Klarna's Potential $1 Billion IPO: Timing And Implications

Table of Contents

The Strategic Timing of Klarna's IPO

The timing of Klarna's potential IPO is a critical factor determining its success. Several key elements contribute to this strategic decision.

Market Conditions and Investor Sentiment

Current market conditions play a significant role in the feasibility of a successful IPO. Several factors need careful consideration:

- Market Volatility: High market volatility can negatively impact valuations and investor appetite, potentially leading to a lower IPO price or even delaying the process. The current economic climate, with potential inflation and interest rate hikes, needs careful assessment.

- Investor Appetite for Fintech: Investor confidence in the fintech sector is crucial. Recent successful or unsuccessful fintech IPOs can significantly influence investor sentiment towards Klarna. A positive track record in similar ventures would boost confidence.

- Macroeconomic Factors: Broader macroeconomic conditions, such as inflation rates, economic growth, and geopolitical events, all impact investor decisions. A robust global economy generally fosters greater investor confidence. Conversely, uncertainty can lead to hesitation.

Klarna's Financial Performance and Growth Trajectory

Klarna's financial health and growth trajectory are central to its IPO success. A strong performance inspires confidence in investors. Key metrics to consider include:

- Key Financial Metrics: Revenue growth, profit margins (or losses and the path to profitability), and user growth are all closely scrutinized. Sustained growth across these metrics signals a healthy and promising future.

- Competitive Advantages and Market Share: Klarna's competitive edge in the BNPL market – features, user experience, brand recognition, global reach – is vital to its valuation. Maintaining or increasing market share strengthens its position.

- Expansion into New Markets and Product Offerings: Diversification into new markets and product offerings demonstrates adaptability and growth potential, reducing reliance on a single market or service.

Competitive Landscape and Market Saturation

The BNPL sector is increasingly competitive, with major players like Affirm, Afterpay (now part of Square), and PayPal vying for market share. This competitive landscape presents both opportunities and challenges:

- Competitive Positioning: Klarna's market position relative to its competitors is paramount. Maintaining a competitive edge through innovation and strategic partnerships is key to success.

- Market Consolidation: The possibility of further market consolidation through mergers and acquisitions influences the timing and valuation of the IPO. A consolidated market may offer both advantages and disadvantages, depending on Klarna's position.

- Regulatory Risks: Regulatory scrutiny and potential future legislation targeting the BNPL sector present a significant risk. Changes in regulations could alter the landscape and impact Klarna's operations.

Implications of a Successful Klarna IPO

A successful Klarna IPO will have wide-ranging consequences.

Impact on Investors

For investors, a successful Klarna IPO presents both opportunities and risks:

- Potential Valuation and Returns: The valuation of Klarna at IPO and subsequent returns will depend on various factors, including market conditions, financial performance, and investor sentiment. Comparable company analysis is crucial here.

- Risks and Downsides: All investments carry risk. Potential downsides include market volatility affecting the share price, changes in consumer behavior impacting BNPL usage, and increased competition.

- Long-Term Growth Potential: Klarna’s long-term growth potential depends on its ability to adapt to changing market conditions and maintain its competitive advantage.

Impact on the BNPL Market

Klarna's IPO will significantly impact the wider BNPL market:

- Increased Competition and Innovation: A successful IPO could spur further competition and innovation within the BNPL sector, potentially benefiting consumers through lower prices, better services, and more diverse offerings.

- Impact on Valuation of Other BNPL Companies: Klarna's valuation will influence how investors perceive and value other BNPL companies. A strong IPO performance could boost the entire sector’s valuation, while a weak performance could have the opposite effect.

- Industry Consolidation: The IPO could trigger further consolidation in the market, with smaller players merging or being acquired by larger ones, creating a more concentrated landscape.

Impact on Consumers

The impact on consumers is multifaceted and warrants careful consideration:

- Access to Credit: Klarna's IPO may influence the availability and accessibility of BNPL services for consumers. Wider adoption could lead to more people utilizing these services.

- Interest Rates and Fees: Increased competition could potentially lead to lower interest rates and fees, making BNPL services more attractive.

- Consumer Spending and Debt Levels: The increased accessibility of BNPL could impact consumer spending and debt levels. Responsible borrowing habits are crucial in this context, and financial education becomes critical.

Conclusion

Klarna's potential $1 billion IPO represents a significant moment for the BNPL industry and the broader fintech sector. The timing of this IPO, driven by a confluence of factors including market conditions, Klarna's financial performance, and the competitive landscape, will have far-reaching implications for investors, competitors, and consumers alike. Understanding the strategic considerations behind this move, and its potential consequences, is crucial for anyone invested in or affected by the future of the financial technology landscape. Stay informed about the developments surrounding the Klarna IPO and its impact on the Buy Now Pay Later market. Further research into Klarna's financials and market positioning will provide a more detailed understanding of the potential outcomes of this highly anticipated event. Keep an eye on Klarna's progress and the wider Buy Now Pay Later market for further insights.

Featured Posts

-

Dodgers Ohtanis 3 Run Blast Fuels 14 11 Victory Over Diamondbacks

May 14, 2025

Dodgers Ohtanis 3 Run Blast Fuels 14 11 Victory Over Diamondbacks

May 14, 2025 -

Eurojackpot 40 000 E Voitto Suomeen Vinkkejae Onneen

May 14, 2025

Eurojackpot 40 000 E Voitto Suomeen Vinkkejae Onneen

May 14, 2025 -

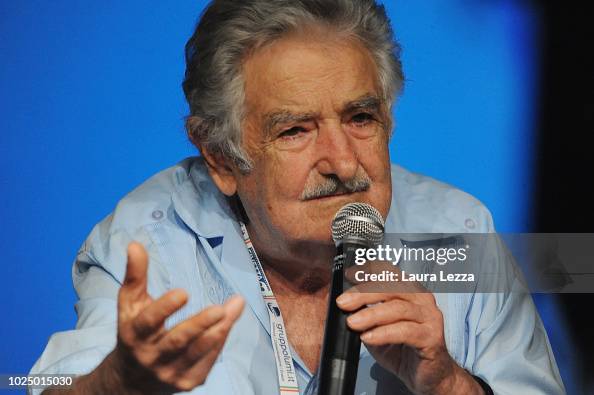

Death Of Former Uruguayan President Jose Mujica At 89

May 14, 2025

Death Of Former Uruguayan President Jose Mujica At 89

May 14, 2025 -

Nomme Directeur General Adjoint Le Nouveau Role D Alexis Kohler A La Societe Generale

May 14, 2025

Nomme Directeur General Adjoint Le Nouveau Role D Alexis Kohler A La Societe Generale

May 14, 2025 -

Conquer Pokemon Go Max Raids A Dynamax Sobble Strategy Guide

May 14, 2025

Conquer Pokemon Go Max Raids A Dynamax Sobble Strategy Guide

May 14, 2025