KSE 100 Plunges: Operation Sindoor And The Fallout On Pakistan's Stock Market

Table of Contents

Operation Sindoor: Unveiling the Details and its Market Implications

Operation Sindoor, a [briefly explain the nature of Operation Sindoor – its goals, and timeline. Be specific but avoid potentially controversial statements unless backed by reliable sources.], sent shockwaves through the Pakistani financial landscape. Its impact on investor sentiment was immediate and dramatic. The uncertainty surrounding the operation's ramifications fueled a climate of fear and speculation, leading to a significant loss of confidence in the market.

- Key actions taken under Operation Sindoor: [List key actions, using bullet points. Be factual and cite sources where possible.]

- Initial market reaction: The PSX responded with sharp sell-offs, and trading halts were implemented on [mention specific dates] to mitigate the panic selling.

- Specific sectors most affected: The [mention specific sectors, e.g., banking, real estate] sectors were particularly hard hit, reflecting their sensitivity to shifts in investor confidence.

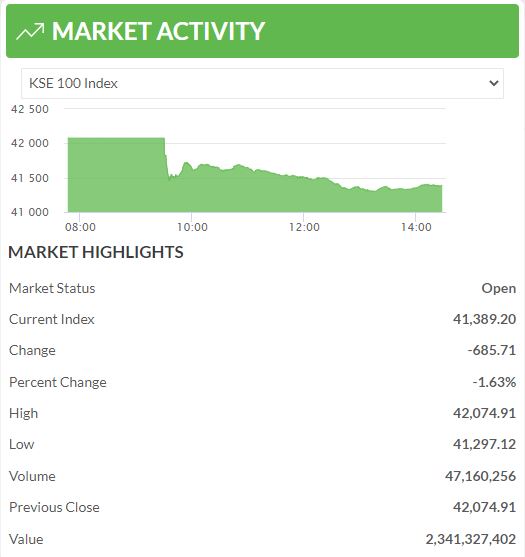

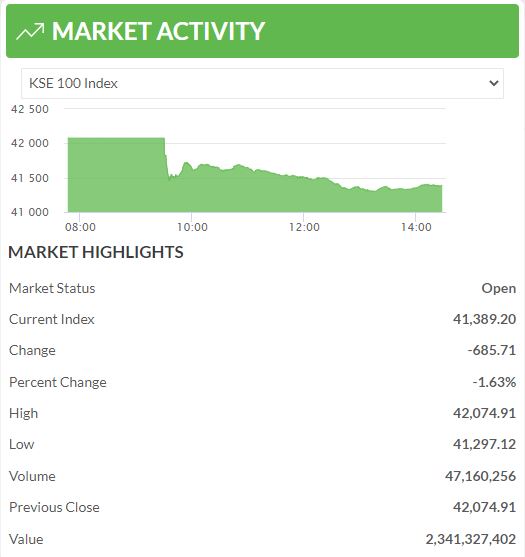

Analyzing the KSE 100's Decline: Magnitude and Contributing Factors

The KSE 100 index experienced a [quantify the percentage drop] decline, marking one of the most significant drops in recent history. This plunge cannot be attributed solely to Operation Sindoor. Other contributing factors include pre-existing political instability, persistent economic uncertainty, and the influence of global market trends. The confluence of these factors created a perfect storm that exacerbated the negative impact of Operation Sindoor.

- Specific days/periods of sharpest declines: The most dramatic drops occurred on [mention specific dates and explain the context].

- Comparison to previous market downturns: Compared to previous market corrections, this decline was [explain how it compares - more severe, less severe, etc.]. Cite relevant data and historical context.

- Technical analysis of chart patterns: [If you have relevant expertise, include a brief, objective technical analysis of the chart patterns observed during the decline. Avoid making overly speculative predictions.]

The Ripple Effect: Impact on Various Sectors of the Pakistani Economy

The KSE 100 plunge had far-reaching consequences across various sectors of the Pakistani economy. The impact varied depending on each sector's vulnerability to investor sentiment and the overall economic climate.

- Sector-specific performance analysis: [Analyze specific sectors – banking, energy, technology, etc. – detailing their performance during the downturn. Use data and statistics to support your claims.]

- Impact on employment and business activities: The decline led to [discuss potential impacts, such as job losses, reduced business activity, etc.].

- Potential long-term consequences for economic growth: The sustained impact on investor confidence could negatively affect foreign direct investment (FDI) and hinder long-term economic growth. This requires careful monitoring and proactive measures by the government.

Government Response and Future Outlook for the KSE 100

The government responded to the market plunge with [detail the government's response – policy changes, statements, etc.]. However, the effectiveness of these measures remains to be seen. The outlook for the KSE 100 is complex, depending heavily on the government's ability to restore investor confidence and address the underlying economic challenges.

- Government's immediate actions and long-term plans: [Outline the government's actions and long-term plans, evaluating their potential impact on the market.]

- Expert opinions and market forecasts: [Include opinions from financial analysts and experts regarding the potential for recovery and future market trends.]

- Potential for a market rebound and factors influencing it: A market rebound is possible, but it hinges on several factors, including [list key factors, such as political stability, economic reforms, and global market conditions].

Conclusion: Navigating the Aftermath of the KSE 100 Plunge

The KSE 100 plunge, significantly influenced by Operation Sindoor, exposed the vulnerability of the Pakistani stock market to political events and economic uncertainties. The decline’s magnitude, combined with pre-existing challenges, created a considerable setback for the economy. While the government's response is crucial, the path to recovery depends on multiple factors, requiring careful observation and informed decision-making.

To navigate the aftermath effectively, staying informed about KSE 100 performance and related economic indicators is critical. Understanding the intricacies of Pakistan's stock market is essential for investors and stakeholders alike. For ongoing KSE 100 analysis and resources to track the market's trajectory after this significant event, consult reputable financial news sources and expert analyses focused on the KSE 100 recovery and investing in Pakistan. Understanding the long-term implications of this plunge and potential KSE 100 recovery is paramount for navigating the evolving landscape of the Pakistan Stock Exchange.

Featured Posts

-

Handhaving Van De Relatie Brekelmans India Kansen En Bedreigingen

May 09, 2025

Handhaving Van De Relatie Brekelmans India Kansen En Bedreigingen

May 09, 2025 -

May 8th 2025 A Look Back At The Trump Administrations 109th Day

May 09, 2025

May 8th 2025 A Look Back At The Trump Administrations 109th Day

May 09, 2025 -

Bone Bruise Sidelines Jayson Tatum Game 2 Implications

May 09, 2025

Bone Bruise Sidelines Jayson Tatum Game 2 Implications

May 09, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its History And Impact

May 09, 2025

The Closure Of Anchor Brewing Company A Look Back At Its History And Impact

May 09, 2025 -

Psg 11 Lojtaret Kyc Te Suksesit

May 09, 2025

Psg 11 Lojtaret Kyc Te Suksesit

May 09, 2025