Lowest Personal Loan Interest Rates: Compare Offers Today

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several key factors influence the interest rate you'll receive on a personal loan. Understanding these factors is crucial to securing the lowest possible rate.

Credit Score

Your credit score is the most significant factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness and risk. A higher credit score indicates a lower risk to the lender, resulting in a lower interest rate.

- Higher credit score = lower rates: The better your credit history, the more favorable the interest rate you'll qualify for. Aim for a credit score above 700 for the best rates.

- Ways to improve your credit score: Paying bills on time, consistently, is paramount. Keeping your credit utilization ratio (the amount of credit you use compared to your total available credit) low is also crucial. Avoid applying for too much new credit in a short period.

- Impact of a lower credit score on loan approval: A lower credit score may make it harder to get approved for a loan, and if approved, the interest rate will likely be significantly higher. You may even be denied a loan altogether. Consider repairing your credit before applying if your score is low.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) represents the percentage of your monthly gross income that goes towards debt payments. Lenders use DTI to assess your ability to manage additional debt. A lower DTI generally leads to better interest rates.

- Calculating DTI: Divide your total monthly debt payments (including loan payments, credit card payments, etc.) by your gross monthly income.

- Ways to lower DTI: Pay down existing debts to reduce your monthly payments. Increasing your income through a raise or a second job can also lower your DTI.

- The impact of a high DTI on securing lower rates: A high DTI suggests you may struggle to repay a new loan, leading lenders to offer higher interest rates or deny your application.

Loan Amount and Term

The amount you borrow and the repayment term significantly impact your interest rate.

- Longer loan terms = lower monthly payments but higher overall interest: Spreading payments over a longer period reduces monthly payments but increases the total interest paid over the life of the loan.

- Shorter terms = higher payments but less interest paid overall: Shorter loan terms result in higher monthly payments, but you'll pay significantly less interest in the long run.

- The relationship between loan amount and interest rates: Larger loan amounts often come with slightly higher interest rates due to increased risk for the lender.

Lender Type

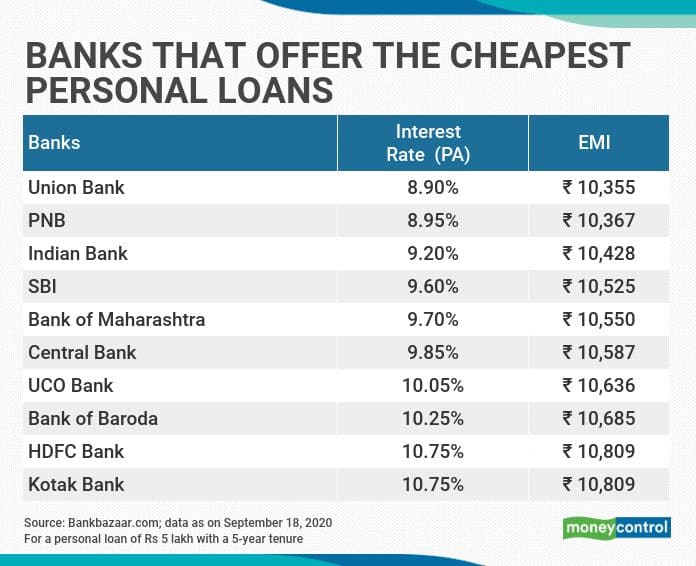

Different lenders offer varying interest rates. Banks, credit unions, and online lenders each have their own lending practices and criteria.

- Advantages and disadvantages of each lender type: Banks often offer a wide range of loan products but may have stricter lending requirements. Credit unions typically offer more competitive rates to their members. Online lenders often provide a convenient application process but may have higher fees.

- Potential variations in fees and terms: Always compare fees and terms, including origination fees, prepayment penalties, and late payment fees, across different lenders.

- Considerations for choosing a lender: Consider factors such as interest rates, fees, customer service, and the lender's reputation before making your decision.

How to Find the Lowest Personal Loan Interest Rates

Securing the lowest personal loan interest rates requires proactive steps.

Shop Around and Compare

Don't settle for the first offer you receive. Compare offers from multiple lenders to find the best rate.

- Using online comparison tools: Several websites allow you to compare personal loan offers from various lenders simultaneously.

- Checking individual lender websites: Visit the websites of individual banks, credit unions, and online lenders to compare their offerings directly.

- Considering pre-qualification offers: Pre-qualification allows you to see potential interest rates without impacting your credit score significantly.

Negotiate with Lenders

Don't be afraid to negotiate with lenders. A strong credit score and a competitive offer from another lender can strengthen your negotiating position.

- Highlighting a strong credit score: Emphasize your excellent credit history to demonstrate your low risk to the lender.

- Presenting a competitive offer from another lender: Showing you have received a lower rate from a competitor can often incentivize a lender to offer a better deal.

- Emphasizing a long-standing relationship with the bank: If you're a loyal customer, mention this to see if you qualify for preferential rates.

Consider Pre-Approval

Pre-approval gives you an idea of the interest rates you qualify for without impacting your credit score substantially.

- Pre-approval doesn't impact credit score significantly: A soft credit check is usually performed, which doesn't affect your credit score.

- Allows for better comparison shopping: Knowing your pre-approved rates empowers you to negotiate more effectively.

- Shows lenders your creditworthiness: Pre-approval demonstrates your creditworthiness to lenders, making you a more attractive borrower.

Avoiding Hidden Fees and Charges

Be aware of hidden fees that can significantly impact your loan's overall cost.

Origination Fees

Origination fees are charged by lenders to cover the administrative costs of processing your loan application.

- Negotiating lower origination fees: Sometimes, you can negotiate a lower origination fee.

- Comparing fees across lenders: Always compare origination fees across different lenders.

- Understanding the implications of these fees on monthly payments: Factor origination fees into your overall loan cost calculations.

Late Payment Fees

Late payments can lead to significant penalties that negatively impact your credit score.

- Strategies for avoiding late payments: Set up automatic payments to avoid missed payments. Budget carefully to ensure you can make your payments on time.

- The impact of late payments on credit score and future loan applications: Late payments severely damage your credit score, making it harder to obtain loans in the future with favorable interest rates.

- Understanding the terms and conditions regarding late payments: Carefully review the loan agreement to understand the consequences of late payments.

Conclusion

Finding the lowest personal loan interest rates requires careful research, comparison shopping, and understanding the factors that influence interest rates. By following the tips outlined above, you can significantly increase your chances of securing a loan with favorable terms. Start your search for the lowest personal loan interest rates today! Compare offers from multiple lenders and secure the best deal that fits your financial needs. Don't miss out on the opportunity to save money on your next personal loan, and remember to carefully consider all aspects of the loan, including fees and repayment terms, to ensure you're making the best financial decision for your situation.

Featured Posts

-

Koster Minta Bps Tak Masukkan Canang Sebagai Komoditas Inflasi

May 28, 2025

Koster Minta Bps Tak Masukkan Canang Sebagai Komoditas Inflasi

May 28, 2025 -

Nba Playoffs Mathurin And Hunter Involved In Game 4 Ejection

May 28, 2025

Nba Playoffs Mathurin And Hunter Involved In Game 4 Ejection

May 28, 2025 -

Is Kanye West Moving On New Romance Rumors Surface

May 28, 2025

Is Kanye West Moving On New Romance Rumors Surface

May 28, 2025 -

K Pops Amas Domination Rose Rm Jimin Ateez And Stray Kids In The Running

May 28, 2025

K Pops Amas Domination Rose Rm Jimin Ateez And Stray Kids In The Running

May 28, 2025 -

Padres Pregame Arraez Off Sheets Returns To Left Field

May 28, 2025

Padres Pregame Arraez Off Sheets Returns To Left Field

May 28, 2025