Legal Battle Looms As Mali Targets Barrick's Gold Mine

Table of Contents

The Core of the Dispute: Mali's Claims Against Barrick

The heart of the Mali-Barrick Gold dispute lies in disagreements over tax payments, contract interpretation, and revenue sharing related to the Loulo-Gounkoto gold mine. The Malian government alleges that Barrick has engaged in tax evasion and breached several clauses within their mining agreement. These allegations center around several key areas:

-

Tax Disputes: The Malian government claims Barrick has underpaid taxes, citing discrepancies in reported profits and deductions. Specific details regarding the alleged tax evasion remain largely undisclosed, pending legal proceedings. This involves scrutiny of complex accounting practices and interpretations of Malian tax law.

-

Contract Renegotiation: Mali seeks to renegotiate the terms of the original mining agreement, arguing that the deal is unfavorable to the nation and doesn't reflect the current market value of the gold extracted. This includes demands for increased royalties and a greater share of the mine's profits.

-

Mining Licenses and State Ownership: The dispute also touches upon the validity and interpretation of existing mining licenses, with Mali potentially arguing for greater state control over the mine's operations or even seeking to revoke the licenses altogether. This raises questions about the security of mining investments in the country.

-

Revenue Sharing: A central point of contention is the revenue-sharing agreement. Mali argues that the current arrangement unfairly benefits Barrick at the expense of the Malian people and their economic development. They seek a significantly higher percentage of the mine’s revenue.

The potential impact on Barrick's operations and profitability is substantial. A successful legal challenge by Mali could lead to significant financial penalties, operational disruptions, and a severely damaged reputation.

Barrick's Response and Legal Strategies

Barrick Gold has publicly refuted the Malian government's claims, stating that all its operations in Mali are conducted in full compliance with the existing agreements and applicable laws. Their legal strategy is likely to focus on several key points:

-

International Arbitration: Barrick will likely rely heavily on international arbitration, utilizing investment treaties between Canada and Mali (or other relevant treaties) to protect its investments and ensure due process. This process would involve an independent tribunal to assess the merits of both sides’ arguments.

-

Legal Defense: Barrick's legal team will present evidence to counter the allegations of tax evasion and contract breaches. This will include detailed financial records, expert testimony, and legal arguments challenging the Malian government’s interpretation of the mining agreements.

-

Investment Treaties: The invocation of international investment treaties is crucial to Barrick's strategy. These treaties often provide protections for foreign investors against unfair or discriminatory treatment, which is a key element of their defense.

-

Counterclaims: It’s possible Barrick may file counterclaims against the Malian government for damages resulting from the disruption to their operations and the negative impact on investor confidence.

-

Legal Precedents and Jurisdiction: The legal precedent in similar mining disputes around the world, and the specific jurisdiction chosen for arbitration, will play a vital role in shaping the outcome of this legal battle.

Wider Implications: Impact on Investment and the Mining Sector in Mali and Africa

The Mali-Barrick Gold dispute has far-reaching implications, extending beyond the immediate parties involved.

-

Foreign Investment: The dispute significantly impacts the investment climate in Mali's mining sector. Uncertainty surrounding the legal security of mining contracts could deter future foreign investment in the country, hindering economic development.

-

Resource Nationalism: This case exemplifies the growing trend of resource nationalism in Africa, where governments seek greater control over their natural resources and renegotiate existing agreements with international companies. This raises concerns about the predictability and stability of the investment environment.

-

Economic Development: The outcome will significantly affect Mali's economic development. The Loulo-Gounkoto mine is a crucial contributor to the nation's economy, and any disruptions to its operations could have severe consequences for government revenue and employment.

-

Mining Regulations: The case will likely influence future mining legislation in Mali and potentially other African countries. Governments may review their mining codes and contracts to better balance national interests with attracting foreign investment.

-

African Mining Industry: The dispute is a significant case study for the broader African mining industry, setting a precedent for future negotiations and disputes between governments and multinational mining corporations. Similar disputes have occurred in other African nations, underscoring the need for clear, transparent, and predictable regulatory frameworks.

The Role of International Organizations and Mediation Efforts

Given the magnitude and international implications of the dispute, the involvement of international organizations in mediation is a significant possibility.

-

International Court of Arbitration: This independent body is frequently used to resolve international commercial disputes. Its involvement would offer a neutral platform for resolving the disagreements.

-

World Bank: The World Bank's International Centre for Settlement of Investment Disputes (ICSID) provides another avenue for dispute resolution. Their expertise in international investment law could prove valuable.

-

Mediation: Successful mediation could help avoid lengthy and costly legal battles. However, the success of mediation efforts hinges on both parties' willingness to compromise and find mutually acceptable solutions. Different dispute resolution mechanisms, such as conciliation or arbitration, may be employed depending on the progress of negotiations.

Conclusion

The legal battle between Mali and Barrick Gold over the Loulo-Gounkoto gold mine represents a significant challenge to the investment climate in Mali and raises broader concerns about resource nationalism in Africa. The outcome of this dispute will have significant implications for both companies and governments involved, setting a precedent for future mining projects and the relationship between resource-rich nations and multinational corporations. The implications of the Mali-Barrick Gold mine dispute are far-reaching and will shape the future of mining investment in Africa.

Call to Action: Stay informed about this developing legal battle and its potential effects on the mining industry in Mali and beyond. Follow our coverage for updates on this critical Mali-Barrick Gold mine dispute and its unfolding implications.

Featured Posts

-

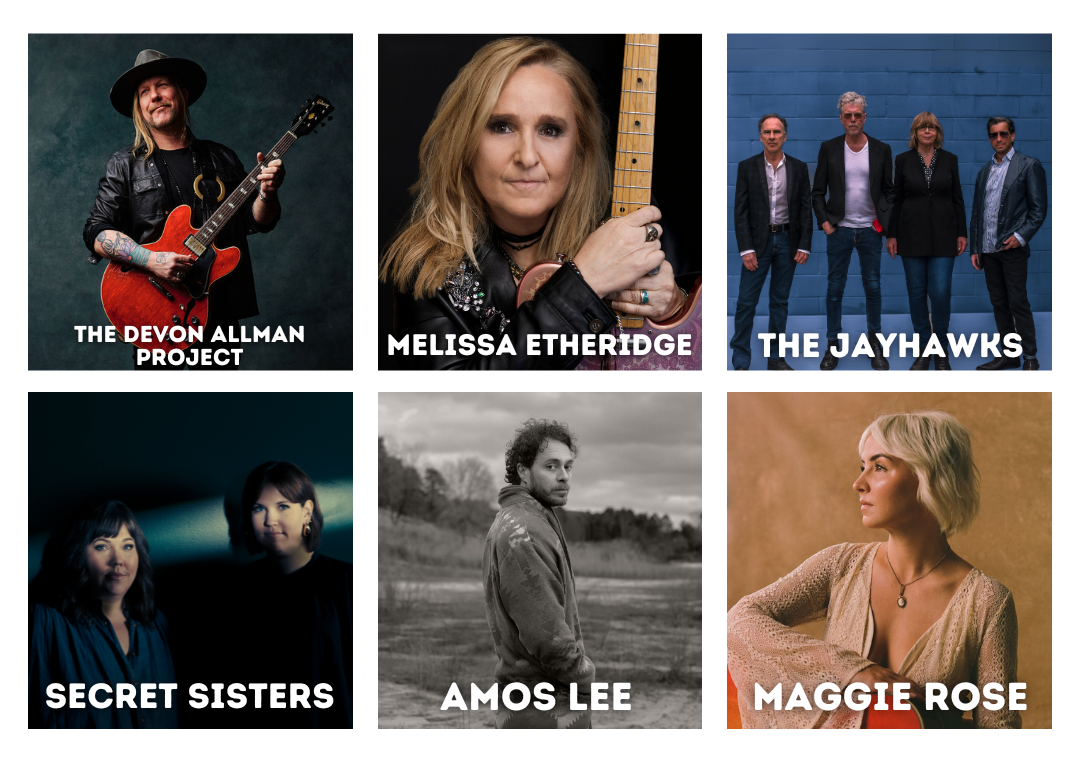

Complete Guide To The 2025 American Music Awards

May 28, 2025

Complete Guide To The 2025 American Music Awards

May 28, 2025 -

Champions League Derby Real Madrid Secures 2 1 Victory Against Atletico

May 28, 2025

Champions League Derby Real Madrid Secures 2 1 Victory Against Atletico

May 28, 2025 -

Rayan Cherki To Liverpool Transfer Speculation Heats Up

May 28, 2025

Rayan Cherki To Liverpool Transfer Speculation Heats Up

May 28, 2025 -

Filming Hailee Steinfelds Controversial Spit Scene In The Sinner

May 28, 2025

Filming Hailee Steinfelds Controversial Spit Scene In The Sinner

May 28, 2025 -

Barcelonas Champions League Charge Raphinhas Impact

May 28, 2025

Barcelonas Champions League Charge Raphinhas Impact

May 28, 2025