Jeanine Pirro Advises Against Stock Market Investment In Coming Weeks

Table of Contents

Keywords: Jeanine Pirro, stock market, investment, market downturn, financial advice, economic forecast, investment warning, stock market prediction, risk assessment.

Conservative commentator Jeanine Pirro has issued a stark warning against investing in the stock market in the coming weeks. Her advice, based on her recent television appearances and social media posts, has ignited conversations about the current economic climate and the potential for a market correction. This article explores Pirro's concerns and examines the broader implications for investors, helping you assess the validity of her claims and make informed decisions about your portfolio.

Pirro's Reasoning Behind the Warning

Jeanine Pirro's warning stems from her assessment of several converging economic and geopolitical factors. She expresses significant concern about the current inflationary environment, citing persistently high prices and the potential for further erosion of purchasing power. While she doesn't offer specific dates, her overall sentiment points towards a cautious approach to stock market investment in the near term.

-

Specific economic indicators Pirro cited: Pirro has frequently highlighted the persistently high inflation rate, pointing to increases in the cost of living as a significant concern. She also expresses worries about rising interest rates, impacting borrowing costs and potentially slowing economic growth.

-

Geopolitical events mentioned: The ongoing war in Ukraine, tensions with China, and global supply chain disruptions are frequently mentioned by Pirro as significant sources of uncertainty impacting market stability. These events, she argues, create an environment of increased risk and volatility.

-

Specific sectors Pirro highlighted as particularly risky: Although not explicitly naming specific sectors, Pirro's general concern about inflation suggests sectors heavily reliant on consumer spending or vulnerable to supply chain issues could be particularly at risk.

-

Links to relevant news articles or videos supporting her claims: [Insert links to verifiable news sources or video clips where Pirro expresses these concerns. Make sure these links are credible and relevant.]

Expert Opinions and Contrasting Views

While Jeanine Pirro's concerns are valid, many financial analysts and economists offer contrasting views. Some experts argue that while risks exist, the current market conditions also present opportunities for strategic investors. They point to potential long-term growth and the possibility of recovering from any short-term dips.

-

Quotes from experts who disagree with Pirro's assessment: [Insert quotes from reputable financial experts who offer a more optimistic or nuanced perspective. Attribute quotes accurately and cite sources.]

-

Different economic indicators or factors these experts highlight: These experts often focus on factors like corporate earnings reports, technological advancements, and long-term economic growth projections as indicators of market strength and potential for continued growth.

-

Alternative investment strategies suggested by these experts: Alternative strategies may include diversification across asset classes, focusing on value stocks, or adopting a long-term investment horizon to ride out short-term market fluctuations.

-

Links to credible sources supporting these alternative viewpoints: [Insert links to articles, research papers, or expert interviews supporting these contrasting viewpoints.]

Assessing the Risks and Rewards of Current Market Conditions

The current stock market presents a complex picture. High inflation and rising interest rates represent significant headwinds. However, corporate earnings remain strong in certain sectors, and technological advancements continue to drive innovation and growth in others.

-

Discussion of current inflation rates and their impact: Current inflation rates, while high, are showing signs of easing in some areas. However, the impact on consumer spending and corporate profitability is a crucial consideration for investors.

-

Analysis of interest rate hikes and their effect on investment: Interest rate hikes impact borrowing costs for businesses and consumers, potentially slowing economic growth but also making bonds more attractive. The impact on stock valuations is a complex issue with differing viewpoints among experts.

-

Explanation of geopolitical risks and their influence on market volatility: Geopolitical risks, including the war in Ukraine and US-China relations, remain sources of uncertainty and can trigger sharp market swings.

-

Overview of potential market corrections and their historical precedents: Market corrections are a normal part of the economic cycle. Examining historical precedents can help investors understand potential magnitudes and recovery times, but past performance isn't necessarily indicative of future results.

Practical Steps for Investors

Jeanine Pirro's warning underscores the importance of careful risk assessment and proactive investment management. Investors should consider the following steps:

-

Diversification strategies to mitigate risk: Diversification across different asset classes (stocks, bonds, real estate, etc.) is crucial to reduce exposure to any single market downturn.

-

Importance of a long-term investment plan: A well-defined long-term investment plan helps investors remain focused on their goals and avoid impulsive decisions driven by short-term market fluctuations.

-

Advice on seeking professional financial guidance: Consulting with a qualified financial advisor can provide personalized advice tailored to your risk tolerance and financial goals.

-

Strategies for protecting investments during market uncertainty: Strategies such as dollar-cost averaging or using stop-loss orders can help mitigate potential losses during periods of market volatility.

Conclusion

Jeanine Pirro's warning against stock market investment highlights the importance of carefully considering current economic and geopolitical factors before making investment decisions. While her concerns regarding inflation and geopolitical instability are valid, alternative viewpoints exist, emphasizing the opportunities within the current market for long-term investors. The decision to invest or not remains a personal one. However, considering Jeanine Pirro's warning, along with the counterarguments and practical advice presented here, empowers you to make a more informed choice. Conduct thorough research, seek professional financial advice tailored to your situation, and develop a robust investment strategy aligned with your risk tolerance and financial goals. Don't ignore the potential implications of Jeanine Pirro's warning regarding stock market investment; use it to inform your strategy and mitigate potential risks.

Featured Posts

-

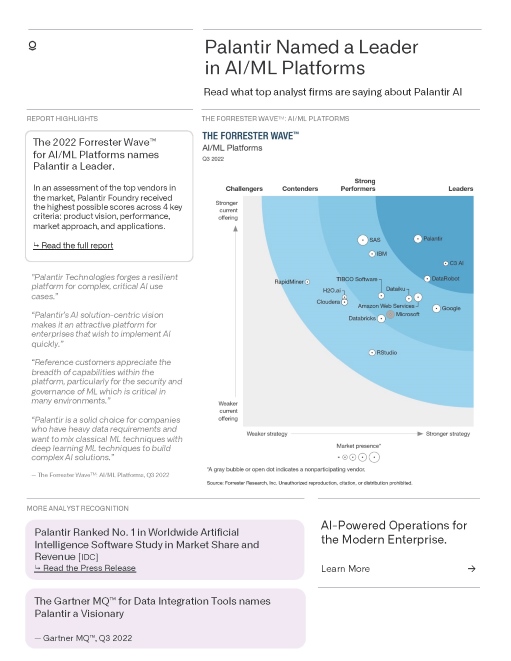

How Palantirs Nato Partnership Will Transform Public Sector Ai

May 10, 2025

How Palantirs Nato Partnership Will Transform Public Sector Ai

May 10, 2025 -

2025 Nhl Playoffs How The Trade Deadline Shaped The Contenders

May 10, 2025

2025 Nhl Playoffs How The Trade Deadline Shaped The Contenders

May 10, 2025 -

Chat Gpt Creator Open Ai Faces Ftc Probe Analyzing The Regulatory Landscape

May 10, 2025

Chat Gpt Creator Open Ai Faces Ftc Probe Analyzing The Regulatory Landscape

May 10, 2025 -

Us Attorney Generals Daily Fox News Appearances Whats Really Going On

May 10, 2025

Us Attorney Generals Daily Fox News Appearances Whats Really Going On

May 10, 2025 -

Clarification Politique Borne Explore La Fusion De Renaissance Et Du Modem

May 10, 2025

Clarification Politique Borne Explore La Fusion De Renaissance Et Du Modem

May 10, 2025