Jerome Powell And The Fed: How Tariffs Threaten Economic Goals

Table of Contents

The Fed's Mandate and Inflationary Pressures

The Federal Reserve operates under a dual mandate: achieving maximum employment and price stability. While seemingly straightforward, balancing these goals becomes exceptionally challenging when external factors like tariffs significantly impact inflation. Tariffs, essentially taxes on imported goods, contribute to inflationary pressures in several ways.

- Increased Import Costs: Tariffs directly increase the cost of imported goods, raising prices for businesses and consumers alike. This effect is amplified when essential raw materials or intermediate goods are subject to tariffs.

- Supply Chain Disruptions: Imposing tariffs can disrupt established global supply chains, leading to shortages and further price increases. Businesses may struggle to find alternative suppliers, resulting in delays and added costs.

- Impact on Consumer Prices: Ultimately, the increased costs of imported goods and disrupted supply chains translate to higher consumer prices, reducing purchasing power and potentially slowing economic growth.

For example, the steel tariffs imposed in 2018 led to increased prices for various industries reliant on steel, from construction to automobiles. This ripple effect contributed to overall inflationary pressure, forcing the Fed to carefully consider its monetary policy response. Data from the Bureau of Labor Statistics clearly shows a correlation between tariff increases and subsequent price hikes in affected sectors.

Tariffs and Economic Growth: A Balancing Act

While tariffs are often presented as a tool to protect domestic industries, they pose a significant risk to overall economic growth. The trade-off between safeguarding specific sectors and fostering broader economic prosperity is a delicate one.

- Reduced Consumer Spending: Higher prices due to tariffs reduce consumer purchasing power, leading to decreased consumer spending. This reduction in demand can slow down economic activity across various sectors.

- Retaliatory Tariffs from Other Countries: Imposing tariffs often provokes retaliatory measures from other countries, escalating trade tensions and further disrupting global trade flows. This tit-for-tat dynamic can significantly harm export-oriented industries.

- Uncertainty in the Business Environment: The unpredictable nature of tariff policies creates uncertainty in the business environment, making it difficult for businesses to plan for the future and discouraging investment.

Industries heavily reliant on imports, such as manufacturing and agriculture, have been particularly hard hit by tariffs. Economic forecasts, both domestically and internationally, consistently demonstrate a negative correlation between tariff increases and projected GDP growth.

Jerome Powell's Response and Policy Challenges

The Federal Reserve utilizes several monetary policy tools to manage inflation and promote economic stability. These include adjusting interest rates and implementing quantitative easing (QE). However, addressing inflation driven by tariffs presents unique challenges for Jerome Powell and the Fed.

- Interest Rate Hikes: To combat inflation, the Fed might raise interest rates. This makes borrowing more expensive, potentially slowing down economic activity and reducing inflationary pressure. However, aggressively raising rates could stifle economic growth unnecessarily.

- Communication Strategies: Clear and consistent communication about the Fed's assessment of the economic situation and its policy intentions is crucial in managing market expectations and maintaining confidence.

- Potential Limitations of Monetary Policy in Addressing Trade Issues: Monetary policy is primarily designed to address domestic economic conditions. Its effectiveness in mitigating the impact of external factors like tariffs is limited.

Past Fed responses to similar economic challenges, such as the inflationary pressures of the 1970s, offer valuable insights, but the current situation is unique due to the nature and scale of the tariff-related disruptions. Experts predict that the Fed will continue to monitor the situation closely, adapting its policies as needed while navigating the complexities of this trade-driven inflationary environment.

The Uncertainty Factor and Market Volatility

The uncertainty surrounding tariff policies is a significant contributor to market volatility. This unpredictability makes it difficult for investors to make informed decisions, impacting both stock prices and the broader economy.

- Impact on Investment Decisions: Uncertainty discourages businesses from making long-term investments, slowing down capital expenditure and overall economic growth.

- Consumer Confidence: The fear of rising prices due to tariffs can erode consumer confidence, leading to reduced spending and further dampening economic activity.

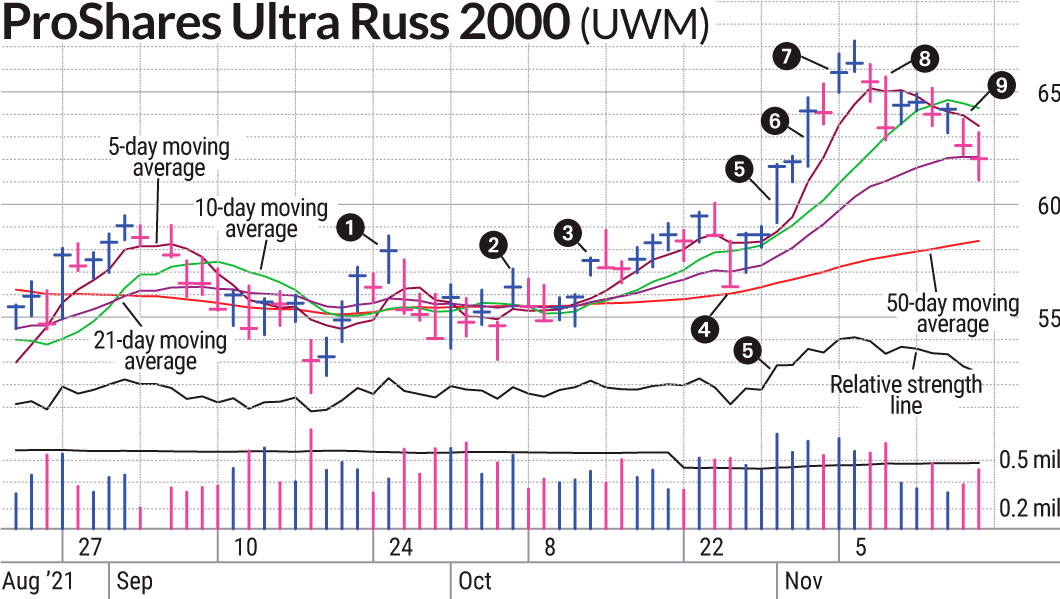

Market indicators such as the VIX (Volatility Index) often spike significantly during periods of heightened tariff uncertainty, reflecting the heightened risk aversion among investors. Charts clearly illustrate the correlation between periods of tariff escalation and increased market volatility.

Conclusion

In conclusion, tariffs pose a significant threat to the Federal Reserve's goals of maximum employment and price stability. They contribute to inflation, stifle economic growth, and create uncertainty in the markets, presenting complex challenges for Jerome Powell and the Fed. The limited effectiveness of monetary policy in addressing trade-related issues underscores the need for comprehensive solutions that involve not only monetary policy but also sound fiscal and trade policies. Understanding the interplay between Jerome Powell, the Fed, and tariffs is crucial for navigating the current economic landscape. Follow the latest updates on how tariffs impact the economy by consulting Federal Reserve publications and reputable economic analysis reports to stay informed about this critical issue.

Featured Posts

-

Apples New I Phone Feature A Must Have For Formula 1 Fans

May 26, 2025

Apples New I Phone Feature A Must Have For Formula 1 Fans

May 26, 2025 -

Moto Gp Argentina 2025 Jadwal Tayang Trans7 Dan Informasi Seputar Balapan

May 26, 2025

Moto Gp Argentina 2025 Jadwal Tayang Trans7 Dan Informasi Seputar Balapan

May 26, 2025 -

Vivre Parmi Les Gens D Ici Conseils Pratiques

May 26, 2025

Vivre Parmi Les Gens D Ici Conseils Pratiques

May 26, 2025 -

The Rise And Fall And Rise Of Russell And The Typhoons A Band Retrospective

May 26, 2025

The Rise And Fall And Rise Of Russell And The Typhoons A Band Retrospective

May 26, 2025 -

Naomi Campbells Reported Met Gala 2025 Ban A Feud With Anna Wintour

May 26, 2025

Naomi Campbells Reported Met Gala 2025 Ban A Feud With Anna Wintour

May 26, 2025