Live Now, Pay Later: Understanding The Costs And Benefits

Table of Contents

The Allure of Live Now, Pay Later: Benefits and Advantages

The appeal of "Live now, pay later" is undeniable. It offers short-term financial flexibility and convenience that many find irresistible. Let's explore the key benefits:

Short-Term Financial Flexibility

- Managing unexpected expenses: Car repairs, medical bills, or emergency home repairs can strain budgets. Live now, pay later benefits provide a way to manage these unexpected costs without immediate financial hardship.

- Spreading the cost of larger purchases: Instead of forgoing a necessary purchase like a new washing machine or a laptop, BNPL allows you to spread the cost over several weeks or months, making it more manageable.

- Improved cash flow management: By breaking down large payments into smaller installments, BNPL can help improve your monthly cash flow and avoid overdraft fees.

- Example: Instead of forgoing a necessary car repair, BNPL allows you to pay it off over time, avoiding the larger upfront cost.

Keyword usage: "Live now, pay later benefits," "financial flexibility," "short-term financing."

Convenient and Easy Application Process

One of the biggest draws of BNPL is its user-friendly nature.

- Online accessibility: Most BNPL services are entirely online, accessible through websites or mobile apps.

- Minimal paperwork: The application process is typically quick and simple, often requiring minimal documentation.

- Instant approval (sometimes): Some providers offer instant approval, providing immediate access to funds.

Keyword usage: "easy application," "convenient financing," "online application process."

Building Credit (Potentially)

While not guaranteed, responsible use of BNPL can potentially contribute to building credit.

- On-time payments: Consistently making on-time payments demonstrates responsible borrowing behavior, which can positively impact your credit score.

- Reporting to credit bureaus: Some BNPL providers report payment history to major credit bureaus, allowing lenders to see your responsible use of credit.

- Important Note: This benefit is contingent upon consistently making on-time payments. Missed payments will negatively impact your credit.

Keyword usage: "credit building," "responsible borrowing," "credit score improvement."

The Potential Pitfalls of Live Now, Pay Later: Costs and Risks

While the allure of "Live now, pay later" is strong, it's crucial to understand the potential downsides.

High Interest Rates and Fees

The convenience often comes with a cost.

- High interest charges: If you don't pay off your balance in full by the due date, interest rates on BNPL plans can be significantly higher than those on traditional credit cards or loans.

- Late payment fees: Missed payments will result in late fees, which can quickly add up.

- Other fees: Some providers may charge additional fees for things like account maintenance or early repayment.

- Example: A seemingly small purchase could accrue significant interest charges if not paid on time.

Keyword usage: "high interest rates," "late payment fees," "BNPL costs."

Impact on Credit Score

Missed or late payments can severely damage your credit score.

- Negative reporting: Late payments are reported to credit bureaus, negatively impacting your credit history.

- Loan applications: A damaged credit score can make it harder to secure loans, mortgages, or even rent an apartment in the future.

- Higher interest rates: Future borrowing will likely come with higher interest rates due to the negative impact on your creditworthiness.

Keyword usage: "credit score damage," "missed payments," "negative credit impact."

Debt Trap Potential

Overusing multiple BNPL services can quickly lead to a debt trap.

- Accumulating debt: Using several BNPL services simultaneously can make it difficult to keep track of payments and easily lead to accumulating debt.

- Financial strain: Managing multiple payments can create significant financial strain and negatively impact your overall financial health.

- Importance of budgeting: Careful budgeting and financial planning are crucial to avoid getting caught in a cycle of debt.

Keyword usage: "debt trap," "overspending," "financial responsibility."

Alternatives to Live Now, Pay Later Services

Before resorting to BNPL, consider these alternatives:

Traditional Loans and Credit Cards

- Traditional loans: For larger purchases, a personal loan might offer lower interest rates and more manageable repayment terms than BNPL.

- Credit cards: Credit cards, used responsibly, can offer rewards and benefits, but careful budgeting and on-time payments are essential. Compare interest rates and fees carefully.

Keyword usage: "traditional loans," "credit cards," "financing options."

Budgeting and Saving

The best alternative to BNPL is often the simplest:

- Budgeting: Creating a realistic budget helps you track your spending and prioritize essential expenses.

- Saving: Putting money aside regularly allows you to make larger purchases without resorting to high-interest financing options.

Keyword usage: "budgeting," "saving money," "financial planning."

Conclusion

"Live Now, Pay Later" services offer short-term financial flexibility, but their high interest rates, fees, and potential impact on credit scores should not be underestimated. While they can be useful for managing unexpected expenses or spreading the cost of larger purchases, responsible usage is paramount. Carefully weigh the benefits against the risks before using BNPL. Make informed decisions when considering "Live Now, Pay Later" options and prioritize responsible financial management. Research different providers and their terms carefully, and always prioritize budgeting and saving to avoid unnecessary debt.

Featured Posts

-

Air Jordan June 2025 A Look At The Upcoming Sneaker Releases

May 30, 2025

Air Jordan June 2025 A Look At The Upcoming Sneaker Releases

May 30, 2025 -

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025 -

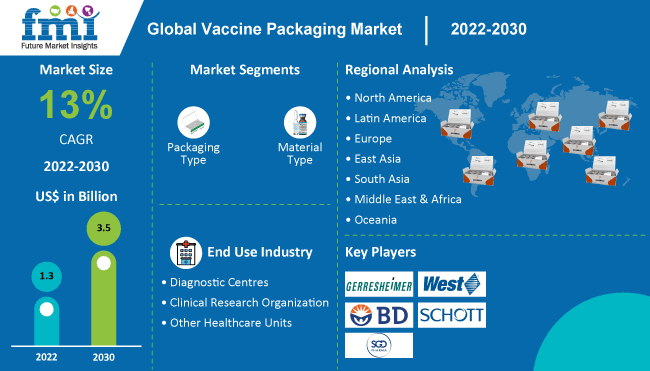

Investment Opportunities In The Booming Vaccine Packaging Market

May 30, 2025

Investment Opportunities In The Booming Vaccine Packaging Market

May 30, 2025 -

Alastqlal Rmz Alkramt Walsyadt

May 30, 2025

Alastqlal Rmz Alkramt Walsyadt

May 30, 2025 -

Andre Agassis Pro Pickleball Debut A Complete Analysis And Recap

May 30, 2025

Andre Agassis Pro Pickleball Debut A Complete Analysis And Recap

May 30, 2025