Low Mortgage Rates: A Catalyst For Canada's Housing Market Recovery?

Table of Contents

The Impact of Low Mortgage Rates on Affordability

Lower mortgage rates are undeniably a significant factor impacting affordability in the Canadian housing market. Reduced interest rates directly translate to lower monthly mortgage payments, making homeownership a more attainable goal for many. This increased affordability affects several key areas:

- Increased Borrowing Power: Lower interest rates mean borrowers can qualify for larger mortgages, even with the same income. This allows potential buyers to consider more expensive properties previously out of reach.

- Lower Monthly Payments for First-Time Homebuyers: The impact is particularly pronounced for first-time homebuyers often operating on tighter budgets. A lower monthly payment significantly reduces the financial burden of homeownership.

- Stimulated Demand: Increased affordability fuels demand, potentially pushing home prices higher due to increased competition among buyers.

The relationship between interest rates and purchasing power is inverse: lower interest rates increase purchasing power, while higher rates decrease it. This dynamic significantly influences the affordability of homes and plays a crucial role in market activity. Keywords related to this section include affordable housing, mortgage affordability, homeownership costs, interest rate impact.

Increased Buyer Demand and Market Activity

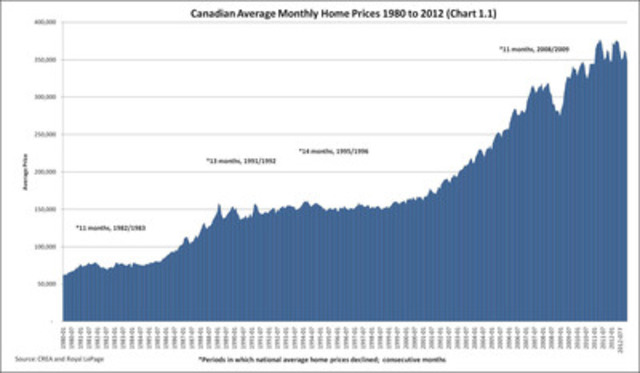

The correlation between low mortgage rates and increased buyer activity is clear. Data from recent months shows a noticeable uptick in home sales transactions across many Canadian markets. This surge in activity is characterized by:

- Rising Number of Home Sales: Statistics from the Canadian Real Estate Association (CREA) and other reputable sources provide quantitative evidence of increased sales activity.

- Increased Competition: The increased demand creates a more competitive market, leading to bidding wars and quicker sales.

- Shorter Time on Market: Properties are often selling faster than in previous periods of lower demand, reflecting the heightened interest from buyers.

These indicators point toward a more active market, fueled in part by the attractiveness of low mortgage rates. Relevant keywords include housing market trends, real estate activity, buyer demand, housing inventory.

Other Factors Influencing the Housing Market Recovery

While low mortgage rates are undeniably influential, it's crucial to acknowledge that they are not the sole determinant of Canada's housing market recovery. Several other key factors are at play:

- Government Policies and Regulations: Government interventions like stress tests and foreign buyer taxes significantly impact market dynamics. These policies aim to manage risk and affordability, influencing buyer behaviour.

- Economic Conditions: Employment rates, inflation, and overall economic stability play a critical role. A strong economy with low unemployment typically supports a healthy housing market.

- Supply and Demand Dynamics: The balance between housing supply and demand is crucial. Housing shortages in certain areas contribute to higher prices, even with relatively low mortgage rates. New construction plays a significant role in addressing supply-side pressures.

These factors interact in complex ways to shape the overall trajectory of the housing market. Keywords include housing policy, economic factors, housing supply, real estate market analysis.

Potential Risks and Challenges

Relying solely on low mortgage rates for a sustained housing market recovery presents several potential risks:

- Overvaluation: If prices rise too rapidly, fueled by low rates and high demand, there’s a risk of overvaluation, potentially leading to a future market correction.

- Increased Household Debt: Lower rates can encourage buyers to take on larger mortgages, increasing household debt levels and making them more vulnerable to economic shocks.

- Interest Rate Hikes: A sudden increase in interest rates could severely impact borrowers, potentially triggering defaults and market instability.

These risks highlight the need for a cautious approach, acknowledging that low mortgage rates are just one piece of a complex puzzle. Keywords here include housing market risk, debt levels, interest rate risk, housing bubble.

Conclusion: Low Mortgage Rates – A Catalyst, But Not the Only Answer

Low mortgage rates have undoubtedly played a significant role in increasing affordability and stimulating buyer demand, contributing to a more active Canadian housing market. However, it's crucial to understand that they are not the sole driver of the recovery. Government policies, economic conditions, and supply and demand dynamics all contribute to the overall market picture. A holistic view that considers all these factors is essential for navigating the complexities of Canada's dynamic housing market. Stay informed about the latest trends in low mortgage rates and consult with financial experts to make informed decisions regarding your real estate investments in Canada's dynamic housing market.

Featured Posts

-

La Rental Market Exploits Price Gouging After Recent Fires

May 13, 2025

La Rental Market Exploits Price Gouging After Recent Fires

May 13, 2025 -

Corruption Case Jeopardizes Colombias Pension Law

May 13, 2025

Corruption Case Jeopardizes Colombias Pension Law

May 13, 2025 -

New Zealands Apple Export Dominance Challenged By South Africa

May 13, 2025

New Zealands Apple Export Dominance Challenged By South Africa

May 13, 2025 -

Murderbots Existential Crisis A Hilarious Sci Fi Adventure

May 13, 2025

Murderbots Existential Crisis A Hilarious Sci Fi Adventure

May 13, 2025 -

Heist Sequel Hits Amazon Prime Everything You Need To Know

May 13, 2025

Heist Sequel Hits Amazon Prime Everything You Need To Know

May 13, 2025