Los Angeles Wildfires And The Growing Market For Disaster Bets

Table of Contents

The Rising Frequency and Intensity of Los Angeles Wildfires

The frequency and severity of wildfires in Los Angeles County have increased dramatically in recent years. This alarming trend is directly linked to several factors, most notably climate change. Prolonged drought conditions, coupled with the infamous Santa Ana winds, create a tinderbox environment, making wildfires more likely to ignite and spread rapidly. Wildfire prevention efforts, while crucial, are often insufficient to combat the scale and intensity of these increasingly frequent blazes.

- Statistical Data: Data from Cal Fire and other sources reveal a stark increase in the number of acres burned and the number of wildfires in Los Angeles County over the past decade. [Insert relevant statistics and source links here].

- Climate Change Impact: Rising temperatures, decreased precipitation, and earlier snowmelt significantly extend the wildfire season and increase the risk of intense, fast-spreading fires. [Insert relevant scientific studies and reports here].

- Wildfire Prevention Limitations: While preventative measures like controlled burns and improved forest management are vital, their effectiveness is limited when facing the combined challenges of climate change and population growth encroaching upon wildland areas.

Traditional Insurance and its Limitations in Covering Wildfire Risks

Homeowner's insurance plays a crucial role in protecting against property losses, but its effectiveness in covering wildfire risks is increasingly limited. While most policies include some level of fire coverage, including wildfires, the reality is often far from ideal. Rising premiums, coupled with coverage caps and stringent claim processes, leave many homeowners vulnerable to significant financial losses in the aftermath of a wildfire.

- Insurance Policy Coverage: Standard homeowner's insurance policies typically cover damage from wildfires, but often with limitations on the amount of coverage, deductibles, and specific exclusions. [Insert examples of policy clauses related to wildfire damage].

- Risk Assessment and Premiums: Insurance companies assess risk based on factors like proximity to wildland areas, vegetation density, and historical wildfire activity. This leads to significantly higher premiums for homeowners in high-risk zones.

- Challenges for Insurance Companies: Widespread wildfire damage can overwhelm insurance companies, leading to delays in claim processing and potential insolvency risks for smaller insurers.

The Emergence of Alternative Disaster Bets: Catastrophe Bonds and Derivatives

In response to the limitations of traditional insurance, alternative financial instruments are gaining traction. Catastrophe bonds (CAT bonds) and other catastrophe derivatives offer innovative ways to transfer wildfire risk. These complex financial instruments allow investors to assume some of the risk in exchange for a potentially high return.

- How CAT Bonds Work: CAT bonds are essentially insurance-linked securities. Investors provide capital to an insurance company or reinsurer, receiving a return if no major catastrophe occurs. If a specified event, such as a large-scale wildfire, triggers the bond, investors lose some or all of their principal.

- Investors in this Market: Hedge funds, pension funds, and other institutional investors are increasingly active in this market, seeking higher returns while diversifying their investment portfolios.

- Benefits and Risks of CAT Bonds: CAT bonds can provide a cost-effective way to transfer risk, particularly for large-scale events. However, investing in these instruments carries substantial risk, especially if a catastrophic event occurs.

The Ethical Considerations of Disaster Bets

The growing market for disaster bets raises significant ethical considerations. Profiting from the misfortune of others is a complex issue. Critics argue that it constitutes speculation on human suffering and disaster profiteering. Conversely, proponents argue that these instruments help to spread and mitigate risk, providing valuable capital for disaster relief and rebuilding efforts. The debate centers on balancing financial innovation with social responsibility.

The Regulatory Landscape of Disaster Bets and Gambling

The regulatory landscape governing disaster bets is complex and evolving. The market is subject to both insurance regulation, which focuses on the solvency and fairness of insurance products, and gambling regulation, particularly when it involves online betting markets, which vary widely by jurisdiction.

- Existing Regulations and Impact: Existing regulations largely focus on ensuring the solvency of insurers and the transparency of financial instruments. However, these regulations may not fully address the unique ethical challenges posed by disaster bets. [Include information on relevant SEC regulations, insurance regulations (like those of the California Department of Insurance), and any relevant federal laws].

- Potential Future Regulatory Changes: Increased scrutiny and potential regulatory changes are likely as the market for disaster bets expands. This could involve greater transparency requirements, stricter ethical guidelines, and potentially even limitations on certain types of disaster bets.

Conclusion

The increasing frequency and severity of Los Angeles wildfires are fundamentally changing the landscape of risk management. The market for disaster bets, encompassing traditional insurance, catastrophe bonds, and other financial instruments, is experiencing substantial growth. While offering innovative ways to mitigate financial losses, this market also raises important ethical and regulatory questions. Understanding the various options available and their implications is crucial for both individuals and institutions exposed to the risk of wildfire damage.

Call to Action: Learn more about how you can protect yourself against the financial risks of Los Angeles wildfires. Research different disaster bet options and find the best strategy to mitigate your risk. Don't wait until the next wildfire season; start planning your wildfire risk management strategy today!

Featured Posts

-

Chto Obsuzhdali Putin I Dzhonson Fokus Na Atomnykh Podlodkakh Rossii

May 12, 2025

Chto Obsuzhdali Putin I Dzhonson Fokus Na Atomnykh Podlodkakh Rossii

May 12, 2025 -

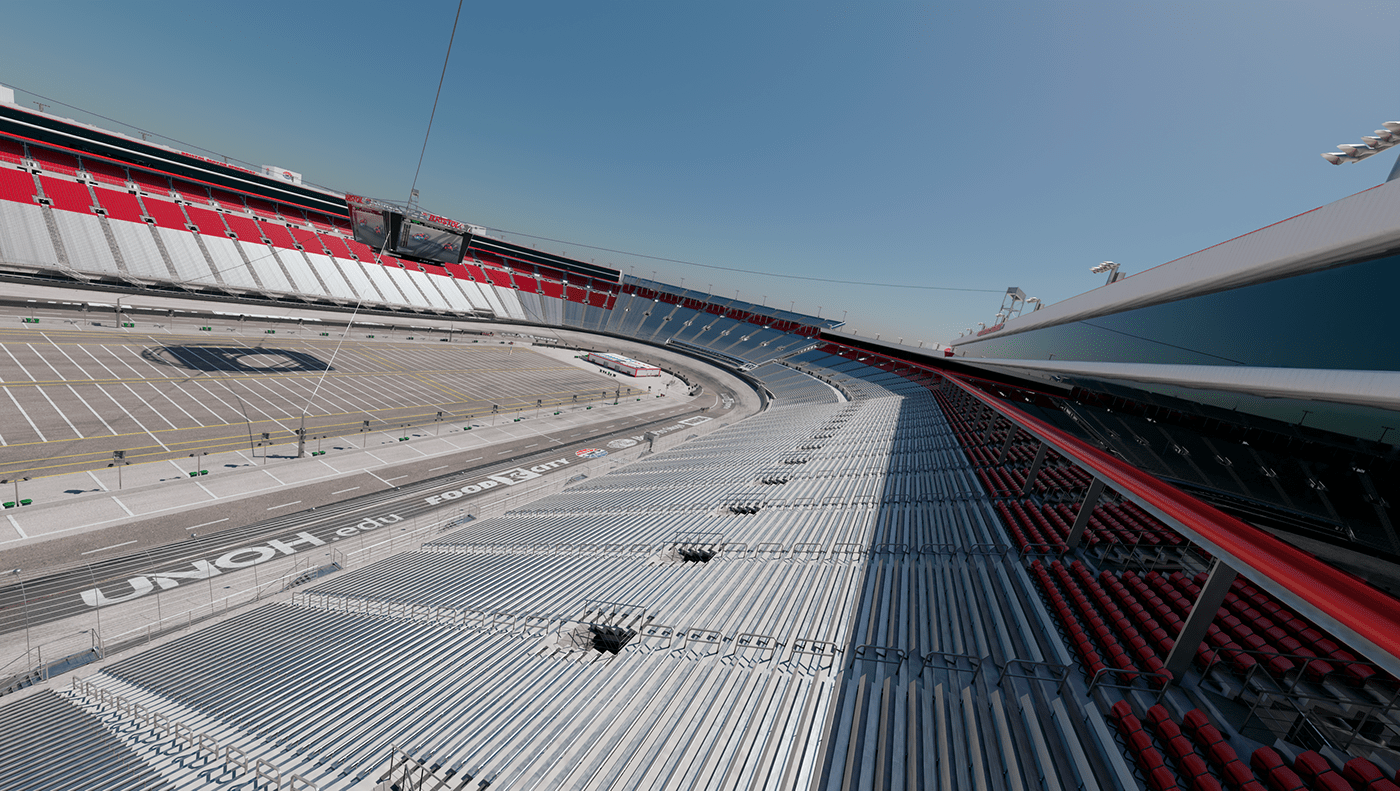

How Many Fans Will Attend The Bristol Speedway Classic Manfreds Perspective

May 12, 2025

How Many Fans Will Attend The Bristol Speedway Classic Manfreds Perspective

May 12, 2025 -

25 Years At Allianz Arena Thomas Muellers Poignant Farewell

May 12, 2025

25 Years At Allianz Arena Thomas Muellers Poignant Farewell

May 12, 2025 -

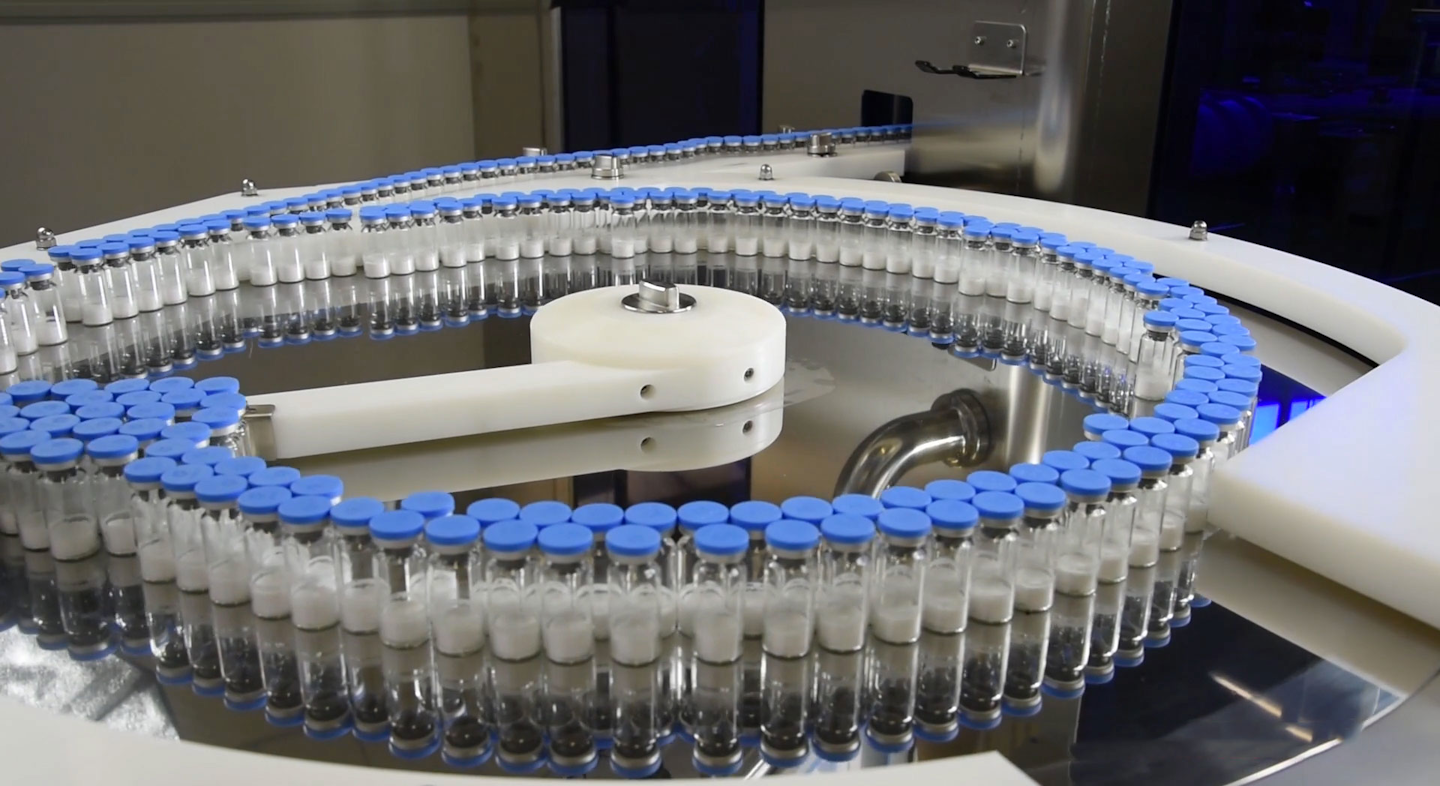

Strategies For Reliable Automated Visual Inspection Of Lyophilized Vials

May 12, 2025

Strategies For Reliable Automated Visual Inspection Of Lyophilized Vials

May 12, 2025 -

The Next Pope Examining Potential Candidates And Their Theological Views

May 12, 2025

The Next Pope Examining Potential Candidates And Their Theological Views

May 12, 2025