Market Downturns: Opportunities For Individual Investors?

Table of Contents

Identifying Market Downturns and Their Causes

A market downturn is characterized by a sustained decline in major market indices, such as the S&P 500 or the Dow Jones Industrial Average. These declines often represent a significant correction from recent highs, typically defined as a drop of 20% or more. Understanding the causes of these downturns is crucial for effective navigation. Several factors can trigger a market downturn, including:

-

Economic Recessions: A widespread economic slowdown characterized by reduced consumer spending, increased unemployment, and decreased business investment often leads to market declines. Recessions historically correlate with significant market downturns.

-

Geopolitical Events: Global conflicts, political instability, and unexpected international events can create uncertainty and trigger market volatility, sometimes resulting in sharp downturns. The impact depends on the severity and global reach of the event.

-

Interest Rate Hikes: Central banks often raise interest rates to combat inflation. Higher interest rates can increase borrowing costs for businesses and consumers, slowing economic growth and impacting market valuations.

-

Inflation: Sustained increases in the general price level erode purchasing power and can lead to decreased investor confidence, impacting market performance. High inflation often prompts central banks to raise interest rates, creating a double whammy for markets.

Key Indicators of Market Downturns:

- Bear Market: A bear market is defined as a decline of 20% or more from a recent market high. It's a significant indicator of a downturn.

- Recessionary Indicators: Economic indicators like GDP growth, unemployment rates, and consumer confidence can signal an impending or ongoing recession, usually preceding market downturns.

- Inverted Yield Curve: When short-term interest rates exceed long-term rates, it's often seen as a predictor of an upcoming recession and subsequent market downturn.

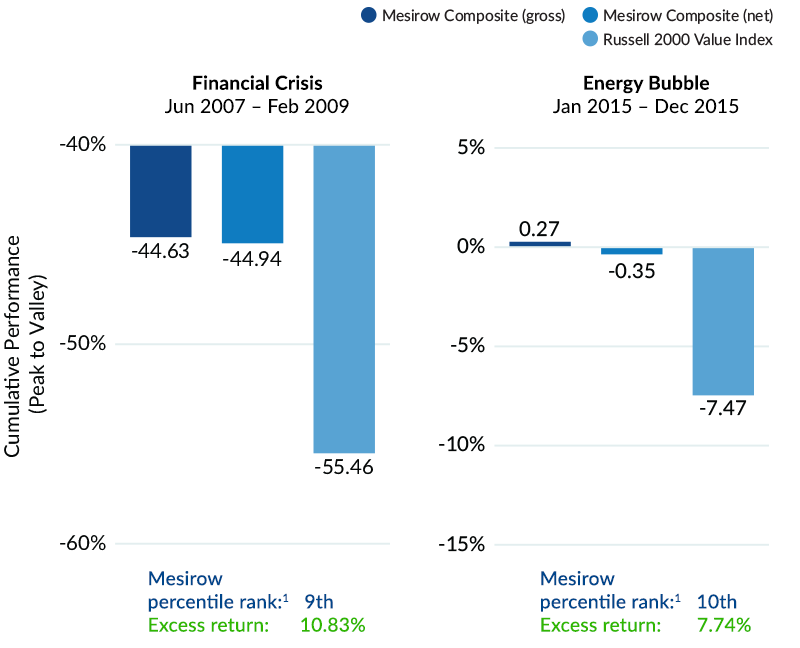

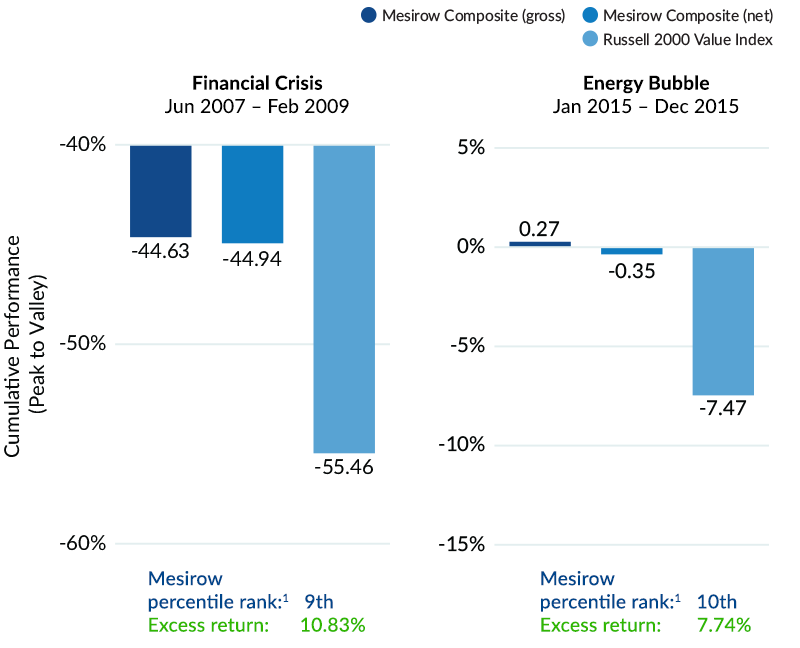

Examples of Historical Market Downturns: The 2008 financial crisis, triggered by the subprime mortgage crisis, and the dot-com bubble burst of 2000 are prime examples of significant market downturns with distinct underlying causes.

Risk Mitigation Strategies During Market Downturns

Navigating market downturns effectively requires a robust risk mitigation strategy. This strategy should encompass several key elements:

Diversification: A well-diversified portfolio across different asset classes (stocks, bonds, real estate, commodities, etc.) is crucial. Diversification reduces the impact of any single asset class performing poorly.

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak.

Asset Allocation and Risk Tolerance: Your investment strategy should align with your risk tolerance and investment timeline. Conservative investors may reduce their equity exposure during downturns, while more aggressive investors might seek opportunities.

Bullet Points:

- Diversify across asset classes: Reduce your reliance on any single investment.

- Maintain an emergency fund: Having 3-6 months of living expenses in a readily accessible account provides a safety net.

- Reduce high-interest debt: Lowering debt frees up cash flow and reduces financial stress during market volatility.

- Adjust your strategy based on your risk profile: A young investor with a long time horizon can tolerate more risk than someone nearing retirement.

Capitalizing on Discounted Assets

Market downturns create compelling buying opportunities for long-term investors. Prices of many assets are temporarily depressed, presenting a chance to acquire valuable assets at a discount.

Value Investing: Value investing focuses on identifying undervalued companies with strong fundamentals. During downturns, many fundamentally sound companies see their stock prices fall disproportionately to their intrinsic value.

Fundamental Analysis: Thorough fundamental analysis is crucial to identify undervalued companies. This involves examining a company's financial statements, competitive landscape, and management quality.

Bullet Points:

- Identify undervalued stocks: Look for companies with strong earnings, low debt, and a competitive advantage.

- Explore sectors less affected by the downturn: Certain sectors, such as consumer staples or healthcare, may be more resilient during economic downturns.

- Consider real estate investments: Real estate prices can also correct during market downturns, offering potential buying opportunities.

Psychological Aspects of Investing During Market Downturns

Emotional discipline is paramount during market downturns. Fear and greed can lead to impulsive decisions that negatively impact long-term investment returns.

Long-Term Perspective: Maintaining a long-term investment perspective is vital. Market downturns are a normal part of the market cycle. Focusing on your long-term goals can help you avoid panic selling.

Avoiding Panic Selling: Panic selling is a common mistake during downturns. Selling assets at a loss locks in those losses, preventing future gains.

Bullet Points:

- Develop a long-term investment plan: This plan should outline your investment goals, risk tolerance, and asset allocation strategy.

- Avoid impulsive decisions: Market volatility can trigger emotional responses. Take time to analyze the situation before making any significant changes to your portfolio.

- Stay informed but avoid excessive news consumption: Constant exposure to negative news can fuel fear and anxiety.

Conclusion

Market downturns, while unsettling, present significant opportunities for the prepared investor. By understanding the causes of market declines, implementing effective risk mitigation strategies, and capitalizing on discounted assets, individuals can potentially enhance their long-term investment returns. Remember, a disciplined approach, a long-term perspective, and emotional control are crucial for successfully navigating market downturns. Avoid impulsive decisions driven by fear; instead, focus on sound investment principles and a well-diversified portfolio.

Call to Action: Don't let market downturns deter you. Learn more about effective strategies for navigating these periods and turning market downturns into opportunities for growth. Start planning your investment approach for the next market downturn today!

Featured Posts

-

Bubba Wallace On Nascar Breaking The Mold

Apr 28, 2025

Bubba Wallace On Nascar Breaking The Mold

Apr 28, 2025 -

23 Xi Racing Unveils New Partner For Bubba Wallace In 2024

Apr 28, 2025

23 Xi Racing Unveils New Partner For Bubba Wallace In 2024

Apr 28, 2025 -

Tackling Americas Truck Bloat Innovative Approaches And Potential Solutions

Apr 28, 2025

Tackling Americas Truck Bloat Innovative Approaches And Potential Solutions

Apr 28, 2025 -

Federal Investigation Millions Lost In Corporate Email Data Breach

Apr 28, 2025

Federal Investigation Millions Lost In Corporate Email Data Breach

Apr 28, 2025 -

Is Kuxius Solid State Power Bank Worth The Higher Price

Apr 28, 2025

Is Kuxius Solid State Power Bank Worth The Higher Price

Apr 28, 2025

Latest Posts

-

New York Knicks Thibodeaus Reaction To 37 Point Blowout

May 12, 2025

New York Knicks Thibodeaus Reaction To 37 Point Blowout

May 12, 2025 -

37 Point Loss Prompts Thibodeau To Call For Greater Resolve From Knicks

May 12, 2025

37 Point Loss Prompts Thibodeau To Call For Greater Resolve From Knicks

May 12, 2025 -

Thibodeaus Plea For More Resolve After Knicks Crushing Loss

May 12, 2025

Thibodeaus Plea For More Resolve After Knicks Crushing Loss

May 12, 2025 -

Ta Zeygaria Ton Playoffs Nba Kai Oi Imerominies Ton Agonon

May 12, 2025

Ta Zeygaria Ton Playoffs Nba Kai Oi Imerominies Ton Agonon

May 12, 2025 -

Knicks Coach Thibodeau Seeks Increased Resolve After 37 Point Defeat

May 12, 2025

Knicks Coach Thibodeau Seeks Increased Resolve After 37 Point Defeat

May 12, 2025