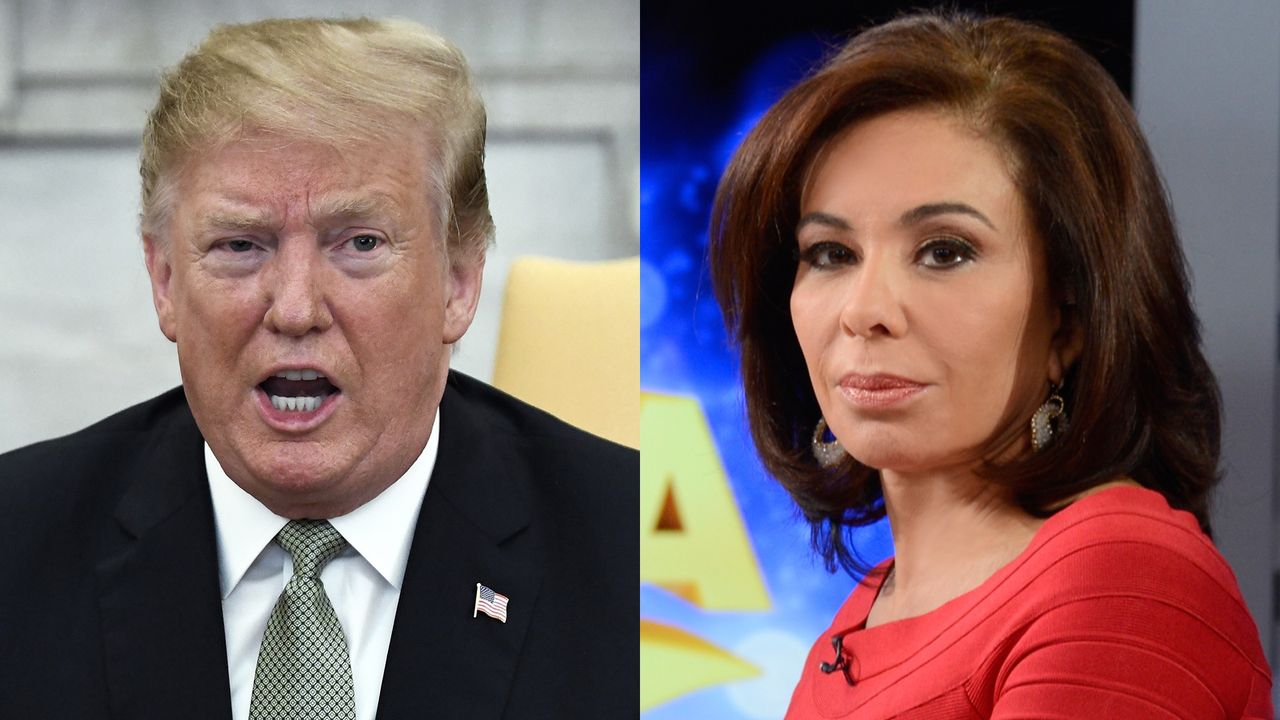

Jeanine Pirro Urges Viewers To Avoid The Stock Market Short-Term

Table of Contents

The Current Economic Climate and Its Impact on Short-Term Investments

The current economic climate presents significant challenges for short-term stock market investing. Several factors contribute to increased risk and reduced potential for returns, making Jeanine Pirro's advice particularly relevant. "Economic uncertainty" is a key phrase reflecting the current situation.

- High inflation erodes returns: Soaring inflation diminishes the purchasing power of your profits, effectively reducing your real return on investment. This makes short-term gains easily wiped out by inflation.

- Rising interest rates impact bond yields and stock valuations: Increased interest rates lead to higher borrowing costs for companies, impacting profitability and potentially lowering stock valuations. This affects both direct stock investments and indirectly impacts bond yields, making short-term bond strategies less appealing.

- Geopolitical uncertainty creates volatility: Global events, such as the ongoing war in Ukraine and escalating trade tensions, introduce significant uncertainty and volatility into the market, making short-term predictions incredibly difficult and increasing the risk of substantial losses. This volatility is a major concern for those pursuing short-term stock market strategies. Understanding these "short-term investment risks" is crucial.

Jeanine Pirro's Specific Concerns and Recommendations

Jeanine Pirro's specific concerns regarding short-term stock market investing haven't been explicitly detailed in a single public statement, but her general conservative stance aligns with a cautionary approach to volatile markets. Her arguments likely emphasize the current economic instability and the potential for significant losses in short-term trading. We can infer her perspective based on her broader commentary on financial prudence.

- Quotes from Jeanine Pirro's statements (Hypothetical, needs to be replaced with actual quotes if available): "In these turbulent times, I urge caution in the market," "Short-term gains are often illusory, while long-term strategies offer greater security." (These are placeholders and should be replaced with actual quotes if accessible)

- Paraphrasing of her key arguments: Pirro likely emphasizes the increased risk of loss due to economic instability and the difficulty of accurately predicting short-term market movements. Her "Pirro's warning" is likely a call for prudence and responsible financial decision-making.

- Specific examples she may have used: She might have referenced past market downturns to illustrate the potential for substantial losses in short-term investments.

Alternative Investment Strategies for Conservative Investors

For those heeding Jeanine Pirro's advice and seeking more stable returns, several alternative investment strategies are available. These focus on "long-term investment strategies" and "conservative investment options" that minimize risk.

- Long-term stock investing (index funds, ETFs): Index funds and exchange-traded funds (ETFs) offer diversified exposure to the market, reducing risk compared to individual stock picking, particularly beneficial for long-term growth.

- Real estate investment: Real estate investments, such as rental properties or REITs (Real Estate Investment Trusts), can provide a steady stream of income and appreciate over time.

- Bonds (government bonds, corporate bonds): Government and high-quality corporate bonds offer relatively stable returns and lower risk compared to stocks, especially in the long term.

- Diversification strategies: Diversifying your portfolio across asset classes (stocks, bonds, real estate) and geographies is a crucial "risk mitigation" strategy. A "diversified portfolio" is far less susceptible to the whims of a single market segment.

Understanding the Risks of Short-Term Trading

Short-term stock market trading carries significantly higher risks than long-term investing. "Short-term trading risks" are substantial and should be carefully considered.

- Emotional decision-making: The pressure of rapid market fluctuations can lead to impulsive and emotionally driven decisions, often resulting in poor investment outcomes.

- Market timing difficulties: Accurately predicting short-term market movements is exceptionally challenging, even for experienced professionals. "Market timing" is notoriously difficult and often unsuccessful.

- Transaction costs: Frequent trading incurs higher transaction costs (brokerage fees, taxes), eroding profits.

- Tax implications: Short-term capital gains are taxed at higher rates than long-term capital gains, further reducing net returns. "Investment losses" are also more impactful, as losses are not as easily offset in the short term.

Conclusion: Heeding Jeanine Pirro's Advice on Short-Term Stock Market Investments

Jeanine Pirro's cautionary message highlights the significant risks associated with short-term stock market investments, particularly in the current volatile economic climate. The analysis above emphasizes the impact of inflation, rising interest rates, and geopolitical uncertainty on short-term trading. Understanding these factors is crucial for responsible investing. We've explored alternative, more conservative long-term strategies to mitigate risk and build wealth steadily. Before making any short-term stock market investments, consider Jeanine Pirro's advice and explore safer, long-term options. Remember, responsible investing is key. Consider your risk tolerance and investment goals carefully, and don't hesitate to seek professional financial advice before making any investment decisions. Focus on "long-term investment planning" and "avoid short-term stock market" approaches for better security and potential for growth.

Featured Posts

-

Exploring The Identity Of David 5 Theories Concerning The He Morgan Brother In High Potential

May 09, 2025

Exploring The Identity Of David 5 Theories Concerning The He Morgan Brother In High Potential

May 09, 2025 -

Red Bulls Driver Dilemma Colapinto Or Lawson

May 09, 2025

Red Bulls Driver Dilemma Colapinto Or Lawson

May 09, 2025 -

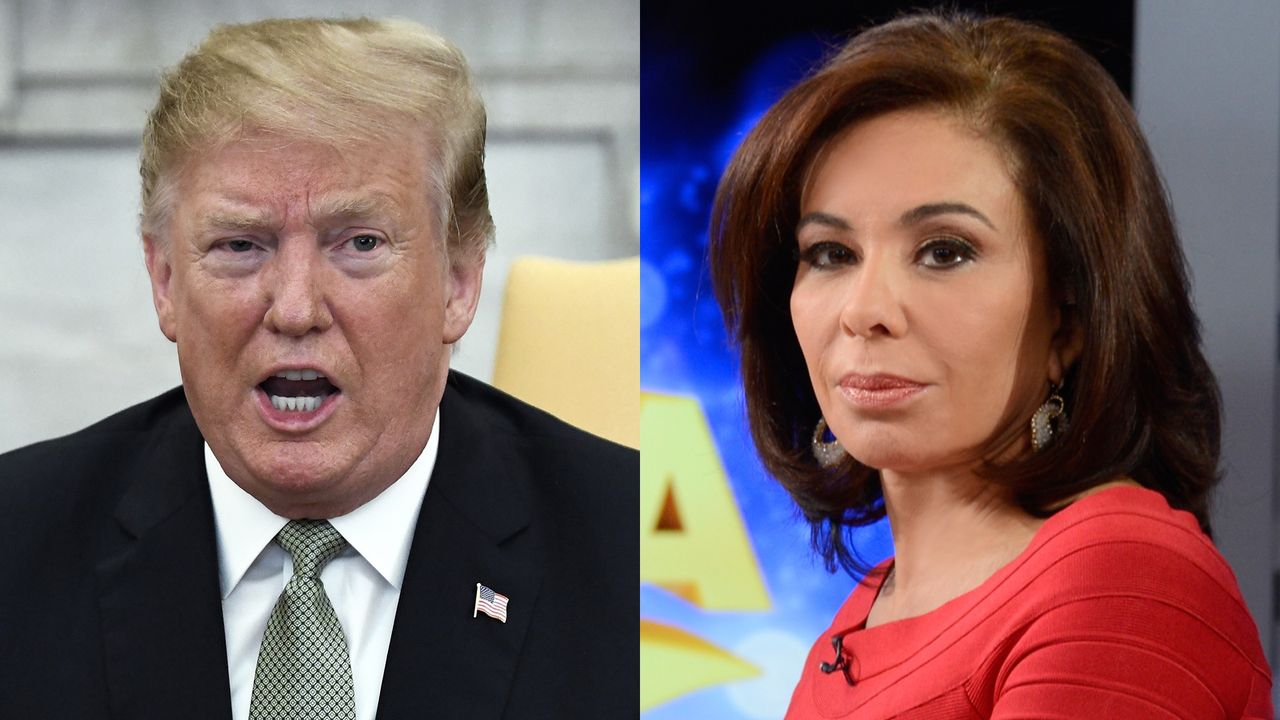

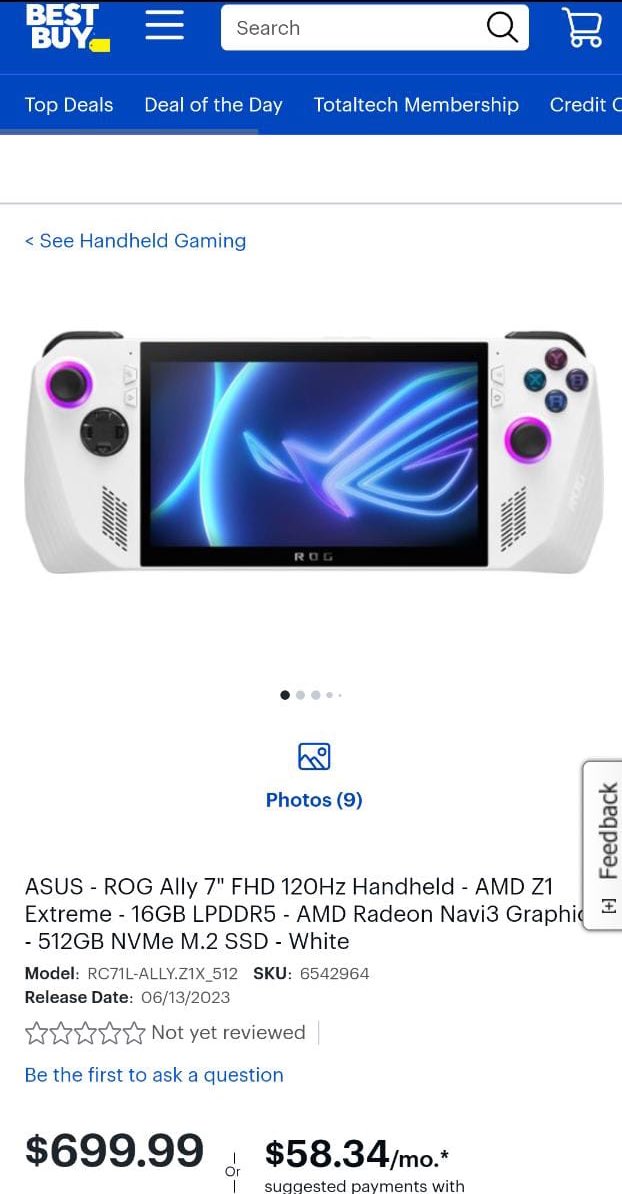

Microsoft And Asus Xbox Handheld Leaked Images Surface

May 09, 2025

Microsoft And Asus Xbox Handheld Leaked Images Surface

May 09, 2025 -

The Latest On Doohan At Williams Addressing Colapinto Transfer Talk

May 09, 2025

The Latest On Doohan At Williams Addressing Colapinto Transfer Talk

May 09, 2025 -

Protecting Your Childs Development Examining The Daycare Dilemma

May 09, 2025

Protecting Your Childs Development Examining The Daycare Dilemma

May 09, 2025