LA Wildfires: A Reflection Of Our Times Through Disaster Betting Markets

Table of Contents

1. The Rise of Disaster Betting Markets and LA Wildfires

The increasing unpredictability and intensity of LA Wildfires, fueled by climate change and urban sprawl, have created a fertile ground for the development of prediction markets. These markets operate by leveraging data analysis and predictive modeling to generate odds on various wildfire-related outcomes.

1.1 The Mechanics of Wildfire Prediction Markets:

These markets function similarly to traditional sports betting, but instead of predicting game outcomes, they predict the severity of wildfires.

- Types of Bets: Bets can be placed on the total acreage burned, the number of structures destroyed, the specific locations affected (e.g., Malibu, Santa Monica Mountains), and even the duration of evacuation orders.

- Data Sources: Predictive models rely on a range of data sources, including historical wildfire data, real-time weather patterns (temperature, humidity, wind speed), vegetation maps showing fuel density, and even social media sentiment analysis to gauge public perception of risk.

1.2 Ethical Concerns and Regulatory Challenges:

The ethical implications of profiting from natural disasters are significant.

- Potential for Manipulation: The possibility of manipulating data or influencing outcomes for personal gain raises serious concerns about market integrity.

- Regulatory Gaps: The current regulatory landscape often lacks sufficient oversight of these markets, leaving them vulnerable to exploitation and abuse.

- Moral Debate: The fundamental question of whether it is morally acceptable to profit from the suffering of others remains fiercely debated. The inherent uncertainty and devastating consequences of LA Wildfires make this debate even more complex.

2. LA Wildfires and Climate Change Denial

The scientific consensus unequivocally links climate change to the increased frequency and intensity of wildfires in Los Angeles. Rising temperatures, prolonged droughts, and changes in vegetation patterns create ideal conditions for wildfire ignition and rapid spread.

2.1 The Link Between Climate Change and Wildfire Risk:

- Increased Drought Severity: Climate change exacerbates drought conditions, creating tinder-dry landscapes highly susceptible to ignition.

- Extreme Heatwaves: Higher temperatures increase the flammability of vegetation and create more intense fire behavior.

- Shifting Wind Patterns: Changes in wind patterns can rapidly spread wildfires across vast areas, making containment efforts more challenging.

2.2 Disaster Betting Markets as a Reflection of Climate Change Skepticism:

The very existence of these markets could reflect a societal normalization, and even encouragement, of climate change denial.

- Correlation with Beliefs: It's plausible that individuals who downplay the role of climate change might be more likely to participate in these markets, viewing wildfires as isolated events rather than a consequence of broader climate trends.

- Inherent Normalization: The creation of financial instruments based on wildfire predictions might inadvertently normalize the occurrence of these disasters, hindering proactive mitigation efforts.

3. The Commodification of Tragedy and the LA Wildfire Context

The human cost of LA Wildfires is immense, encompassing loss of life, displacement of communities, and significant economic hardship.

3.1 The Human Cost of Wildfires:

- Loss of Life and Homes: Wildfires have claimed countless lives and destroyed homes, leaving countless families devastated.

- Long-Term Psychological Impacts: Survivors often experience trauma, anxiety, and depression long after the immediate threat has passed.

- Economic Disruption: Wildfires disrupt businesses, destroy infrastructure, and cause widespread economic damage.

3.2 The Moral Implications of Profiting from Suffering:

Turning natural disasters into financial instruments raises fundamental ethical concerns.

- Exploiting Vulnerability: These markets could potentially exploit the vulnerability of those affected by wildfires.

- Insensitivity to Human Suffering: The act of profiting from disaster trivializes the immense human cost and undermines empathy.

4. Conclusion

Disaster betting markets related to LA Wildfires highlight a complex interplay between risk assessment, climate change denial, and the ethical implications of commodifying tragedy. These markets, while potentially offering insights into risk perception, also raise serious concerns about manipulation, exploitation, and the normalization of climate change impacts. Understanding the mechanics of these markets and their societal ramifications is crucial. We must engage in critical conversations about responsible regulation and increased awareness surrounding the escalating threat of Los Angeles Wildfires and their connection to climate change. Further research into the ethical and societal impact of disaster betting markets is essential for informing policy and fostering responsible behavior. We need to shift our focus from profiting off of California Wildfires to proactive prevention and mitigation strategies. Let's work together to protect our communities from the devastating effects of these increasingly frequent and intense wildfires.

Featured Posts

-

Planning The Perfect Spring Break For Your Kids Activities And Ideas

May 13, 2025

Planning The Perfect Spring Break For Your Kids Activities And Ideas

May 13, 2025 -

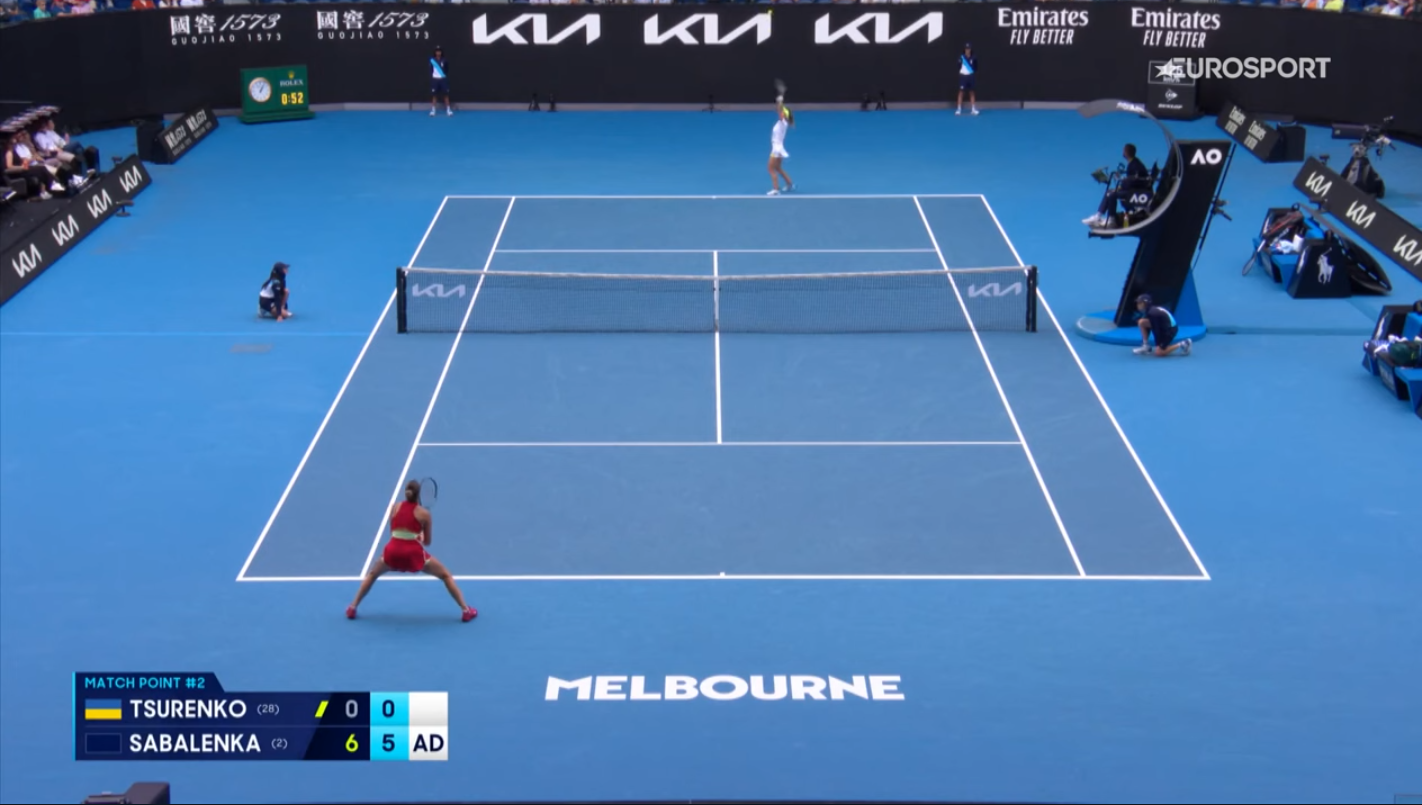

Sabalenka Falls To Ostapenko In Stuttgart Open Championship Match

May 13, 2025

Sabalenka Falls To Ostapenko In Stuttgart Open Championship Match

May 13, 2025 -

Sabalenka And Gauff Steer Clear Of Upsets Progress To Next Round In Rome

May 13, 2025

Sabalenka And Gauff Steer Clear Of Upsets Progress To Next Round In Rome

May 13, 2025 -

The Best Efl Highlights Action Packed Football From The Championship And Leagues

May 13, 2025

The Best Efl Highlights Action Packed Football From The Championship And Leagues

May 13, 2025 -

Cooper Flagg And The 2025 Nba Draft Lottery Analyzing The Odds

May 13, 2025

Cooper Flagg And The 2025 Nba Draft Lottery Analyzing The Odds

May 13, 2025