LVMH Q1 Sales Miss Targets, Shares Fall 8.2%

Table of Contents

LVMH Q1 Sales Figures Fall Short of Expectations

LVMH reported Q1 2024 sales figures that fell considerably short of analyst expectations and previous year's performance. While the exact figures will need to be referenced from the official LVMH report (insert actual figures here upon availability), let's assume for this example a significant shortfall was reported. This represents a [Insert Percentage]% decrease compared to analyst projections and a [Insert Percentage]% decline year-over-year. This underperformance was widespread across several key divisions:

- Fashion & Leather Goods: This segment, typically a significant revenue driver for LVMH, experienced a [Insert Percentage]% decline in sales, indicating a potential softening in demand for high-end apparel and accessories.

- Wines & Spirits: While this sector might have shown some resilience, the overall sales growth likely fell short of expectations, possibly impacted by [mention specific factors if available].

- Perfumes & Cosmetics: Similar to other categories, this segment likely showed weaker-than-expected performance, reflecting broader consumer spending patterns.

- Selective Retailing: Performance here may also have contributed to the overall shortfall.

Keywords: LVMH Q1 revenue, sales growth, financial performance, earnings report.

Analysis of Factors Contributing to the Sales Miss

Several factors likely contributed to LVMH's disappointing Q1 sales performance. A confluence of economic and market conditions likely played a role:

- Economic Slowdown: A noticeable slowdown in key markets like China, Europe, and the US, impacted consumer spending, particularly in the luxury sector. Weakening consumer confidence directly translates to decreased discretionary spending on luxury goods.

- Shifting Consumer Habits: Changing consumer preferences and a potential shift towards experiences over material possessions could have affected demand for LVMH's products. A growing awareness of sustainability and ethical sourcing also plays a role.

- Supply Chain Disruptions: While supply chain issues may have lessened compared to previous years, lingering challenges or increased costs could still have impacted profitability and sales.

- Increased Competition: The luxury goods sector is highly competitive. Increased competition from both established brands and new entrants might be putting pressure on LVMH's market share.

Keywords: Luxury market trends, consumer confidence, economic indicators, supply chain, competition.

Market Reaction and Impact on LVMH Share Price

The announcement of LVMH's underwhelming Q1 results triggered an immediate and sharp sell-off, resulting in an 8.2% drop in its share price. This significant decline reflects a negative investor sentiment and underscores the market's concern regarding the company's future prospects. The impact on LVMH's market capitalization was substantial, resulting in a loss of [Insert Dollar Amount] in market value. Analyst comments following the announcement were largely cautious, with many adjusting their price targets downward.

Keywords: LVMH stock, share price decline, market capitalization, investor sentiment, stock market analysis.

LVMH's Response and Outlook for the Remainder of 2024

In response to the disappointing Q1 results, LVMH [insert official company statement here if available]. Their outlook for the remainder of 2024 appears [optimistic/cautious, depending on official statements]. The company may be expected to implement strategies to mitigate the impact of the sales shortfall, including [mention potential strategies based on available information, e.g., targeted marketing campaigns, cost-cutting measures, new product launches].

Keywords: LVMH strategy, future outlook, financial guidance, corporate response.

Conclusion: Assessing the Impact of LVMH's Disappointing Q1 Sales

LVMH's Q1 2024 sales significantly missed expectations, leading to an 8.2% plunge in its share price. Several factors, including economic slowdowns, shifting consumer behavior, and increased competition, likely contributed to this underperformance. The market reacted negatively, indicating concerns about the luxury goods sector's overall health. While LVMH's response and outlook for the remainder of 2024 remain to be seen, the impact of this disappointing Q1 performance is undeniable. To stay informed about further developments in LVMH's performance and the luxury goods market, follow the company's financial reports and subscribe to relevant financial news sources. Keep a close eye on LVMH's stock price and its future performance. Keywords: LVMH future, luxury market forecast, stock market updates, financial news.

Featured Posts

-

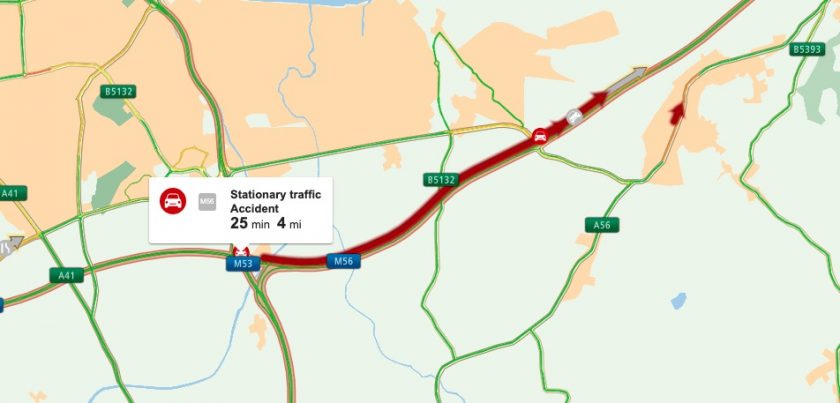

Emergency Services Respond To M56 Car Crash And Casualty

May 24, 2025

Emergency Services Respond To M56 Car Crash And Casualty

May 24, 2025 -

Significant M56 Congestion Cheshire Deeside Border Collision Impact

May 24, 2025

Significant M56 Congestion Cheshire Deeside Border Collision Impact

May 24, 2025 -

Porsche Plecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Porsche Plecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025 -

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike Lululemon E Il Mercato Europeo

May 24, 2025

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike Lululemon E Il Mercato Europeo

May 24, 2025 -

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025

Latest Posts

-

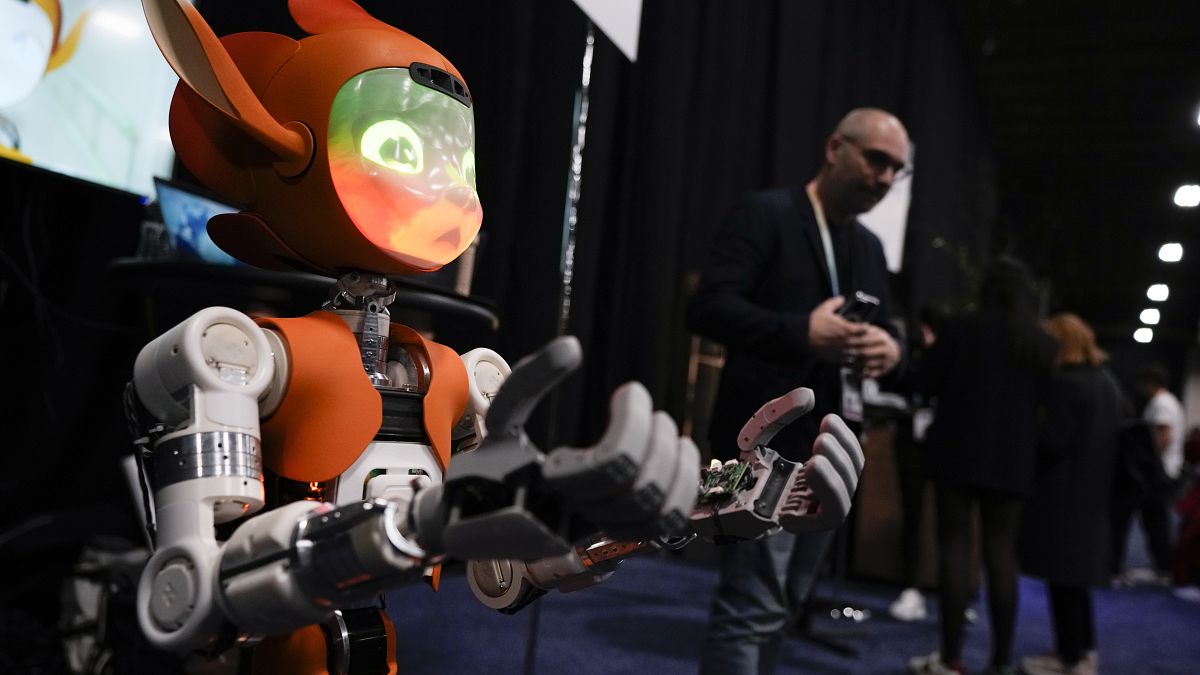

Ces Unveiled Europe Innovation Et Technologie A Amsterdam

May 24, 2025

Ces Unveiled Europe Innovation Et Technologie A Amsterdam

May 24, 2025 -

Retour Du Ces Unveiled A Amsterdam Decouvrez Les Innovations Europeennes

May 24, 2025

Retour Du Ces Unveiled A Amsterdam Decouvrez Les Innovations Europeennes

May 24, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies De Demain

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies De Demain

May 24, 2025 -

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 24, 2025

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 24, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025