the implications for your investment strategy. Understand the potential opportunities and mitigate the risks associated with the sustained yield rise in Japanese Government Bonds (JGBs).

Featured Posts

-

Godzilla X Kong Sequel Jack O Connell Joins The Cast

Apr 25, 2025

Godzilla X Kong Sequel Jack O Connell Joins The Cast

Apr 25, 2025 -

The Zuckerberg Trump Dynamic Impact On Facebook And Beyond

Apr 25, 2025

The Zuckerberg Trump Dynamic Impact On Facebook And Beyond

Apr 25, 2025 -

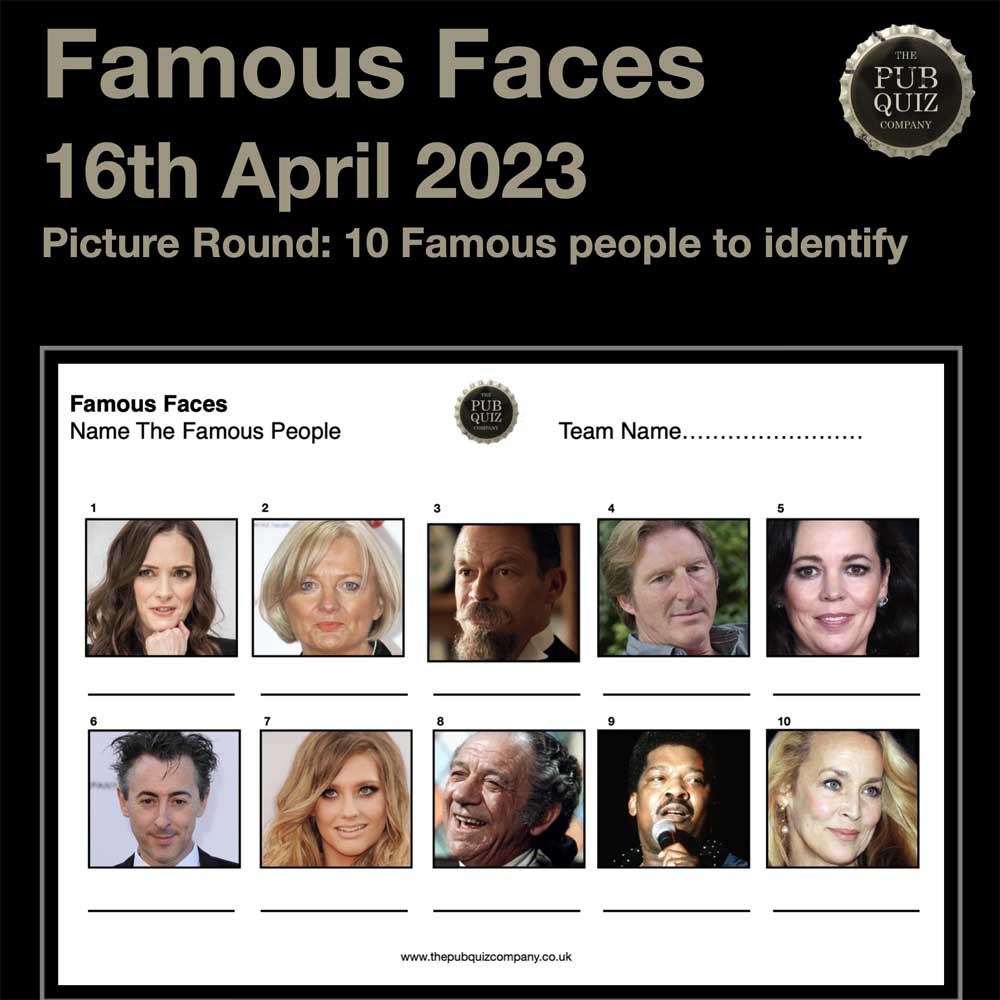

Recognize These Faces From April 1999

Apr 25, 2025

Recognize These Faces From April 1999

Apr 25, 2025 -

Meja Rias Modern Di Rumah Ide Desain Sederhana And Elegan 2025

Apr 25, 2025

Meja Rias Modern Di Rumah Ide Desain Sederhana And Elegan 2025

Apr 25, 2025 -

Longer Term Japanese Government Bond Yield Rebound Evidence From Swap Markets

Apr 25, 2025

Longer Term Japanese Government Bond Yield Rebound Evidence From Swap Markets

Apr 25, 2025