Judge Rejects Challenge To Trump's Use Of IRS Data To Target Undocumented Migrants

Table of Contents

The Case Against Trump's Use of IRS Data

The lawsuit challenged the Trump administration's use of IRS data for immigration enforcement, arguing that this practice violated taxpayers' privacy rights and due process. The plaintiffs, a coalition of advocacy groups and individual taxpayers, alleged the government's actions were unlawful and unconstitutional.

-

Plaintiffs and Legal Representation: The lawsuit was filed by a diverse group of plaintiffs, including the American Civil Liberties Union (ACLU), the National Immigration Law Center (NILC), and several undocumented immigrants directly affected by the policy. They were represented by prominent civil rights lawyers specializing in immigration and data privacy law.

-

Alleged Violations: The plaintiffs argued that the use of IRS data for immigration enforcement violated their Fourth Amendment rights (protection against unreasonable searches and seizures) and their Fifth Amendment rights (due process). They claimed the government's access to and use of their tax information was an unwarranted invasion of privacy.

-

Specific IRS Data and Misuse: The lawsuit focused on the alleged misuse of specific IRS datasets, including tax returns and taxpayer identification numbers (TINs). The plaintiffs claimed this data was used to create a database of potentially undocumented immigrants, leading to increased immigration enforcement actions, including deportations.

-

Relevant Statutes and Precedents: The lawsuit cited several relevant statutes, including the Internal Revenue Code and the Privacy Act of 1974, arguing that the Trump administration's actions violated these legal protections. The plaintiffs also relied on previous court decisions concerning data privacy and the limits of government power in immigration enforcement.

The Judge's Ruling and Reasoning

The judge, in a [insert type of ruling - e.g., summary judgment], dismissed the lawsuit, rejecting the plaintiffs' arguments.

-

Summary of the Ruling: The judge ruled that the plaintiffs lacked standing to challenge the government's use of IRS data, meaning they could not demonstrate they had suffered a legally recognized injury. The ruling essentially dismissed the case without addressing the merits of the plaintiffs’ claims regarding the use of IRS data targeting undocumented migrants.

-

Rationale for Rejection: The judge's rationale focused on the limited scope of judicial review in cases involving national security and immigration enforcement. The court indicated that it would not interfere with executive branch decisions on such matters.

-

Legal Precedents: The judge cited various precedents related to executive authority in immigration matters and the limitations on judicial intervention in such cases. These precedents were used to justify the court’s reluctance to assess the legality of the data-sharing practices.

-

Dissenting Opinions: [Mention any dissenting opinions or concurrences. If none, state this clearly.] There were no dissenting opinions in this case.

Implications for Data Privacy and Immigration Enforcement

The ruling has significant implications for data privacy and immigration enforcement.

-

Potential for Future Misuse: The decision potentially sets a precedent for the future use of sensitive IRS data for non-tax purposes, raising concerns about potential abuses of power. This could lead to increased surveillance and targeting of vulnerable communities.

-

Erosion of Trust: The judge's decision could erode public trust in the IRS and the government's commitment to protecting taxpayer information. Concerns remain that individuals may be less likely to comply with tax laws if they fear their information will be misused for immigration enforcement.

-

Impact on Undocumented Immigrants: The ruling leaves undocumented immigrants more vulnerable to deportation and other forms of discrimination based on the government's use of IRS data. This exacerbates existing inequalities within the immigration system.

-

Legislative and Regulatory Responses: This decision has spurred calls for legislative action to strengthen data privacy protections and clarify the permissible uses of IRS data. Discussions around potential reforms to the Internal Revenue Code and the Privacy Act are ongoing.

Public Reaction and Ongoing Debate

The ruling has generated significant public reaction and sparked a continuing debate about the ethical and legal implications of using IRS data targeting undocumented migrants.

-

Public Statements: Advocacy groups have strongly criticized the decision, emphasizing the privacy concerns and the potential for discriminatory enforcement practices. Government officials, on the other hand, have defended the legality and necessity of the practice. Legal experts are divided, with some agreeing with the judge's ruling and others expressing serious reservations.

-

Ethical Concerns: The ethical concerns center on the fairness and transparency of using tax data for immigration enforcement without explicit consent. The use of this data raises questions about government overreach and the erosion of trust between citizens and the state.

-

Future Litigation: While this particular case is dismissed, similar legal challenges are likely to emerge, focusing on different aspects of the policy or seeking different legal avenues to challenge the practice.

-

Policy Discussions: Discussions are underway about the need for updated laws and regulations to prevent the misuse of IRS data for immigration enforcement. These discussions involve legislators, policymakers, and civil society organizations.

Conclusion

This article explored the recent judicial rejection of a challenge against the Trump administration’s use of IRS data to target undocumented migrants. The ruling, while upholding the administration’s actions, raises serious concerns about data privacy, due process, and the appropriate role of government agencies. The ongoing debate highlights the need for a clear legal framework governing the use of sensitive taxpayer information for non-tax purposes. Further scrutiny and potential legislative action are crucial to prevent future misuse and protect the rights of all individuals. Understanding the implications of this decision regarding the use of IRS data targeting undocumented migrants is vital for informing the ongoing conversation surrounding immigration enforcement and data privacy. Staying informed about further developments in this case and similar legal challenges is critical.

Featured Posts

-

New Taverna Offers Traditional Greek Food In Portola Valley

May 13, 2025

New Taverna Offers Traditional Greek Food In Portola Valley

May 13, 2025 -

Air Traffic Controller Shortage High Profile Trials And Thc Drinks Todays Top News

May 13, 2025

Air Traffic Controller Shortage High Profile Trials And Thc Drinks Todays Top News

May 13, 2025 -

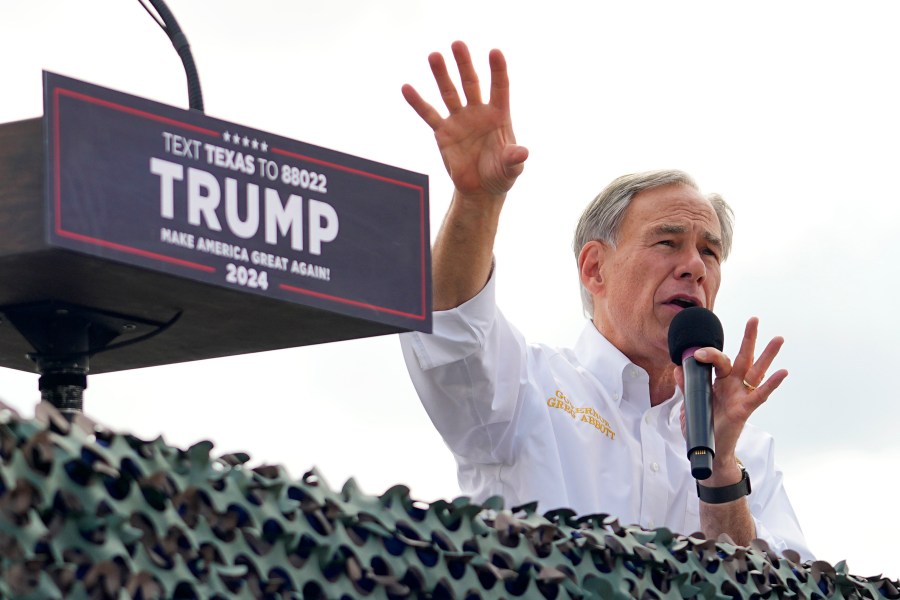

Outcry From North Texas Faith Leaders Over Abbotts Epic City Investigations

May 13, 2025

Outcry From North Texas Faith Leaders Over Abbotts Epic City Investigations

May 13, 2025 -

New Twist For Nhl Draft Lottery Live Drawing From Studio

May 13, 2025

New Twist For Nhl Draft Lottery Live Drawing From Studio

May 13, 2025 -

Murderbots Existential Crisis A Hilarious Sci Fi Adventure

May 13, 2025

Murderbots Existential Crisis A Hilarious Sci Fi Adventure

May 13, 2025