Mangalia Shipyard: Desan's Acquisition Bid

Table of Contents

Desan's Profile and Acquisition Strategy

Desan Group Overview

Desan Group, a [insert relevant industry sector] conglomerate, is known for its [mention key characteristics: strong financial standing, innovative approach, etc.]. While specifics regarding their financial performance are [mention source if available, otherwise say "not publicly available in detail"], their previous acquisitions in [mention relevant sectors, if any] demonstrate a strategic focus on [mention their overarching business strategy]. Understanding Desan Group's corporate strategy is crucial to assessing their potential impact on Mangalia Shipyard. Their acquisition history suggests a focus on [mention key acquisition patterns: market consolidation, technological advancement, etc.], which could offer clues to their long-term vision for the Romanian shipyard. Keywords: Desan Group, financial performance, corporate strategy, acquisition history, Romanian investment.

The Rationale Behind the Mangalia Shipyard Bid

Desan's interest in Mangalia Shipyard likely stems from several factors. A strategic acquisition of this scale could offer significant benefits, including: expanding their market reach into the European Union and beyond; gaining access to skilled labor and existing infrastructure; and acquiring a strategically valuable asset in a growing market. The Romanian market, with its potential for growth in the shipbuilding sector, presents a lucrative opportunity for expansion. Keywords: strategic acquisition, market expansion, business growth, Romanian market, shipyard privatization.

- Potential Synergies: Desan might leverage existing expertise and resources to streamline operations and improve efficiency at Mangalia Shipyard.

- Proposed Investment Plans: Modernization of facilities, expansion of production capacity, and investment in new technologies are likely key elements of Desan's proposed investment.

- Long-Term Vision: Desan's long-term vision likely involves transforming Mangalia Shipyard into a modern, competitive shipbuilding facility, contributing to the growth of the Romanian economy.

Impact on Mangalia Shipyard and its Workforce

Potential Benefits for Mangalia Shipyard

The Desan acquisition could bring substantial benefits to Mangalia Shipyard. Increased investment in modernization and upgrades could lead to enhanced competitiveness in the global shipbuilding market. This, in turn, could secure long-term job security for the workforce and attract new talent. Economic development in the surrounding region could also be stimulated by increased activity and investment. Keywords: job creation, economic development, modernization, shipyard upgrade, investment in Romania.

Potential Challenges and Risks

Despite the potential benefits, the acquisition also presents challenges. Restructuring is likely, potentially leading to job losses in certain areas, even as new roles are created elsewhere. Integration of different management styles and corporate cultures could also prove difficult. A thorough risk assessment is crucial to mitigate potential negative impacts. Keywords: job security, restructuring, integration challenges, risk assessment, shipyard privatization.

- Impact on Employees: Existing employees may face uncertainty regarding their roles and responsibilities, requiring transparent communication and retraining initiatives.

- Changes in Operations: Operational changes are likely, potentially affecting work processes, production methods, and overall efficiency.

- Social and Environmental Impacts: The acquisition should consider its impact on the local community and the environment, implementing sustainable practices.

Regulatory and Political Aspects of the Acquisition

Romanian Government's Role

The Romanian government plays a crucial role in the approval process. Existing privatization policies and regulations will significantly influence the outcome of the bid. Transparency and adherence to legal frameworks are critical to ensure a fair and efficient acquisition process. Keywords: government regulation, approval process, privatization policy, Romanian government, shipyard privatization.

Competition and Market Dynamics

The acquisition could significantly alter the competitive landscape of the Romanian and international shipbuilding market. Analysis of potential market share shifts, and the reactions of competitors, is crucial. Keywords: market competition, industry analysis, global shipbuilding, market share.

- Legal and Regulatory Hurdles: Navigating legal and regulatory hurdles will be a key challenge for Desan.

- Reactions from Competitors: Existing players in the market may respond strategically to Desan's acquisition.

- Long-Term Implications: The long-term implications for the Romanian shipbuilding industry will depend on how effectively the acquisition is managed and integrated.

Conclusion: The Future of Mangalia Shipyard Under Desan's Potential Ownership

Desan's acquisition bid for Mangalia Shipyard presents a complex scenario with both significant opportunities and potential risks. While the potential for modernization, increased investment, and job creation is considerable, challenges related to restructuring and integration must be addressed proactively. The Romanian government's role in overseeing the process will be vital in ensuring a positive outcome for all stakeholders. The future of Mangalia Shipyard under Desan's potential ownership hinges on effective management, transparent communication, and a commitment to sustainable growth. To stay informed about further developments regarding the Mangalia Shipyard and Desan's acquisition bid, follow reputable news sources specializing in Romanian business and the shipbuilding industry.

Featured Posts

-

Hollywood Production Halted Wga And Sag Aftra Strike Update

Apr 26, 2025

Hollywood Production Halted Wga And Sag Aftra Strike Update

Apr 26, 2025 -

The Osimhen Transfer Why Manchester United Face A Financial Hurdle

Apr 26, 2025

The Osimhen Transfer Why Manchester United Face A Financial Hurdle

Apr 26, 2025 -

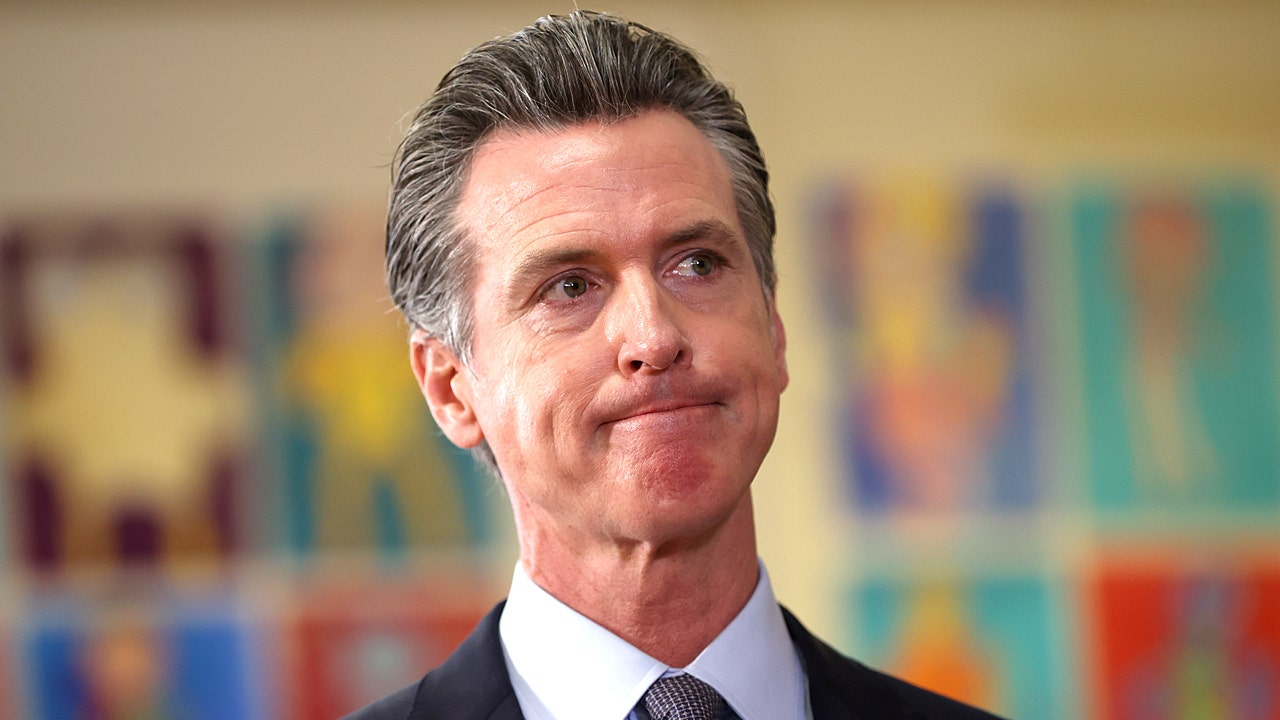

Barstools Portnoy Attacks California Governor Newsom

Apr 26, 2025

Barstools Portnoy Attacks California Governor Newsom

Apr 26, 2025 -

Ray Epps Sues Fox News For Defamation A Deep Dive Into The January 6th Claims

Apr 26, 2025

Ray Epps Sues Fox News For Defamation A Deep Dive Into The January 6th Claims

Apr 26, 2025 -

Price Gouging Allegations Against La Landlords Surface After Recent Fires

Apr 26, 2025

Price Gouging Allegations Against La Landlords Surface After Recent Fires

Apr 26, 2025

Latest Posts

-

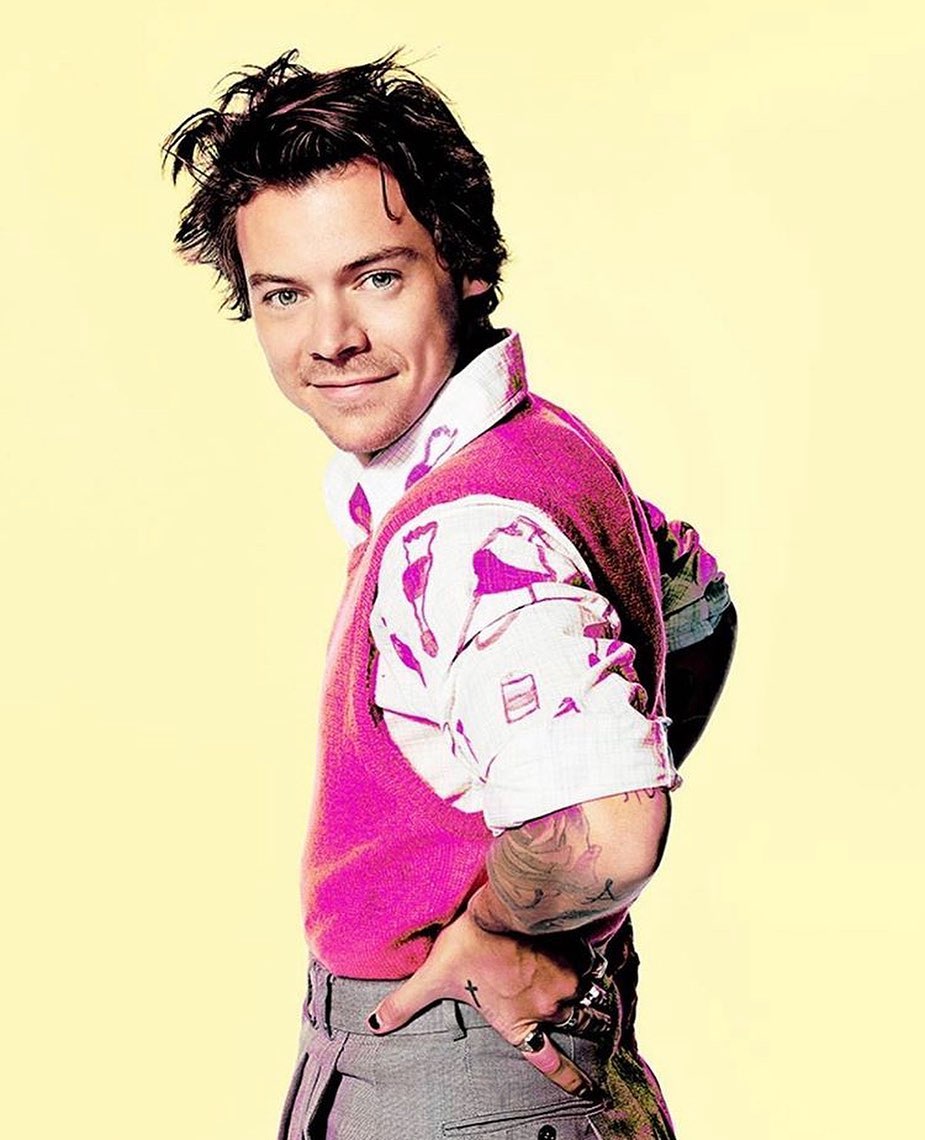

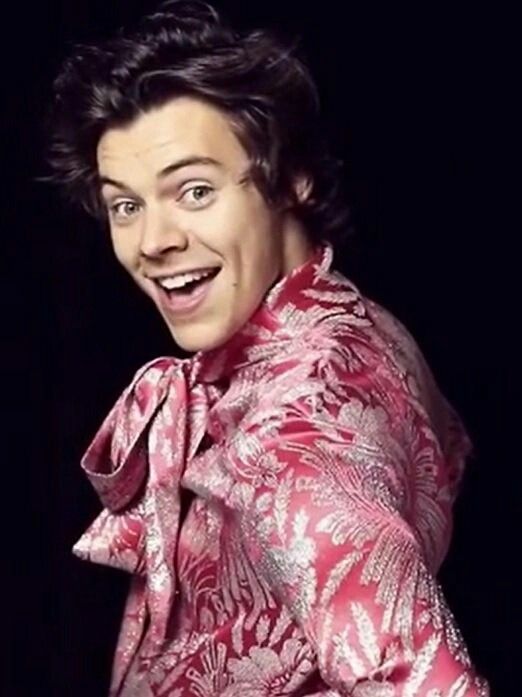

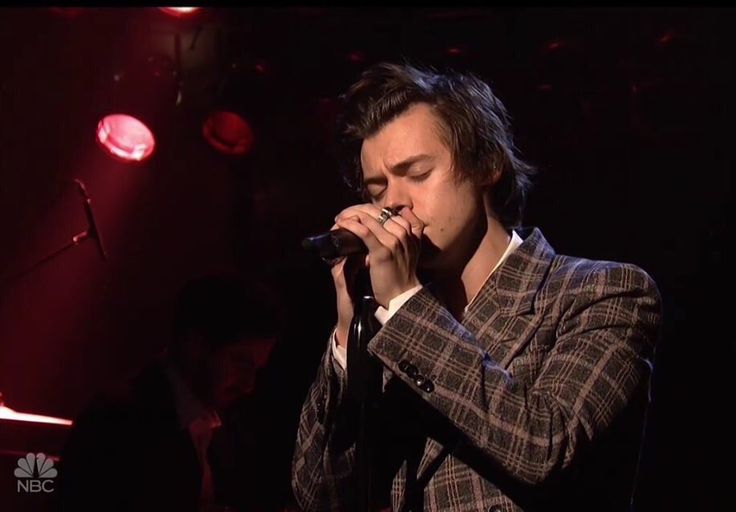

Snls Failed Harry Styles Impression His Honest Response

May 09, 2025

Snls Failed Harry Styles Impression His Honest Response

May 09, 2025 -

The Snl Impression That Upset Harry Styles

May 09, 2025

The Snl Impression That Upset Harry Styles

May 09, 2025 -

Harry Styles Snl Impression A Disappointing Reaction

May 09, 2025

Harry Styles Snl Impression A Disappointing Reaction

May 09, 2025 -

Harry Styles Reaction To His Subpar Snl Impression

May 09, 2025

Harry Styles Reaction To His Subpar Snl Impression

May 09, 2025 -

Harry Styles Response To A Critically Bad Snl Impression

May 09, 2025

Harry Styles Response To A Critically Bad Snl Impression

May 09, 2025