Kerrisdale Capital's Critique Sends D-Wave Quantum (QBTS) Stock Tumbling

Table of Contents

Kerrisdale Capital's Accusations Against D-Wave Quantum (QBTS)

Kerrisdale Capital, renowned for its insightful (and often critical) short-selling research, released a report leveling serious accusations against D-Wave Quantum. The report paints a picture of a company with an unsustainable business model, alleging significant issues with financial reporting and marketing practices.

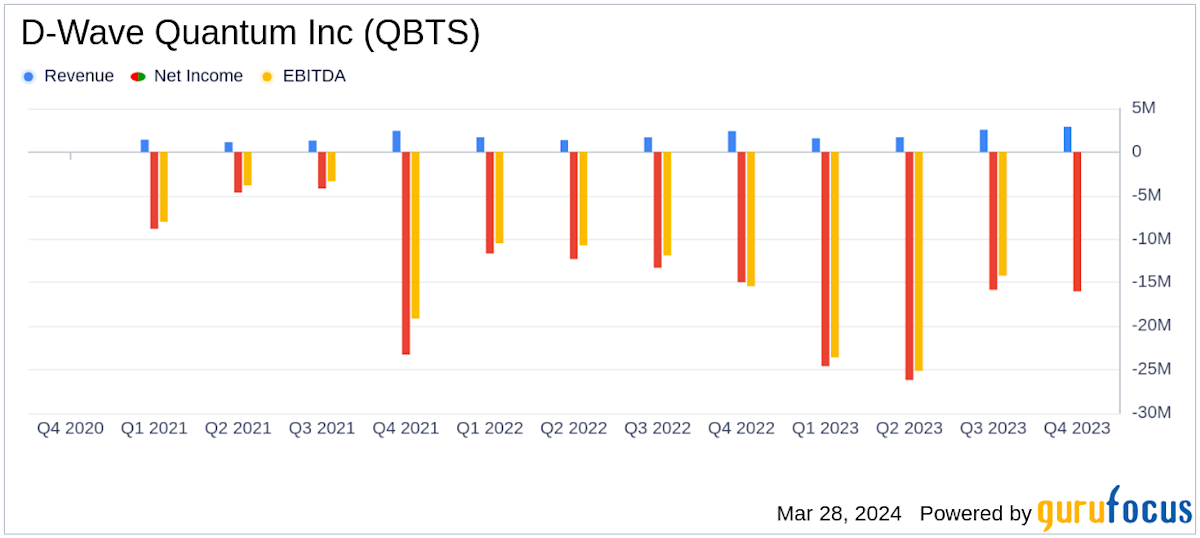

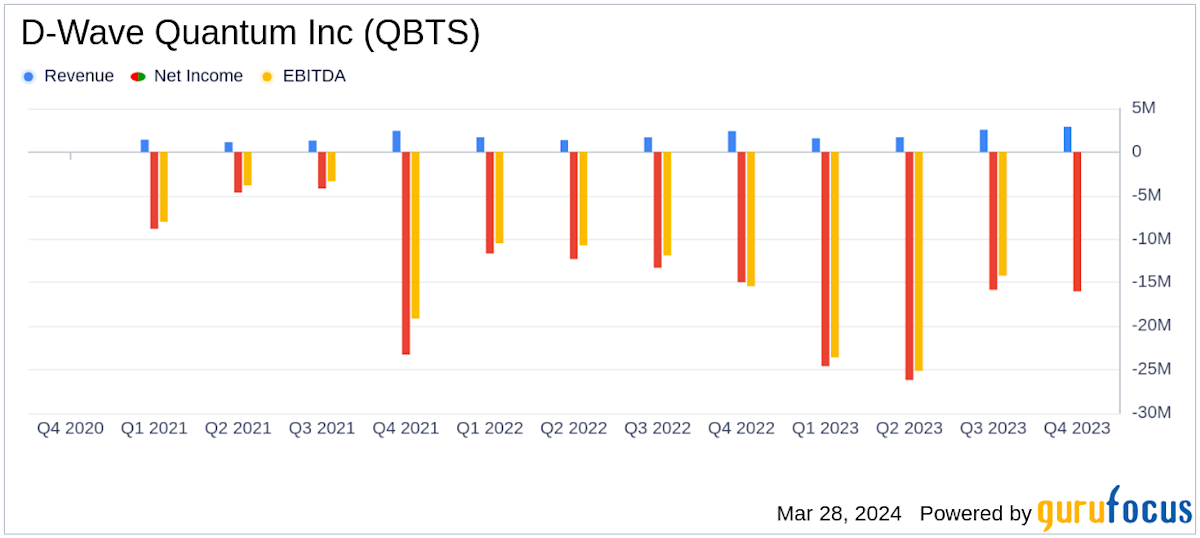

- Overstated Revenue: Kerrisdale claims D-Wave Quantum has significantly overstated its revenue figures, potentially through aggressive accounting practices and misleading characterization of certain contracts. Specific examples cited in the report (if publicly available) would be detailed here, including references to page numbers or sections.

- Misleading Marketing: The report alleges that D-Wave Quantum's marketing materials misrepresent the capabilities of its quantum computing technology, exaggerating its performance and applicability to real-world problems. This could include claims of market dominance or technological breakthroughs not supported by evidence.

- Unsustainable Business Model: Kerrisdale suggests that D-Wave Quantum's current business model is fundamentally flawed and unlikely to achieve long-term profitability. This could involve an assessment of the company's cost structure, customer acquisition strategies, and overall market position within the competitive quantum computing landscape.

These accusations, if substantiated, would represent a significant blow to the credibility and financial health of D-Wave Quantum. Keywords relevant to this section include: D-Wave Quantum accusations, Kerrisdale Capital report, QBTS financial statements, quantum computing market analysis, revenue overstatement, and misleading marketing claims.

Market Reaction to the Kerrisdale Capital Report: The QBTS Stock Tumbles

The immediate market reaction to Kerrisdale Capital's report was swift and severe. QBTS stock experienced a dramatic drop, with percentage changes and trading volume data included here to illustrate the magnitude of the decline. For example, a statement like "Following the report's release, QBTS stock plunged by X%, with trading volume increasing Y% compared to the previous day" would provide quantifiable evidence of the market's response.

Investor sentiment shifted dramatically from cautious optimism to widespread concern, as reflected in analyst downgrades and negative media coverage. The overall market volatility surrounding the event further amplified the stock price decline. Contributing factors, if any exist (e.g., broader market trends impacting the tech sector), would also be discussed. Keywords used in this section will include: QBTS stock price drop, market reaction, investor sentiment, trading volume, stock market volatility, and quantum computing investment.

D-Wave Quantum's Response to Kerrisdale Capital's Critique

D-Wave Quantum issued an official response to Kerrisdale Capital’s accusations (if available). This section would summarize D-Wave Quantum’s official statement, assessing its effectiveness in mitigating the negative impact on investor confidence. The analysis would consider:

- The key points of D-Wave Quantum's counterarguments.

- The tone and style of their response (defensive, conciliatory, etc.).

- The effectiveness of their communication strategies.

The company’s response (or lack thereof) would be critically evaluated, considering whether it successfully addressed the core issues raised in Kerrisdale Capital's report. Keywords relevant to this section are: D-Wave Quantum response, rebuttal, damage control, press release, investor relations, and quantum computing technology.

The Future Outlook for D-Wave Quantum (QBTS) Stock

The long-term impact of Kerrisdale Capital's report on D-Wave Quantum remains uncertain. The future outlook for QBTS stock depends on several factors, including:

- The validity of Kerrisdale's accusations.

- D-Wave Quantum's ability to address investor concerns.

- The broader trajectory of the quantum computing industry.

Expert opinions and market forecasts (if available), along with a balanced assessment of potential risks and opportunities, would form a crucial part of this section. The analysis would aim to provide a reasoned projection of QBTS's potential for recovery or further decline. Keywords relevant to this section include: QBTS stock forecast, future outlook, quantum computing industry outlook, investment risks, and stock market prediction.

Conclusion: Analyzing the Impact of Kerrisdale Capital's Critique on QBTS and the Future of Quantum Computing

Kerrisdale Capital's critical report on D-Wave Quantum has sent shockwaves through the quantum computing sector. The accusations of overstated revenue, misleading marketing, and an unsustainable business model triggered a significant drop in QBTS stock price and sparked widespread investor concern. While D-Wave Quantum has issued a response, the long-term impact on the company and the broader quantum computing industry remains to be seen. This event highlights the importance of conducting thorough due diligence and effective risk management when investing in emerging technologies. Before investing in QBTS stock or any other quantum computing company, it's crucial to conduct your own comprehensive research and understand the inherent risks involved. Remember to always practice due diligence when considering investments in the dynamic world of D-Wave Quantum (QBTS) and other quantum computing stocks.

Featured Posts

-

Wlos Hosts Good Morning Americas Ginger Zee Before Asheville Rising Helene Broadcast

May 21, 2025

Wlos Hosts Good Morning Americas Ginger Zee Before Asheville Rising Helene Broadcast

May 21, 2025 -

Occasionverkoop Abn Amro Impact Van De Toenemende Vraag Naar Autos

May 21, 2025

Occasionverkoop Abn Amro Impact Van De Toenemende Vraag Naar Autos

May 21, 2025 -

Councillors Wifes Jail Sentence For Tweet Threatening Hotel Arson

May 21, 2025

Councillors Wifes Jail Sentence For Tweet Threatening Hotel Arson

May 21, 2025 -

Vackert Var Det Inte Men Jacob Friis Era Inleddes Med Bortaseger Mot Malta

May 21, 2025

Vackert Var Det Inte Men Jacob Friis Era Inleddes Med Bortaseger Mot Malta

May 21, 2025 -

Real Madrid Manager Search Klopps Agent Speaks Out

May 21, 2025

Real Madrid Manager Search Klopps Agent Speaks Out

May 21, 2025