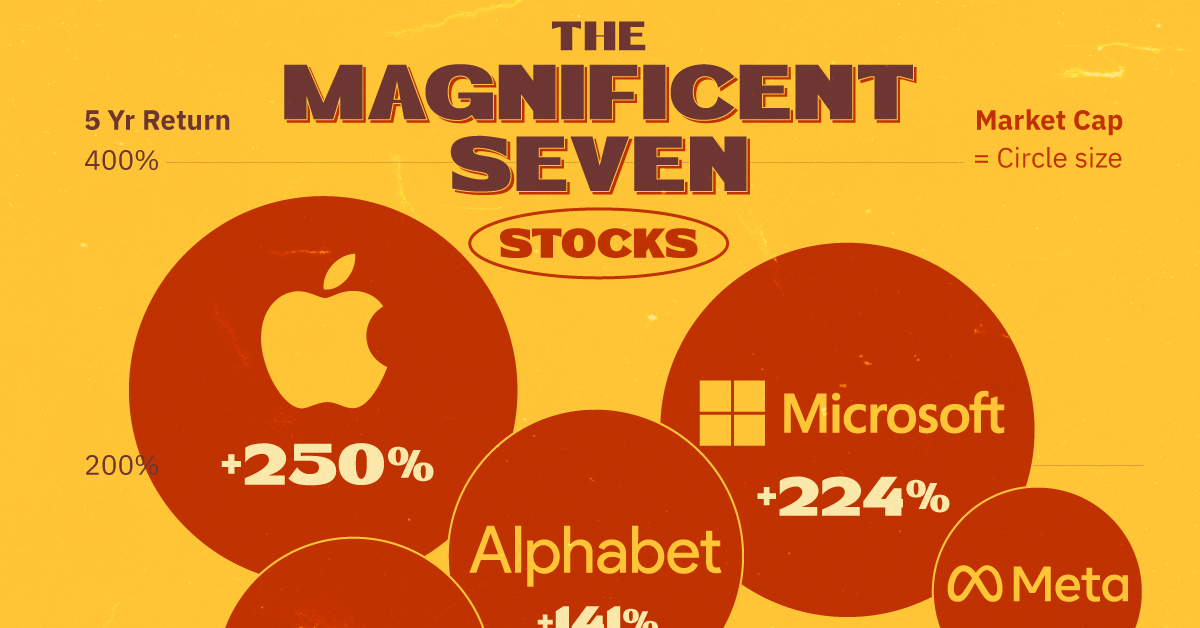

Magnificent Seven Stocks: $2.5 Trillion Market Value Lost In 2024

Table of Contents

The Leading Contributors to the $2.5 Trillion Loss

Individual Stock Performance Analysis

The $2.5 trillion loss wasn't evenly distributed across the Magnificent Seven. Each company experienced a significant downturn, impacting their individual market capitalization. To fully understand the scale of the decline, let's analyze the percentage loss for each company (Note: This section would ideally include a visually appealing chart or graph showing the percentage change in stock price for each company from the beginning of 2024 to a specified point).

- Apple: Experienced a [insert percentage]% decline in its stock price, losing approximately [insert dollar amount] in market capitalization.

- Microsoft: Suffered a [insert percentage]% drop, resulting in a market cap loss of around [insert dollar amount].

- Alphabet (Google): Saw a [insert percentage]% decrease, losing approximately [insert dollar amount] in market value.

- Amazon: Experienced a [insert percentage]% decline, with a market capitalization loss of about [insert dollar amount].

- Meta (Facebook): Suffered a [insert percentage]% drop, shedding approximately [insert dollar amount] in market value.

- Tesla: Experienced a [insert percentage]% decline, losing around [insert dollar amount] in market capitalization.

- Nvidia: Saw a [insert percentage]% decrease, losing approximately [insert dollar amount] in market value.

Keywords: Stock price decline, market capitalization loss, individual stock performance, Apple stock price, Microsoft stock price, Alphabet stock price, Amazon stock price, Meta stock price, Tesla stock price, Nvidia stock price.

Macroeconomic Factors Fueling the Decline

Interest Rate Hikes and Inflationary Pressures

Rising interest rates implemented by the Federal Reserve to combat inflation significantly impacted tech stock valuations. Higher interest rates increase borrowing costs, making it more expensive for companies to invest in expansion and innovation. This directly affects future growth projections, leading investors to reassess valuations.

- The Federal Reserve's aggressive monetary policy aimed to curb inflation, but it inadvertently dampened investor enthusiasm for high-growth tech stocks.

- Increased borrowing costs impacted both the Magnificent Seven's operational expenses and their ability to attract investment capital.

Geopolitical Uncertainty and Its Ripple Effects

Geopolitical instability, including [mention specific geopolitical events, e.g., the war in Ukraine, trade tensions between the US and China], created uncertainty in the global market. This uncertainty led to risk aversion among investors, causing a sell-off in riskier assets like tech stocks.

- The war in Ukraine disrupted supply chains and increased energy prices, further exacerbating inflationary pressures.

- Trade tensions between major economies added to the overall market uncertainty, prompting investors to seek safer investments.

Keywords: Inflation, interest rates, Federal Reserve, monetary policy, geopolitical risk, investor sentiment, market volatility.

Sector-Specific Challenges Facing the Magnificent Seven

Increased Competition and Market Saturation

The tech sector is experiencing unprecedented competition. New entrants and disruptive technologies are challenging the dominance of the Magnificent Seven. Market saturation in some areas, particularly in the smartphone and social media markets, has also contributed to slower growth.

- The emergence of [mention specific competitors or technologies] has intensified competition and eroded market share for some of the Magnificent Seven.

- Increased competition forces these companies to invest more heavily in research and development to maintain a competitive edge.

Regulatory Scrutiny and Antitrust Concerns

Increased regulatory scrutiny and antitrust investigations have created headwinds for the Magnificent Seven. Concerns over monopolistic practices and data privacy have led to regulatory actions impacting their operations and valuations.

- Antitrust lawsuits and investigations have added to the uncertainty surrounding the future of these companies.

- Regulatory changes related to data privacy and online advertising have impacted revenue streams.

Keywords: Competition, market saturation, regulatory pressure, antitrust, market share, tech regulation.

Investor Sentiment and Market Volatility

Shift in Investor Confidence

Investor confidence in the Magnificent Seven has waned significantly in 2024. Negative news, disappointing earnings reports, and analyst downgrades contributed to a broader sell-off.

- Concerns over slowing revenue growth and increased competition fueled a decline in investor confidence.

- Negative media coverage and public scrutiny amplified the negative sentiment surrounding these companies.

Increased Market Volatility and its Impact

The overall market experienced heightened volatility in 2024. This volatility amplified the impact of negative news on the Magnificent Seven's stock prices, leading to significant fluctuations.

- Rapid and unpredictable swings in the market exacerbated the losses experienced by the Magnificent Seven.

- Increased market volatility created uncertainty and risk aversion among investors.

Keywords: Investor confidence, market volatility, stock market fluctuations, risk aversion, earnings reports.

Conclusion: Navigating the Aftermath of the Magnificent Seven's Decline

The $2.5 trillion market value loss suffered by the Magnificent Seven in 2024 highlights the interconnectedness of macroeconomic factors, sector-specific challenges, and investor sentiment. The decline underscores the inherent risks associated with investing in high-growth tech stocks, particularly in times of economic uncertainty. While the future remains uncertain, understanding the factors contributing to this decline is crucial for navigating the evolving tech market. Staying informed about the future performance of the Magnificent Seven and the broader tech sector is critical for investors. Stay informed about the future performance of the Magnificent Seven stocks and navigate the evolving tech market by subscribing to our newsletter for daily updates on market capitalization analysis and tech stock market trends.

Featured Posts

-

Dsv Leoben Neues Trainerteam Fuer Die Regionalliga Mitte

Apr 29, 2025

Dsv Leoben Neues Trainerteam Fuer Die Regionalliga Mitte

Apr 29, 2025 -

Pw C Philippines Opens New Bgc Office

Apr 29, 2025

Pw C Philippines Opens New Bgc Office

Apr 29, 2025 -

Jeff And Emilie Goldblums Sons At Italian Football Game

Apr 29, 2025

Jeff And Emilie Goldblums Sons At Italian Football Game

Apr 29, 2025 -

Nyt Spelling Bee March 14 2025 Complete Guide To Todays Puzzle

Apr 29, 2025

Nyt Spelling Bee March 14 2025 Complete Guide To Todays Puzzle

Apr 29, 2025 -

Dwindling Resources In Gaza Calls To End Israels Aid Ban Intensify

Apr 29, 2025

Dwindling Resources In Gaza Calls To End Israels Aid Ban Intensify

Apr 29, 2025