Live Now, Pay Later Financing Options Explained

Table of Contents

How Live Now, Pay Later Financing Works

The BNPL process is generally straightforward. It typically involves these steps:

-

Choosing a Merchant: Select a retailer or online store that offers BNPL options at checkout. Many merchants partner with various financing providers, offering a range of installment payments and deferred payment plans.

-

Selecting the Financing Option: At checkout, choose the "live now, pay later" option instead of paying with a credit card or debit card.

-

Applying for the Loan: The application process is often quick and easy, usually requiring minimal personal information. You'll typically need to provide your name, address, date of birth, and potentially your bank details for automated payments.

-

Approval Process: The lender will perform a soft credit check (which typically doesn't affect your credit score). Instant approval or a quick decision is common, although eligibility criteria vary between lenders.

-

Understanding the Repayment Schedule: Once approved, you'll receive details of your payment schedule, including the amount, frequency (e.g., weekly, bi-weekly, or monthly), and any applicable interest rates or fees. Many BNPL providers offer interest-free periods, provided you repay the full amount within a specified timeframe.

Bullet Points:

- Simple application process, often requiring minimal personal information.

- Instant approval or a quick decision, providing immediate access to funds.

- Flexible repayment options to suit your budget and financial circumstances.

- Potential for interest-free periods, allowing you to avoid extra charges.

- Clear payment schedule, ensuring you know exactly what's expected and when.

Different Types of Live Now, Pay Later Plans

Several types of live now, pay later plans exist, each with its own nuances:

-

Installment Loans: These involve fixed monthly payments spread over a set period. The total amount is divided into equal installments, making budgeting easier.

-

Deferred Payment Plans: These allow you to delay payment for a specified period, typically interest-free. However, failure to pay the full amount by the due date usually incurs substantial interest charges. This is sometimes called a "buy now, pay later" arrangement with a deferred payment option.

-

Point-of-Sale Financing: This type of financing is offered directly by retailers at the point of sale. The retailer often partners with a financing company to offer these options.

-

Buy Now Pay Later Apps: Standalone apps like Klarna, Afterpay, and Affirm provide point of sale financing across multiple merchants, offering flexibility in where you can use them. These apps typically have their own application process and eligibility criteria. These apps provide a wide range of financing options.

Benefits and Drawbacks of Live Now, Pay Later

Like any financial tool, BNPL offers both advantages and disadvantages:

Benefits:

- Convenience: A seamless and easy checkout process, speeding up the purchase experience.

- Flexibility: Various repayment options to accommodate different budgets and financial situations.

- Improved Cash Flow: Spreading payments over time can improve short-term cash flow, making large purchases more manageable.

- Accessibility: It can be easier to obtain financing through BNPL than through traditional credit cards, especially for those with limited credit history.

Drawbacks:

- Potential for High Interest Charges: Late or missed payments can result in significant interest charges and impact your credit score negatively.

- Impact on Credit Scores: While some BNPL providers don't impact your credit score, others do report your payment history to credit bureaus.

- Risk of Accumulating Debt: Overusing BNPL can lead to excessive debt if you're not careful about managing your finances and repayment schedule. Overspending is a real risk.

Choosing the Right Live Now, Pay Later Option for You

Selecting the right BNPL option requires careful consideration:

-

Compare Interest Rates and Fees: Interest rates and fees can vary significantly between providers. Carefully compare the options available to find the most favorable terms.

-

Check the Repayment Terms: Understand the repayment schedule, including the length of the repayment period and the amount of each installment.

-

Read Reviews and Check the Lender's Reputation: Research the lender's reputation and read reviews from other consumers to gauge their reliability and customer service.

-

Consider Your Budget and Repayment Ability: Only use BNPL if you're confident you can make your payments on time and avoid accumulating debt.

Conclusion:

Live now, pay later financing offers a convenient way to manage purchases, but it's crucial to use it responsibly. Understanding how BNPL works, its different types, and its potential benefits and drawbacks is essential. By comparing various providers, carefully assessing your financial situation, and sticking to a budget, you can leverage the convenience of live now, pay later financing without compromising your financial health. Make informed decisions when considering live now, pay later financing to enjoy its benefits without compromising your financial health.

Featured Posts

-

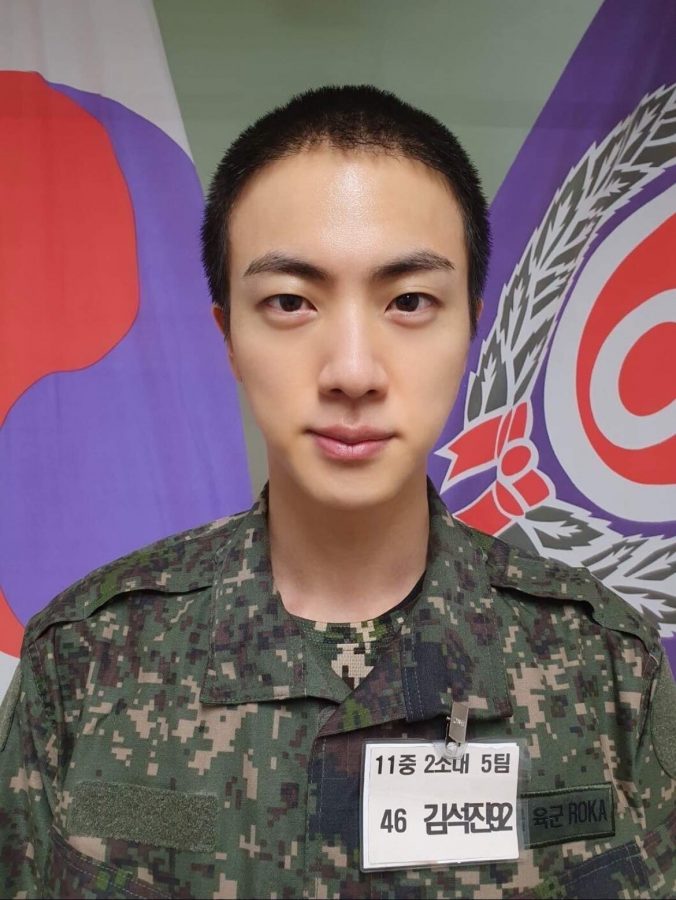

La Escena De Accion De Jin En Run Bts Impresionante Y Emocionante

May 30, 2025

La Escena De Accion De Jin En Run Bts Impresionante Y Emocionante

May 30, 2025 -

Philippe Tabarot Et La Greve A La Sncf Des Revendications Jugees Injustifiees

May 30, 2025

Philippe Tabarot Et La Greve A La Sncf Des Revendications Jugees Injustifiees

May 30, 2025 -

London Klub Melder Varm Interesse For Kasper Dolberg

May 30, 2025

London Klub Melder Varm Interesse For Kasper Dolberg

May 30, 2025 -

Oasis Tour Ticket Sales An Analysis Of Ticketmasters Legal Compliance

May 30, 2025

Oasis Tour Ticket Sales An Analysis Of Ticketmasters Legal Compliance

May 30, 2025 -

Domaci Zpravy Slavnostni Vyhlaseni Vitezu Stavba Roku

May 30, 2025

Domaci Zpravy Slavnostni Vyhlaseni Vitezu Stavba Roku

May 30, 2025