KRW/USD Exchange Rate: Trump's Criticism And The Potential For A Stronger Won

Table of Contents

Trump's Criticism and its Impact on the KRW/USD Exchange Rate

Former President Trump repeatedly accused South Korea of manipulating its currency, the South Korean Won (KRW), to gain an unfair trade advantage against the US dollar (USD). He argued that a deliberately undervalued KRW made South Korean exports cheaper and more competitive in the global market, harming American businesses. This rhetoric significantly impacted the KRW/USD exchange rate, creating periods of volatility.

The historical context is important. Before Trump's presidency, the KRW/USD rate fluctuated based on various economic factors, including global trade balances and South Korea's economic performance. However, Trump's pronouncements injected a significant geopolitical element into the equation.

- Specific examples of Trump's statements regarding the KRW/USD: Trump frequently used Twitter and public speeches to express his concerns, often labeling South Korea a "currency manipulator."

- Analysis of market reactions to those statements: These statements often led to short-term volatility in the KRW/USD exchange rate, with the Won sometimes weakening against the dollar in response to the perceived pressure.

- Mention any trade policies implemented in response: While no direct punitive measures solely targeting currency manipulation were implemented against South Korea, the overall trade tensions under Trump's administration undoubtedly influenced the KRW/USD dynamic and contributed to uncertainty in the USD KRW forex market. The threat of tariffs and trade wars created a climate of risk aversion.

Factors Contributing to a Potentially Stronger Won

Several factors contribute to the potential for a stronger Won against the dollar. South Korea's robust export-oriented economy plays a key role. Strong export performance increases demand for the KRW, pushing its value upwards.

Furthermore, global economic factors significantly influence the KRW/USD exchange rate. Interest rate differentials between the US and South Korea, and global inflation rates, can influence capital flows and thus the currency's value.

- South Korea's export performance and its impact on the currency: South Korea's tech sector and manufacturing prowess drive substantial export revenue, boosting demand for the KRW.

- Foreign investment flows into South Korea: Consistent foreign direct investment (FDI) into South Korea's tech and manufacturing sectors further supports the Won.

- The Bank of Korea's monetary policy and its effect on the Won: The Bank of Korea's monetary policy decisions, particularly regarding interest rates, influence the attractiveness of the KRW to international investors. Higher interest rates generally attract more investment, strengthening the currency.

Analyzing the Current KRW/USD Exchange Rate and Future Predictions

As of [Insert Current Date], the KRW/USD exchange rate is approximately [Insert Current Exchange Rate]. Predicting future movements is inherently complex, but several factors will likely shape the KRW/USD rate. Continued strong export growth, increased foreign investment, and a stable geopolitical environment would all contribute to a stronger Won. Conversely, global economic slowdowns, trade tensions, or unexpected policy changes could exert downward pressure.

- Short-term and long-term predictions for the KRW/USD: Short-term fluctuations are expected, depending on market sentiment and news events. Long-term projections often vary among experts but generally consider South Korea's economic fundamentals.

- Analysis of expert opinions and forecasts: Many financial institutions and economists publish regular forecasts for the KRW/USD, which provide valuable insight, though it's important to remember that these are predictions, not guarantees.

- Discussion of potential risks and uncertainties: Geopolitical risks, changes in global trade policies, and unexpected economic shocks all represent potential uncertainties that could influence the KRW/USD exchange rate.

Conclusion

Trump's criticism of South Korea's currency practices undoubtedly created volatility in the KRW/USD exchange rate. However, the longer-term trajectory of the KRW is more nuanced and depends on a multitude of economic and geopolitical factors. A strong export sector, consistent foreign investment, and sound monetary policy from the Bank of Korea all point towards a potentially stronger Won. While short-term fluctuations are inevitable, understanding the underlying economic fundamentals is key to navigating the KRW/USD exchange rate. Stay informed about the dynamic KRW/USD exchange rate and its implications for global markets. Understanding the KRW/USD exchange rate is crucial for investors and businesses involved in the South Korean economy. Continue your research and stay updated on the latest developments affecting the KRW/USD exchange rate.

Featured Posts

-

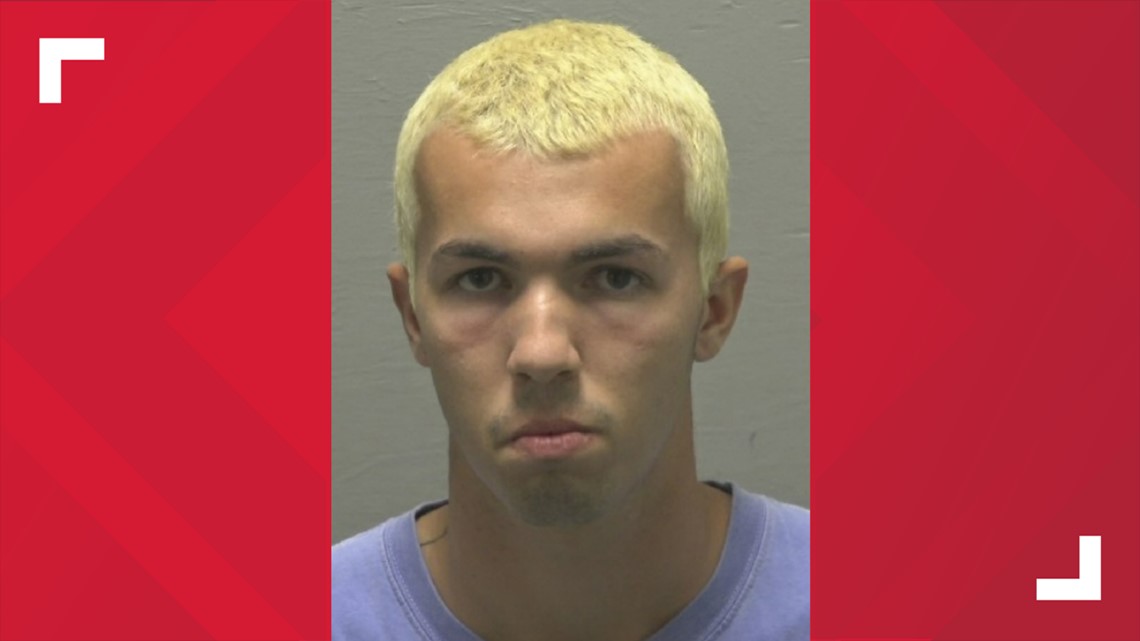

Former Charlottesville Weatherman Charged With Sexual Extortion

Apr 25, 2025

Former Charlottesville Weatherman Charged With Sexual Extortion

Apr 25, 2025 -

Brides Outrage Bridesmaids Makeup Too Bold For The Wedding

Apr 25, 2025

Brides Outrage Bridesmaids Makeup Too Bold For The Wedding

Apr 25, 2025 -

Palestinian Student Remains Detained After Us Citizenship Interview

Apr 25, 2025

Palestinian Student Remains Detained After Us Citizenship Interview

Apr 25, 2025 -

Bundesliga Union Berlin Holds Bayern Munich To A Draw

Apr 25, 2025

Bundesliga Union Berlin Holds Bayern Munich To A Draw

Apr 25, 2025 -

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Betting On Tragedy

Apr 25, 2025

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Betting On Tragedy

Apr 25, 2025