Las Vegas Caesar's Properties: A 24-Hour Market Value Assessment

Table of Contents

Factors Influencing 24-Hour Value Fluctuation

The value of Caesar's properties, like any asset, isn't static. It's a constantly shifting landscape influenced by a complex interplay of factors. Understanding these nuances is crucial for investors and anyone interested in the Las Vegas market.

Stock Market Performance

The overall health of the stock market significantly impacts Caesar's stock price (CZR), directly affecting the perceived value of its properties. A positive day on the Dow Jones or S&P 500 often translates to increased investor confidence and a rise in CZR, boosting the value of Caesar's assets. Conversely, negative market trends can lead to a decrease.

- Positive Market Events: A strong earnings report from another casino company, positive economic indicators, or a general market uptrend can all positively impact CZR and Caesar's properties.

- Negative Market Events: A recessionary fear, geopolitical instability, or negative news affecting the gaming industry can cause a downturn in CZR and consequently, a decrease in perceived property value.

- Market Volatility: Short-term market fluctuations can cause significant swings in the perceived value of Caesar's properties, even if the underlying fundamentals remain strong. This emphasizes the importance of understanding market volatility when assessing short-term valuations.

Gaming Revenue & Occupancy Rates

Real-time data on gaming revenue and hotel occupancy are crucial indicators of Caesar's properties' short-term value. High occupancy rates and strong gaming revenue demonstrate strong demand and profitability, increasing investor confidence and driving up perceived value.

- High Occupancy & Revenue: Weekends typically see higher occupancy and revenue than weekdays, leading to increased short-term value. Successful marketing campaigns or major events also contribute to this.

- Low Occupancy & Revenue: Conversely, periods of low occupancy or decreased gaming revenue signal weaker performance and can negatively impact the perceived value of Caesar's properties.

- Real-Time Data Analytics: Caesar's, and other investors, utilize real-time data analytics to monitor key performance indicators (KPIs) and adjust strategies accordingly, influencing short-term valuations.

News and Events

Breaking news significantly impacts market sentiment and, consequently, the value of Caesar's properties. Positive news can boost investor confidence, while negative news can trigger sell-offs.

- Positive News: Announcements of new partnerships, successful expansion projects, or positive regulatory changes can lead to a surge in CZR and increased property valuations.

- Negative News: Regulatory setbacks, negative publicity, or economic downturns can severely impact investor confidence and decrease the perceived value of Caesar's properties.

- Social Media & Sentiment Analysis: Social media sentiment and online news coverage are closely monitored to gauge public perception, providing valuable insights into potential short-term value fluctuations.

Currency Exchange Rates

Given the significant international tourism in Las Vegas, currency exchange rates heavily influence the value of Caesar's properties. A strong US dollar can reduce international tourism, impacting revenue and thus, property values.

- USD Strength: A strong USD against major currencies like the Euro or British Pound can lead to reduced international visitor spending and potentially lower revenue for Caesar's properties.

- USD Weakness: Conversely, a weaker USD makes Las Vegas more attractive to international tourists, potentially boosting revenue and positively impacting property valuations.

- Hedging Currency Risk: Caesar's actively manages currency risk through hedging strategies, mitigating the impact of fluctuations on its overall profitability and property valuations.

Analyzing Specific Caesar's Properties

The diverse portfolio of Caesar's Entertainment Corporation offers a range of properties with varying market sensitivities.

The Cosmopolitan of Las Vegas

The Cosmopolitan, known for its modern design and luxury amenities, caters to a high-spending clientele. Its location on the Las Vegas Strip contributes significantly to its value.

- Value Fluctuations: The Cosmopolitan's value is sensitive to changes in luxury travel trends and high-roller spending habits. Economic downturns may impact its occupancy more than budget-friendly properties.

Caesars Palace

Caesars Palace, an iconic landmark, benefits from its historical significance and established brand recognition. Its large scale and diverse offerings provide a buffer against short-term market fluctuations.

- Value Fluctuations: While its historical significance provides a strong foundation, its value is still subject to overall market trends and competition from newer resorts.

Other Notable Properties

Caesar's portfolio extends beyond Las Vegas, including properties in other US locations and internationally. These properties contribute to the overall portfolio value and exhibit varying levels of market sensitivity.

- Regional Variations: Properties in different regions exhibit differing levels of sensitivity to local economic conditions and tourism trends.

Conclusion

This assessment highlights the complex interplay of factors influencing the 24-hour market value of Caesar's properties. Stock market performance, gaming revenue, news events, and currency fluctuations all play crucial roles. The analysis demonstrates that understanding these dynamic elements is key for anyone interested in the Las Vegas real estate market. Want to delve deeper into the fascinating world of Las Vegas real estate investment and learn more about the fluctuating value of Caesar's properties? Continue exploring our resources or contact us for expert analysis on Caesar's Entertainment Corporation and its diverse portfolio.

Featured Posts

-

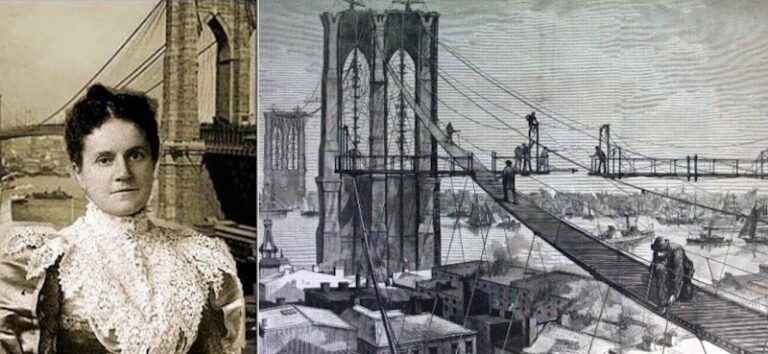

Honoring Emily Warren Roebling Her Essential Role In Building The Brooklyn Bridge

May 18, 2025

Honoring Emily Warren Roebling Her Essential Role In Building The Brooklyn Bridge

May 18, 2025 -

Winning Numbers Daily Lotto Tuesday 29 April 2025

May 18, 2025

Winning Numbers Daily Lotto Tuesday 29 April 2025

May 18, 2025 -

Best Crypto Casinos Usa Jackbit Review And Comparison

May 18, 2025

Best Crypto Casinos Usa Jackbit Review And Comparison

May 18, 2025 -

Ta Pio Epityximena Ellinika Onomata Sti Lista Forbes Mia Analysi Ploytoy Kai Epixeirimatikotitas

May 18, 2025

Ta Pio Epityximena Ellinika Onomata Sti Lista Forbes Mia Analysi Ploytoy Kai Epixeirimatikotitas

May 18, 2025 -

Novak Djokovic In Servetinin Sirri 186 Milyon Dolarlik Gelir

May 18, 2025

Novak Djokovic In Servetinin Sirri 186 Milyon Dolarlik Gelir

May 18, 2025