Lower-Than-Expected PBOC Support For Yuan This Year

Table of Contents

Reasons for Reduced PBOC Support

The PBOC's lessened intervention in the Yuan exchange rate stems from a confluence of factors, shifting the focus from short-term currency management to longer-term economic goals.

Shifting Economic Priorities

The PBOC appears to be prioritizing domestic economic growth and structural reforms over maintaining a specific Yuan exchange rate band. This reflects a strategic shift towards long-term stability, even if it means accepting short-term fluctuations in the currency's value.

- Focus on Domestic Growth: The PBOC is increasingly focusing on stimulating domestic demand and fostering sustainable economic growth through targeted fiscal and monetary policies.

- Structural Reforms: The emphasis has shifted towards addressing structural imbalances within the Chinese economy, including reducing reliance on exports and fostering innovation.

- Reduced Exchange Rate Targeting: The PBOC's commitment to a tightly controlled exchange rate band seems to be waning, allowing for greater market-determined fluctuations.

- Policy Changes: Recent announcements from the PBOC indicate a move towards more flexible monetary policy tools, including adjustments to reserve requirements and interest rates, rather than direct Yuan intervention.

Concerns about Capital Flight

The PBOC's reduced support for the Yuan may also be linked to concerns about capital flight. Excessive intervention to prop up the currency could deplete foreign exchange reserves, potentially destabilizing the financial system.

- Preserving Foreign Exchange Reserves: The PBOC is likely wary of using its substantial foreign exchange reserves to defend the Yuan aggressively, preferring to conserve these reserves for unforeseen circumstances.

- Capital Outflow Scrutiny: Increased scrutiny of capital outflows is designed to curb speculative activity and maintain stability within the financial system.

- Risks of Intervention: Excessive intervention in the foreign exchange market can be counterproductive, potentially attracting speculative attacks and further weakening the Yuan.

- Scale of Potential Capital Flight: While precise figures are difficult to ascertain, analysts suggest that the potential for capital flight, particularly if the Yuan depreciates significantly, remains a major concern for the PBOC.

Global Economic Uncertainty

Global economic uncertainty, including high inflation and rising interest rates in major economies, has also influenced the PBOC's decision to reduce its support for the Yuan.

- Global Inflation and Interest Rate Hikes: Rising interest rates in the US and other developed economies have strengthened the US dollar, putting downward pressure on the Yuan.

- US Dollar Strength: The strong US dollar makes US assets more attractive to investors, potentially leading to capital outflow from China.

- Geopolitical Factors: Geopolitical tensions and uncertainties contribute to investor risk aversion, impacting investor confidence in the Chinese economy and the Yuan.

- Impact of Global Events: The ongoing war in Ukraine, for example, has created significant global economic uncertainty, directly impacting investor sentiment towards emerging market currencies like the Yuan.

Implications of Reduced PBOC Support

The PBOC's reduced support for the Yuan has significant implications for businesses, investors, and the global economy.

Impact on Businesses

Increased exchange rate volatility directly impacts businesses operating in China, particularly those heavily involved in import and export activities.

- Exchange Rate Volatility: Fluctuations in the Yuan's value create uncertainty for businesses, affecting import and export costs and making financial planning more challenging.

- Currency Risk Hedging: Businesses face increased challenges in hedging currency risk, requiring more sophisticated strategies and potentially higher costs.

- Profitability and Investment Decisions: Exchange rate volatility can impact profitability and influence investment decisions, potentially leading to delays or cancellations of projects.

- Impact on Specific Sectors: Sectors heavily reliant on imports or exports, such as manufacturing and trade, are particularly vulnerable to Yuan fluctuations.

Implications for Investors

For investors, the reduced PBOC support for the Yuan introduces increased risk and uncertainty.

- Increased Risk and Uncertainty: Investors in Chinese assets face increased risk due to the potential for further Yuan depreciation.

- Potential Capital Losses: Yuan depreciation can lead to capital losses for investors holding Yuan-denominated assets.

- Sophisticated Currency Risk Management: Investors need to employ sophisticated currency risk management strategies to mitigate potential losses.

- Impact on Investment Classes: The impact varies across different investment classes, with some potentially more exposed than others.

Wider Global Economic Effects

The PBOC's actions have potential ripple effects across global trade and financial markets.

- Ripple Effects on Global Trade: Yuan volatility can affect global trade flows, impacting businesses and consumers worldwide.

- Uncertainty for International Investors: The reduced PBOC support increases uncertainty for international investors considering investments in China.

- Impact on Global Inflation and Interest Rates: Changes in the Yuan's value can influence global inflation and interest rate dynamics.

- Potential Global Consequences: The reduced support could contribute to broader global economic uncertainty and financial market volatility.

Conclusion

The PBOC's lower-than-expected support for the Yuan reflects a significant shift in economic priorities and a more cautious approach to managing exchange rate volatility. This decision has profound implications for businesses, investors, and the global economy. The reduced intervention necessitates a more nuanced understanding of the evolving Chinese economic landscape and requires a reassessment of investment strategies to account for the increased currency risk.

Call to Action: Understanding the dynamics behind the PBOC's reduced Yuan support is paramount for successfully navigating the complexities of the Chinese economy. Stay informed about the latest developments regarding PBOC monetary policy and Yuan exchange rates to make well-informed investment decisions and effectively mitigate potential risks associated with the fluctuating Yuan. Learn more about managing your exposure to Yuan fluctuations and adapting your portfolio to this new economic environment.

Featured Posts

-

Jacob Wilson And Max Muncy A Potential 2025 Opening Day Reunion

May 16, 2025

Jacob Wilson And Max Muncy A Potential 2025 Opening Day Reunion

May 16, 2025 -

Understanding Jeremy Arndts Negotiation Role In Bvg Talks

May 16, 2025

Understanding Jeremy Arndts Negotiation Role In Bvg Talks

May 16, 2025 -

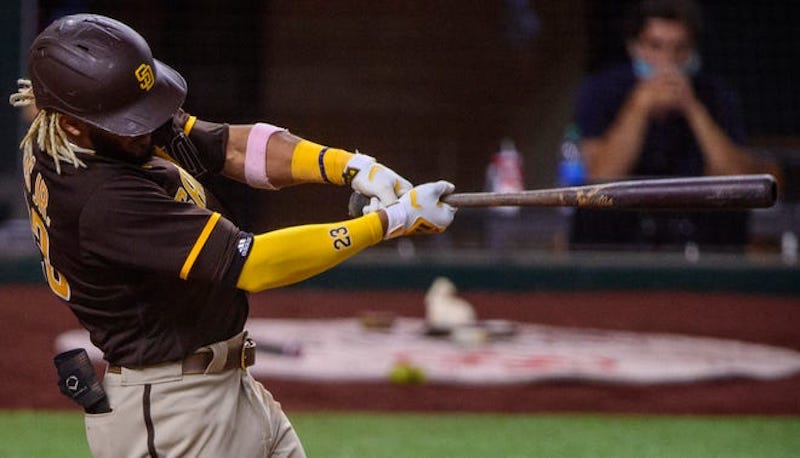

Taylor Wards Grand Slam Angels Upset Padres In 9th Inning

May 16, 2025

Taylor Wards Grand Slam Angels Upset Padres In 9th Inning

May 16, 2025 -

Will The Toronto Maple Leafs Clinch A Playoff Spot Against The Florida Panthers

May 16, 2025

Will The Toronto Maple Leafs Clinch A Playoff Spot Against The Florida Panthers

May 16, 2025 -

Oakland As Lineup Change Muncys Addition And Second Base Start

May 16, 2025

Oakland As Lineup Change Muncys Addition And Second Base Start

May 16, 2025