Japan's Steep Yield Curve: A Growing Concern For Investors And The Economy

Table of Contents

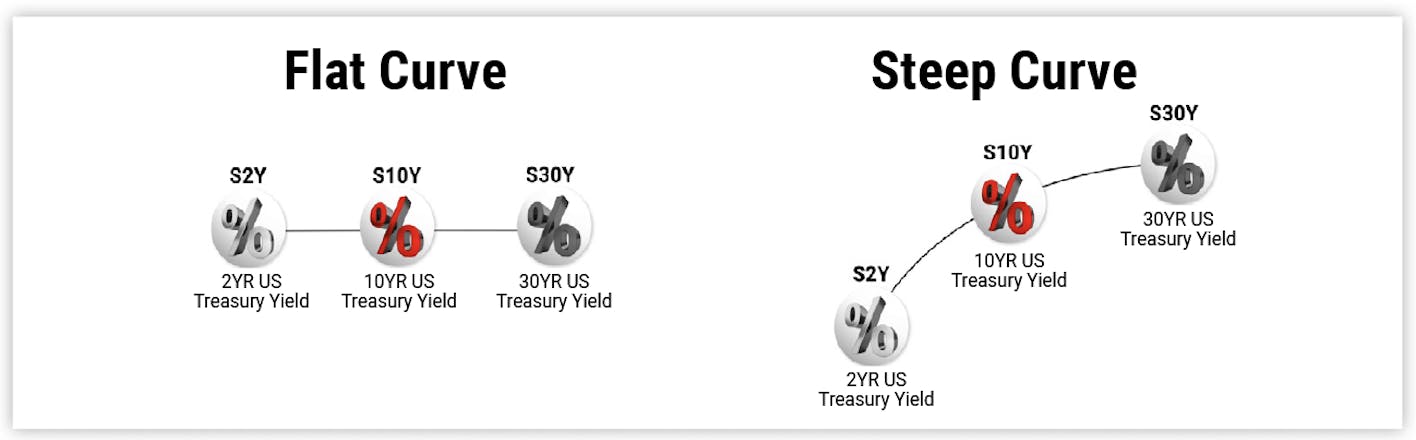

Understanding Japan's Yield Curve

A yield curve graphically represents the relationship between the interest rates (yields) and the time to maturity of debt instruments of the same credit quality. It's typically calculated by plotting the yields of government bonds with different maturities, ranging from short-term (e.g., 3-month Treasury bills) to long-term (e.g., 30-year bonds). A "steep" yield curve signifies a substantial difference between short-term and long-term yields, where long-term yields are significantly higher than short-term yields. This often suggests expectations of future economic growth and inflation. [Insert current graph showing Japan's yield curve here].

- Short-term vs. Long-term Interest Rates: Short-term interest rates are more sensitive to the BOJ's monetary policy actions, while long-term rates reflect market expectations of future inflation and economic growth. A steep curve indicates that the market anticipates higher inflation and stronger economic growth in the future.

- Yield Curve Types: Yield curves can be normal (upward sloping), inverted (downward sloping), or flat. Japan's current steep yield curve is a significant deviation from its historically low and often flat yield curve.

- Historical Context: Historically, Japan has experienced periods of very low, even negative, interest rates across the yield curve. The current steepening represents a dramatic shift from this prolonged period of low yields.

Factors Contributing to Japan's Steep Yield Curve

Several interconnected factors are contributing to the steepening of Japan's yield curve.

The BOJ's Yield Curve Control (YCC) Policy

The BOJ's Yield Curve Control (YCC) policy aimed to maintain exceptionally low short-term interest rates and control the 10-year government bond yield around zero. However, this policy has faced increasing pressure recently. The intended effect was to stimulate borrowing and investment, but the unintended consequence has been the widening gap between short and long-term yields, creating this steep yield curve.

- YCC Targets: The BOJ set specific targets for the 10-year government bond yield, attempting to keep it near zero.

- Limitations and Risks of YCC: YCC struggles to account for unexpected shifts in market sentiment and inflationary pressures. Attempts to maintain the target yield can lead to distortions in the bond market and create further volatility.

- Market Reactions: Recent adjustments and hints of potential shifts in the BOJ’s YCC policy have caused significant market reactions, further impacting the yield curve.

Inflationary Pressures

Japan is experiencing a rise in inflation, exceeding the BOJ's target for the first time in decades. These inflationary pressures are significantly impacting long-term bond yields as investors demand higher returns to compensate for the erosion of purchasing power.

- Inflation Data: [Cite specific inflation data for Japan from reputable sources]. The persistent rise in inflation, even if moderate compared to other developed nations, is a key driver of the steepening yield curve.

- Global Inflation Impact: Global inflationary pressures, driven by factors such as supply chain disruptions and the energy crisis, are influencing inflation in Japan.

- Imported Inflation: The rising cost of imported goods is contributing to domestic inflation, which is reflected in longer-term bond yields.

Global Economic Uncertainty

Global economic uncertainty, including the ongoing war in Ukraine and concerns about a global recession, is also playing a role. Geopolitical risks and a potential slowdown in global growth can influence investor sentiment, causing a flight to safety and impacting Japanese bond yields.

- US Interest Rate Hikes: The Federal Reserve's interest rate hikes in the US impact global capital flows and affect Japanese bond yields.

- War in Ukraine's Impact: The war in Ukraine adds to global uncertainty, further contributing to volatility in the bond market.

- Risk Aversion: Increased risk aversion among investors leads to a demand for safer assets, which can impact bond yields differently across maturities, contributing to a steeper yield curve.

Implications for Investors and the Economy

The steepening yield curve has significant implications for both investors and the Japanese economy.

Impact on Investors

The steep yield curve presents challenges for investors navigating the Japanese bond market and other asset classes. Understanding the risks and opportunities is crucial for portfolio management.

- Japanese Government Bonds (JGBs): Investors need to carefully assess the risks and opportunities presented by JGBs in this environment. The steepening curve changes the risk-return profile.

- Corporate Bond Yields: The steep yield curve also influences corporate bond yields, impacting borrowing costs for Japanese companies.

- Investment Strategies: Investors may need to adjust their portfolios to mitigate risks associated with the changing yield curve dynamics, perhaps considering diversifying into other asset classes or hedging strategies.

Impact on the Japanese Economy

A steep yield curve can have significant consequences for the Japanese economy. Increased borrowing costs could stifle economic growth and impact both businesses and consumers.

- Impact on Investment and Spending: Higher borrowing costs can reduce business investment and consumer spending, potentially slowing economic growth.

- Financial Stability Risks: A rapidly steepening yield curve can create risks to financial stability, potentially leading to unexpected market movements.

- Government Response: The Japanese government's response to the steepening yield curve and its potential impact on the economy will be crucial in shaping future economic conditions.

Conclusion

Japan's steepening yield curve presents a complex challenge, driven by a confluence of factors including the BOJ's monetary policy, rising inflation, and global uncertainty. This poses significant risks to both investors and the Japanese economy. Understanding the intricacies of this situation is crucial for navigating the current market landscape. Stay informed on the evolving dynamics of Japan's steep yield curve. Continue to monitor relevant economic indicators and seek professional financial advice to effectively manage your investments in the face of this evolving economic landscape. Further research into Japan's monetary policy and its impact on the yield curve is essential for informed decision-making.

Featured Posts

-

Chainalysis Acquisition Of Alterya A Boost For Blockchain Security

May 17, 2025

Chainalysis Acquisition Of Alterya A Boost For Blockchain Security

May 17, 2025 -

The Brunson And Doncic Trades Which Dealt A More Devastating Blow To The Dallas Mavericks

May 17, 2025

The Brunson And Doncic Trades Which Dealt A More Devastating Blow To The Dallas Mavericks

May 17, 2025 -

Andor Season 2 Trailer Exploring The Journey From Death Star To Yavin 4

May 17, 2025

Andor Season 2 Trailer Exploring The Journey From Death Star To Yavin 4

May 17, 2025 -

Exploring Jack Bit A Leading Contender For Best Crypto Casino 2025

May 17, 2025

Exploring Jack Bit A Leading Contender For Best Crypto Casino 2025

May 17, 2025 -

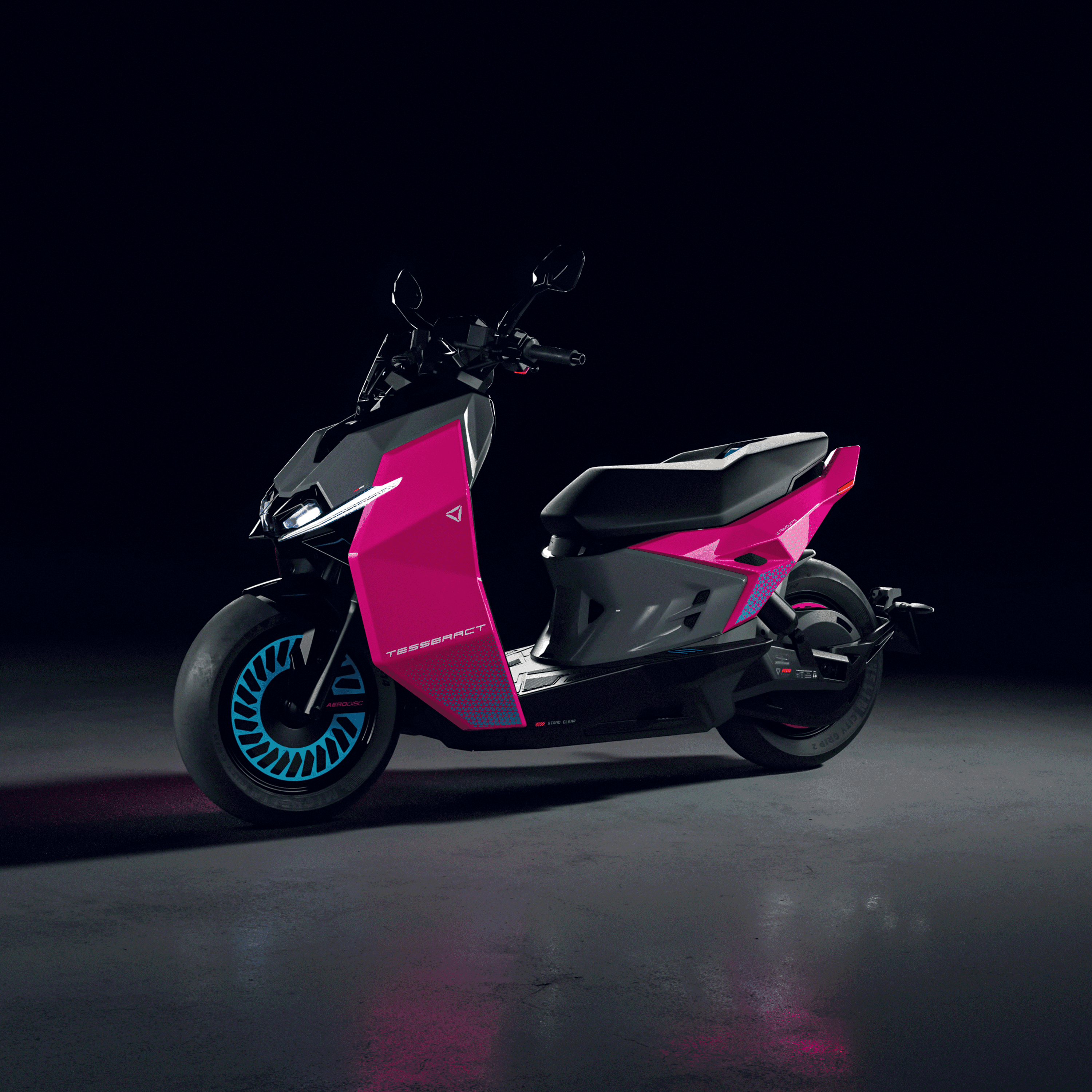

Top 3 Reasons To Consider The Ultraviolette Tesseract Electric Scooter

May 17, 2025

Top 3 Reasons To Consider The Ultraviolette Tesseract Electric Scooter

May 17, 2025