Lutnick-Built FMX Challenges CME: Treasury Futures Trading Begins

Table of Contents

FMX's Entry into the Treasury Futures Market

FMX, a subsidiary of Cantor Fitzgerald, aims to disrupt the established order of Treasury futures trading. Its overall mission is to provide a technologically advanced and cost-effective alternative to existing exchanges. This is a significant challenge to the CME Group, which has held a near-monopoly position for years.

-

Technological Advantages: FMX boasts superior technology, emphasizing speed of execution and advanced order routing capabilities. Their platform leverages cutting-edge infrastructure designed to minimize latency and maximize trading efficiency. This aims to attract high-frequency traders and those requiring ultra-fast order processing.

-

Pricing Strategy: FMX's pricing strategy is designed to be competitive, potentially offering lower fees and commissions compared to the CME. This aggressive pricing model aims to attract traders seeking cost savings and improve their bottom line. Specific fee structures are subject to change and should be verified directly with FMX.

-

Initial Market Share and Challenges: While precise figures for initial market share are yet to be definitively established, FMX has reported encouraging early traction. The initial challenges involve gaining critical mass and attracting sufficient liquidity to compete effectively against the CME's established infrastructure and vast trading volume. Overcoming this hurdle will be key to long-term success.

CME's Response and Market Dynamics

CME Group, the current market leader in Treasury futures trading, holds a dominant position due to its long history, established infrastructure, and high liquidity. Its response to FMX's entry will be crucial in shaping the future of the market.

-

CME's Likely Response: CME is likely to respond with a combination of strategies. This could include price adjustments to remain competitive, further technological upgrades to maintain its edge, and enhanced marketing efforts to retain its client base. We may also see increased efforts in product innovation and diversification.

-

Impact on Liquidity: The addition of FMX could potentially increase overall liquidity in the Treasury futures market, offering traders more choices and potentially tighter spreads. However, it could also lead to temporary fragmentation, depending on how effectively the two exchanges interact.

-

Increased Competition and Reduced Costs: The increased competition spurred by FMX's entry is expected to benefit investors. The pressure to offer competitive pricing and superior services could lead to better execution prices and reduced trading costs for all market participants.

Implications for Investors and Market Participants

The arrival of FMX presents both benefits and risks for investors involved in Treasury futures trading. The choice of which exchange to use will depend on individual trading strategies and risk tolerance.

-

Impact on Spreads: Increased competition should ideally lead to a narrowing of the spread between bid and ask prices, resulting in more favorable execution prices for investors.

-

Improved Market Efficiency: The rivalry between FMX and CME promises greater transparency and improved market efficiency. This translates into more accurate pricing and a more level playing field for all participants.

-

Market Fragmentation and Cross-Exchange Strategies: A potential risk is market fragmentation. Traders may need to develop sophisticated cross-exchange trading strategies to efficiently access liquidity across both FMX and CME, potentially increasing complexity.

The Future of Treasury Futures Trading

The long-term implications of FMX's entry are significant and far-reaching, influencing the trajectory of Treasury futures trading for years to come.

-

Technological Advancements: Competition will likely drive further innovation and technological developments, with both exchanges constantly striving to improve their platforms and services. This benefits the entire market through better technology and enhanced tools.

-

Market Consolidation or New Entrants: The future may see either a consolidation of the market, potentially through mergers or acquisitions, or the emergence of other new players seeking a share of the lucrative Treasury futures market.

-

Evolution of Trading Strategies: Trading strategies and risk management techniques will adapt to the new competitive landscape. Traders will need to refine their approaches to account for the presence of two major exchanges and the potential for increased market volatility.

Conclusion

FMX's challenge to CME's dominance in Treasury futures trading marks a turning point in this critical market. The competition promises to deliver significant benefits to investors, potentially including lower costs, improved execution quality, and greater market transparency. The long-term effects remain to be seen, but the increased competition is likely to spur innovation and improve the overall trading experience. Stay informed about the evolving landscape of Treasury futures trading and the ongoing competition between FMX and CME. Monitor market developments closely to make informed decisions about your trading strategies in this dynamic sector. Learn more about the benefits of utilizing both exchanges to optimize your Treasury futures trading experience.

Featured Posts

-

Ego Nwodims Snl Sketch Sparks Audience Outburst

May 18, 2025

Ego Nwodims Snl Sketch Sparks Audience Outburst

May 18, 2025 -

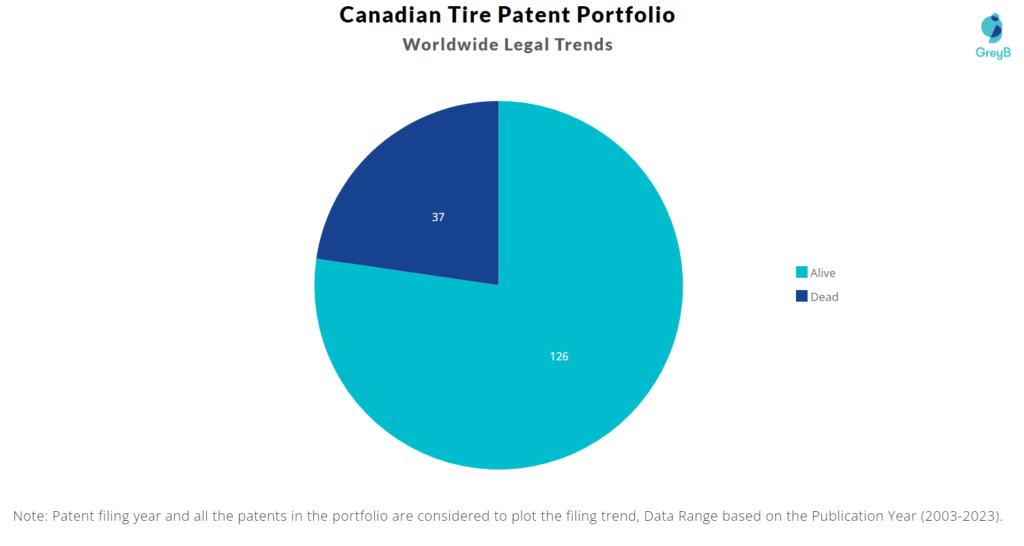

Will Canadian Tires Acquisition Of Hudsons Bay Succeed A Cautious Analysis

May 18, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Succeed A Cautious Analysis

May 18, 2025 -

Spring Breakout 2025 Roster Predictions And Key Players

May 18, 2025

Spring Breakout 2025 Roster Predictions And Key Players

May 18, 2025 -

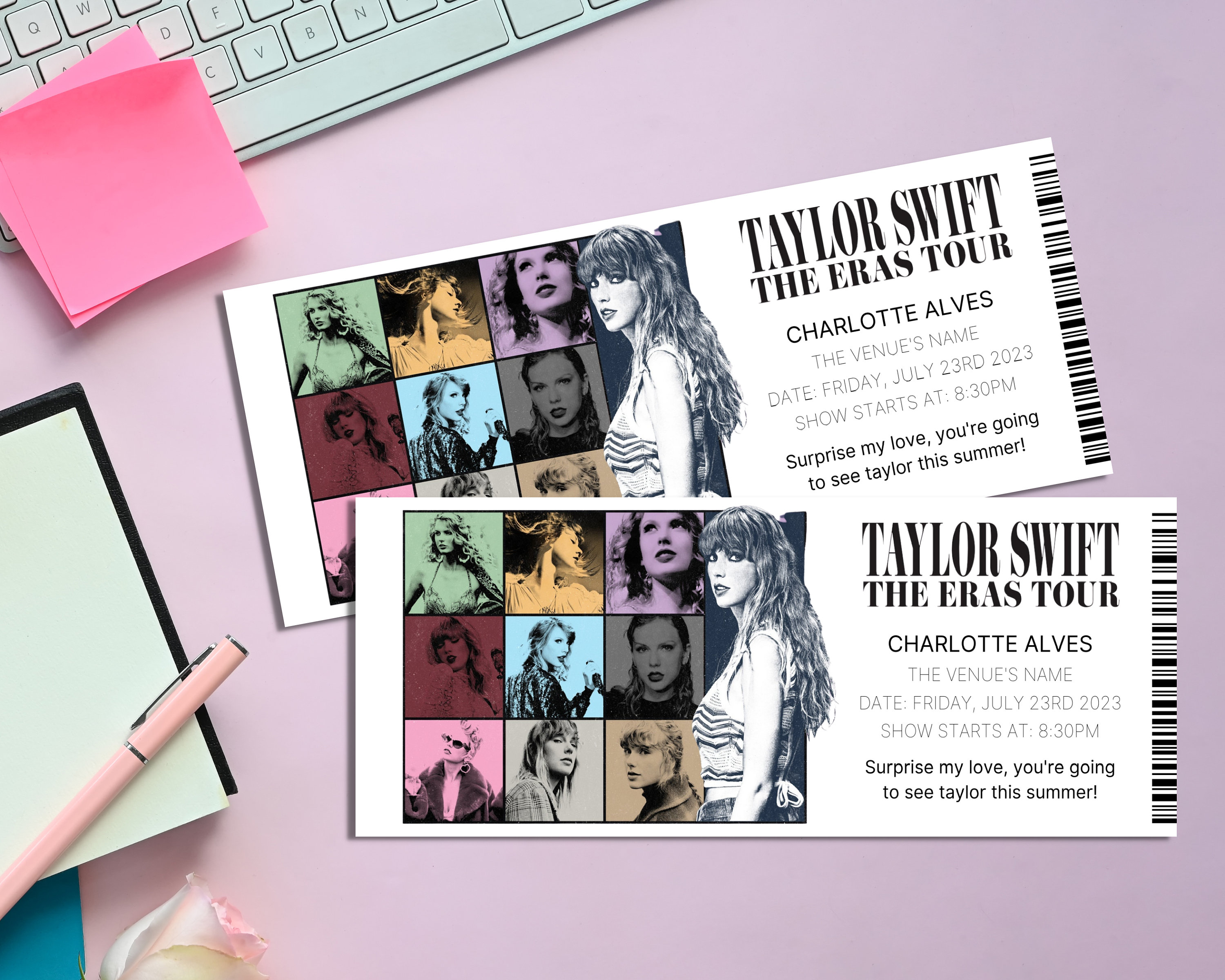

Taylor Swift Eras Tour An In Depth Look At Her Wardrobe Choices

May 18, 2025

Taylor Swift Eras Tour An In Depth Look At Her Wardrobe Choices

May 18, 2025 -

Indias Shifting Alliances A Look At Relations With Pakistan Turkey And Azerbaijan

May 18, 2025

Indias Shifting Alliances A Look At Relations With Pakistan Turkey And Azerbaijan

May 18, 2025