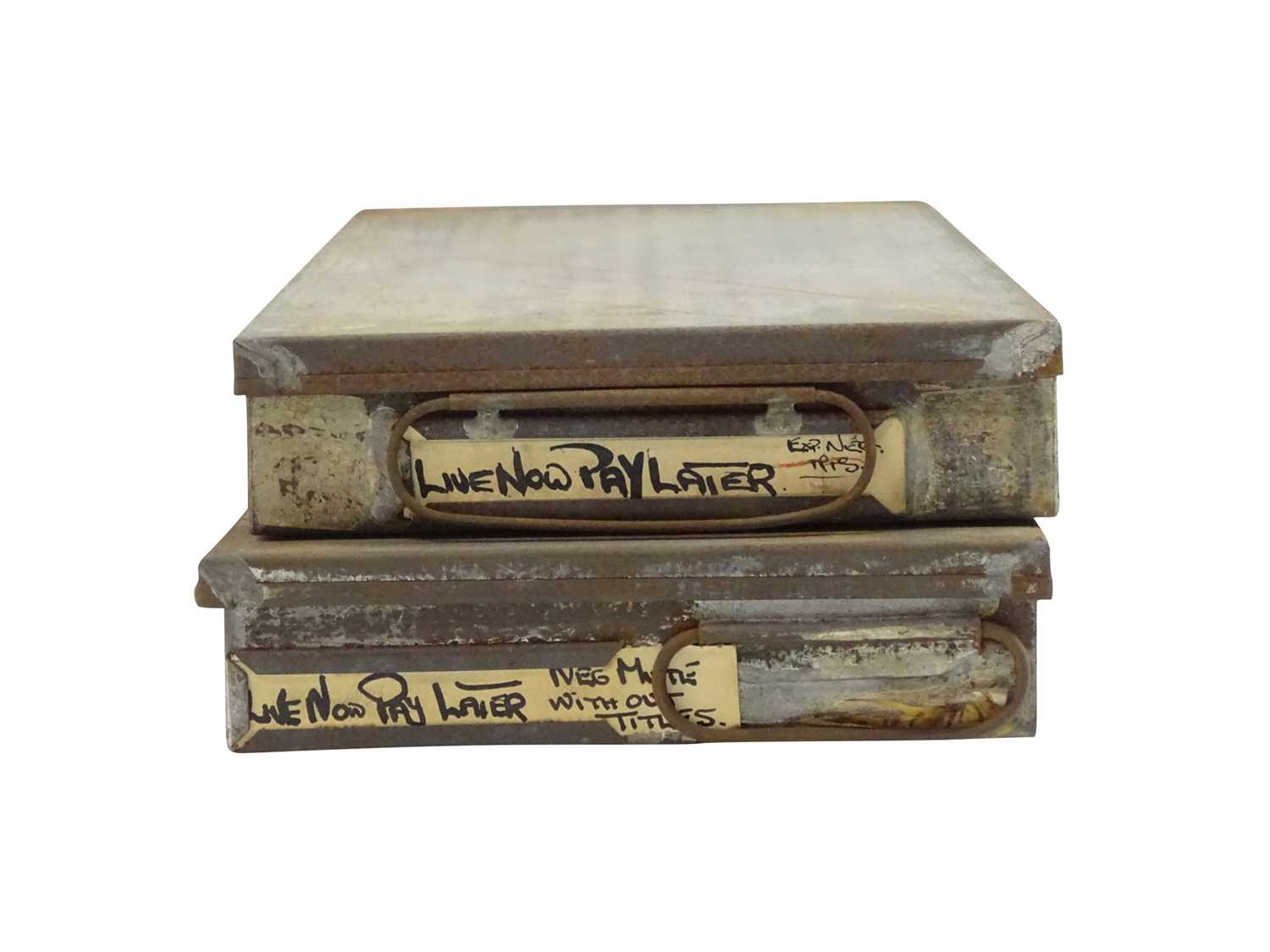

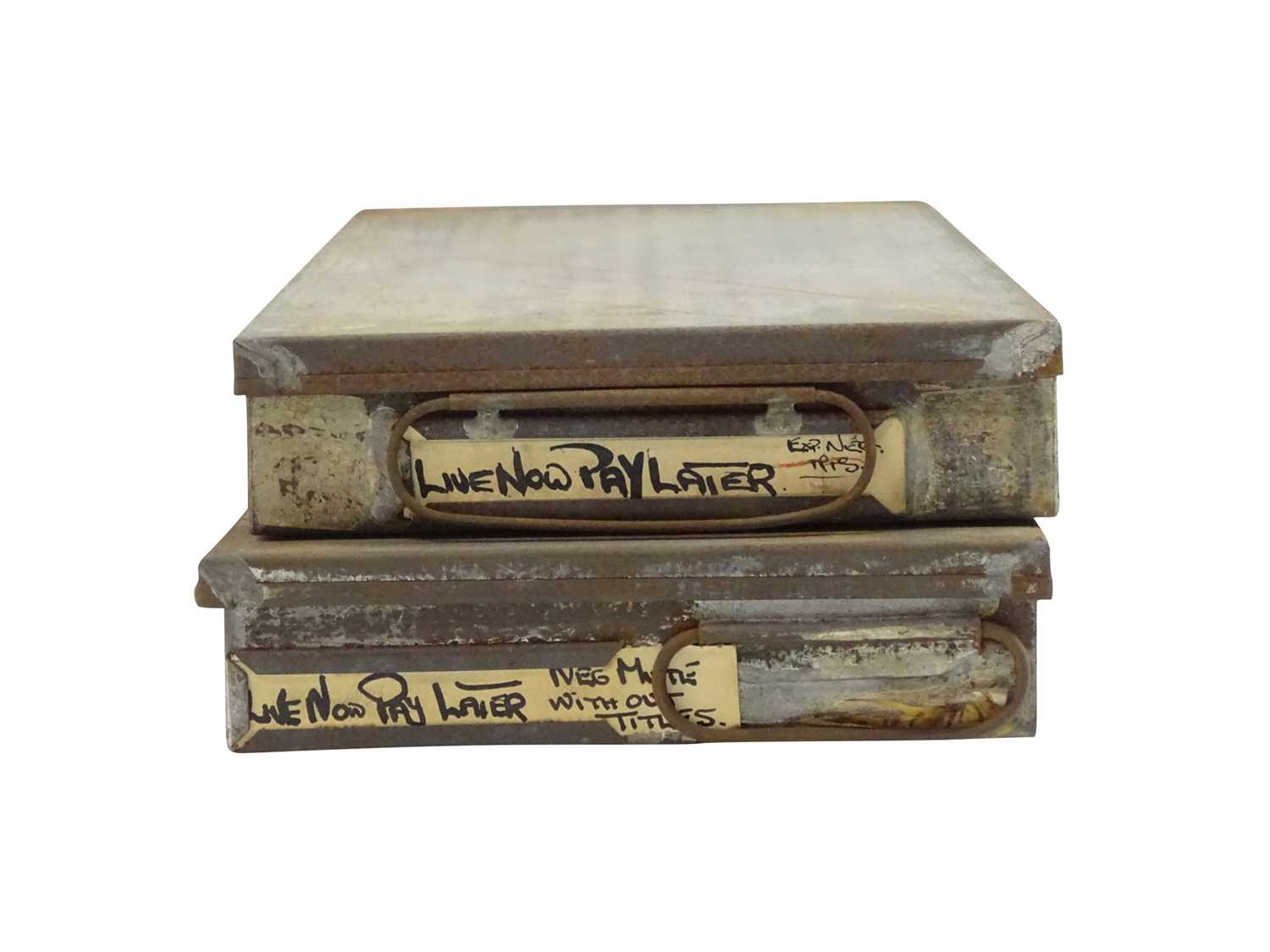

Live Now, Pay Later: A Comprehensive Review Of Top Services

Table of Contents

Understanding Live Now, Pay Later (LNPL) Services

Live Now, Pay Later (LNPL), also known as buy now, pay later (BNPL) or point-of-sale financing, allows you to purchase goods and services and pay for them in installments over a short period, typically a few weeks or months. Instead of paying the full amount upfront, you spread the cost across several payments. This can be incredibly useful for managing unexpected expenses or larger purchases.

Key Terms:

- Buy Now, Pay Later (BNPL): The most common term for these services, emphasizing the immediate purchase and delayed payment.

- Point-of-Sale Financing: This refers to the fact that the financing is arranged at the point of sale, typically during the online checkout process or in-store.

- Installment Payments: The method of payment, where the total cost is divided into smaller, regular payments.

Benefits of Using LNPL:

- Improved Cash Flow: Avoids the immediate strain on your budget associated with larger purchases.

- Budget Flexibility: Allows you to spread the cost of an item over time, making it easier to fit into your monthly budget.

- Building Credit Responsibly (with some providers): Some LNPL services report your payment activity to credit bureaus, potentially helping to build your credit history. However, this is not universally true, so be sure to check.

- Convenient Online and In-Store Payments: LNPL services are widely accepted both online and at physical retailers, offering flexibility in how you shop.

Potential Drawbacks of LNPL:

- High Interest Rates (if not paid on time): Missing payments can lead to significant interest charges and late fees. Always check the terms and conditions.

- Potential Debt Accumulation: Overusing LNPL services can quickly lead to accumulating debt if you're not careful about managing multiple payments.

- Impact on Credit Score (if misused): While responsible use can improve your credit score, late or missed payments will negatively impact your credit rating.

Top Live Now, Pay Later Providers: A Detailed Comparison

Here's a comparison of three leading LNPL providers:

Provider A: Klarna

Klarna offers a variety of services, including "Pay in 30," "Pay in 4," and a virtual shopping card. They have a wide network of retail partners and a user-friendly app.

Pros: Wide acceptance, flexible payment options, user-friendly app.

Cons: Late fees can be substantial, credit checks may be conducted for certain plans.

-

Key Features:

- Virtual shopping card for online purchases.

- App integration for easy payment management.

- Extensive retailer partnerships.

- Flexible payment plans (Pay in 30, Pay in 4, etc.).

-

Eligibility Criteria: Generally requires users to be of legal age and meet certain financial criteria, which may include a soft credit check.

Provider B: Afterpay

Afterpay is known for its simple four-payment plan: split the purchase cost into four equal installments, due every two weeks.

Pros: Simple and straightforward four-payment plan, wide acceptance.

Cons: Can be less flexible than other providers, late fees apply for missed payments.

-

Key Features:

- Four-payment plan, with payments due every two weeks.

- Clear late fee structure.

- Customer support available through various channels.

-

Eligibility Criteria: Requires users to be of legal age and meet minimum eligibility requirements which can vary by region. Income verification might be required.

Provider C: Affirm

Affirm offers longer-term installment loans with varying interest rates depending on your creditworthiness. They are known for their transparency regarding fees and interest rates.

Pros: Longer repayment terms, potential for lower monthly payments, transparent interest rates.

Cons: Credit check required, higher interest rates for those with poor credit.

-

Key Features:

- Longer repayment terms compared to other providers.

- Loan amounts can be higher than other services.

- Interest rate transparency.

- Detailed loan terms clearly presented.

-

Eligibility Criteria: Requires a credit check as part of their loan approval process. Interest rates and loan amounts offered depend on the applicant’s credit score.

Choosing the Right Live Now, Pay Later Provider for You

| Provider | Payment Plans | Fees | Credit Check? | Interest Rates |

|---|---|---|---|---|

| Klarna | Pay in 30, Pay in 4 | Late fees, potential APR | Sometimes | Variable |

| Afterpay | 4 installments | Late fees | Usually not | Typically 0% |

| Affirm | Variable | Interest rates, fees | Yes | Variable |

The best LNPL provider for you depends on your individual needs and financial situation. Consider the length of the repayment period you require, the fees charged, and your comfort level with credit checks. Responsible use is key; only use LNPL for purchases you can comfortably afford to repay on time.

Responsible Use of Live Now, Pay Later Services

To avoid debt traps and maximize the benefits of LNPL, follow these strategies:

- Create a budget: Track your income and expenses carefully to ensure you can comfortably afford your LNPL payments.

- Only use LNPL for essential purchases: Avoid impulse buys and focus on necessary items.

- Pay on time: Avoid late fees and potential damage to your credit score. Set reminders for your payment due dates.

- Limit the number of LNPL accounts: Managing multiple payments can become overwhelming. Stick to one or two at most.

- Check the terms and conditions: Understand the fees, interest rates, and repayment terms before committing to a plan.

- Seek help if needed: If you’re struggling to manage your LNPL payments, contact the provider or seek advice from a credit counselor.

Numerous resources are available to help with debt management, including non-profit credit counseling agencies. Don't hesitate to reach out for support if needed.

Conclusion

Live Now, Pay Later services offer a convenient way to manage purchases and improve cash flow. However, responsible use is crucial. This review has highlighted the key features and differences between some of the top LNPL providers, empowering you to choose the best option for your financial needs. Remember to carefully compare fees, eligibility requirements, and repayment terms before committing to any Live Now, Pay Later plan. Choose wisely and utilize these services responsibly to unlock their benefits without falling into debt. Start exploring the best Live Now, Pay Later option for you today!

Featured Posts

-

Us Visa Policy Changes In Response To Social Media Censorship

May 30, 2025

Us Visa Policy Changes In Response To Social Media Censorship

May 30, 2025 -

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025 -

Le Jugement De Marine Le Pen 5 Ans D Ineligibilite Et Ses Consequences

May 30, 2025

Le Jugement De Marine Le Pen 5 Ans D Ineligibilite Et Ses Consequences

May 30, 2025 -

Kyriaki 11 5 Ti Na Deite Stin Tileorasi

May 30, 2025

Kyriaki 11 5 Ti Na Deite Stin Tileorasi

May 30, 2025 -

Potapova Triumphs Over Zheng Qinwen In Madrid

May 30, 2025

Potapova Triumphs Over Zheng Qinwen In Madrid

May 30, 2025