Market Analysis: Dow Futures, Gold Prices, And Current Economic Uncertainty

Table of Contents

Dow Futures: A Leading Indicator of Market Sentiment

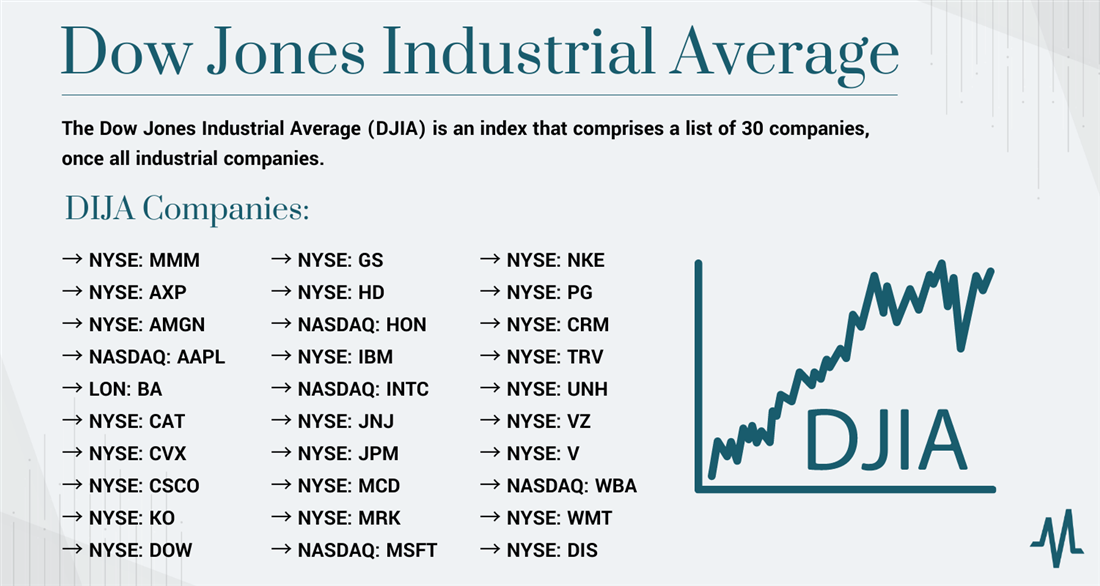

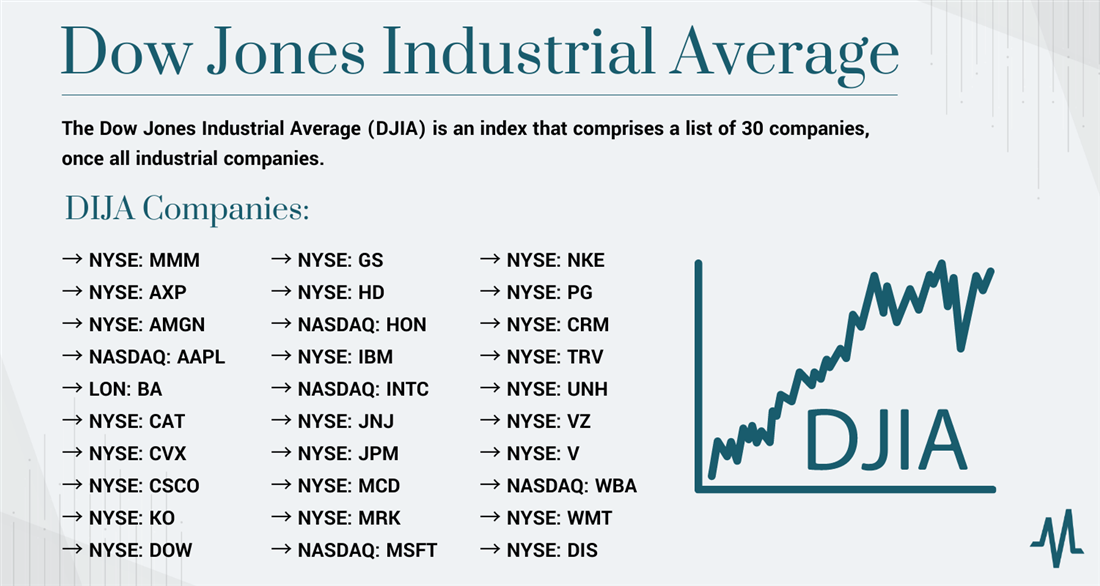

Dow Futures contracts are derivative instruments that track the expected future performance of the Dow Jones Industrial Average (DJIA). They act as a powerful predictor of stock market sentiment, offering insights into investor expectations and overall market direction. Recent trends in Dow Futures have been highly volatile, reflecting the uncertainty in the broader economy. Analyzing these trends is critical for any investor seeking to understand potential market movements.

- Analysis of recent Dow Futures price movements: A close examination of daily, weekly, and monthly charts reveals significant fluctuations, often mirroring reactions to major economic news releases.

- Factors influencing Dow Futures: Several factors significantly impact Dow Futures prices, including interest rate hikes by central banks (like the Federal Reserve), inflation data releases (CPI and PPI), and geopolitical events (such as international conflicts or trade disputes).

- Potential scenarios for Dow Futures: Based on current economic data, several scenarios are plausible, ranging from a continued period of volatility to a more sustained upward or downward trend, depending on how various economic factors resolve.

- Technical analysis of Dow Futures charts: Employing technical analysis tools, such as moving averages, relative strength index (RSI), and support/resistance levels, can provide further insights into potential price movements. However, remember that technical analysis alone should not be the sole basis for investment decisions.

Gold Prices: A Safe Haven in Times of Uncertainty

Gold has historically served as a safe-haven asset, attracting investors during times of economic and political uncertainty. When market volatility increases and other assets decline, investors often flock to gold, perceiving it as a store of value that holds its worth relatively better during turbulent periods. Recent gold price fluctuations directly reflect the current economic anxieties.

- Factors affecting gold prices: Several factors impact gold prices, notably inflation (gold often rises in value during inflationary periods), the strength of the US dollar (an inverse relationship often exists), and geopolitical risks (global instability often drives gold demand).

- Correlation between gold prices and Dow Futures movements: Often, an inverse correlation exists between gold prices and Dow Futures. When Dow Futures fall, indicating bearish market sentiment, gold prices tend to rise as investors seek refuge in the safe-haven asset.

- Potential future price movements for gold: Predicting future gold prices is challenging, but considering current market conditions, such as inflation and interest rate expectations, allows for informed speculation.

- Strategies for investing in gold: Investors can access the gold market through various avenues, including physical gold (bars and coins), gold exchange-traded funds (ETFs), and gold mining stocks. Each option carries unique risks and rewards.

The Interplay Between Dow Futures, Gold Prices, and Economic Uncertainty

The relationship between Dow Futures, gold prices, and macroeconomic factors is complex but crucial to understand. Analyzing this interplay is key to making informed investment choices.

- Correlation analysis between Dow Futures and gold prices: As mentioned, a negative correlation frequently exists, suggesting investors shift between risk-on (Dow Futures) and risk-off (gold) assets depending on their assessment of economic conditions.

- Impact of inflation on both Dow Futures and gold prices: High inflation tends to negatively affect Dow Futures (as it erodes corporate profits) and positively impact gold prices (as it's considered a hedge against inflation).

- Influence of interest rate changes on both assets: Interest rate hikes usually pressure Dow Futures (higher borrowing costs reduce corporate investment and consumer spending) and may initially suppress gold prices (as higher rates make holding non-interest-bearing assets like gold less attractive). However, in the long-term, high interest rates can increase gold's appeal as inflation may soar.

- Diversification strategies considering both Dow Futures and gold: Incorporating both Dow Futures and gold into a diversified portfolio can help mitigate overall risk. The allocation depends on individual risk tolerance and investment goals.

Strategies for Navigating Market Volatility

Managing risk during periods of economic uncertainty is paramount. Developing a well-defined investment strategy aligned with your risk tolerance is essential.

- Diversification strategies to minimize risk: Diversification across asset classes (stocks, bonds, commodities, real estate) is crucial to reduce portfolio volatility.

- Importance of risk assessment and tolerance: Honestly assessing your risk tolerance is vital before making any investment decisions. Avoid investments you don't fully understand.

- Hedging strategies using Dow Futures or gold: Utilizing Dow Futures or gold as a hedge against market downturns can help protect your portfolio from significant losses.

- Importance of long-term investment planning: Long-term investment planning helps navigate short-term market fluctuations, focusing on consistent growth over time.

Conclusion: Making Informed Decisions in Uncertain Markets

This market analysis highlights the intricate relationship between Dow Futures, gold prices, and the current economic climate. Monitoring these key indicators is essential for developing effective investment strategies. Remember that market volatility is inherent, and understanding the interplay between these assets helps prepare you for unexpected events. To successfully navigate market uncertainty and build a resilient portfolio, stay informed, conduct thorough market analysis, develop a robust investment strategy, and, critically, seek professional financial advice before making any investment decisions related to Dow Futures, Gold Prices, and understanding current economic uncertainty. Don't hesitate to consult with a qualified financial advisor to tailor a strategy that aligns with your specific financial goals and risk tolerance.

Featured Posts

-

Is Ai Revolutionizing Wildlife Conservation Exploring The Positive And Negative Impacts

Apr 23, 2025

Is Ai Revolutionizing Wildlife Conservation Exploring The Positive And Negative Impacts

Apr 23, 2025 -

Yankees Historic Night 9 Home Runs Judges Triple Crown Performance

Apr 23, 2025

Yankees Historic Night 9 Home Runs Judges Triple Crown Performance

Apr 23, 2025 -

Exec Office365 Breach Nets Millions For Hacker Feds Allege

Apr 23, 2025

Exec Office365 Breach Nets Millions For Hacker Feds Allege

Apr 23, 2025 -

Hollywood Production Grinds To Halt As Actors Join Writers Strike

Apr 23, 2025

Hollywood Production Grinds To Halt As Actors Join Writers Strike

Apr 23, 2025 -

Comparing The Public Perception Of Blue Origins Failures And Katy Perrys Career Trajectory

Apr 23, 2025

Comparing The Public Perception Of Blue Origins Failures And Katy Perrys Career Trajectory

Apr 23, 2025